This in-depth analysis on the Ally Bank stock will hopefully serve as a good example of how investors can look at a company’s qualitative factors and combine it with quantitative financial data to make good stock purchases.

Ally Financial (Ally), one of the most popular online banks, just recently released their 2nd Quarter results and they were quite remarkable.

The 2nd quarter results showcased several of the ongoing strengths of this bank, with increasing strength in their auto loans division and the exploding growth in their consumer deposits.

As more and more people do their “stuff” online, it just makes sense that they would do their banking online, which has led Ally Bank to being voted the best online bank for the third year in a row, according to Kiplinger’s.

Let’s take a look under the hood and see what is driving the Ally Bank stock and company towards success.

Overview of the Ally Bank Stock

Ally Financial was founded in 1919 and is headquartered in Detroit, Michigan. They were formerly known as GMAC Inc and changed their name to Ally Financial in 2010. Ally Financial is one of the growing numbers of online-only banks and has been voted the best three years running.

Ally boasted revenues of $1.56 billion last quarter, which was a 6% growth year over year, with an adjusted EPS of $0.97 for the 2nd quarter 2019, compared to the $0.83 adjusted EPS of the 2nd quarter of 2018, which shows a year over year increase of 17%.

Return on equity of 16.6% was up 597 basis points YoY, compared to 10.65% from 2018. Additionally, Core ROTCE of 12.4%, which was down 45 bps YoY. Ally’s efficiency ratio was 46.1%, which improved 160 basis points, year-over-year, which is an outstanding number and indicates a very profitable bank.

Net income improved to $381 million during the 2nd quarter, compared to the net income of $349 million in the second quarter of 2018 an increase of 9.1% over the previous year, all of this driven by higher net financing revenue.

Net financing revenue improved to $1.2 billion, which was up $63 million from a year ago, driven by asset growth and deposit growth. Net financing revenue was $25 million higher quarter-over-quarter, primarily due to higher retail auto portfolio yields.

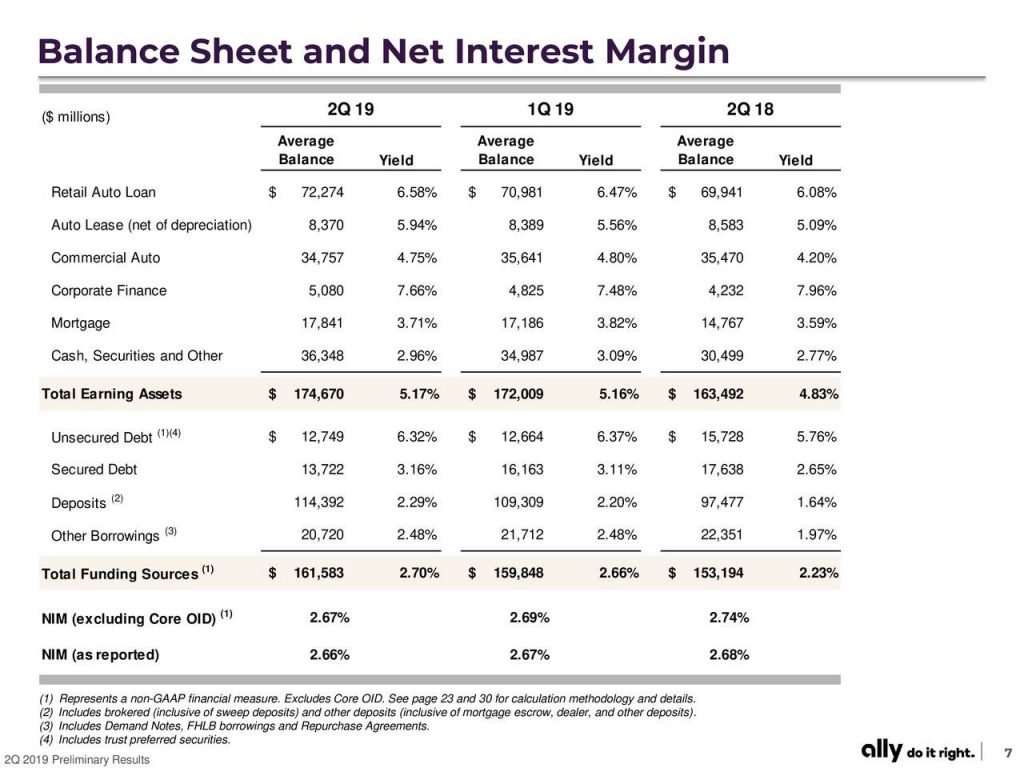

Chart courtesy of Ally Financial 2nd Quarter Earnings Call Slides

Net interest margin or NIM was 2.66%, which was down 2bps YoY. Additionally NIM was down seven bps YoY, primarily due to the growth of lower-yielding, capital-efficient assets such as mortgages and securities. The lower NIM was “driven by ongoing diversification and elevated premium amortization in our mortgage and investment security portfolios as benchmarks declined, and prepayments increased” per Jenn LeClair, CFO.

Noninterest expense increased $42 million YoY, driven by higher weather-related losses and additional costs associated with the growth of the bank. On a year-over-year basis, weather losses increased by $18 million as loses during 2018 were much more moderate.

All in all, the major metrics we like to look at in regards to banks are all showing very positive signs of a bank that is growing and doing the right things for us, the shareholders.

The Ally Bank Growth Story

Speaking of growth, let’s take a look at what is driving the growth for Ally.

The first section you have to talk about in regards to Ally is their continued focus on loans, particularly auto loans.

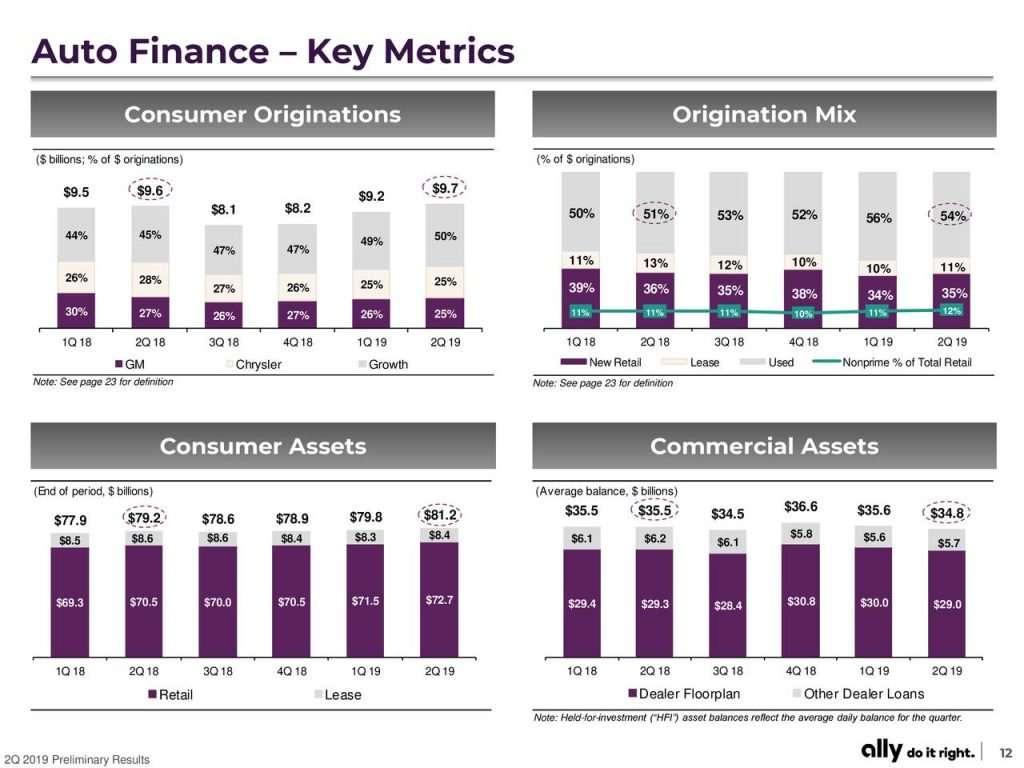

Chart courtesy of Ally Financial 2nd Quarter Earnings Slides

As we can see a few highlights of the performance per auto finance, there was growth YoY of consumer originations from $9.6 billion Q2 2018 to $9.7 billion in Q2 2019, all this while decisioning a record 3.3 million applications during the quarter. All of which was up 8% YoY and the highest level every for Ally.

Ally has also grown their dealer relationships this quarter to over 18,000 dealerships, which was the 21st consecutive quarter of growth in dealerships, which helps confirm Ally’s position as one of the leading auto lenders in the US.

“Risk-adjusted margins increased during the quarter as new origination yields of 7.6% expanded 56 basis points year-over-year, resulting in another quarter of increasing portfolio yields and declining loss rates.”

Ally’s credit trends remain solid as retail auto net charge offs declined nine bps from 95 bps compared to the prior year, this helps showcase the strength of Ally’s underwriting and credit risk management, which they have seen a decline of net charge offs over the last six quarters.

For a more in-depth look at Ally’s auto loan performance, check out this fantastic article from Gary J. Gordon.

Turning to deposits as a means of growth for Ally, after all, deposits are the bread and butter of all banks and raw material that allows them to lend out money to their customers.

From Jeff Brown, CEO from the 2nd Quarter earnings call earlier.

“Deposit customers of 1.9 million grew by 100,000 quarter-over-quarter, a 23% increase year-over-year, or 350,000 new customers. A majority of inflows continue to be sourced from traditional banks highlighting the ongoing trend among consumers who are seeking increased value and convenience from their bank. These are the cornerstones of our nationwide, always-on, digital bank, evidenced by Ally being named the best online bank for the third consecutive year by Kiplinger’s earlier this month.”

As the direct deposit market continues to grow by an average of 15% since 2008, which represents around 10% of all total retail deposits, Ally as the largest online-only bank is well situated to take advantage of this continued growth in direct deposits.

As more and more people spend their lives online, it only makes sense that they would gravitate towards online banks. Frankly that is what drew me to them as a customer.

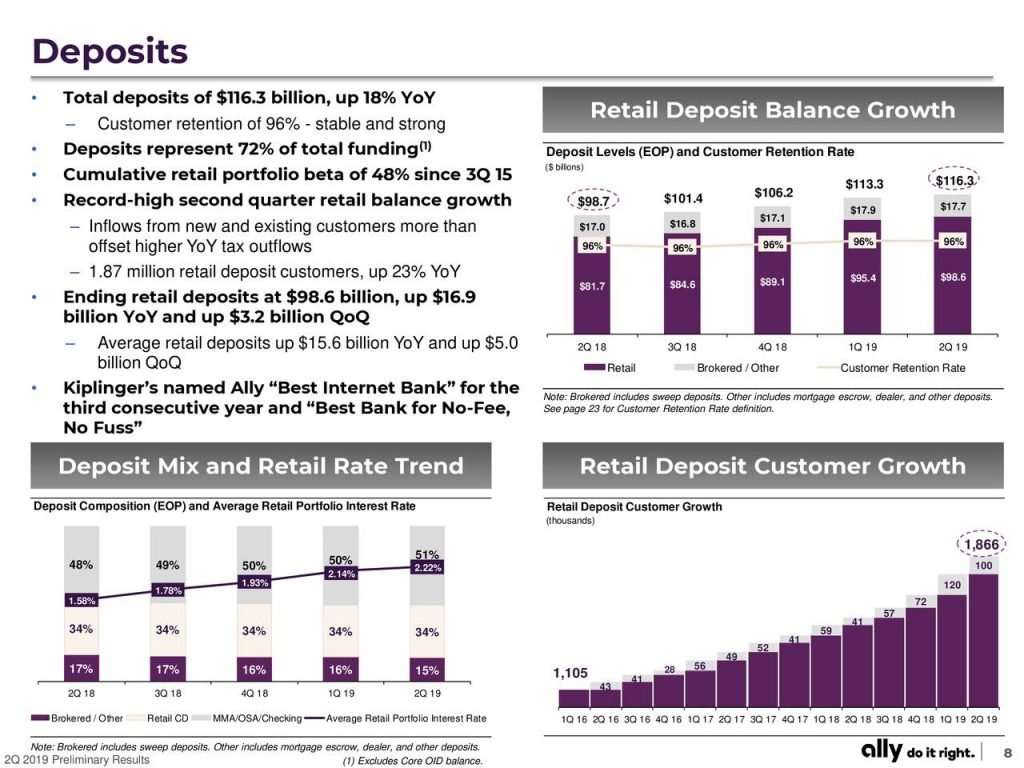

Chart courtesy of Ally 2nd quarter earnings slides

As we can see from the chart above, there are a lot of great things going on with the deposit growth. First, we can see that total deposits of $116.3 billion were up 18% YoY, and that customer retention is 96%, which is very stable over the last YoY.

Ally grew it’s retail deposit customers by 23% YoY, to a total of 1.87 million customers. Also, it’s retail deposits were up $16.9 billion YoY, for a total of $98.6 billion.

Ally has grown its retail customers from 1.10 million customers in 2016 to the current total of 1.87 million, a growth of 70% over a little of two years. Looking over their balance sheets from the 10-ks, you can see the growth of deposits from $66.4 billion in 2015 to $106.1 billion in 2018, a growth of 59.7% over those three years.

Growth like that is what is going to take Ally to the next level and continue to give it the raw material to help grow their auto loan segment as well. It just makes sense that more and more people are going to move towards online banking, as our lives move more and more towards the internet, which you can see illustrated by the continued focus of the brick and mortar banks on the digital arena.

Deposit growth like the one that Ally is seeing is only going to continue to grow and this I believe is what is going to see this bank grow into the future, as the deposits grow the raw funds for the growth in lending, particularly auto lending will lead to greater profitability.

As seen by the large banks like Wells Fargo, JP Morgan, and so on, deposit growth has fueled their growth through the years and has enabled banks like Wells Fargo to weather their latest storms. After all, banks have a certain “stickiness” to them; I have heard it said that leaving your bank is harder than leaving your significant other.

Ally Bank Stock Risks

Ok, we have spent a fair amount of time talking about all the good stuff, now we need to focus on potential areas that could lead to Ally being an unwise investment.

The first discussion, of course, will be about the Fed and their discussions of the potential for raising rates. In this era of abnormally low interest rates, any rate increases have been a boon for banks as this is the primary driver for profitability.

Likewise, any cuts in interest rates could be a cause for a decrease in profitability as the margin between the bank’s rates and the cutting of the rates they borrow, leaving less money on the table for the borrowing bank.

And speaking of rate cuts, on July 31st there was a rate cut of 25 basis points, which the Fed deems as an appropriate action to sustain the continued economic expansion.

While not being a large cut in rates this could lead to a cut in profitability for all banks, at this time we will have to wait and see how this affects Ally over the next quarter or two.

Another potentially very large risk is the amount of long-term debt that Ally is currently carrying, their debt to equity ratio is quite high at 3.07 TTM, much higher than I like to see as this always makes me nervous.

Comparing this to much larger banks like Wells Fargo which is currently 1.74 TTM, and JP Morgan 1.33 TTM, likewise smaller banks with a similar market cap like Citizens Financial Group, carries a debt to equity of 0.52 TTM.

Ally’s current long-term debt is sitting at $42.3 billion, with a rate of 4.01%, which yielded an interest of $419 million for the 2nd quarter. Of the long-term debt, $30.1 billion is secured debt, with the payments for the debt $9.57 billion are due within one year, the balance of $32.73 being due after one year.

All things being equal Ally easily has the cash-flow to make those debt payments in the next year, and for the foreseeable future. And Ally has done a fantastic job of reducing their long-term debt over the last five years, from a high of $66.2 billion to the current level of $42.3 billion.

My concern with such high debt levels compared to their equity could be a recipe for disaster if not left unchecked and efforts are not made to bring that more under control, which Ally’s management has done. After all, out of control debt is the major cause of most bankruptcies and leads to the ruin of most companies.

Ally Bank Stock Valuation

What is Ally worth? That is the question we will tackle in this section by examining some key metrics and looking at a dividend discount model.

The current PE for Ally is 8.38 as of March 2019, which is below the industry standard of 11.80. The low PE shows that Ally is currently underpriced by the market in comparison to its potential for growing earnings.

Next up is tangible book per share, which currently is at 35.80, which is over the current market price of Ally of $33.35 as of July 31st, 2019 — also indicating a slight undervaluation in comparison to Ally’s book value.

Instead of doing a DCF for Ally, I like to use a dividend discount model, and for Ally, I will use the following inputs:

- Current annual dividend $0.68

- Expected growth of 8%

- Risk-free rate of 2.2%

- Estimated market return of 5.68%

- Beta of 1.29

I like to use more conservative numbers when plugging in growth rates; this helps me build in a margin of safety in my calculations, in case I make an error in enthusiasm or if I am drinking too much of the “Kool-Aid.”

Based on the numbers that I have plugged into my calculator, I come up with a valuation of $48.09 for Ally, which I feel is a little high but not out of the realm of possibilities, a valuation closer to $42 to $45 I feel is a lot more realistic.

As with all calculations, remember that it is better to be approximately right versus precisely wrong, and the formula is only as good as the estimates that we plugin.

Final Thoughts

Overall all I think Ally is a strong bank with a lot going for it. Their online model is perfect for today’s consumer and how we live on the internet.

Additionally, eliminating the brick and mortar model has helped them lower costs and enable them to offer much higher interest rates on both their check and savings accounts, which has helped attract more customers, giving them growing deposits which in turns helps them offer more loans.

Ally’s management has done a fantastic job of managing its capital and has been buying shares to the tune of almost 1 billion dollars with a plan for an additional $1.25 billion more, along with a growing dividend, albeit only for the last five years. Ally’s management has demonstrated that they are looking out for their shareholders and are looking for additional ways to continue to grow both their profits as well as equity.

I am currently a shareholder of Ally Bank stock; I was lucky enough to buy in at $22.16 almost eight months ago, but I still feel that Ally is undervalued and I will continue to add to my portfolio.

Related posts:

- 6 Simple Metrics for Bank Stocks Analysis So you want to start analyzing bank stocks? Well you found the right place. First off, understand that bank stocks are a unique beast compared...

- Core Bank Processing: A Breakdown of the Sector Updated 10/12/2023 The history of banking and how we handle our money is a fascinating subject, and the evolution of how we bank has been...

- Wells Fargo (WFC) 10Q Summary First Quarter 2020 Wells Fargo 1Q20 Summary Wells Fargo reported its first-quarter earnings on April 14, 2020. What follows is a summary of the bank’s results for the...

- Understanding the Commercial Banking Industry – A Simple Guide Updated 1/5/2024 “Banking is a very good business if you don’t do anything dumb.” Warren Buffett The banking industry is an unknown entity to most...