Out of the many aspects of fundamental analysis, reading debt covenants is probably among the most arduous, discouraging, and ignored part of the job. But in a time of crisis, much of the focus shifts from earnings and sales to debt covenants and liquidity.

As an investor, it’s critical to understand a company’s true risks. As Charlie Munger says, “All I want to know is where I’m going to die, so I’ll never go there.”

And an examination of several of a company’s debt covenants can help quantify these inherent risks, so that you can identify when a company is skating a fine line with their levels of leverage, or if it really does have a built-in margin of safety and great cushion of cash flows/assets.

This in-depth guide about debt covenants will cover [Click to Skip Ahead]:

- What a Debt Covenant Is

- Where to Find the Documents Which Lay Out Debt Terms

- How to Find the Debt Covenants for a Credit Revolver

- How to Find the Debt Covenants for Long Term Debt (“Notes”, or “Senior Notes”)

- Investor Takeaway

Debt covenants can be a tricky beast to read; I’ve seen ones which span 30+ sections and I haven’t even really been reading that many.

But as you read more and more of them, you’ll learn which sections to skip or skim over, similar to the way you do when you plow through a 10-k.

And with the example we’ll look at today, a simple Indenture document with 7 sections for its debt covenants, you’ll see it can be done (understanding these arcane documents) if you know how to do it and where to look.

What a Debt Covenant Is

Some of the most common forms of debt, and thus sources of capital, available for a public corporation can include:

- Bond issuance (senior notes and others)

- Credit revolvers (for working capital or liquidity crunches)

- Convertible bonds or types of preferred stock

When a company issues a bond, for example, you’ll see an agreement which lays out the following terms:

- How much the company owes (in principal)

- When that principal is due

- How much the company owes (in interest)

- When that interest is paid

- If the company can pre-pay the bond early

- Restrictions placed by the borrower on the company (i.e. debt covenants)

- Other complicated under-workings

Unfortunately, we couldn’t possibly cover every aspect of a debt agreement even in an extensive guide like this—which is maybe why conservative investors like Warren Buffett tend to avoid highly leveraged companies as a general rule.

But, we can be approximately right instead of precisely wrong, which can help understand a company’s true financial position in addition to the commonly used debt-risk formulas to analyze businesses (like Coverage Ratios and Net Debt to EBITDA).

Where to Find the Documents Which Lay Out Debt Terms

Again, another way to describe the terms of a debt or credit is with the Indenture Agreement. From there, you can source the terms of any bond of credit revolver, as well as any debt covenants which may have been included as a requirement to issuing the bond.

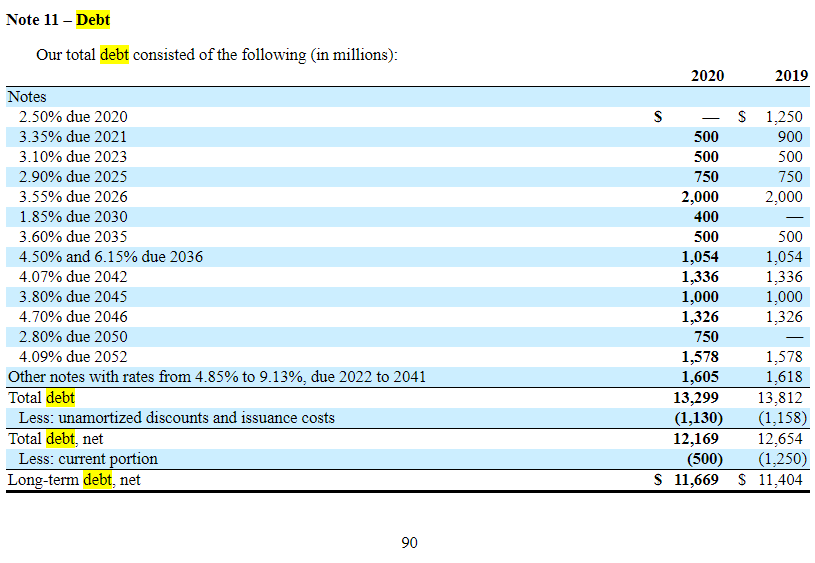

For this example, we will take the latest 10-k from Lockheed Martin, ticker $LMT. First, do a search “ctrl+f” for the term “debt” and click to the Notes to the Financial Statements to see a detailed description of the terms of their various debt liabilities. For $LMT, this is Note 11:

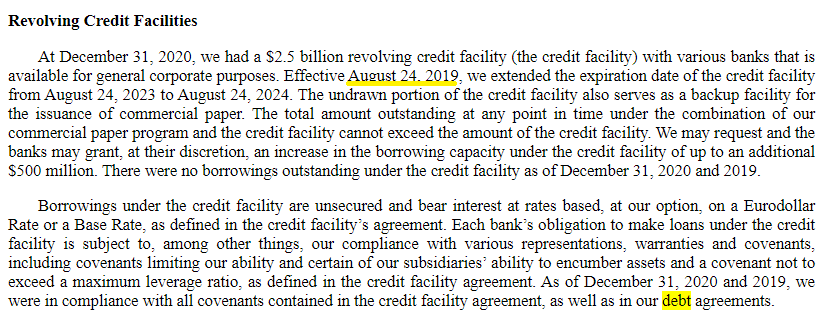

You can see we have each of the notes, and their principal, included in this table. Further down the page, we also see this disclosure about their credit revolver:

I like to look at the debt covenants for a credit revolver because it tells me if a company would be able to tap their credit line in case the world fell apart tomorrow (we’ve seen plenty of cases of exactly this happening in 2008-2009, 2020, etc).

Not every company keeps a high current ratio (working capital with much more current assets than current liabilities) due to the many differences in varying business models across the market. Some companies are more capital intensive than others, some are paid and accrue expenses with different timing than others, and some managements are simply more aggressive than others (not always a bad thing).

Going back to our Revolving Credit Facilities screenshot, we can see that their latest credit facility’s terms were updated on August 24, 2019, as the expiration date was extended.

We also see that this credit facility has $2.5 billion available and no debt outstanding at the time. Considering the company has $13.9B in current liabilities, this extra credit availability plus the cash of $3.1B on the balance sheet would greatly assist the company in case it were to go through a liquidity crunch, as long as the company maintains its debt covenants (if any).

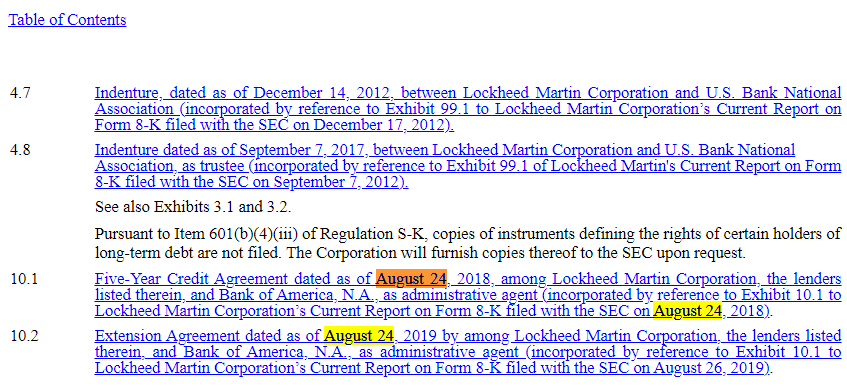

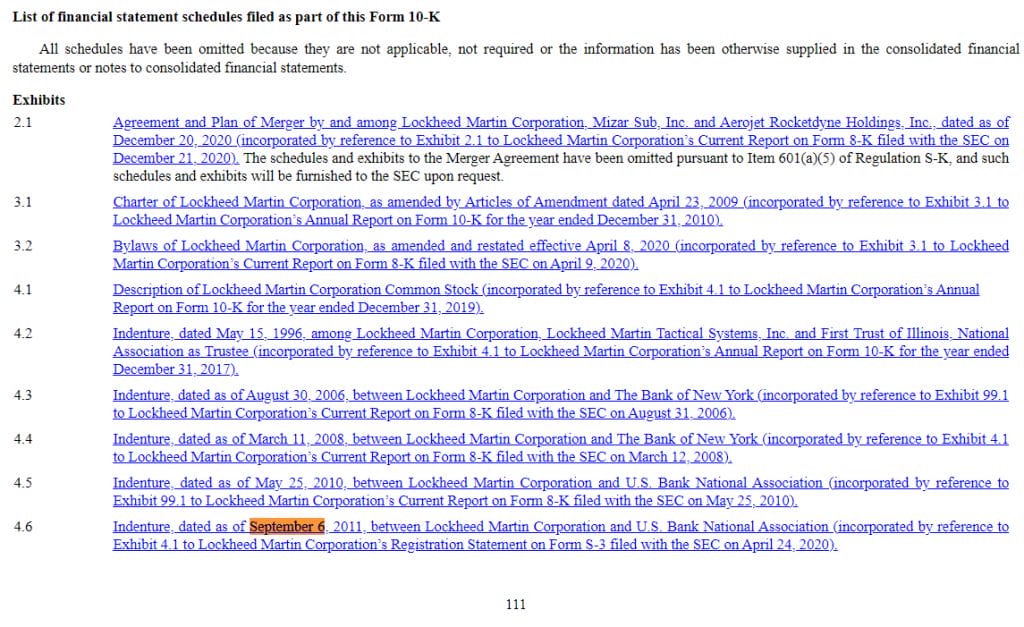

To find Indenture documents, Credit Agreements, and their supplements (updates to the documents), scroll all the way down to the bottom of the 10-k and look for the many links/ exhibits.

How to Find the Debt Covenants for a Credit Revolver

In this case, we are looking for a debt agreement dated on or around August 24, 2019. Here’s the one for Lockheed:

Clicking on the Five-Year Credit Agreement, we see the following sections (articles) of the document:

- Definitions

- “Article 2”

- Conditions

- Representations and Warranties

- Covenants

- Defaults

- The Agents

- Change in Circumstances

- Miscellaneous

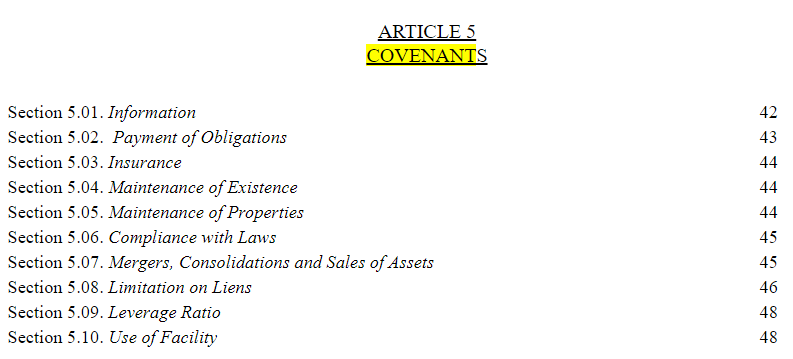

We’re looking for debt covenants, so we can search (ctrl+f) for “covenant” to scan through article 5. But before we dive in, notice how there are 10 sections within article 5, which you can see in the Table of Contents:

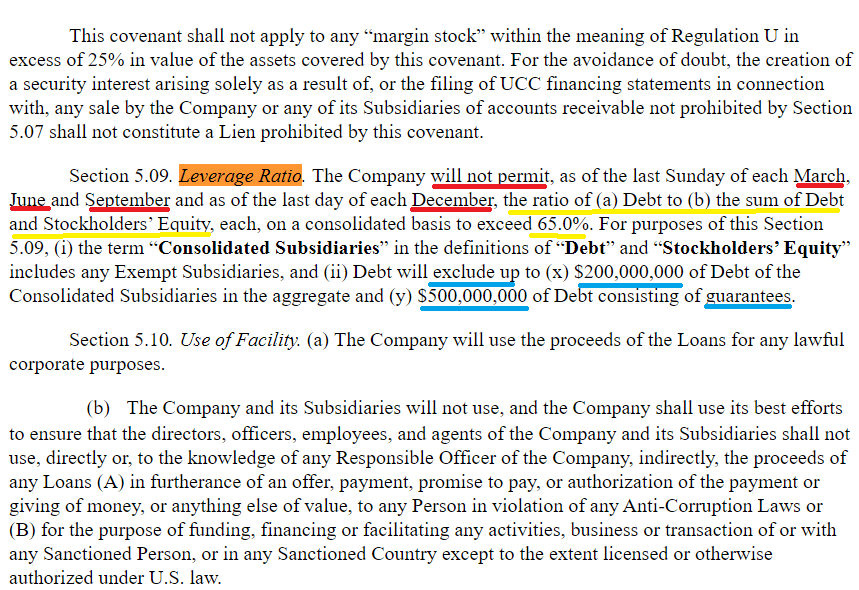

A lot of this is boiler plate language that you’ll see in many Credit Agreements, but one that obviously sticks out is Section 5.09. Leverage Ratio. Let’s search for that and see what the required ratio is:

Now we can see, in pretty plain English, that the company must maintain a leverage ratio below the following:

Leverage Ratio = Debt / (Debt + Shareholders’ Equity) < 65%

Note that the specific definition of the type of leverage ratio, and the required ratio itself, can vary from agreement to agreement, which is why it’s important to read these through carefully.

You can read through the entire article of Debt Covenants if you want, but it’s not easy reading.

In this case for $LMT, we’ve found a tangible ratio that the company should try and meet at all times, so that it can access the Credit Facility when it needs it the most. And hopefully, the company has a cushion on which ever Debt Covenants are required on their revolver, so that even a significant downturn in assets or revenues will still allow easy access.

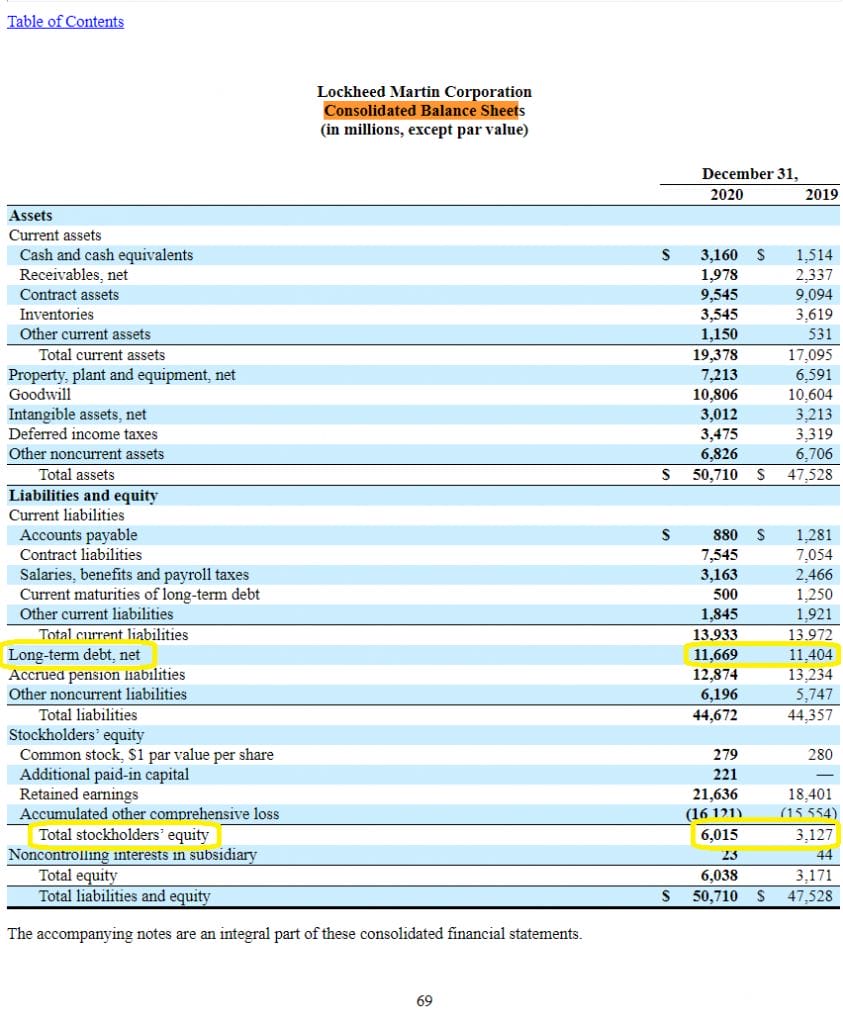

Let’s go back to the $LMT 10-k and calculate this debt covenant leverage ratio to see how the company is doing in meeting this requirement. From the company’s Consolidated Balance Sheet:

We can calculate the leverage ratio as the following:

- 2020: 66%

- 2019: 78%

Note that we haven’t included the exclusions, which should drop the total leverage ratio, but this gets us in the ballpark.

We can see that Lockheed’s leverage ratio today is pretty strong, but the company was skating on thin ice in 2019. While management might be tempted to use their inflow of cash ($1.5B+) to buyback their very cheap shares, they also could benefit from the peace of mind that extra short term liquidity would provide in case some revenue streams dry up.

How to Find the Debt Covenants for Long Term Debt (“Notes”, or “Senior Notes”)

Now let’s look at the company’s debt covenants on their long term bonds (“notes”), to see if there are any additional restrictions on either solvency ratios or the option to add additional future debt.

Going back to Note 11, we can see the following disclosure on their Long-Term Debt (bolded emphasis mine):

Long-Term Debt

In May 2020, we issued a total of $1.2 billion of senior unsecured notes, consisting of $400 million aggregate principal amount of 1.85% Notes due in 2030 (the “2030 Notes”) and $750 million aggregate principal amount of 2.80% Notes due in 2050 (the “2050 Notes” and, together with the 2030 Notes, the “Notes”). Interest on the Notes is payable semi-annually in arrears on June 15 and December 15 of each year beginning on December 15, 2020. We may, at our option, redeem the Notes of any series in whole or in part at any time and from time to time at a redemption price equal to the greater of 100% of the principal amount of the notes to be redeemed or an applicable “make-whole” amount, plus accrued and unpaid interest to the date of redemption.

In June 2020, we used the net proceeds from the offering plus cash on hand to redeem $750 million of the outstanding $1.25 billion in aggregate principal amount of our 2.50% Notes due in 2020, and $400 million of the outstanding $900 million in aggregate principal amount of our 3.35% Notes due in 2021 at their redemption price.

In October 2020, we repaid $500 million of long-term notes with a fixed interest rate of 2.50% due November 2020. In November 2019, we repaid $900 million of long-term notes with a fixed interest rate of 4.25% according to their scheduled maturities.

We made interest payments of approximately $567 million, $625 million and $635 million during the years ended December 31, 2020, 2019 and 2018, respectively.

That’s quite a bit of action over the year, which makes a lot of sense considering the circumstances. Long term interest rates dropped after the pandemic caused the Fed to drop the Fed Funds Rate, and so many companies took advantage of the healthy bond market to refinance debt at lower rates.

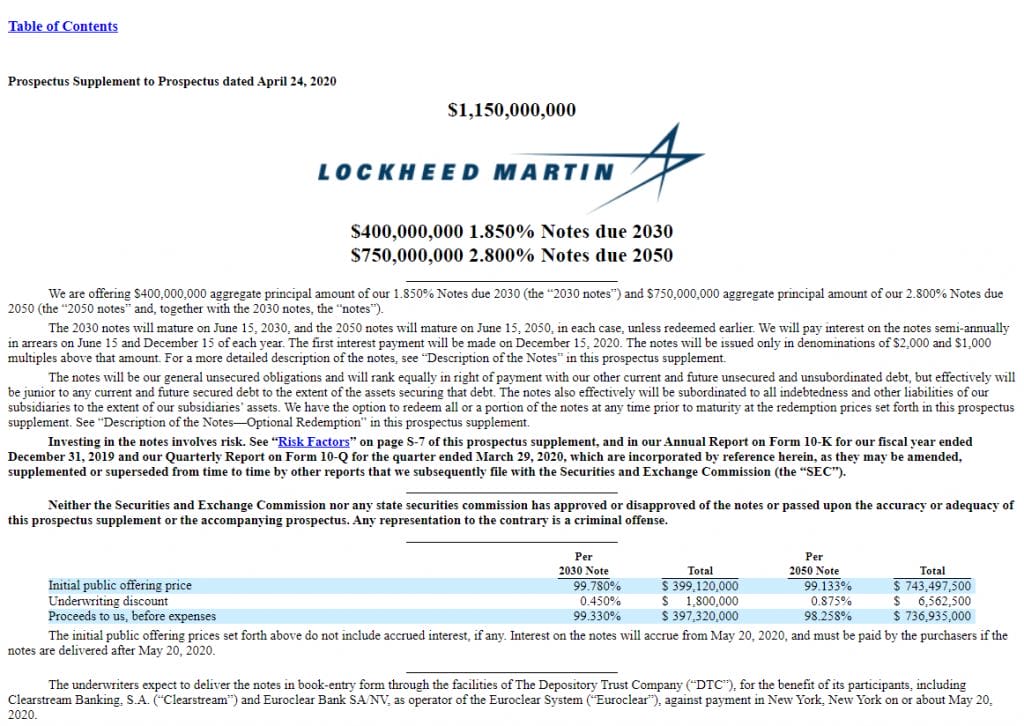

I bolded the 2050 notes since those were the bonds with the highest principal amount issued for the year, so why don’t we take a look at the Indenture document for these notes to find the debt covenants?

Unfortunately, we see no links to this document at the bottom of the 10-k, so we’ll have to do some additional digging.

The disclosure above mentioned the notes were issued in May 2020, so let’s find any documents from that time period which should outline the terms. In this case, on the company’s SEC.gov page, we can see a prospectus (Form 424B5) filed on 05-18-20, which looks like this:

Keep in mind that just because a company issues notes doesn’t mean they will always find a buyer, but in this case we know from the 10-k that the company “used the net proceeds from the offering plus cash on hand to redeem…” So, we know they closed on their issuance.

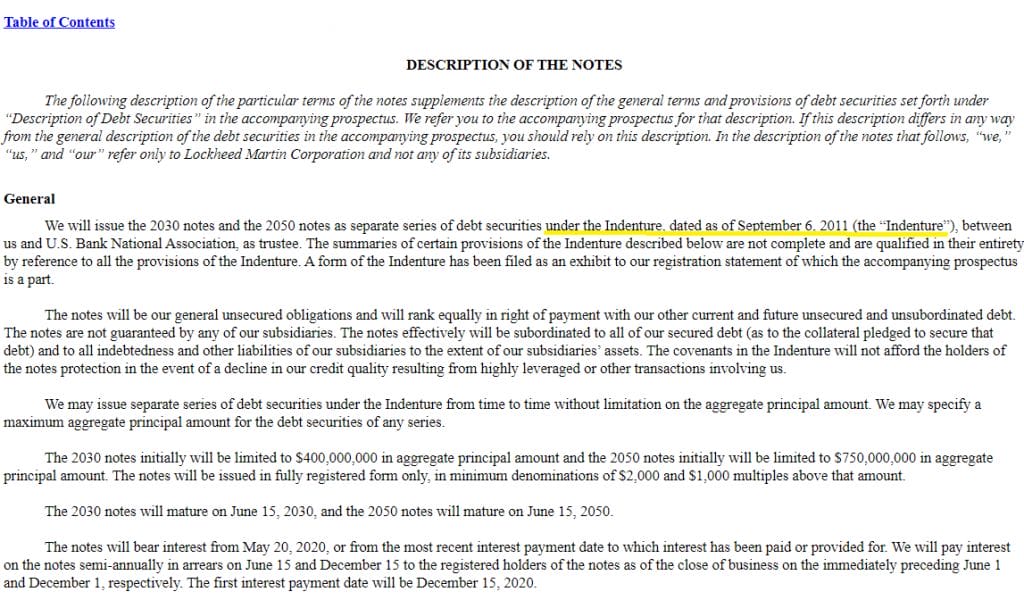

Within this prospectus document we can find some descriptions of the notes, which also clue us in on where to find any debt covenants. Scrolling down to the “Description of the Notes”, we can see the following:

With this valuable information now secured, we can go back to the latest 10-k, find the Indenture document from September 6, 2011, and identify the debt covenants there. We see the link on the bottom of page 111:

Going through the same process that we went through to find the debt covenants for the Credit Agreement (see above), we can see the following sections in ARTICLE 4 COVENANTS:

- 4.01 – Certain Definitions

- 4.02 – Payment of Securities

- 4.03 – Limitation on Liens

- 4.04 – Limitation on Sale-Leaseback Transactions

- 4.05 – No Lien Created, etc

- 4.06 – Compliance Certificate

- 4.07 – SEC Reports

We don’t see any mention of any sort of coverage ratios in the table of contents, but let’s do a quick skim to make sure we didn’t miss anything.

In this case, I don’t see anything, and so it’s likely that the company is unencumbered to accrue future indebtedness without much limitation, assuming they can find a buyer/creditor.

Investor Takeaway

Sifting through the various SEC filings isn’t always easy, especially if you are not versed in doing so. Hopefully this guide has provided you the means to investigate debt covenants, term sheets, and Indenture documents for all of the companies you analyze in the future.

There are many key parts to the 10-k, which we’ve provided resources for, such as these:

- How to Read SEC Filings – Dissecting the 10-k Annual Report

- Explaining Management Discussion and Analysis (MD&A); 10-k Overview

- Financial Statement Footnotes: Treasure Trove of Information from the 10-k

But don’t worry about absorbing it all at once if you’re first starting out. You can learn as you go with these valuable investment analysis skills, and keep them with you for life.

Like with investments, knowledge grows at a compounding rate.

I find it easiest to learn things as I come across them in my fundamental analysis. For example, if I see a company with high leverage, that’s when I refer to my knowledge (and probably this post!) on debt documents and ratios.

When I see a company with a complex ownership structure mentioned in their risks section, that’s when I might brush up on proxy statements and corporate management structures.

However you decide to tackle these, be sure you’re constantly learning and growing.

That’s how you’ll make the concepts stick, and really master fundamental analysis.

We have a free email list you can subscribe to for helpful lessons throughout this journey, which you can access by clicking on the button below.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Translating a Bond Indenture into Simpler Terms (Real-Life Example) A bond indenture is simple in theory. It’s a document outlining the terms of a bond; what the issuer’s (or borrower’s) obligations are to the...

- Operating Leverage Formula: How to Calculate It with the Income Statement Updated 9/3/2023 “For a fundamental investor, anticipating revisions in expectations is the key to generating attractive returns. Sources of those revisions include fundamental outcomes (typically...

- Pros and Cons: Held to Maturity (HTM) Securities on Companies’ Balance Sheets Updated 3/30/2023 Did you know the majority of financial assets for most companies comprise marketable securities? Did you also know companies such as Microsoft, Amazon,...

- Net Debt to EBITDA Guide: Risks, Valuation, Examples, and S&P 500 Data Updated 8/25/2023 Net Debt to EBITDA ratio is a common tool for measuring risk. It’s often listed in company financials. The logic is simple, and...