Updated 5/1/2024

Reading a company’s 10k is required if you want to invest in it, and part of that reading is scouring the financial statement footnotes.

In fact, many seasoned investors read through the financial statement footnotes first to assess the company’s financial condition.

On many occasions, the financial statement footnotes contain some of the juiciest information in the financial reports. They contain many of the important details concerning subjects such as debt and its components, such as terms, interest payments, and different components of that debt.

The footnotes are a treasure trove of information, and the company sometimes includes items in them, knowing that investors or analysts won’t read them. As investors, we must understand what is contained in this section and what to look for when reading.

As we continue learning the language of investing or accounting, we study the financial statements, which contain the income statement, balance sheet, and cash flow statement. The final step is to analyze the financial statement footnotes, including more detailed information that may enlighten us about debt, inventories, dividends, earnings, and much more.

In today’s post, we will learn:

- What Are the Financial Statement Footnotes?

- Where Do You Find Financial Statement Footnotes?

- Financial Statement Footnotes Checklist

- Walk Through of Financial Statement Footnotes

Ok, let’s dive in and learn more about financial statement footnotes.

What Are Financial Statements Footnotes?

Footnotes to the financial statements are the additional information below the financial statements that help enlighten investors on how the company arrives at its financial figures in their statements.

The footnotes also help explain any irregularities or inconsistencies in the year-to-year accounting methods.

We can think of it as a supplement to the financial statements, providing additional clarity to the financial statements.

The information in the financial statement footnotes is important, and they may reveal any underlying issues concerning the company’s health.

Footnotes are included in the annual or quarterly report to clarify the financial statements’ brevity. The footnotes are quite long, and inclusion in the main text of the report could muddy the data presented in the annual or quarterly report.

Using footnotes allows readers to absorb the general flow of information in the financial statements while allowing investors to access additional information if they feel it is necessary for their analysis.

These notes are important because they contain information related to numerous subjects, such as:

- Accounting methodologies

- Pension plan details

- Stock option compensation information

- Debt schedules

- Inventories

All of these subjects may have material impacts on the company’s bottom line and are, therefore, important to analyze.

Footnotes can also explain certain irregularities or unusual activities, such as one-off incomes or expenses, and their impact on the company and provide further information regarding their possible future impacts.

Where Do You Find Financial Statement Footnotes?

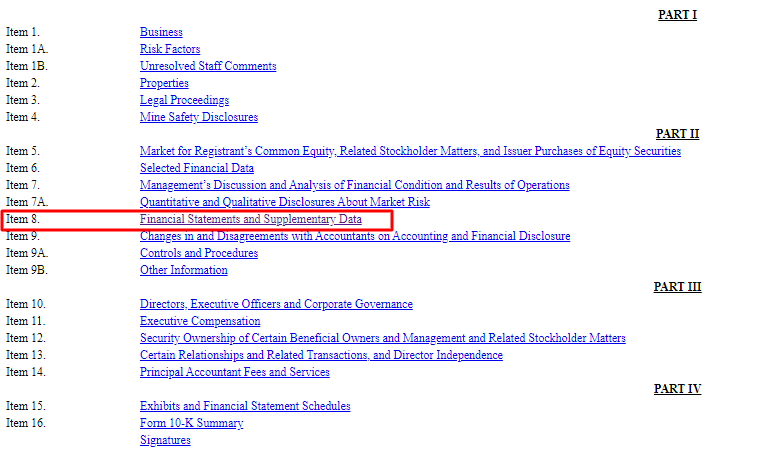

Item Eight of the quarterly or annual financial statements contains the footnotes and all the other financial statements.

You will find the footnotes in the same position, below the financial statements, in every financial statement released. Sometimes, select information contained in those footnotes is in section seven or management’s discussion of financial conditions.

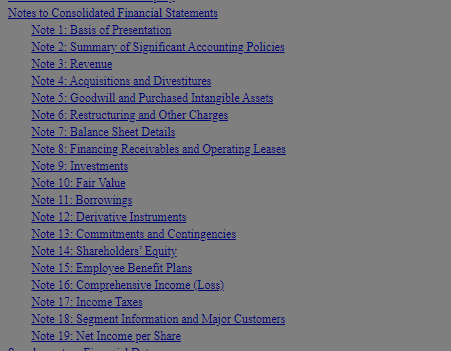

After reading through the main financial documents, you will arrive at the financial statement footnotes; in the case of the example I will show below, Cisco outlines each footnote in a table of contents, which is nice to see and makes it easier to locate the specific footnote you want to analyze.

However, a note of caution: not every company is quite so considerate; in fact, of the last fifty or so financial statements I have read, only Cisco has laid out the footnotes in such a way.

Financial Statement Footnotes Checklist

The list of items in the footnotes is quite long, and the following list touches on some.

- Accounting Policies

- Accounting changes

- Contingencies and commitments

- Risks

- Business combinations

- Fair value

- Cash

- Receivables

- Investments

- Goodwill

- Debt

- Segment data

The above is a snapshot of the possibilities that can go on for miles. Clearly, if all the information listed above were in the financial statements’ text, it would overshadow them.

The treasure trove of information contained in the above line items is staggering and would be overwhelming to try to absorb all in one sitting. Like eating a pizza, it is best to focus on one area at a time and work through the notes, picking the section you want to focus on and moving on to the next section.

The footnotes can generally be divided into two camps. The first camp concerns the company’s accounting methods for determining its financial position, including revenue recognition.

The other camp focuses on operational and financial results such as earnings, segment results, or debt.

Walk Through Financial Statement Footnotes

Cisco suggests walking through a company’s financial statement footnotes to get a flavor of how these notes work.

As we mentioned above, the organization of the notes falls into two camps, with the accounting sections presented first, followed by the operational and financial conditions next.

The footnotes regarding the accounting policies are broken up into specific areas such as revenues, inventories, and fair value, which tells us what the company’s policies are in that area and how they account for its value.

For example, revenue recognition is one of the most important aspects of any company, and in the footnotes, the company will outline how and when they recognize revenue. At first, you might think, ” Okay, that appears pretty obvious. However, it is not as cut and dry as you might think.

For example, Ford recognizes the sale of a car when the dealership takes possession of the vehicle, not when the customer purchases the vehicle. So when you look at the revenue for Ford, it is booking that sale when the car leaves Ford’s plant and moves to the dealership, not when you take it home.

For our purposes today, I will walk through ten more common notes to financial statements to give you a flavor of what kind of information we might find in the notes. The list we will present is not comprehensive; rather, it is a guide to more common sections of the footnotes to help educate us on the possibilities available in the footnotes.

Note 1: Basis of Presentation

Here, we will find a thumbnail sketch of the business and what it does to generate revenue. Common comments may include what the company does for the business and how it does that work. For example, does it produce the products itself, or does it farm out the products?

Cisco’s notes inform us about the business cycle, which runs on a 52-week cycle and ends its fiscal year on the last day of July. They also outline the geographic scope of the company and how it divides its segments and relate all business only to the controlling interests of the business.

Note 2: Summary of Significant Accounting Policies

In this note, we see an outline of each accounting method contained in the financial statements, which helps investors better understand the company’s financial statements. Each note uses a notation regarding any significant accounting decision made by the company.

At the very least, we should see notes explaining how a company handles accounting for depreciation, ending inventories, the basis of consolidation, treatment of income taxes, employee benefits, and intangibles. The list is a small sampling of the presentation offered in the notes.

Cisco presents up to 27 notes in this section, covering topics such as cash, revenue recognition, depreciation, employee benefits, and more.

For example, regarding cash and cash equivalents, Cisco recognizes cash as any security purchased that is highly liquid and has a maturity of three months or less.

The company adopted the latest FASB accounting rule regarding revenue recognition, which eliminated all industry-specific guidance. The new guidance dictates revenue recognition begins when a customer obtains control of said goods or services at the agreed-upon purchase price. The ruling also applies to contract sales, which require any subscription sales to be capitalized and amortized according to a set schedule.

Note 3: Revenue

In this section, Cisco lays out the revenues collected for the company and gives a deeper breakdown of the different products sold. This section benefits you by allowing you to see if a current product is driving the revenue for the company or how a new product is impacting the company’s revenues.

For companies such as Cisco, Intel, Nvidia, or Apple, it is nice to see a breakdown of the individual products sold and how those sales drive revenue.

If the company is discussing the new product in the management discussion, but you see that it is only 2% of revenues. This helps understand management’s focus and to see the direction in which they think the company might pivot.

Note 4: Acquisitions and Divestitures

This section includes all the information related to Cisco’s acquisitions for the period, whether annually or quarterly.

In Cisco’s case, acquisitions are a major part of its growth strategy; the company uses acquisitions to add different parts to its company. For example, in 2019, the company acquired five companies for a total of $2.86 billion for the year.

Also listed are any divestitures the company might have performed, which account for any decreases in revenues because of the sale of those companies.

Note 5: Goodwill

The goodwill note breaks down all information regarding goodwill for Cisco. It breaks down the information by segment, goodwill schedule, and intangibles and outlines all the amortization tables. Any questions concerning the goodwill of Cisco are answered here, including what the company expects to list as goodwill in the upcoming five years.

Note 6: Borrowings

One of my favorite notes in any company’s financials is that here, you will find anything and everything related to the company’s debt.

In Cisco’s case, the company outlines both short-term and long-term debt in different sections. Here, we can see the effective rate the debt carries and the expected maturity dates for both short-term debt, commercial paper, and long-term debt.

We can also see a schedule of debt maturities, which helps you see not only how much overall debt Cisco carries but also when that debt becomes due. This, in turn, helps you see how the need for free cash flow impacts the debt repayment.

Also included is any information related to any credit facilities the company might have, which allow it to borrow in the event of some calamities, such as a natural disaster or global pandemic.

Note 7: Commitments and Contingencies

The above note contains information regarding any contingent liabilities that may arise. In this section, you will find information regarding, for example, litigation that may lead to future income loss. The company may have an income tax dispute that affects its future results.

In Cisco’s case, the note here consists mostly of the contracts it uses to purchase supplies to produce the products it sells; also included are any warranties on its products, leases, and guarantees.

Note 8: Income Taxes

We will find all we want to know about the income taxes Cisco pays each year. Included are federal, state, and foreign taxes, all broken by current and deferred status.

Also listed are tables outlining the company’s tax rate and any allowable offsets. Later in the section, additional information is provided regarding deferred taxes and the liabilities and assets associated with those deferred taxes.

Note 9: Segment Information and Major Customers

Here, Cisco outlines the major segments in which the company reports its financial operations, which include each of the three segments. In this section, we can see the breakdown of the segments by revenue and the gross margin for each segment. That information helps us see what areas drive the profitability of Cisco.

Also, Cisco details the company’s major customers; at the time, no company accounted for more than 10% of the company’s revenues.

If you are looking at utilizing a company’s relative valuation based on its segment revenues or doing a sum-of-the-parts valuation, this is the note for you. Some companies will break down the segment revenues by costs, EBITDA, and other metrics to help you better understand the company’s operations.

Note 10: Net Income Per Share

In this note, all the information breaks down the net income per share, including the revenues, costs, and shares outstanding. In some cases, the company will list the results by quarter so you can see the quarterly progress of the company.

That wraps up the progression of the financial statement footnotes and how we read through them.

Final Thoughts

The financial statement footnotes are a treasure trove of information; they outline the company’s financial condition in great detail.

To truly understand any company, we must examine its financial documents. One such task is reading the financial statement footnotes, which contain many nuggets of information.

Many experienced investors who are familiar with a company well might focus solely on the footnotes in their analysis.

Unfortunately, not all investors take advantage of this section and focus solely on management’s discussion or the big three financial documents. But to truly understand the company you want to own, reading the footnotes is a must.

I will leave you with this thought: when recently asked how to get smarter, Buffett held up a stack of papers and said, “Read 500 pages like this every day. That’s how knowledge builds up, like compound interest.”

We will wrap up our discussion today regarding the financial statement footnotes.

As always, thank you for taking the time to read this post. I hope you find something of value on your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Valuation of Goodwill: Common Formulas Used to Estimate a Value “We don’t think in terms of appraising physical assets. We think in terms of economic goodwill… We only buy if we think [economic goodwill] will...

- How to Look Up Debt Covenants: A Real-life Example from a 10-k Out of the many aspects of fundamental analysis, reading debt covenants is probably among the most arduous, discouraging, and ignored part of the job. But...

- Simple Income Statement Structure Breakdown (by Each Component) Updated 8/7/2023 The income statement is the first of the big three financial documents that all public companies must file. But what do we know...

- Deferred Revenue: Debit or Credit and its Flow Through the Financials Basic accounting for public companies can get confusing with different terms that mean the same thing (like deferred and unearned revenue), vs opaque definitions (such...