Amazon stock split?

What the heck.

“Hey, I have some AMZN stock, don’t split mine in half!”

Was that you just now? If so, take a deep breath, it’s going to be OK. That’s not what we mean when we say stock split!

Let’s first start off by saying what a stock split even is…

When a company splits their stock, the reasoning is usually because they think that the price is so high that it might be deterring people from purchasing that stock.

For instance, the AMZN stock price as of 9/6 was $1,833.51. So, if you were saving $150/month, it would take you over 13 months of just saving that money before actually being able to buy any of that stock – and that’s assuming that the AMZN stock price won’t continue to rise!

So, if you were saving $150/month, starting with $0, would that deter you from buying AMZN stock?

I can tell you that I would 100% not take this approach. I would look for a company with a much lower stock price to purchase.

Something that’s important that I want to note – many people confuse the terms “cheap” and “expensive” with the price of a stock, such as AMZN is “expensive” because it’s over $1,800.

No.

That’s not what people mean.

When people are saying that a stock is expensive, they’re saying that the valuation is expensive.

For instance, you could have a $10 stock that has a price/earnings (P/E) ratio of 50 and a $300 stock that has a P/E of 12. In this example, the “expensive” stock is the $10 stock and the “cheap” stock is the one that is $300/share.

The reasoning for these terms is the valuation. I didn’t want to get too far off track, but this was a mistake that I often made when I started listening/reading about investing, so I wanted to explain it for you all!

So back to stock splits – a company is more likely to split a stock because their share price is too high for the average investor, which has nothing to do with a stock being cheap/expensive.

As I mentioned the AMZN stock price on 9/6 was over $1,833/share. For context, the average S&P 500 price that day was $123. So, yes, I would say that the high price for AMZN is likely a huge deterrent for the average investor.

“Ok Andy, I get it. I know what a stock split is – so is AMZN going to do this?”

Long story short, I have no freaking idea, but I think they should.

AMZN isn’t a stranger to stock splits as they’ve done three before in the late 90’s.

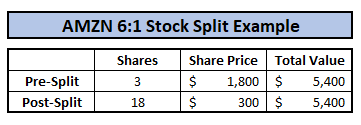

I think that if Amazon did a 6:1 stock split at $1,800 current price (I’m using a round number for easy math), then the new share price would be $300/share.

If you’re a current AMZN stockholder, don’t panic thinking that you just lost a ton of money. Your 3 shares at $1,800/share have now turned into 18 shares at $300/share.

As a current shareholder, it has no true value to you, but I think there is some unwritten value here…by lowering the stock price, I think you now have two major advantages:

The price is now much lower for all investors

Once the split goes through, people that previously couldn’t afford AMZN now might be able to and will “want to buy in while they can.”

This in turn will theoretically drive up the price and the total amount of value of the company is still the same, but the demand has increased. And guess what, this includes you!

Yes, you had three shares before, but maybe you were saving up to your fourth share and had $900 saved. Now you can go buy 3 shares at $300/share rather than waiting until you got the remaining $900 saved up!

You have more shares for the same total value, so you have increased flexibility

AKA, you can sell 3 shares now if you’d like, which is equivalent to half of a share before the stock split, which you obviously cannot sell half of a share.

All this being said, not all companies choose to split their stock.

The main reason for choosing to not split their stock is because there are perceived values based off a company’s stock price, for right, wrong or indifferent reasons.

A high stock price oftentimes comes with a level of prestige while a lower stock price may flash a red “danger, danger” warning sign. Again, the actual price of the stock has absolutely zero impact on the performance or outlook of the company, but not everyone looks at the stock market in such a quantitative way that many of us do.

Back in 2017, Jeff Bezos, the Amazon CEO, was asked if the company was going to split their stock due to the rising stock price and he responded by saying “That’s something we consider from time to time. We don’t have any plans to do that at this point, but we will keep looking at it.”

In short, that sounds like a PC way of saying no, but that was also back in 2017.

A lot can change in a couple of years, and a lot has changed when specifically referring to Amazon. For instance, the highest price for AMZN in 2017 was $1,195.83. As I mentioned, the stock price on 9/6 was up to $1,833.51, which is a 53% increase over the 2017 high.

The answer that Bezos gave wasn’t completely dismissive of a stock split, but more or less a “not now” type of answer, in my eyes.

If you find yourself in the situation that I described earlier, where you’re actively working on a way to save up enough, or even to add to your portfolio, then I would recommend that you keep an even closer look on AMZN and what Bezos says in his future comments.

I feel like this topic isn’t going to go away anytime soon, and if AMZN isn’t willing to split the stock now, when will they be ready?

Related posts:

- Tesla and Apple Did It – Is it Time for a Google Stock Split? Stock splits are a really unique thing nowadays and with so many companies doing it lately, it makes me wonder if it’s also time for...

- Hey Andy – What Happens When a Stock Splits? Have you ever wondered what actually happens when a stock splits? Chances are there are two groups of people reading this right now – 1...

- Should Investors Care if a Stock gets Delisted? With all the fanfare going on in the news about Chinese stocks being delisted from U.S. exchanges, many investors are currently wondering what will happen...

- The 8 Stock Market Secrets to Success That I Wish I Knew When I First Started Updated – 12/14/23 To get to the secret of success in the stock market takes just a few easy to remember, short phrases which are...