Updated 10/12/2023

The history of banking and how we handle our money is a fascinating subject, and the evolution of how we bank has been an incredible journey. Not long ago, we had to balance our checkbooks to ensure we had enough money to pay our bills. Or we had to read our statements to stay current with our mortgages, but now all of that is automated by core bank processing.

Core bank processing, led by Fiserv, Jack Henry, and others, allows customers and businesses to manage their finances electronically.

To better understand how to invest in these companies, we need

to understand their business operations and how they make money. Core bank processing is a big part of the evolution of how we manage our money, and these companies are on the cutting edge of that change, but they don’t get much love from the investing community.

Without core bank processing, companies such as PayPal or Square wouldn’t be able to do what they do, and we’d have to go back to the Stone Age and balance our checkbooks; yuck!

In today’s post, we will learn:

- What is Core Banking?

- Core Banking Functions

- What Core Banking Systems Do Banks Use?

- Leading Core Banking Providers

Okay, let’s dive in and learn more about core bank processing.

What is Core Banking?

Most analysts describe core banking as the back-end system that processes banking transactions across branches. The core banking system comprises all processes, including deposits, credit and loan processing, and ATM functions.

Central to the essential core banking services are:

- Opening new accounts

- Servicing loans

- Calculating interest

- Processing deposits

- Withdrawals

- Customer relationship management

Think of core banking as the daily functions whenever we interact with our bank, check our balances, pay a bill, take money out at an ATM, or pay our mortgage.

The core banking processing system allows all these functions to happen in real time, enabling customers to manage their money flow.

These systems aim to make existing customers feel they have greater control and freedom over their account transactions. As the tech improves, the transactions become faster, safer, and less clunky.

The fact that we can bank remotely in today’s world allows customers greater flexibility and functionality. It makes these core banking systems even more integral to banks such as Wells Fargo and JP Morgan.

The improved core bank processing is also a boon for banks on the economic side because it lowers operational costs. For example, the tech allows banks to use less human resources to execute daily functions.

As the technology improves, core bank processing becomes more efficient and user-friendly, allowing bank employees and consumers to feel better about moving money. These improvements simplify banking and make it more convenient for customers, extend the outreach of banks to remote locations, and enable more people to become part of the banking world.

Core Banking Functions

Core banking became possible because of the advent of computers and their increased speed and reliability. Consider that before the 1970s, it used to take at least a day for any transaction to post in your account because each branch had local servers, but it didn’t link to a central system.

Over the past 30 years, banks moved to a core banking application to support their operations via a Centralized Online Real-Time Exchange (CORE).

These centralized the bank branch transactions on a centralized data center, enabling customers to make transactions anywhere and simultaneously update the transaction across the network.

The software improvements reduced the banks’ human resource needs and increased efficiency. The software now allows core operations of the bank to, in real-time:

- Record transactions

- Passbook maintenance

- Interest calculations on loans and deposits

- Customer records

- Balance of payments and withdrawal

The software, installed at the different branches, connects the branches with the data servers and interconnects through landlines or, more recently, the cloud.

The core bank processing interfaces with the bank’s general ledger systems and reporting tools to keep track of customers’ transactions, enabling the customer and bank to keep track of all transactions in real time.

The core banking applications are often the bank’s biggest single expense, and legacy software replacement is one of the major issues in allocating money and time to replace. Much of the spending in the sector revolves around updating or upgrading a combination of service-orientated design and supporting new technologies.

Many leaders in the core bank processing sector implement or create custom applications for their customers. Others focus on implementing or creating customized commercial applications for their vendors. Additionally, system integrators focus on taking creators’ applications and integrating them into the bank’s core bank processing.

Some leaders, such as Fiserv, Jack Henry, and FIS, handle the above to give their customers an all-in-one package to ease the transfer from legacy products to the cloud.

Jack Henry, for example, offers a core bank processing system, Jack Henry Banking, an open-source technology that allows customers to build on top of Jack Henry’s solution and add additional features and products without having to rip out the legacy tech. These functions help lessen the cost and burden for banks and make the transitions to faster, safer, and more functional solutions for the bank’s customers easier.

What Core Banking Systems Do Banks Use?

There are thousands of different banks worldwide. With the growing influence of fintechs, novo banks, and neo banks, the need for increased software solutions offered by core bank processing systems will only increase.

There is also the matter of legacy banks turning over their systems to keep pace in this fast-paced technological world.

Banks worldwide spend millions of dollars upgrading or maintaining their core banking systems, which usually interface with tens or hundreds of other systems. The core banking systems interact with a high volume of traffic. Banks expect them to function without interruption, with any downtime in the system catastrophic, inviting customer ire and a significant loss of potential revenue.

The legacy banking systems currently in place have traditionally succeeded in reliability, with failures being rare. However, with the advent of APIs, cloud banking, and digital banking, banks are seeing a considerable shift in how banking products interact with customers.

The expectations are that banks process transactions in real-time, link with customers’ favorite fin-techs in weeks, release new features to keep up with customers’ needs, and scale their infrastructure to match the growing demand for faster and safer transactions.

The older, legacy core bank processing systems can’t always keep up, and many banks are facing the problem of either replacing their legacy systems or upgrading their legacy tech.

When the bank decides to move on from its legacy core banking systems, there are many pain points to consider. Among them is the dwindling talent pool to maintain these systems and excessive code customization to keep up, which elevates the complexity and makes additional changes difficult or risky for the bank.

In response to these issues, the leaders in the core bank processing are moving to a new breed of systems, incorporating more cloud-ready, API-rich, open-source code systems to enable quicker turnaround of the above issues.

Embracing the new type of core banking processes makes upgrading systems easier, pushing the envelope on customer experiences and making the costs more affordable for the banks.

According to SDK.com, the top core bank processing systems are:

- Tenemos: with over 500 million end-users

- Mambu: with over 14 million users, one of the newer players on the block

- Backbase: over 90 million users

- Oracle FLEXCUBE: over 380 million users, and yes, that Oracle

- Finacle: over 1 billion end-users

- Finastra: over 175 million retail-accounts

The above are all global companies, with the leaders here in the US:

- Fiserv

- Jack Henry & Associates

- Oracle with FLEXCUBE

- FIS

- Finastra

Leading Core Banking Providers

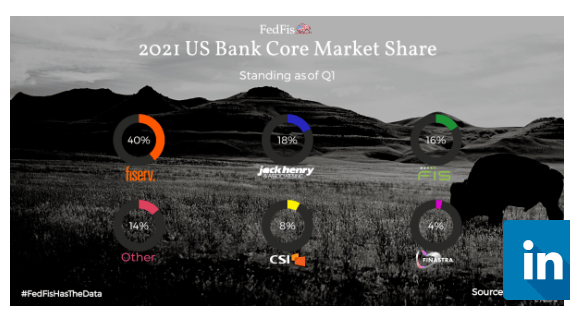

Below is a graph highlighting the market share for the top providers in the US market. Fiserv, Jack Henry, and FIS are the top providers of core bank processing, with Fiserv as the leader. However, each company tends to focus on different sectors and segments.

For example, Fiserv is the leader, focusing on large and mid-sized banks. Some well-known names include:

- JP Morgan

- US Bank

- Wells Fargo

- Visa

- Ally Bank

- Fifth Third Bank

With a current market cap of $73 billion, Fiserv serves over 11,000 banks and credit unions in the US, and their core processing powers one out of every three banks and digital offerings for 95 of the top 100 banks in the US.

Fiserv works with banks in the $1 to $50 billion assets range, which is its sweet spot, along with over 3,200 credit unions. The US bank IT spend is reported to be $67 billion annually, with $12 billion in the $1-$10 billion range, each with around $10 million in the budget for IT spending. That is a lot of market share available for Fiserv.

As Fiserv expands its cross-sells with its “surrounds,” additional services, the company has grown its average sales to customers from 20 products to 37.

The company expects the segment to grow at 4% for 2021 with continued outperformance in the mid-market banks ($1-$50B) and cross-selling of additional services.

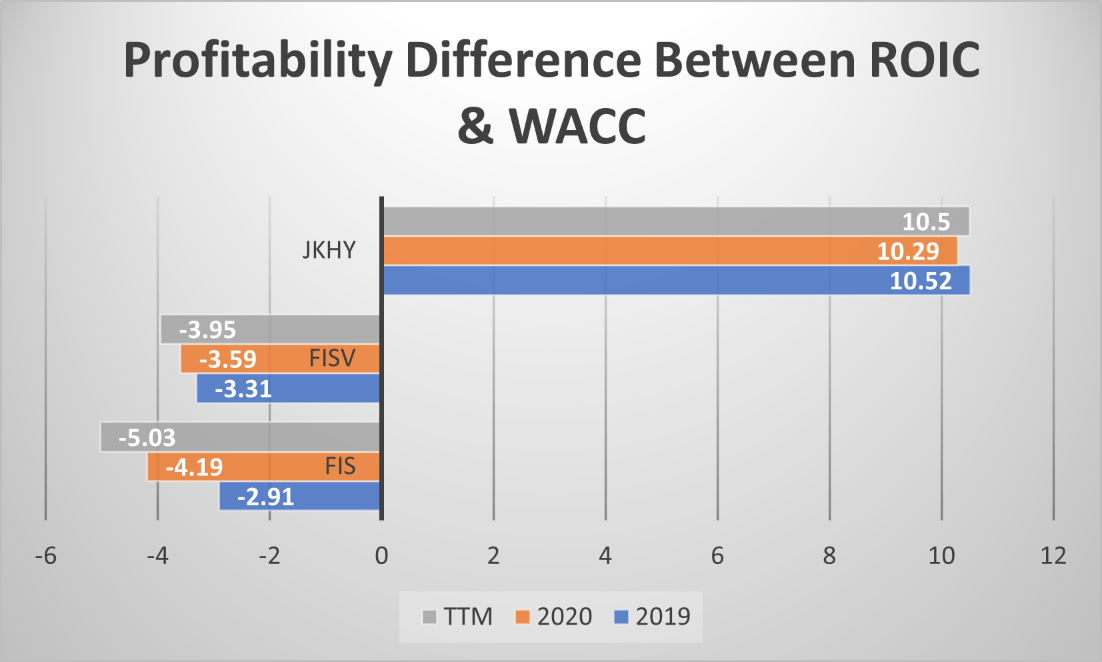

Fidelity National Services, or FIS, is another leader in the space, with a market cap of $76 billion. FIS’s roots lie in core bank processing systems, the most basic and mission-critical system for banks. This business lives in the company’s banking segment, which makes up almost 50% of the company’s revenues.

FIS’s customers typically sign multi-year contracts; their customer retention is around 99% annually. Its leading market share gives FIS an edge in the core banking sector and provides a scalable business.

All of that gives all three of these players a measure of a moat, with most banks hesitant to rip out their core system to go with another player. The switching costs for changing core bank processing are immense, which provides another level of moat.

Like Fiserv, FIS’s customers tend towards larger accounts, which carry more leverage for FIS.

Jack Henry, the smallest of the group, with a market cap of $12.8 billion, focuses much more on the smaller regional banks and credit unions, with their stated target having $50 million in assets. Unlike Fiserv and FIS, Jack Henry works towards organically building out its company.

Jack Henry’s business model lends itself to stability, with most of its revenue recurring under long-term contracts and subscription business. The company weathered the financial crisis quite well but has struggled coming out of it as banks put off upgrading their core bank systems.

The company has outgrown its competitors and is picking up incremental share, evidenced by its 40 competitive takeaways in 2021. The high switching costs make this process a slow churn, but Jack Henry is a leader in open-source bank core bank systems, encouraging banks to adopt their system.

The core segment is approximately one-third of Jack Henry’s revenues, and their customers typically sign long-term contracts, and their customer retention approaches 99% annually.

The biggest difference between the business operations for the big three is that both Fiserv and FIS are essentially roll-ups and use M&A to build a leading position in core banking. That strategy has both good and bad, the good being a larger market share and increased revenue potential; the bad is that the acquired platforms require more upkeep and maintenance to prevent any loss of customers. The loss of customers put both companies at risk of maintaining any switching cost benefits.

In contrast, Jack Henry approaches growth more organically and uses M&A more strategically. The focus on building unified platforms for banks and credit unions gives Jack Henry a slimmed-down product, allowing it to focus its resources and help it maintain competitive margins relative to its peers.

Jack Henry also has done a fantastic job of creating additional complementary products for its services, giving it greater add-on capabilities and growth possibilities.

Investor Takeaway

Core bank processing is far from a sexy, exciting industry, but it provides the framework for all the fun, exciting changes occurring in the banking industry.

As with any sector or industry, understanding the business is the best way to invest. The core bank processing sector contains technology and processes that make it hard to understand exactly what they do, but most of the companies in this sector make money from two recurring sources: long-term contracts and subscriptions.

That way, they are not much different than Salesforce or Netflix, but with a different product. All the companies have their moat and serve different market sectors; for example, Fiserv focuses on large enterprises, Jack Henry focuses on the smaller end of the market, and FIS in the middle.

And with that, we will wrap up our discussion for today on core bank processing.

As always, thank you for taking the time to read today’s post, and I hope you find some value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- The Future of Debit Card Processing, What It Is and How It Works Updated 10/27/2023 In 2020, the Federal Reserve Bank of Atlanta conducted a Survey of Consumer Choice, which reported that: Evidence also shows that increasing debit...

- Pin Debit Networks: A Guide to This Unknown World Updated 9/25/2023 In a survey recently released by the Federal Reserve Bank of Atlanta, U.S. consumers use their debit cards to make payments 68% of...

- How Payment Processing Works: A Guide for Beginners Updated 4/4/2024 How many of you still carry cash, or how many of us still pay for anything with cash? If you are like me,...

- Key Players in the Payment Processing Flow Updated 11/9/2023 Analysts expect global payment revenues to grow to $2.5 trillion by 2025, according to McKinsey, after returning to their historical 6 to 7...