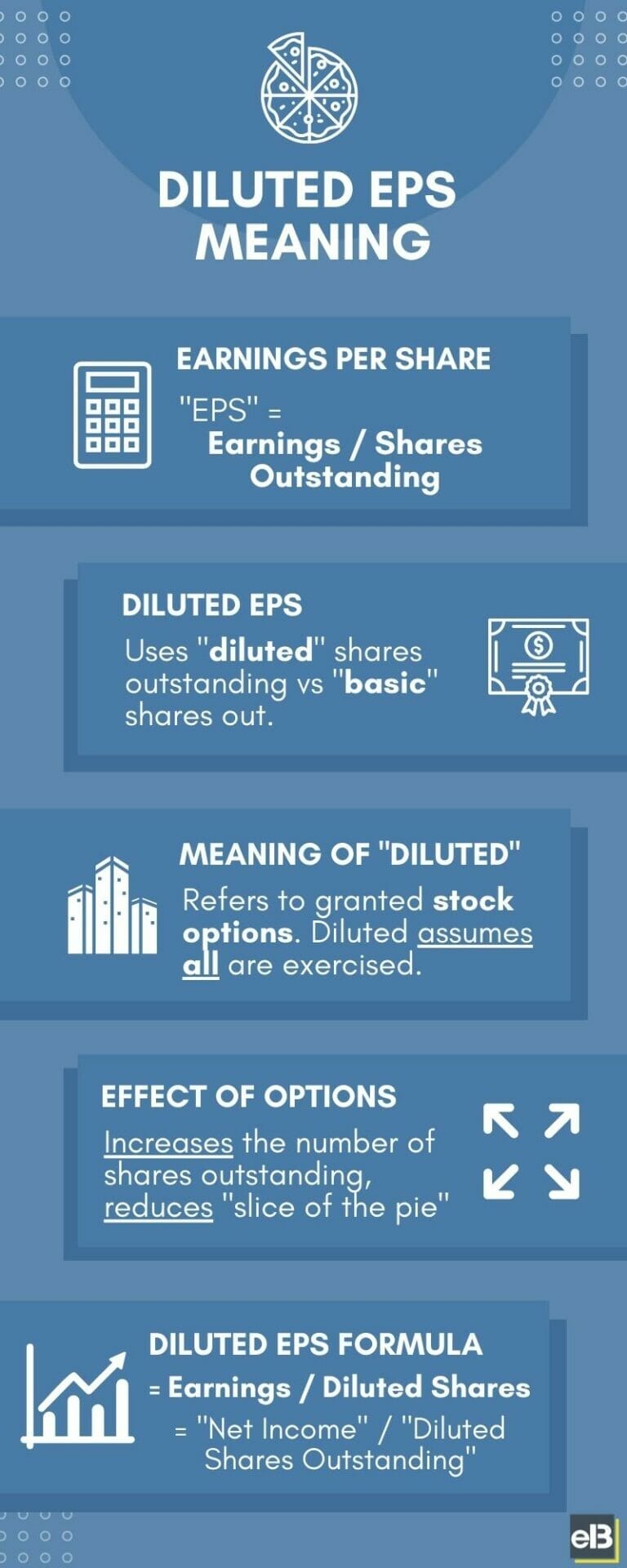

Take a look at any income statement and you’ll see EPS (or Earnings Per Share) divided into two categories: diluted EPS and basic EPS. Which EPS figure should you rely on, and what do those terms mean? The infographic below summarizes it simply:

- EARNINGS PER SHARE

- EPS = Earnings / Shares Outstanding

- DILUTED EPS

- Uses “diluted” shares outstanding instead of “basic” shares outstanding

- MEANING OF “DILUTED”

- Refers to granted stock options. Diluted assumes all options are exercised.

- EFFECT OF OPTIONS

- Increases the number of shares outstanding, reduces “slice of the pie.”

- DILUTED EPS FORMULA

- Diluted EPS = Earnings / Diluted Shares

- Diluted EPS = “Net Income” / “Diluted Shares Outstanding”

The Basics of Shares Outstanding and EPS

Calculating EPS is done by dividing earnings (“net income”) by shares outstanding. The difference between “diluted” and “basic” lies in how you count shares outstanding.

Basically, the diluted EPS formula calculates the “worst case” scenario for shares outstanding. This is the case where the company is as diluted as it’ll ever be.

If you understand basic corporate compensation, you’ll know that many employees are paid through stock options (“stock based compensation”). However, the premise of a stock option is that the employee has the choice to either exercise the option or hold it longer.

Sometimes, these stock options take time to vest. It’s virtually impossible to determine when a stock option will be exercised.

This creates a basic problem for accountants. How do you categorize a stock option? Of course it’s a share, but if it isn’t exercised, then it isn’t currently part of the total shares outstanding. But… it can be exercised at any time so it can’t just be ignored from the financial statements.

Basic EPS vs. Diluted EPS

This dilemma created big problems for Wall Street during the early 2000s, until the solution was created: basic EPS and diluted EPS.

Basic EPS calculates all of the current shares outstanding without taking stock options into regard.

Diluted EPS considers every single stock option, whether it’s been exercised or not. This calculation is assuming that every stock is already exercised, and so shareholder dilution won’t be any worse than this.

It was only a little after the turn of the millennium that diluted EPS was invented. It took much controversy and a few scandals to spurn its creation. Warren Buffett famously spoke out about stock-based compensation, saying:

“If stock options aren’t compensation, then what is it? If compensation isn’t an expense, then what is it?”

Warren Buffett

When using EPS in my own fundamental analysis calculations, I always use diluted EPS. Why would I ever use a value that isn’t accurate such as basic EPS?

Turns out, much of Wall Street also uses EPS, and any time you see an EPS calculation, it’s generally assumed to be diluted EPS.

I say, if basic EPS doesn’t count all of the possible shares outstanding, then what does it count? Diluted EPS should be your only consideration, and now you know why.

Related posts:

- Sample Earnings Per Share Analysis on the FANG Stocks An Earnings Per Share analysis is one of the most common ways that investors will attempt to evaluate a stock. My goal for this post...

- 4 Types of Company Growth Rates and How to Calculate Them Investors demand growth from companies. Wall Street loves growth. But how is company growth defined exactly? In this post we’ll examine 4 separate types of...

- What is a Good PEG Ratio? Updated: 4/6/2023 The PEG ratio was one popularized by the famed fund manager Peter Lynch, who went on to post one of the best mutual...

- Why Do Companies Repurchase Shares? To Create Value. Some of the greatest CEOs of all-time used lots of share buybacks to create outstanding returns. In many cases, these share repurchases can be fantastic...