Updated 5/5/2023

Scuttlebutt investing might not seem possible to average investors. After all, many of us don’t work in the industry. We can’t talk with management. But you can apply aspects of Philip Fisher’s scuttlebutt with the stocks you research.

“Scuttlebutt” was a word invented by famed investor Philip Fisher in his bestselling Common Stocks and Uncommon Profits.

It refers to finding out about a business by talking to people in the industry.

Today, I will show you why you should use a scuttlebutt investing approach to picking stocks. And I’ll show you how even the average investor can apply it, even if you don’t have access to top management.

We will cover the following topics:

- Scuttlebutt: The True Picture of a Business

- How to Do Competitor Analysis

- How to Analyze the Value Chain

- Investor Takeaway

Let’s get started on this simple but powerful method for finding great stock market opportunities today and over the rest of your life.

How Only Scuttlebutt Paints the True Picture of a Business

In the book, Fisher spends 3 short pages outlining “What ‘Scuttlebutt’ Can Do”. In essence, Fisher explains the process of scuttlebutt as talking to as many people as you can about a company that you are interested in a potential investment for.

In particular, I want to highlight the following section of the chapter:

The business “grapevine” is a remarkable thing. It is amazing what an accurate picture of the relative points of strength and weakness of each company in an industry can be obtained from a representative cross-section of the opinions of those who in one way or another are concerned with any particular company.

Philip Fisher

The idea of collecting multiple vantage points through the representative cross-section of a company is one of the simplest yet most powerful ideas for effective research for investing.

This idea of a representative cross-section of a company is also called “the value chain” by the very well-respected business school professor Michael Porter, and it is key to truly understanding a business.

Porter also referred to it as the “five forces”; let’s summarize the idea.

Almost every business is part of a larger ecosystem. Most businesses have the following:

- Customers

- Competitors

- Suppliers/ vendors

We can define competitors further by:

- Current competitors

- Substitute products or services

- And/or, new entrants

A company is intimately involved with each of these major players, as they all can directly affect the profitability and success of a business. They comprise Porter’s “five forces”; we can apply this to the scuttlebutt investing idea because it was also defined by Fisher as our “representative cross-section”.

I guess there’s nothing new under the sun.

Scuttlebutt Through Competitor Analysis

Starting with competitors is an obvious part of analyzing a business, but you might be surprised at how easy it is to overlook.

As we try to apply scuttlebutt investing to our research process as average investors, it should go without saying that we should try to read annual reports, and lots of them.

Reading an annual report is probably your most efficient way to get the scoop about a company directly from management. In fact, even Warren Buffett says that he doesn’t spend that much time talking to management but rather spends most of his days reading through the annual reports from companies and the annual reports of their competitors.

Those competitor reports are essential because even in a document as official as an annual report, it’s easy for biases to slip in and color the information.

People usually don’t think poorly of themselves and their abilities, and psychological research has shown that we routinely evaluate ourselves more highly than our actual skills suggest. There was a study done by Ola Svenson which has proven to be pretty comical; over 93% of U.S. students polled thought that they were above-average drivers, yet the math would tell you that it’s impossible for more than 50% of people to be above average at anything.

This is a feature and not a bug of the human race—without it, we would not have had as much progress.

The rosy-tinted glasses that are inherent in ourselves will also apply to management and the way they think about their business and its prospects.

However, when analyzing others it’s much more likely we will be objective, especially when we don’t have a personal stake in them.

Oftentimes you can learn more about a business by reading about the business from others, and this can particularly apply when reading annual reports. Fisher mentioned that competitors will often talk freely about a competitor if they know they won’t be quoted on it, and the legendary investor Peter Lynch has mentioned that some of his best ideas actually came from talking to competitors who admit when a business has a strong advantage in an industry.

The most practical takeaway for the average investor from all this: read the annual report of every competitor to a business if you can.

This will give you a much more complete picture than just a single annual report ever can.

How to Do Competitor Analysis

Of course, before you can analyze the competitors to a business you have to know who those competitors actually are.

Maybe around 50% of the time, a company will directly reference its competitors in its annual report, which makes it easy enough for the average investor.

Let me show you quickly how to do this.

First, we want to pull up the annual report (or “10-k”) for the business we are analyzing. I’ve been using bamsec.com lately, which pulls filings for publicly traded companies.

Say we want to learn about Oshkosh Corp, ticker symbol $OSK. From bamsec.com I’ll type in “OSK” into the search box, and then click on the latest filed “10-K” under the “Financials” box.

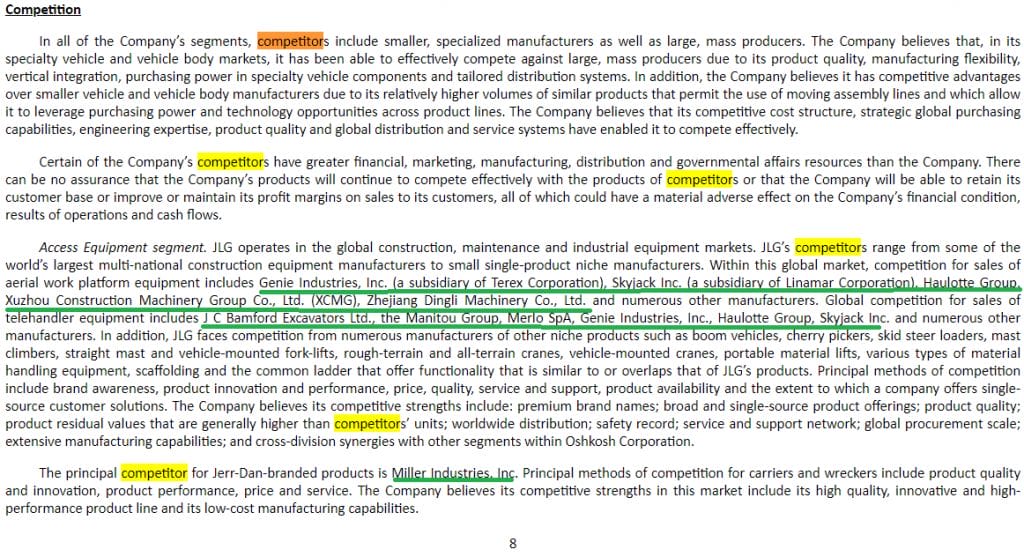

This should load our annual report, which is usually anywhere between 50-100+ pages long. From there, I’ll use the shortcut “ctrl+f” to search for “competitor”. This helps narrow it down, and there is a long list of competitors for Oshkosh displayed prominently in their “Competition” section, as we can see here:

Because Oshkosh is an industrial conglomerate with multiple business segments, we see they compete with different companies in their different product lines.

As the average or even professional investor, it might not make sense to study every single company, particularly if there are dozens, so an astute investor should investigate who the biggest players are and concentrate on analyzing those.

As Phil Fisher’s son Kenneth Fisher said in the intro of the book, investigating stocks for investment is more of an art than a science, especially when you are using a scuttlebutt approach, and it’s more important to follow the research path where it naturally takes you rather than methodically applying a stringent process every single time.

In the case of Oshkosh, you’d want to identify (A) the company’s most profitable segment and/or (B) the company’s highest growth potential segment and then do scuttlebutt on their competitors in those areas by reading through their annual reports in addition to Oshkosh’s.

Finding Competitors When They Are Not Disclosed in a 10-k

Like I said, maybe 50% of the time, you’ll find a complete list of a company’s competitors in their 10-k, but half of the time, you won’t get so lucky.

I’ve observed that the bigger the company, in general, the less descriptive they are about their competitors.

So, if you’re researching a company that doesn’t list its competitors, try reading the annual report of a smaller competitor who might disclose a list of direct competitors in their own 10-k. Alas, sometimes figuring out even a single smaller competitor isn’t straightforward—here are three tools you can use if you run into this.

1—There’s a great free website called finviz.com which is fantastic for screening for investment ideas and constructing an industry map of competitors for a company.

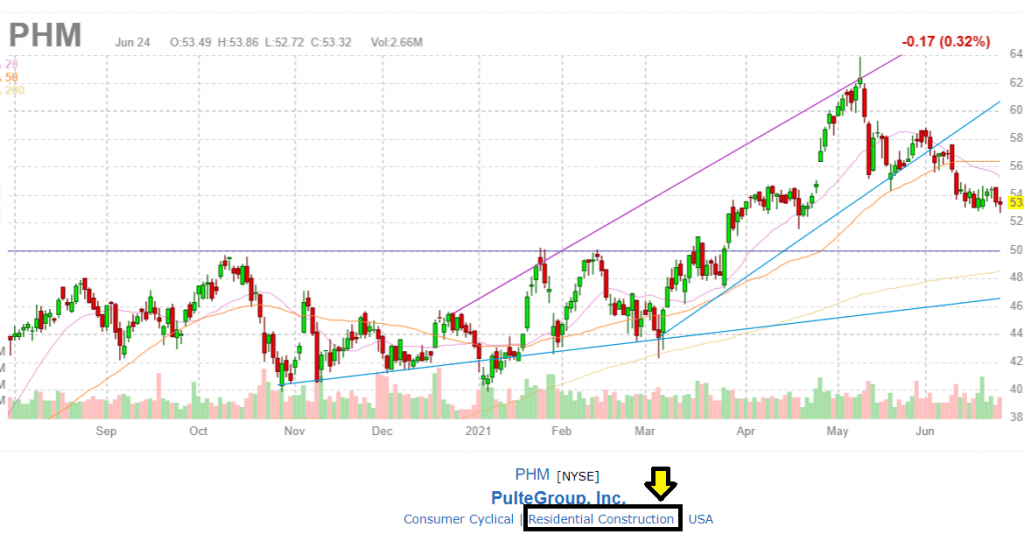

For example, homebuilder PulteGroup (ticker: $PHM) competes in a highly fragmented homebuilders industry and does not list its major competitors in its 10-k. In this case, we can use finviz to get a list instead.

After typing PHM into the search bar for finviz, we get the following screen:

I’ve highlighted where the company’s industry is displayed; you can click there to get a full list of other companies in the Residential Construction industry as defined by the finviz website.

2—Sometimes a company will list direct competitors inside of their “peer group”. The Peer Group is one of the ways many companies will tie compensation for executives, through comparisons of financial results to their competitors in an industry.

If it’s still not clear who a company’s competitors are based on the 10-k, and an online tool like finviz, you can look in a company’s proxy statement to find a list of peers, some of which might be direct competitors in their industry.

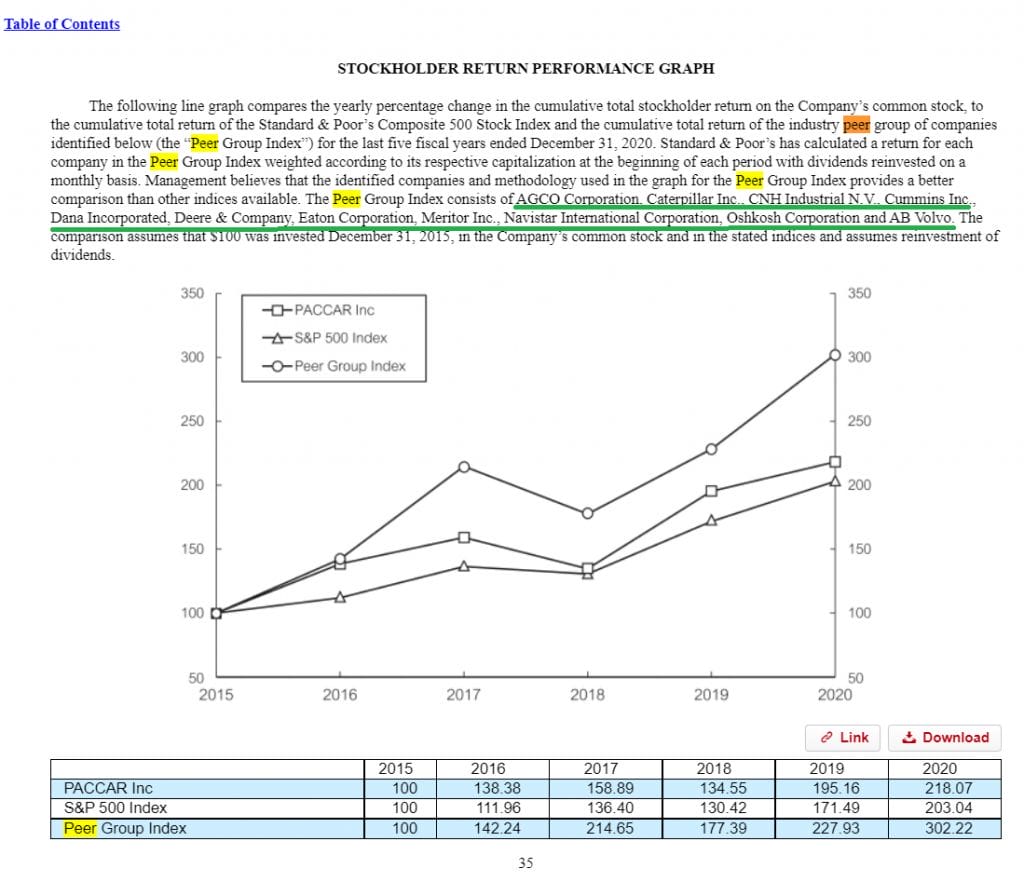

To find a company’s proxy statement we can use bamsec again; type in a company like PACCAR ($PCAR) and click on their latest “DEF 14A” under the Proxies box.

From there, search (“ctrl+f”) for “peer”, after which you should be able to find a list of companies which can comprise main competitors.

In PCAR’s case, they do:

From other research I’ve done I know that some of the main competitors to PACCAR are included in this list such as Navistar International and AB Volvo, and we can read those annual reports to try and find their other main competitors, such as Daimler.

3—Sometimes you can just figure out who direct competitors are through a Google search. It’s pretty self-explanatory but might lead you down the wrong path, but you should figure out if the reference ended up being wrong after reading their annual report as well.

Once you’ve established that list of competitors, your work is about to begin and it’s time to tear through some 10-k’s.

Through the process you should get a complete picture of an industry and the competitive landscape between its competitors, which is the essence of the scuttlebutt investing philosophy first espoused in public literature by the late and great Philip Fisher.

Scuttlebutt Through the Value Chain

The value chain is one of the lesser-considered parts of company analysis but can be just as crucial.

As we go down the value chain of different public corporations, we’re better able to derive a company’s revenue drivers. The same can be done for cost drivers by going up the value chain.

Let’s take the automobile industry as an example of a multi-tiered value chain.

The obvious answer is that a consumer who buys a Ford.

But the more accurate answer is that a company like Ford has both suppliers and buyers in their value chain which are embedded in the entire process.

For example, Ford will often sell to dealers who then sell to customers. Ford prefers to sell to dealers rather than direct-to-consumers because they can sell larger volumes at a time by selling to multiple dealers without bearing the costs of having to employ sales personnel. Ford can instead focus on their core competencies, which are manufacturing and mass advertising, leaving face-to-face interaction with consumers to someone else.

Moving up the value chain, Ford might not manufacture every single component which goes into their vehicle. Ford might purchase certain components from suppliers—whether these are automatic dimming mirrors or the entire engine.

It’s by moving both up and down Ford’s value chain that an investor can gain key insights into Ford’s business and financial results.

For example, a large publicly traded used car dealer might have better information on the sales trends of cars in the industry than a manufacturer like Ford might. Pressures on the dealers might show up first in their financials and then appear in Ford’s down the line.

Really, the possibilities behind important information or insights about a business from examining the value chain are limitless, which points back to Fisher’s approach to scuttlebutt as an art rather than a strict process.

It’s a powerful advantage to the investor who isn’t afraid to turn over rocks and dig into the nitty-gritty of an industry.

How to Analyze the Value Chain

The way to analyze the value chain for a company is similar to how you might analyze the competitors.

Again, I’d start with the 10-k of the business you are analyzing and look for any mentions of top suppliers or customers. Oftentimes if a customer makes up more than 5-10% of revenues or a supplier makes up more than 10% of purchases, the name of that customer will show up directly in the 10-k, usually under the “Risk Factors” section.

But, many times a company’s suppliers or customers are not included directly in the annual report, and you might want to use some intelligent methods to investigate it like the ones discussed already.

Additional resources which you can use include things like:

- Investor presentations

- Earnings call transcripts

- Quarterly reports (10-q’s)

- Mentions in credible news or industry publications

A favorite tool for me when perusing investor presentations and conference calls is Seeking Alpha, which is also a free resource for researching all kinds of aspects of different companies.

Investor Takeaway

Though the great investing teacher Philip Fisher mentioned talking to many people in, or related to, a company to help with our investment decisions, we can take the same principles without talking to anybody at all.

As average investors, we might not have the same kind of access that a professional institutional investor might—which is why some investors might miss the critical nature of this idea.

But that doesn’t mean we can’t use the scuttlebutt investing idea when researching stocks to buy, and I hope this post has outlined exactly how to do that.

I know that reading annual reports can be daunting, but I promise you it will make you so much of a better investor as you start to do more and more of them.

Take it one company at a time, and try it on the companies that excite you the most.

The direct disclosure from management is in a section of the 10-k called the MD&A (Management’s Discussion and Analysis)—click on that link to see how to read that simply and effectively.

I’ll let Fisher close with another great quote from this short but powerful chapter:

In the case of really outstanding companies, the preponderant information is so crystal clear that even a moderately experienced investor who knows what he is seeking will be able to tell which companies are likely to be of enough interest to him to warrant taking the next step in his investigation.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Investor’s Checklist of What Not to do According to Phil Fisher Similar, but in the complete opposite of my most recent blog about Phillip Fisher’s 15 Points to Look for in a Common Stock, Fisher also...

- An Outline of the Phil Fisher Investment Philosophy Shared in His Book Phil Fisher, author of Common Stocks and Uncommon Profits, has now taken a shift in the most recent chapter of his book to focus on...

- Famous Growth Investor on Why Conservative Investors Sleep Well Phil Fisher, author of Common Stocks and Uncommon Profits, has been one to always talk about the power of how conservative investors sleep well, and...

- Tips for Conquering the Narrative Fallacy in the Stock Market Every stock carries a narrative. Hopefully this narrative has been borne from numbers. But, two people can look at the same set of facts and...