Have you been working hard and want to treat yourself? Keep reading to find out if you truly can afford a new truck, or if it’s just another want.

One of the first things I wanted to do when I got my first real job was to buy a new vehicle. I had been driving a beater for six years throughout high school and college, and I was finally ready to have that big payment. Of course, growing up in a rural area, my first question was, “Can I afford a new truck?”

Unfortunately for me at the time, the answer was no. I was looking in the $25-30K range, and even in 2015, prices were well above that. However, looking back now, I wish I would have bought that brand-new truck and still owned it. There is about a 95% chance it would be worth as much now as it was back then.

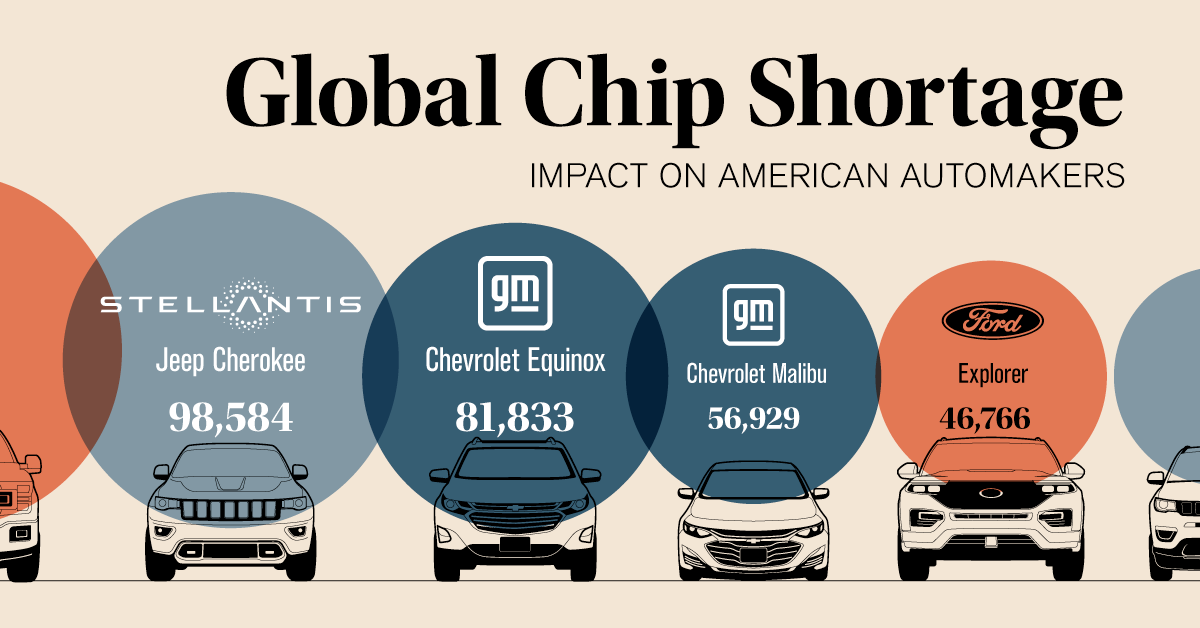

When evaluating if you can afford a new truck, that is the toughest part right now. Not only have all vehicles skyrocketed in value because of the microchip shortage, but trucks, in general, have also increased at an even faster pace.

The Microchip Shortage:

So, let’s start at the beginning of this one. The COVID-19 Pandemic severely strained our supply chain in the United States. One of the biggest hit items was a microchip for cars (and many other electronics) that put a major shortage in the market.

With fewer new vehicles on the lot, that drove the prices of used cars through the roof. At one point I took my used SUV for an oil change, and they offered me $5,000 more than I paid for it on the spot. Keep in mind that I had driven the car for over a year and put 12,000 miles on it since purchasing it.

It sounds great to make $5,000 on a vehicle, but I quickly learned it would cost me $10,000+ to get another car in the used market that I was interested in. The microchip shortage has gotten better, but there were still 1.7 million fewer cars produced in 2021 compared to 2019.

You may ask, “Won’t inflation help bring prices down?” I’ll admit, I think the longer you wait here in 2022, the lower prices will be on all vehicles. With the chip shortage slowing down (a little bit), and the economy under pressure, one of the first cuts you will see in someone’s budget is a new vehicle.

It’s very interesting for me to write about this now because I’m in the market for a new truck as well. I last purchased a truck in 2017, and I’m finally ready to upgrade. It is crazy what $44,000 bought me in 2017, and what that will buy me now (which is next to nothing).

Inflation and the Evolution of the Full-Size Pickup:

As I mentioned above, inflation in cars has been horrible over the last two years because of supply/demand constraints from the chip shortage. But, while car prices have seen inflation of around three to four percent, truck inflation is over five percent per year for the last three years. That means a $50,000 truck in 2019 is now nearly $58,000 in 2022.

Yes, inflation is a huge issue, and a recession in our economy is likely the only thing to slow this down. This is purely my opinion, so take it for what it’s worth. I’m still not sure the vehicle market will slow down in a recession.

Why do you ask? This recession is based on inflation. Prices are going up and are certainly slowing things down in the economy, but people are still working. And if there is one thing I know about Americans, they love to spend. So, people are willing to still take on car payments even if they are 10 percent higher than in the past. Americans still have jobs and are willing to push their budget to the absolute max for some items of luxury.

The other item to look at is the evolution of the full-size pickup. If you look at Chevrolet, Ford, Dodge, Toyota, and even Nissan, they are all making full-size trucks that have cabs with more space than a full-size SUV. Most of these backseats have enough room for multiple car seats and even a dog (trust me from experience).

So, in the past, it might have made sense to get a Suburban or a Ford Explorer for a huge family, but now it’s just not necessary. Not to mention a spray-in bed-liner and tonneau cover basically give you a massive trunk where you don’t have to worry about the weather hitting any of your stuff.

Trust me, I grew up in a family of trucks, and they were nothing like they are today. I remember cramming into the backseat of my grandpa’s truck to ride to town for breakfast, and there was nothing safe about that. But all these changes and upgrades have created a vehicle that is much to be desired by any American.

I challenge you the next time you are on the road, watch all the vehicles that you pass, you will see many full-size pickup trucks which have become the new “family vehicle”. So, when thinking, “Can I afford a new truck?”, just remember, everyone else wants one too.

Figuring Out your Budget:

Now let’s get into the meat and potatoes of the “Can I afford a new truck” subject. As you have heard me preach time and time again, it all comes down to the budget. But the budget all depends on you. The bottom line is that you know what you can and can’t afford. If you are truly able to afford a new truck, you’ve done your homework, but don’t forget some of the underlying questions that can make a huge difference.

Are you saving for something bigger? Let’s say you are planning to get married, planning to have children soon, or planning to purchase your first home. It doesn’t matter what it is, if you are planning a major purchase soon, or you expect your spending to increase soon, you should double check your budget figures for a new truck.

When my wife and I first met, we lived in an apartment that was only $750 a month for rent. We both had great jobs and were making plenty of money to have a car payment double that. However, I knew in the next year or two we would be looking to purchase our first home. Even with a $120,000 first home (which is cheap depending on where you live), I still needed to come up with more than $20,000 as a down payment.

Instead of having a $1,200 truck payment, I kept my beat-up car that had over 100,000 miles and saved that extra money for our new home. Once we purchased our new home (which had a similar mortgage as our monthly rent), I was then able to go out and buy my dream vehicle. At the time without children, it was more of a sports car.

My point with this is that a car is a luxury, it’s not a need. Some penny pinchers would sit and argue all day that having a nice vehicle or a new truck is a complete waste of money. I’ll tell you, that is not me. I’ve always been someone who enjoys a nice car or truck, but I also know that it is an extra that should be put on the back burner if there are other things you need.

If you can cross that off your list, then it becomes very simple. Plug a payment into your budget and decide if it makes sense. This is going to be different for everyone. Some folks want their budgets within a penny each month, others know they are going to fluctuate five to ten percent each month depending on what they have planned.

I try to be as detailed as possible, but I also understand that I can’t predict the future. I didn’t know my daughter was going to break her arm in July and it was going to cost me $500 to get it taken care of. I didn’t know my wife’s car was going to need new brakes in August and cost me $600. But I do know that if I take my normal spending and add in payment for a new truck, I can get by each month and not have any issues up to a certain amount.

When you are determining if you can afford a new truck, do the simplest thing possible. Plan out all of your expenses and income for a month, and see if there is enough left over to take on a car payment.

Other factors that you can include to justify the purchase are gas mileage and repairs. If you are getting a vehicle that is substantially better on gas, you can do some simple math to figure out how much you are saving.

For example, on 2,000 miles in a month, a vehicle that gets 10 miles per gallon better will save you nearly $70 per month. If you are constantly taking your car into a shop to be repaired, a new vehicle shouldn’t incur those costs so you can add that into a payment.

Be sure to not create funky math just to justify getting a new truck, but there are certainly a few items you need to consider.

Other Items to Consider:

When considering “Can I afford a new truck?”, I would also challenge you to really do your homework on a new truck. Maybe new means “new to you” or maybe it means brand new with zero miles. On one hand, because of the chip shortage, used vehicles carry a premium, but you can still find some savings with a used vehicle compared to a new one.

For trucks, the old saying that it loses 20 percent once you drive it off the lot is likely a bit of a stretch, but there is no doubt once you sign the paperwork you are in the red. A used vehicle has already lost that instant depreciation and can sometimes be the smarter buy.

Let me clarify: when I say used vehicle, I mean something that is only two to three years old and under 30,000 miles on it. Often there are still factory warranties remaining on the vehicle and they have barely been broken in. I am a firm believer if you take care of a vehicle, it can last for 200,000+ miles. The biggest issue with a used vehicle is you don’t know who had it before you.

The best tip I’ll give you (in my opinion) is to look for a used car coming off lease. That means it’s only had one owner and leases typically offer a maintenance program so it’s safe to assume that the car has been taken care of. I have done this for my last two vehicles and have had all but zero maintenance on either one (knock on wood).

I will admit, my cousin who always buys or leases a new car seems to always get free maintenance included and never has issues, but I know they also have a much bigger payment each month than I do.

As with anything when it comes to finances, your comfort level is going to be the biggest item. Are you okay with a month here and there dipping into your savings if unexpected expenses occur? Or are you one that has to be above the red line on your spending and income to be satisfied?

There is no wrong answer, but now with vehicles being so expensive, you do need to do your due diligence in the beginning. If you buy a $60,000 vehicle with very little upfront money, you can get upside down quickly, meaning you owe more than the vehicle is worth. If you are in that situation and your income drops substantially or goes away, you could find yourself in a tough situation.

But on the flip side, you only live once. If you have a good job and make enough money to spoil yourself occasionally, don’t drive a rusted-up vehicle your whole life. Go out and treat yourself.

Related posts:

- How Much Should I Budget for a Car? At times you need to treat yourself, but always make sure to calculate how much you can spend on a car before you go crazy!...

- How to Use the Doctor Budget Tool to Set Your Finances Straight Recently, I was fortunate to be invited on the Investing for Beginners Podcast and talk about my personal finance experiences and introduce Doctor Budget to...

- Simple Vehicle Maintenance Checklist to Save Your Budget Don’t get a nice car. Pay for your car outright. Maybe don’t even get a car if you can manage without one. If you’re into...

- What Are the Rules on your Income to Rent Ratio in Today’s World? I remember being 16-years old and thinking that moving out from my parents’ house was going to be the best day of my life. While...