Updated 7/24/2023

“Warren Buffett tells us, ‘The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own affairs.'”

― Howard Marks, Mastering The Market Cycle: Getting the odds on your side

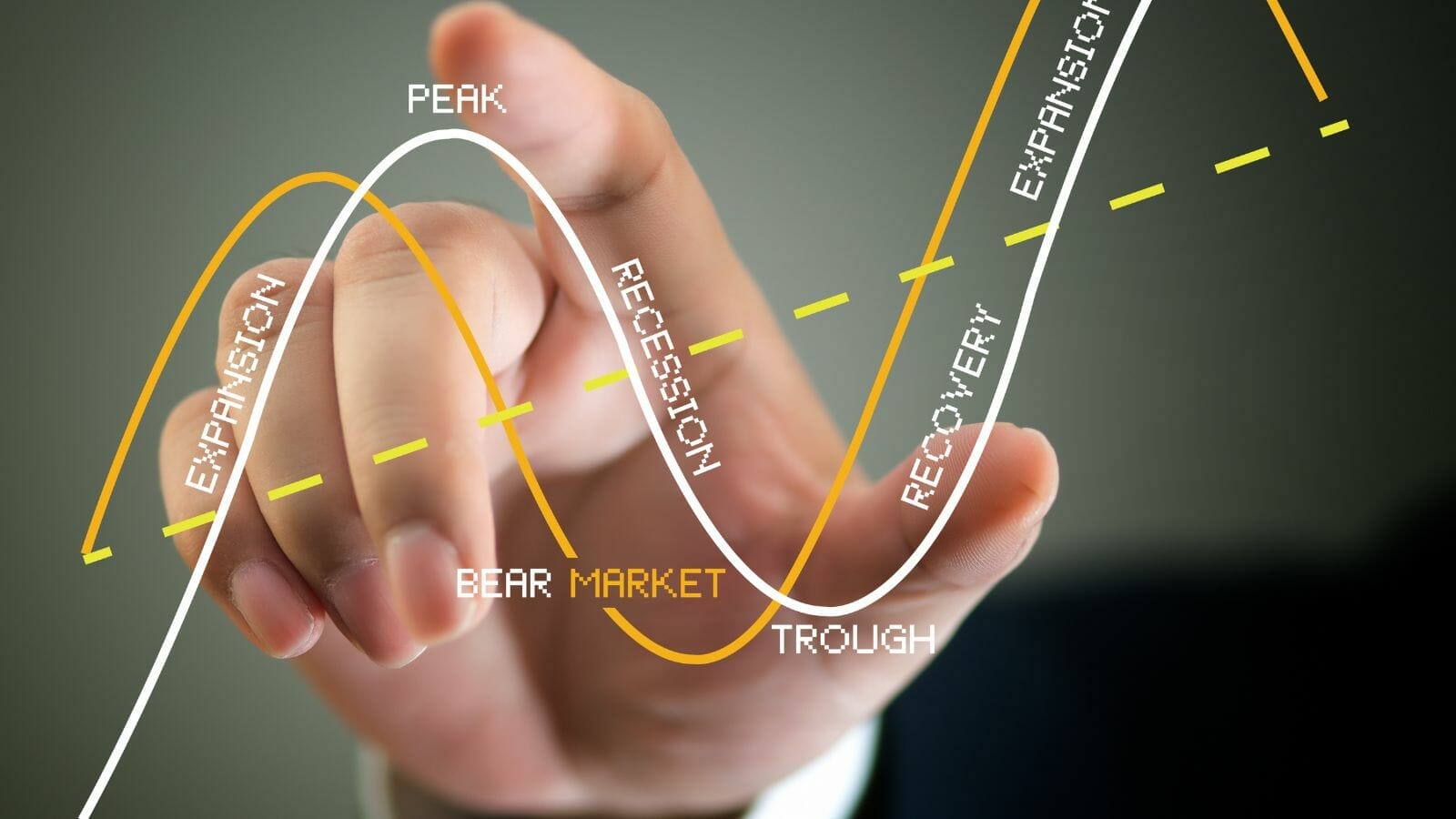

Stock market cycles, represented by the bear and bull markets, ebb and flow through time. Investing during different market cycles presents different issues, and understanding the different stock market cycles and their impacts on our investments is crucial.

Many believe there is no risk to investing during good times until the market worsens. But the converse of that is true; some of the best times to invest are when times are the worst. Looking at the stock market history, there is ample evidence of stock market cycles and how they move. Often, a bear market leads to a bull market and vice versa.

In today’s post, we will learn:

- What Are Market Cycles?

- What Are the Four Stages of a Market Cycle?

- How Long Are Market Cycles?

- Timing Market Cycles, Pros, and Cons

Okay, let’s dive in and learn more about stock market cycles.

What Are Market Cycles?

Market cycles, also known as stock market cycles, are economic trends analysts observe during different business environments. Stock market cycles move from certain securities (stocks) or asset classes, performing better than the competition during different periods. In some cases, economic environments might be more conducive to other companies than others.

For example, banks might struggle when interest rates are low, where cloud-based businesses could soar. These mini-cycles feed the larger stock market and create cycles within the stock market.

Nothing expresses the dual nature of the stock market better than the bull and bear markets. Many investors and analysts assign these terms during different parts of the overall stock market cycle and consider them the two major phases.

The reality is that smaller parts make up the whole stock market cycle, and assigning two larger terms, such as bear and bull gives us a sense of a rising or falling stock market, depending on the market’s direction.

As a general rule, bull markets are periods when the stock market sees rising prices, often over many years. Bear markets are shorter periods, generally, where fundamental factors drive down stock prices. The “official” rule is a bear market declaration when the market drops 20% below market highs.

Sometimes these bear or bull markets can be quick and sudden, with March 2020 being the perfect example, with a quick 20% in a few weeks, then bouncing back during the summer to go on to all-time highs by the end of the year.

Some fun facts, since 1946, the US market has endured 11 bear markets, which lasted an average of 16 months, and prices dropping an average of 34%. During that same period, bull markets lasted five years on average, with gains in prices of 149% in the S&P 500.

What Are the Four Stages of a Market Cycle?

We observe cycles in all aspects of life; for example, most cicadas have a life cycle of two to five years, but some have 17 years. Other cycles include the planet Earth, which has had a life cycle for billions of years.

The stock market has cycles, too, some lasting years, others shorter periods. The stock market cycle is rising, peaking, topping out, and declining. As they move from cycle to cycle, one recedes while another grows in an ever-revolving cycle.

Most investors run into problems when they fail to recognize that markets are cyclical and accept that some cycles will end while others will start. Of course, picking a top of a cycle is almost impossible, and many investors spend a lot of time predicting the ups and downs of market cycles, but no one can predict the future.

Understanding market cycles and how to read the tea leaves will help you become a more rounded investor.

Yes, Martha, the stock market doesn’t always go up and to the right, and we need to understand the different components of a stock market cycle to profit from them.

Here are the four major elements of the stock market cycle and how we can recognize them.

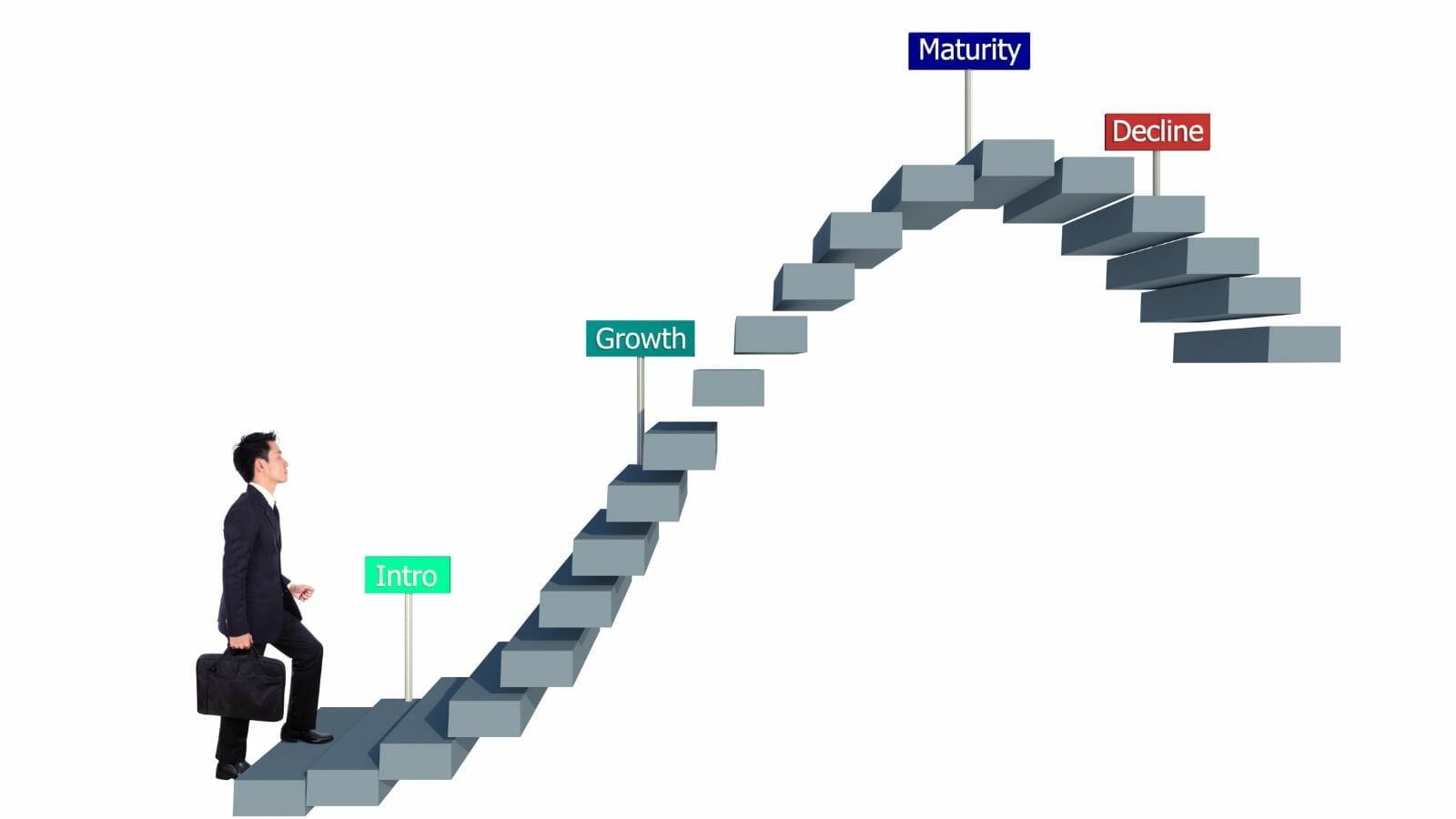

- Accumulation Phase: During this stage, immediately following the bottom of a market cycle, after determining the worse is over, value investors, experienced traders, and money managers start to buy. As the importance of valuations starts to grow, market sentiment switches from negative to neutral, but the overall market is still in bear mode.

The media is still bearish and produces plenty of doom and gloom, and those that tried to hold on through the bear market give up and sell their positions. But, during the accumulation phase, prices begin to flatten out, and for those selling out, there are others on the other side of the trade scooping up the values.

- Mark-Up Phase: At this point, the stabilization of the market has been going on for a while and is starting to move higher. Technical trades, seeing the volatility trending, recognize the sentiment change and the market’s direction is moving higher.

The media begins predicting that the worst is over, but the economic data lags, with unemployment remaining high and reports of hiring remaining stagnant in some industries. As the Mark-Up Phase matures, FOMO (fear of missing out) starts to take hold, and investors experience feelings of greed.

As the phase matures, the late majority piles into the market and trading volumes explode. Here, the greater fool theory starts to take hold, with valuations climbing above historical norms, and logic goes to the back of the bus as greed takes total control as the late majority piles in, smart money, and insiders start to leave.

- Distribution Phase: During the third phase, sellers begin to reign, with this part of the cycle identified by a period of bullish sentiment from the previous stage that becomes more mixed. The prices in the market enter a sideways market, where they trade a fixed range without many extensions, and this sideways market can last weeks or months.

But this phase can come and go quickly; for example, during February 2020, the Nasdaq experienced a month-long distribution phase before moving higher before the Covid outbreak.

When the distribution phase ends, the stock market reverses direction, with classic double and triple tops before continuing downward.

Emotions run high during the distribution phase, with periods of fear, hope, and greed, as it appears that the market might start reversing direction. Valuations are at extreme levels, with companies trading at all-time highs, with value investors sitting this phase-out. Sentiment in this phase eventually turns bearish but can change quickly with extremely bad economic news or some bad world news. Investors unable to sell for breakeven begin to settle for small losses.

- Mark-Down Phase: This is by far the most painful phase in the stock market cycle for those still holding positions at elevated prices. Many investors hold onto underwater positions in vain, hoping they can break even or that things will return to normal soon. When the market falls below 50% of previous highs, the laggards and others that failed to realize things had turned for the worse start to sell.

This is a sign that the bottom is close for the early adopters.

How Long Are Market Cycles?

As we can see, it is almost impossible to see exactly where one phase starts and another ends. Each market cycle occurs as it happens, without clear, defined beginnings or ends and no set time lengths. Some phases can last days, and some can last years.

The stock market cycles are often a matter of perspective, with short-term traders seeing them in smaller time frames while other long-term investors see them in longer times, such as 20-year cycles.

Stock market cycles are always evident in hindsight, 20/20 and all. They are often evident by looking at the price tops of the S&P 500 and the lowest price of the same index.

The definition of a bull market is a rise in stock prices of 20%, usually from lows of a 20% drop and preceding another drop of 20%.

The definition of a bear market is the opposite; a 20% drop in prices from previous highs defines a bear market.

The current bull market run of the stock market is the longest in recorded history of 13 years. It began on March 9, 2008, and has continued until today, with a brief bear market during March 2020 with the beginning of the Covid pandemic.

There is no set time for the length of any of the four phases of the stock market cycle. Sometimes the cycle may take days, years, or as in the current bull market, decades. Instead of focusing on the length of time, it is better to focus on the particular company’s performance you are analyzing.

Sometimes your company will move in the opposite direction of the stock market cycle. Worrying about market tops or bottoms is a fool’s errand. Instead, focus on your investments and their performance.

Market enthusiasm tends to top out as bull markets increase in velocity, evidenced by the enthusiasm during the dot-com boom in the 1990s, which eventually popped in 2000. These are typical behaviors during the ebbs and flows of the stock market cycles.

Timing Market Cycles, Pros, and Cons

Timing the stock market cycles is a fool’s errand because no one knows the future, and we don’t have any certain way of knowing when tops or bottoms will happen. But there are ways to profit from the ups and downs of the market cycles.

Howard Marks, the co-chairman and co-founder of Oaktree Capital Management, an investment manager with over $120 million in assets under management, wrote a wonderful book, Mastering the Market Cycle.

In a recent interview with Barry Ritholtz, Mark’s stated:

“Recognizing and dealing with risk and understanding where we are in the market cycle are really the two keys to success.”

Here is another quote from the superb Jason Zweig in his review and interview of Marks:

“Mr. Marks admits his book is a kind of tug of war between his certainty that “we don’t know what the future holds” and his belief that “we can identify where the market stands in its cycle.” By studying how the economy, the markets, and the psychology of investors all move in long cycles of expansion and contraction, Mr. Marks and Oaktree have been better able to cut back risk near market peaks and ramp it up near market bottoms, he says. But Mr. Marks doesn’t think you can use that sort of understanding to go all in or all out of markets again and again. He likes the book’s subtitle—”Getting the Odds on Your Side”—better than its title, he quips. “Recent performance doesn’t tell us anything we can rely on about the short-term future,” he says, “but it does tell us something about the longer-term probabilities or tendencies.”

As Marks explains in the book, there are several ways to profit from market cycles, typically:

- Be aggressive when the market is in a down cycle, taking advantage of depressed prices.

- Be fearful when the market is on an upward swing.

If you are looking for tricks to time the short-term market swings, there are no such tricks in the book. Instead, he suggests increasing your risk level when signs of euphoria or despair become extreme and taking advantage of price changes.

Marks feels that stock market cycles move in long, multi-year cycles, and their turning signals are recognizable but rare and spread out. Investors who try to take advantage of short-term signals are most likely basing their moves on noise, typically from the media.

Marks identifies the ups and downs of market cycles by studying how the economy, markets, and investor psychology move in long expansion and contraction cycles. And during market peaks, he cuts back on risk and increases risk near market bottoms.

Our human psychology conspires to make us make poor choices, with most people getting excited at market highs and depressed at market lows, which prevents us from buying lows and selling highs.

Instead, Marks encourages us to study the market cycles and act accordingly. Increase risk or aggression near market bottoms, and scale back risk near or at market highs. After all, we have no way of knowing when a market will turn until after it does, so you can try to behave accordingly by being aware of cycles and where you are in a current market cycle.

Investor Takeaway

During March 2020, I saw all those emotions on full display as world news was doom and gloom as the pandemic progressed and fears of a total breakdown of the economy. The stock market plunged further, faster than any other time in history. It was hard to watch all of your stocks in the red. But remembering what Marks discussed in his book, I was able to find companies that were depressed in prices but still exhibiting strong financials and was able to take advantage of those depressed prices.

It was difficult, but remaining calm during the crisis and trying to be rational helped me think through the best course of action.

You can also adopt these ideas by understanding the stock market cycles, being prepared for any situation, and having a list of companies you would want to buy in the event of a market collapse.

I highly encourage you to get Mark’s book and read through it, either the physical book or the audio version. Understanding the stock market cycle can help you take advantage of different market points as they move through the cycle. After markets drop, they always recover, and vice versa.

And with that, we will wrap up our discussion for today on stock market cycles.

As always, thank you for taking the time to read today’s post, and I hope you find some value in your investing journey. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- “There is Always a Bull Market Somewhere.” Or is there? Brand new investors might look at a rising stock market and all-time highs as a potential indicator that stocks are expensive. However, new investors should...

- Comparing the Bull and Bear Market In a nutshell, a bull is seen as someone who is optimistic and believes that stocks will rally. This is a bullish outlook. On the...

- Wall Street Bear – Friend or Foe?! One of the most dangerous things in the investing world is dealing with a Wall Street Bear. If you’re like me and a total CNBC...

- The Tyranny of Stock Market Bubbles: History Repeats Itself As the saying goes, “history repeats itself.” Smart investors are willing to learn from the lessons of history’s mistakes. Other investors have lost money in...