Updated 4/4/2024

How many of you still carry cash, or how many of us still pay for anything with cash? If you are like me, not many of us. The use of credit cards, debit cards, and online payment processing has exploded over the last ten years. But do any of us understand how payment processing works?

The pandemic accelerated the move towards cashless transactions, where stores like Walmart kept running out of silver to return to customers because none of their customers paid in cash.

Payment processing has many layers, and it remains a bit confusing until you understand how the payments flow from one point to the other. Most of us are familiar with Visa and Mastercard, some of the world’s most recognizable brands. However, newcomers like PayPal, Square, Venmo, and others have entered the space and disrupted payment processing.

In today’s post, we will learn:

- How Does Payment Processing Work?

- How Do Payment Processors Make Money?

- Different Investment Opportunities in the Payment Processing Sector

Okay, let’s dive in and learn more about how payment processing works.

How Does Payment Processing Work?

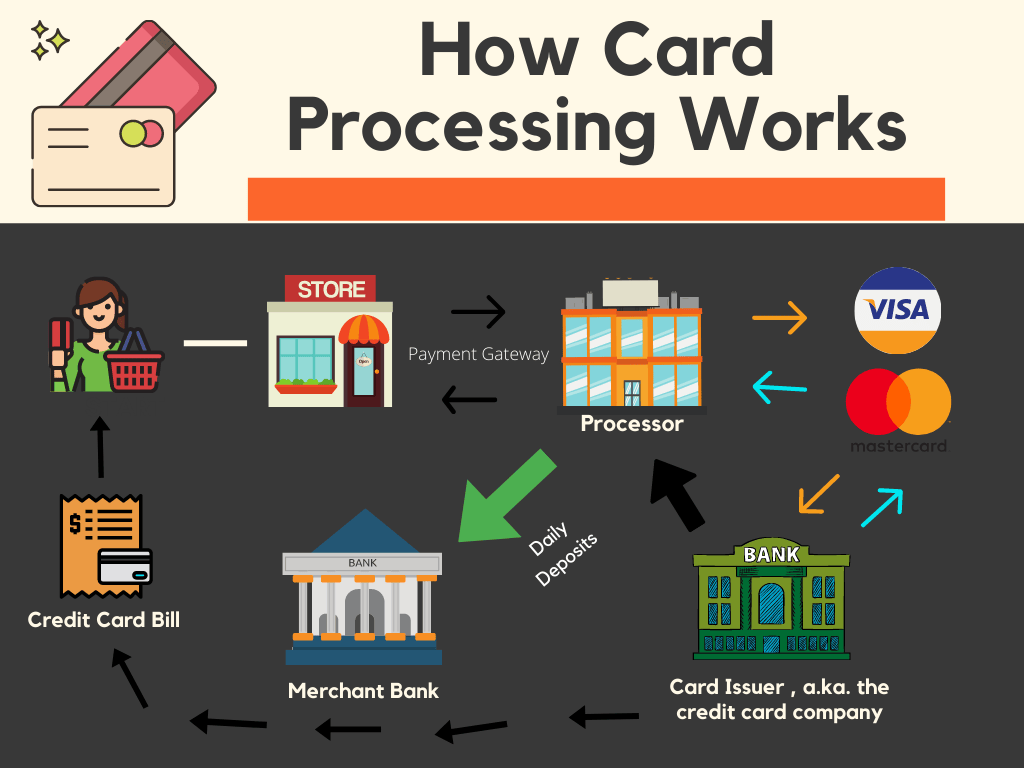

When we swipe our cards, it seems like a pretty simple process—we swipe our Visa card, and voila, the payment is complete in a few minutes. However, the process behind the scenes remains far more complicated, even though it only takes seconds to complete—the card’s sliding and signing the receipt complete only the first and last steps. Although the process remains quick, multiple stages and multiple actors behind the scenes enable it to happen seamlessly.

Surprisingly, one of the largest expenses most small business owners experience remains credit card processing fees, but most are unfamiliar with the process or how the fees happen. As investors, we need to understand the whole process to fully comprehend how a company like Visa or Square makes money.

Before discussing the actual transaction steps, let’s examine the six actors involved in this highly coordinated dance.

Key players:

- Cardholder: pretty self-explanatory, that us. There are two main cardholders: a transactor who pays for the bill in full and a debit card. The other is a revolver, which uses a credit card and pays part of the bill when due while the balance accrues interest.

- Merchant: the store or vendor who sells services or products to the customer or cardholder. The merchant accepts electronic or plastic payments while also sending card information to the cardholder’s issuing bank. Also, it receives payment authorization from the same bank.

- Acquiring bank/Merchant bank: the acquiring bank acts as the middleman between the merchant and the bank. They receive the merchant’s payment authorization requests, send them through the right channels, and then relay the issuing bank’s answer to the merchant.

- Acquiring process/Service provider: A third party is sometimes the arm of the acquiring bank. A service provider processes the payments by receiving and sending information from the merchant to the bank and back. In many cases, the party is unrelated to the issuing bank or may be an extension of the bank. For example, Wells Fargo has an arm of its business department processing payments for the bank. However, other banks outsource the activity because they don’t want the hassle.

- Credit Card Network: Think Visa, Mastercard, Discover, and American Express. These entities operate the networks processing electronic payments worldwide while also governing interchange fees. As we have discovered, the credit card network receives the payment details for the acquirer, then sends the payment authorization query to the issuing bank, and sends the acceptance back to the acquiring processor.

- Issuing Bank/Card Issuer: Think JP Morgan, Wells Fargo, Chase. These are the financial institutions that issue us the plastic we use to buy stuff; the Visa card is from Chase, not Visa. The issuing bank is the one receiving the card authorization and either approving or declining it.

The whole process only takes seconds, which is amazing when we think about it. In many cases, some confusion can arise from the whole process because the merchant bank can also be the acquiring bank. It can then handle several steps of the process and make it easier for the issuing bank to process payments.

In some cases, the merchant/acquiring and issuing banks are all part of the same company. For example, JP Morgan Chase offers its customers all the aspects of card processing, so it acts as the go-between for the merchant and card networks such as Visa.

In other words, Chase issues the merchant a machine that allows them to process customers’ cards either online or in the store. The merchant then processes the payments by sending them through the network via Visa and deposits the money in the merchant’s account, which is at Chase. This allows the merchant to house all of the processing and deposits in the same place, saving them time and money.

Next, let’s cover the actual process more so we understand it.

Card processing, either online or in the store, happens in three distinct processes:

- Authorization

- Settlement

- Funding

Let’s first look at how cards are authorized:

- The cardholder presents their card in person or virtually to a merchant in exchange for products or services. The request might come in the form of a card terminal in-store, POS (point-of-sale) system, or through the e-commerce gateway on the merchant’s website. Payment processing can also occur through a merchant’s mobile or in-app process.

- Once the payment is received, the merchant sends an authorization request to the payment processor.

- For example, the payment processor sends the request through the appropriate network, either Visa or Mastercard. The payment eventually reaches the issuing bank.

- The authorizations, including CVV numbers, validation, and expiration dates, are made to the issuing bank.

- Then, the issuing bank either approves or declines the transaction.

- The issuing bank then sends the approval or denial back the way it came to the card association, merchant bank, and back to the merchant.

Pretty simple, huh?

An easy way to think about the flow is to visualize a highway. First, we get on the highway headed for our destination, in this case, the issuing bank. We get on our highway through a ramp (merchant processor); once on the highway, we choose which direction to go (credit card association, Visa/Mastercard); once we decide on the direction, we arrive at our destination, the issuing bank.

Now, let’s look at a simplified settlement process and funding of card payments.

- Merchants send authorized batches of transactions to their payment processor, often at the end of the business day or at a predetermined time.

- The payment processor details the transactions to the card associations, who communicate the appropriate information to the issuing banks on their networks.

- The issuing bank debits the cardholder’s account for the transaction.

- The issuing bank then transmits the funds to the merchant bank minus interchange fees.

- The merchant bank deposits the funds in the merchant’s account.

Pretty simple, huh? Considering this all happened overnight when it used to take days. It allows the merchant to get their money quicker, helping their cash flows.

How Do Payment Processors Make Money?

When a merchant accepts a card payment, either with a debit, credit, or online payment, they process the payment for the customer’s convenience. However, that convenience comes at a cost to the merchant in terms of fees.

Because of these fees, many merchants look for the cheapest processors or mark up their products to cover the fees. In some cases, small businesses choose not to offer card payments because the fees eat too much into their profits.

For example, a merchant charges $100 for a product, and we pay for it with our credit card. The merchant may receive that $100 in deposits minus the processing fees, which equals $3. Therefore, the merchant will get a deposit of $97 in their account or receive a bill later for the $3.

To determine how the payment processor gets paid, let’s look at the breakdown of fees and how that $3 gets divided among the different sector players.

Much of this structure depends on the merchant’s transaction volume and what rates they can negotiate. The processor’s fees vary depending on the transaction type. Many of the fees are flat, per-transaction, or volume-based.

To avoid complete confusion, we will discuss some of the major fees.

Merchant Discount Rate

The discount rate is the fee that merchants pay for the ability to accept card transactions. The fees are the basis of the services provided from one of the following:

- Merchant banks

- Acquiring banks

- Payment processors

- All of the above are in one entity

The fees range between 2% to 3%, with online merchants paying the higher end of the scale, but the fees can go as high as 5%. The discount fee is charged by adding sales tax to the bill. There are several components of the discount rate:

- Interchange fee – Visa and Mastercard rule the roost, and this is the fee they charge for using their networks to process payments. The acquiring bank and processor pay this fee to the issuing bank. Most fees in the payment processing world come in multiple parts, and the interchange fee is no different. A percentage goes to the issuing bank (Capital One), and a fixed transaction fee goes to the credit card network (Visa). For example, the per-swipe fee might be 2.35% plus $0.15. The interchange fees can vary depending on the type of card swipe, for example:

- The physical presence of the card

- Lack of physical presence on the card

- Manually entered

- Card type – rewards, bonus, Black Card

- Assessments—Visa and Mastercard charge this transaction fee for sales made with their branded cards. The fee is usually determined by the volume of transactions processed during the month. It is generally fixed and not negotiated by the acquiring bank. Visa, for example, might charge 0.11% for assessment plus $0.0195 per card swipe. The interchange and assessment fees account for around 75% to 80% of card processing fees.

- Markups – the other 25% to 30% of card processing fees come from the markup of interchange and assessment fees from acquiring banks or processors. The markups can vary depending on the processor and different pricing models.

The above fees are the major ones for payment processing; there are additional fees the companies can charge, but the ones that most directly affect both the merchant and payment processors are above.

Let’s do a quick exercise to follow the money.

The customer goes into their favorite store and purchases an item for $100. Let’s follow the flow of money for the 3% or $3 of the discount rate that the payment processing companies charge:

- Merchant acquirer (Global Payments, FIS, Square, PayPal) – $0.75

- Merchant processor – $0.10

- Credit Card Network (Visa, Mastercard) – $0.15

- Issuing Bank – (Bank of America, CapitalOne) – $2

- Merchant – receives $97 for sale, fees already deducted

The above is a simplified example of how the merchant’s cash flow goes from the payment processing system to the merchant. If you want to see a great video breaking it all down, check out this link.

Once we break it down, it is not so complicated. There are many levels to understand, but once we decode the system, it makes much more sense.

Different Investment Opportunities in the Payment Processing Sector

There are multiple opportunities to find investment ideas in the payment processing industry, like many tech world areas.

Let’s start with the merchant acquirers, typically the customer-facing merchants who acquire the merchant’s payment processing, say, a small baseball card shop.

These merchant acquirers can own the whole payment processing ecosystem, except for the credit card processing networks like Visa and Mastercard. But for our purposes here, let’s break it down by different payment processing system segments. One thing to note is that you might see the same company at different stages of payment processing.

Merchant Acquirers

|

Company |

Ticker |

Market Cap |

|

Global Payment Network |

GPN |

$63.60B |

|

Fidelity National Information |

FIS |

$90.59B |

|

PayPal |

PYPL |

$291.99B |

|

Square |

SQ |

$110.65B |

|

JP Morgan |

JPM |

$468.44B |

|

Bank of America |

BOA |

$324.73B |

|

Fiserv |

FISV |

$83.09B |

Credit Card Network

|

Company |

Ticker |

Market Cap |

|

Visa |

V |

$480.52B |

|

Mastercard |

MA |

$379.84B |

Issuing Banks

|

Company |

Ticker |

Market Cap |

|

American Express |

AXP |

$115.44B |

|

Capital One |

COF |

$59.01B |

|

Discover |

DFS |

$30.21B |

|

JP Morgan |

JPM |

$468.44B |

|

Wells Fargo |

WFC |

$162.68B |

The above are just some examples of possible investments in various payment processing experience stages. As with any investment, we must do our due diligence to find the opportunity that works best for our portfolio and risk tolerance.

All the companies remain great businesses; some are in the growth stage, such as Square and PayPayl, while others, such as Visa and Mastercard, have become more mature. But just because it is a little old in the tooth doesn’t mean it isn’t important to the economy or has a crucial impact on the processing network.

Investor Takeaway

The payment processing segment continues as a vital, growing part of the economy and has exploded in usage with the pandemic’s stay-at-home orders. The evolution toward a cashless system had begun already, but the pandemic only accelerated that evolution.

With most consumers using their phones to make payments online or with their mobile wallets, the trend will only accelerate. And with the rise in cryptocurrencies, who knows where the payment space will lead?

Recently, I read that Walmart is embracing the idea of creating a bank to capture some of the profits available in payment processing. This makes sense because Walmart is a low-cost provider, and those processing fees eat into its bottom line. And if it can capture that additional 0.50% to 0.75% of its profits, that is a move worth making.

As with any investment, we must understand how the business makes money. Decoding the payment processing ecosystem has interested me for quite some time. As with my interest in banks, I want to learn more about how processing payments makes sense.

There are many great companies in this space, but make sure you understand the business’s economics before putting your hard-earned money to work.

With that, we will wrap up our discussion for today.

Thank you for taking the time to read today’s post, and I hope you find something of value in your investing journey. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Key Players in the Payment Processing Flow Updated 11/9/2023 Analysts expect global payment revenues to grow to $2.5 trillion by 2025, according to McKinsey, after returning to their historical 6 to 7...

- The Future of Debit Card Processing, What It Is and How It Works Updated 10/27/2023 In 2020, the Federal Reserve Bank of Atlanta conducted a Survey of Consumer Choice, which reported that: Evidence also shows that increasing debit...

- How Visa Makes Money: A Business Model Breakdown Updated 10/12/2023 Visa Inc (V) is one of the leading payment brands globally and its cousin Mastercard (MA). Visa provides payment services to over 200...

- The History of American Express and their Business Model Updated 11/24/2023 American Express’s history helped shape the finance structure, along with its unique business model. Warren Buffett thinks so highly of American Express that...