Brand new investors might look at a rising stock market and all-time highs as a potential indicator that stocks are expensive. However, new investors should consider the quote I heard from the popular Jim Cramer when I first started investing—that “there is always a bull market somewhere”.

If there’s always a bull market somewhere, then this implies that a bull market is not universal. Some stocks might be in a bull market at the same time others might be in a bear market.

Taking that logic further, if not all stocks are included during a bull market, then there are some stocks that are probably cheap, even when the market is at all-time highs.

This is contingent on the assumption that there indeed is “always a bull market somewhere”. With this post, I’d like to examine this statement and whether it’s true most of the time or not.

To start, let’s dive into the shoes of a beginner, through their lens following a strong couple years in the stock market (2020 and the middle of 2021). Here’s part of an email we received from a podcast listener which we can examine with a deep dive here:

“Even through COVID we are right now I feel at a high point in the market just based off of how well the housing industry is doing and I bought some SPY stocks in Feb and am up like 19% or a ridiculous amount, so when the market is at a high point or even at the peak do you usually still see many of these companies that are valued below their intrinsic value or do they tend to rise with the rest of the market?”

Thanks,

Ben

Going back to the idea of a bull market, if the companies tend to rise with the rest of the market then it would imply that near all-time highs, all stocks are in a bull market.

There’s some truth to that statement—a rising tide tends to raise all boats.

That said, when looking for value during an extremely high “tide”, then this idea would be increasingly impossible if all stocks rose together during bull markets. Because if during a bull market all stocks rose together, then during a bear market all stocks would have to fall together.

If all stocks were to fall together, then during a bear market you probably couldn’t make the statement that there is, in fact, always a bull market somewhere.

I’d like to take a look at some recent history of the stock market to try and apply some practicality to this idea.

The Peculiar Bear and Bull Markets of 2019-2021

While the term bear and bull market can be defined by strict rules, such as a certain rise or fall of prices at a given time, these kinds of markets aren’t obvious when you are in them.

A bear or bull market is only obvious in hindsight.

And also, though you can quantify a bear and bull market with number rules, you can’t quantify them as the same. They’ll tend to have a different pace, and different range of highs and lows, in every single one. That’s because they tend to generally follow the economy.

Our most recent history of 2019, 2020, and mid-2021 give a great example of just how different bull markets can be, with even a bear market being squeezed in during 2020.

2019

In 2019, you had a pretty typical bull market where people were starting to fear a bubble and/or end of the cycle. This was because stocks showed similar characteristics to previous bull market peaks, such as growth stocks widening their outperformance against value stocks, and certain stocks trading with extremely high valuations (Tesla was one of the poster child’s here).

You also had the FANG stocks absolutely crushing it with high rates of revenue growth, earnings growth, and total returns, and commanding higher valuation premiums compared to the rest of the market which reminded some investors of the “Nifty-Fifty” period of the 1960s and 1970s.

To those of you not familiar with the Nifty-Fifty stock market, this was a period of time when investors seemed to value the safety of the top biggest 50 companies over any other metric.

This belief perpetuated upon itself, until those 50 stocks dominated the market in both size and recent return. This caused any fund manager who was not heavily invested in Nifty-Fifty stocks to greatly underperform, which caused many of them to get flushed out of the market and only perpetuated the Nifty-Fifty craze further.

So, during 2019 you started to see some similarities to the Nifty-Fifty time and the FANGs. You also had interest rates that seemed at impossibly low levels after many years of falling—which caused macro fears about the Fed’s potential inability to stimulate the economy during a possible future recession.

On top of that, Bitcoin started to rebound in this year and it appeared to some onlookers that there were bubbles forming in both Bitcoin and Tesla.

Can you say there was always a bull market somewhere during 2019?

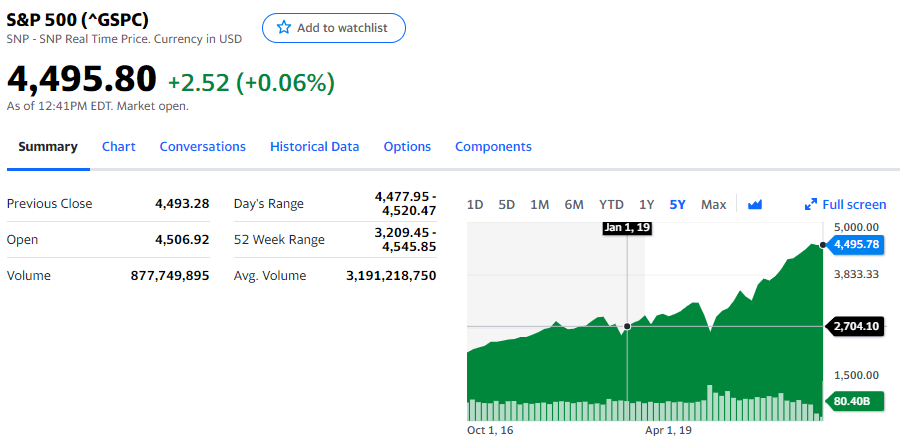

Definitely you can say that the stock market as a whole was still in a long bull market in this year. Since the market tailed off near the end of 2018, 2019 was a refreshing case of a nice continuation of steady rising stocks. See the following charts from Yahoo Finance:

That said, just because things were great in the USA doesn’t mean that was the case everywhere else. This chart of the Emerging Markets Index Fund by Vanguard shows that 2019 was basically a flat year for these emerging market stocks (ticker: $VMO):

If there was a bull market in the USA-dominant S&P 500 and yet a flat market in emerging markets, you could make the argument that the “bull market somewhere” was in the United States.

2021

Now let’s skip forwards in time to where we find ourselves today. Then we’ll circle back to the interesting 2020 case study.

I find the 2021 bull market somewhat difficult to quantify because there have been many mini-themes scattered throughout it.

It started with growth continuing on its high-flying trend from late 2020. Then, we had a strong and fast recovery in cyclical stocks as investors became optimistic about the vaccine and strong re-opening and hiring numbers. The Fed keeping their support steady also seemed to help greatly here.

Then some of that cyclical recovery pulled back, and we moved into what the now famous Cathie Wood from ARK Invest called a “diversified market”, then into more defensive names. Her recent video described that path nicely:

Certain pockets of the investment universe saw explosions of capital inflows—new, innovative asset classes like cryptocurrencies (especially Ethereum and for a time “Dogecoin”) and NFTs (non-fungible tokens) propelled furious bull markets (bubbles maybe?) in their own markets.

A new stock market vehicle called SPACs (special-purpose acquisition company), which are an alternative to an IPO, had its 15-minutes of fame followed by what appears to be a bear market.

Late 2020

Of course, 2020 is the fun year to diagnose because so many things happened on the worldwide level as well as the stock market.

Starting with the end first, the market rebounded sharply from its pandemic lows, and continued to crush all-time highs throughout the end of the year.

Instead of feeling like there might’ve been a bull market somewhere, living through it… it did seem to be a bull market everywhere. The explosions in Tesla’s stock and Bitcoin also made their various appearances throughout late 2020 and 2021– further stoking the bubble conversations.

But of course, like with 2021 this doesn’t completely paint the true picture.

Not all stocks saw the great rush that the end of 2020 bull market experienced—just a few that come to mind include real estate stocks (such as REITs), most defensive stocks which stayed flat after a strong beginning to the year, and utilities and many value stocks (until November).

Was there a bull market somewhere? Yes obviously, you could’ve shot fish in a barrel.

But was there also “a bear market somewhere”. I’d say also yes, as you could examine any of those names that did not participate in the rush.

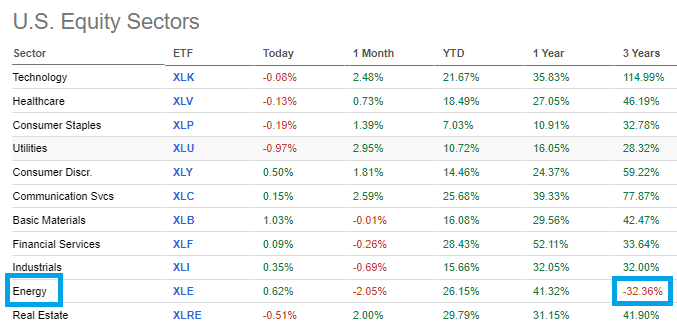

I’ll also offer that this theme is consistent even if you zoom out; check out the tough 3y performance of Energy stocks as an example especially compared to the other sectors:

Early 2020

Here’s where the fun starts, at least in the sense that there’s many pieces to analyze, especially the bear market panic.

Many of the trends from 2019 continued at the beginning of 2020 until the appearance of the world stopping pandemic.

Predictably, markets collapsed.

You had markets swinging with wide volatility, and exchanges closing down as daily loss limits were reached, automatically triggering those closures.

Until the Fed stepped in, the market was basically in a free fall and a new bear market started, with fears abound that we were heading for the next Great Depression. I’ll admit to believing that this was very possible, but I stuck to my guns and the timeless principles of the stock market which led me to hold my stock exposure throughout the carnage regardless of how I felt about the economy.

In this new, fear-gripped market, stocks sold off throughout—with cyclical stocks tending to sell off at a much more violent rate. There seemed to be a bear market everywhere at this point; part of this might have been due to the sudden lack of liquidity and part from fear.

You can’t really blame people for feeling all of this fear and panicking; we literally had a stoppage of all aspects of the economy besides “essential businesses” due to lockdowns.

All of that said, it’s hard to identify any sort of bull market anywhere during this time period, albeit it was a very short time period.

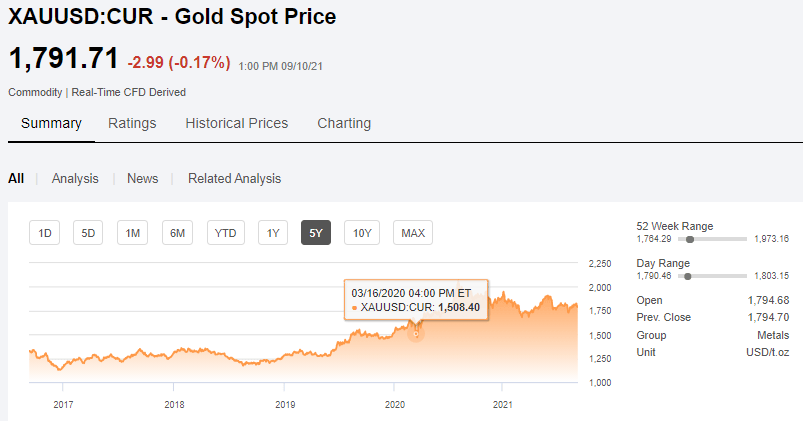

Even Gold sold off, albeit at a much lower rate than every other market, as this chart from Seeking Alpha shows:

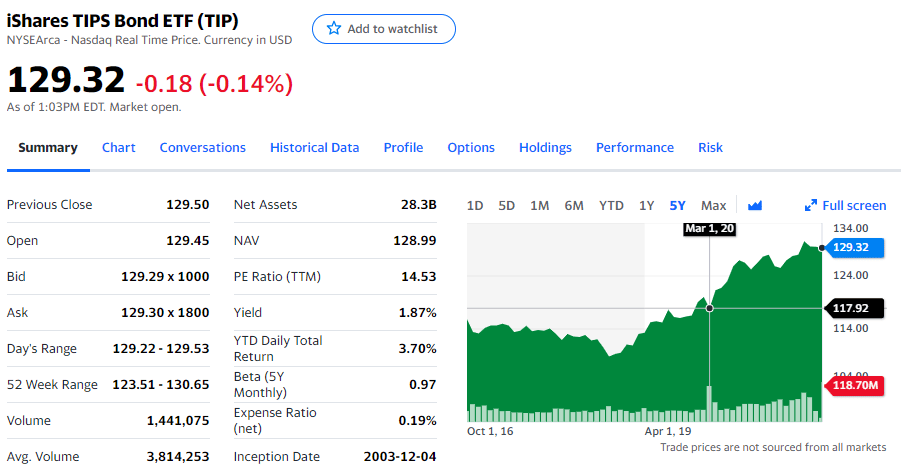

That said, there was a slight bull market for inflation-adjusted securities (also known as TIPs), which are government bonds whose yields are adjusted for inflation. These did not fall during March 2020, and you can argue that cash didn’t fall either:

I think it’s a somewhat weak argument to say that assets not correlated to the stock market, like bonds and gold, mean there’s always a bull market somewhere.

It’s not helpful to investors who are allocating the majority of their wealth to stocks to make these statements.

At the same time, just because everything falls in a panic doesn’t mean that these are bad places to be invested in.

Investor Takeaway

Maybe a better takeaway is that—during a market panic—there’s always opportunities somewhere as some stocks get hit more than others. As long as there’s no fundamental, long term change to those underlying businesses,

When I think about the implications of “there’s always a bull market somewhere”, I interpret that as the presence of simultaneous bear and bull markets creates opportunities for investors looking for value at any given time.

That’s a practical application of the statement.

And based on what I’ve seen, that does seem to be true.

But, the road of investing is a rocky one, and there will be times where things will be very tough and panic will sit in. At times like that, there will probably be no bull market anywhere in any place in the stock market.

That doesn’t mean that investors can’t do well from future bull markets, or that there’s no opportunities for the future at that time.

It just means that investors should expect bear markets to be universal, and all stocks to fall at some point. But, recoveries and future bull markets are also universal, it’s just that the scope, trend and timing of those will probably hit pockets of the market differently.

The bottom line: As investors looking for value during all-time highs, we can take comfort in the idea that there probably is “always a bull market somewhere”, because we can extrapolate that to expect that there’s probably “always an opportunity somewhere”.

The interesting characteristic of the stock market—that a bull market hits stocks differently in scope, trend, and timing—means that the never ending search for great stocks can be quite worthwhile.

Just as Jim Cramer stoked my enthusiasm for the stock market when I first started investing, I hope that these ideas have further stoked your own.

Because the most powerful component of the stock market is the compounding we receive from it, and by looking for great stocks trading at good prices, we might even be able to multiply that compounding.

Related posts:

- Comparing the Bull and Bear Market In a nutshell, a bull is seen as someone who is optimistic and believes that stocks will rally. This is a bullish outlook. On the...

- Stock Market Cycles: How to Analyze and Profit Updated 7/24/2023 “Warren Buffett tells us, ‘The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our...

- Wall Street Bear – Friend or Foe?! One of the most dangerous things in the investing world is dealing with a Wall Street Bear. If you’re like me and a total CNBC...

- What Stock Market Tops Look Like– History of the NASDAQ and Dow It’s so easy to say “this time is different.” Well, that’s one thing that’s never different during stock market tops. That people will never stop...