Updated 9/25/2023

The short ratio is widely used when understanding the short selling behind a stock. It can tell you how many fund managers or retail investors bet a stock will fall.

The short ratio indicates the number of shares that investors sell short over the average daily volume of the stock, on the basis of 1 or 3 months.

In this post, we will talk about the basics of short selling, which is critical to understanding the short ratio and why short squeezes are possible. Editor’s Note: This is a guest contribution by Christina Pomoni.

- How Short Selling Works

- Understanding the Short Ratio

- How a Short Squeeze Works

- Why should you care about the Short Ratio?

- Using the Short Ratio as a Value Investor

The short ratio can help identify potential short squeezes. It can also be a great warning sign to to help avoid money-losing long-term investments.

Fund managers are sophisticated investors; if they are shorting a stock, there’s often a fundamental reason. A high short ratio should indicate the need to analyze a company’s fundamentals further to understand why Wall Street is bearish.

How Short Selling Works

Short selling is a high-risk strategy to be used only by traders with a strong conviction on their bearish ideas.

The goal of a short seller is to correctly anticipate a drop in the price. So, short selling tends to work better in bear markets than bull markets. However, there have been plenty of cases of successful short-selling amidst great bull markets.

The short ratio is a great indicator of how bearish Wall Street is on a stock. Because the short ratio is calculated by using the number of shorted shares in the market, it tells us how other traders are betting on the stock. The proof is in the pudding (number of shares shorted).

The Basics

A short seller will start by buying a stock at a given price using leverage, anticipating that the price of the stock will drop lower than this price.

By buying a stock with leverage and then immediately selling the stock, a short seller gets cash now but still owes those shares back to his/her broker. If the stock goes lower, the short seller buys back the shares at a lower price, returning those shares back to the broker.

The profit on such a trade is the difference between the price when the seller borrowed and sold the shares, and the price the shares were bought back at.

However, if the stock price goes up instead of down, the short seller must buy back those shares at a higher price, since they are still owed to the broker.

This can create a double-edged sword of losses– interest payments owed on the shares borrowed plus the amount lost if a stock goes higher.

Let’s look at an example.

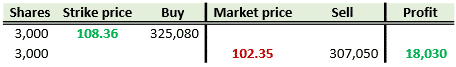

Say you want to short a stock trading at $108.36. So, you decide to enter a short-sale contract by borrowing 3,000 shares of your broker and selling them in the open market for a total of 3,000 x $108.36 = $325,080.

Let’s say that within a week, the stock price drops to $102.35. You then decide to close your short sale, and you sell 3,000 shares at $102.35 for a total of 3,000 x $102.35 = $307,050. You return the 3,000 shares to your broker and you make a profit of $325,080 – $307,050 = $18,030 minus borrowing fees and broker commission.

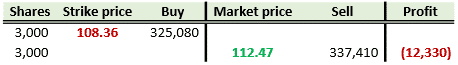

This would be how you close the position if your anticipation of a price decline comes true. On the contrary, if the stock price rose to $112.47, you would return the 3,000 shares to your broker for a higher price that you bought them. In that case, you would incur a loss of (3,000 x $108.36) – (3,000 x $112.47) = -12,330 minus the borrowing fees and broker commission.

Understanding the Short Ratio

Usually, large financial websites such as Yahoo Finance, Google Finance and so forth mention the short ratio, so you don’t need to calculate it on your own.

Let’s say you had a stock with a short ratio of 6.23.

First of all, this means that the number of days required to cover the short position is a bit more than 6. Typically, investors are looking for a short ratio between 8 to 10 days or higher because it is generally expected that a short ratio of this size is relatively difficult to cover, so the stock will go through a rally before hitting an upswing. For this reason, you may encounter a short ratio as the “days-to-cover” ratio, as well.

So, if the short ratio of the stock is 6.23 and the average daily volume over a period of 30 days is 480,000 shares, it means that 2.99 million shares have been shorted. The short ratio is calculated as:

Short ratio = (Number of shorted shares) / (30-day average daily volume)

If we know that the short ratio is 6.23, we can infer how many shares are shorted by calculating the following:

6.23 = x / 480,000

6.23 * 480,000 = x

x = 2,990,400 shares are shorted.

How a Short Squeeze Works

Notice how in the short selling example, the investor was required to borrow the shares in order to make a bet on the downside of the stock.

Borrowing shares from a broker is also called buying “on margin”.

When you borrow from a broker on margin, you have to pay an interest fee on the borrowed amount, just like you would if borrowing money for any other use.

Like with other borrowing, buying on margin also means needing to put collateral on the amount you borrowed.

This can become problematic for a trader on margin if the trade goes against him.

This is because brokers require collateral for any shares borrowed. The higher a stock rises, the more money that is needed to be borrowed. So in other words, the more money that is being borrowed by the trader, the more collateral they need to put up.

The Basics

Now remember, that the short seller is borrowing the shares to bet on selling them at a lower price in the future.

If the stock rises instead of falls, that cost of borrowing increases due to the shares being more expensive. The short seller is “on the hook” for more and more money the higher the stock goes. This will require more margin, and thus more collateral, in order to satisfy the new requirement.

This is commonly called the dreaded “margin call”.

If the trader cannot come up with the additional collateral, their short position will be closed, often at a loss to the trader.

As a stock continues to move higher, more and more short sellers receive margin calls from their brokers. This forces more short sellers to close their positions, which pushes the share price even higher as less traders are short the stock.

This can cascade like an avalanche. The more short sellers that are “squeezed” and can’t cover their margin calls, the more margin calls that are required.

This continues to build on itself and can create huge stock gains in a very short time period.

An educated trader can look at the short ratio to identify stocks with many short sellers. These high short ratio stocks can be prime candidates for future short squeezes.

At the same time, an investor can look at changes in the short ratio over time to see the sentiment of Wall Street changing on a stock in real-time.

Why should you care about the Short Ratio?

Like mentioned, the short ratio can be a great tool for identifying potential future short squeezes. It can also help find undervalued opportunities in companies with healthier fundamentals than is perceived.

On the technical trading side, stocks under consolidation can provide an opportunity for short-term profit. They have steady support and resistance levels and may trade within a narrow price range, with trading volume that is relatively low and without major spikes. This could signal a stock whose price looks indecisive, and could break to a noticeable trend.

Another great aspect of the short ratio is it can suggest higher trading liquidity. Those traders with strategies that rely on liquidity, particularly on smaller-size stocks, could find opportunities within those stocks with higher short ratios due to the ability to quickly and easily enter and exit the trade.

And then of course, the short ratio can be used to find the stocks that Wall Street is already bearish about and then simply piling on and riding that trend. Oftentimes, it’s the worst-performing businesses that come with high short ratios. Their dire financial situations can be so apparent that shorting the stock with other smart traders can seem like shooting fish in a barrel.

However, please remember that short selling is not an easy strategy. You have to understand how the market behaves and what your true risks are, to capitalize on short selling.

Because of the margin requirements, shorting a stock is an inherently short-term strategy. The longer that a short position is kept open, the more interest you’ll have to pay to your broker to keep your trade on margin.

This alone should keep many prudent investors away from a strategy like short selling, as market timing has proven to be such an impossible task.

Whatever you do, please don’t short a stock solely because you think its price is overvalued.

Shorting a great company simply because you think its stock is expensive is a sure way to destroy your wealth because for one:

“The markets can remain irrational longer than you can remain solvent.”

–John Maynard Keynes

Some great companies eventually grow into their higher valuations. Some companies continue to trade at high valuations for years or even decades. That’s a long time to burn even the most disciplined short seller, especially when considering margin calls that can eventually bleed you dry. Even if you are eventually right about the stock, being wrong on the timing can be very costly.

If there’s one secret to success in the stock market it’s compound interest. By executing short sell trades you are inherently betting against compound interest.

The stock market is a great place to invest because the potential upside is unlimited while the potential downside is capped (to -100% of your money).

In the case of short selling, you flip that paradigm—where the highest potential upside is only 100% and the potential downside is unlimited.

That’s not a great place to be in. You might be able to get lucky on some trades over the short term, but it’s not a sustainable strategy. Betting against business success and the power of incremental increases through compound interest is not likely to be a winning bet for almost anyone.

Using the Short Ratio as a Value Investor

As previously alluded to, where the short ratio could be a great asset to the long term investor is for those who buy deep-value stocks.

As the “apes” on Reddit’s Wall Street Bets showed, heavy short selling can serve like a loaded spring, just waiting for a catalyst to the upside.

The catalyst could be something as unpredictable as a mob that drove retail investors into stocks like Gamestop and AMC. It could also be something as basic as a company performing slightly better than bearish expectations.

Just because a stock looks like it’s heading for bankruptcy doesn’t always mean it is. The short ratio can be a great tool for the right deep-value investor with the stomach for volatility and a severe case of contrarian thinking.

But remember that with deep value investing, a few things have historically led to its success. One, a largely diversified portfolio with at least 50-100 stocks, and two, a short-term holding period with active rebalancing.

If you are not taking those steps with your deep value strategy, you may be in for a world of hurt.

Related posts:

- How to Calculate a Stock’s Upside Potential Got the following question from a reader: “I was wondering, how does one go about calculating upside potential?” The answer to this question is really...

- Stock Repurchases: How They Work and Their Effect on Earnings Updated 3/6/2024 In today’s market, share repurchases are the choice that most public companies use to return value to their shareholders. Investing giants such as...

- The Market Is Crashing! Am I In Danger of a Margin Call Watch? Recently I wrote an article about investing with margin and honestly, when I was done with all of my research and writing, I actually convinced...

- Should Investors ‘Buy the Rumor, Sell the News’? Have you ever heard the saying “buy the rumor, sell the news?” I hadn’t heard it before until Dave said it on an episode of...