DECREASING term life insurance? That sounds backwards, right?

WRONG!

Not too long ago I wrote a post about term life insurance that really explained some great things about it. Term life insurance can be a great tool as long as you are using it for the right purposes, which I fully outline here. But have you ever heard of Decreasing Term Life Insurance?

It seems like many people have not, but I truly think it’s somewhat of a hidden gem when looking at different insurance policies.

Decreasing Term Life Insurance is a policy where you pay the same amount throughout the entirety of the term, but your coverage will slowly decrease throughout that timeframe.

When I first was explained this option I had to hear it a few times because in my head I kept thinking, “wait, so I am going to pay the same amount every year, but my coverage will only decrease throughout this term? Why would I ever do this?”

The answer to why you would do this might seem hard to comprehend at first – and it should be.

The policy is essentially designed to help you accomplish two main goals:

- It can set you up that if something ever happened to you, your coverage is set to provide help on fixed costs such as a car loan, mortgage, etc.

- If your thought process is that you want to protect your family as much as you can for a certain amount of time, and then at that point they’re on their own, then this can accomplish that.

When first reading my main two points, it might sound a little bit harsh, so let me explain further:

Let’s imagine this situation – your main concern is that if you passed away, your family would be stuck with a mortgage or other type of loan that they won’t be able to afford, so they would need to move. A great way to combat this would be Decreasing Term Life Insurance. Why? Let me explain. This is the situation:

Your mortgage has 20 years left on it and in total you owe $300,000.

Let’s say that the Decreasing Term Life Insurance plan that you have been offered costs you $50/month gets you a $500,000 benefit on Day 1.

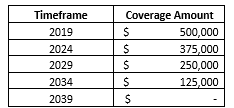

A typical amount that you can expect to lose annually would be 5%, so let’s just say that your total coverage amount would look something like the chart below:

So, the real question is “why would you want this?”

Well, we established that in this situation, your number one fear was that you were going to leave a large payment/debt on your family without you being there to help provide for them.

Theoretically, your total mortgage would dwindle down over the years as you made your monthly payments, so the total owed would be less, therefore requiring you not need as much coverage as you did the year before.

This Decreasing Term Life Insurance plan will allow your premiums to stay the same throughout the entirety of the term, and stay relatively low, compared to if you just wanted to pay for normal term life insurance that would have the same coverage the entire time. Essentially, this would be a little bit more specific to your individualized goal.

Similar to the situation above, this would be “hedging your bets” in a sense.

For instance, let’s say that your goal is that you want to pay for your kids’ college.

To do so, you think you need $100,000/child, or a total of $200,000 (since you have two kids in this example). So, you open a Decreasing Term Life Insurance plan where you start with $200,000 of coverage on Day 1.

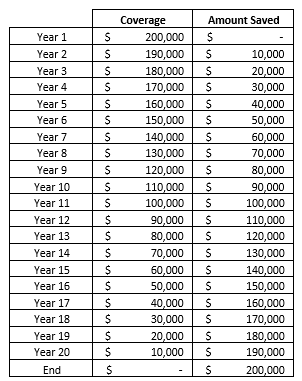

Your plan is to save $10,000/year, which is the same amount that your Decreasing Term Life Insurance will decrease by in this example. So, in theory, you are offsetting the amount that the coverage is dropping each year by saving that amount. See the chart below that shows an annual breakdown of how this would look:

Again, it’s important to note with insurance, that insurance is not a money-making tool – it’s a sense of security.

Yes, you very well could get to the end of the term and all you have done is “waste” money on a “worthless scam”, but that’s not the point of insurance – the point is that if something had happened to you in Year 5 and you only had $40,000, where was the remaining $160,000 going to come from?

That’s where this plan is very useful.

Yes, you could simply just get term life insurance, but that wouldn’t address your needs and it would likely cause you to pay a higher premium since your coverage wouldn’t decrease – so in other words, you’d be paying more for some “extra” coverage that you didn’t really need.

When used properly, Decreasing Term Life Insurance is a fantastic plan – you just need to know your objective before deciding if this will properly address that concern.

In general, if your goal is to cover a loan or outstanding debt, or to cover an expense that is X years away, this could be a fantastic plan. I highly encourage you to dive in further if you think that I am describing your situation!

Please do not hesitate to comment and I would be more than happy to assist further!

Related posts:

- Why Do Financial Gurus Love Short Term Life Insurance? First and foremost, I am very proud of you for taking the step to look at Life Insurance, but if you’re getting just started, you’re...

- How Does Term Life Insurance Work? Why are all of our most valuable assets insured, except for the ones that you love? This post will explain how term life insurance works...

- Mortgage Refinancing Analysis – Easy Template Included! With interest rates at historically low levels across the U.S. and much of the globe, now might be a great time for homeowners to refinance...

- Use this FREE 401k Loan Calculator to See if a 401k Loan is Right For You! I’ve made it well-known in the past that I had borrowed from my 401k to help payoff some higher debt in the past and I...