Master Limited Partnerships, also known as MLPs, are a great vehicle for income investors, similar to REITs, in that they distribute the majority of their earnings in the form of dividends. However, not many investors are familiar with these types of investments, let alone how to conduct an MLP valuation.

Dividends and the search for yield is the goal of many investors, and MLPs offer both in spades, but they do come with risk, as with any other investment.

The trick is to understand the companies and how they make money.

In many cases, an MLP might offer a yield of upwards of 9%+, which is extremely attractive, but it does come with risks associated with those high-yields.

Like REITs, MLPs have their own language they speak, and the key to understanding an MLP is to understand that language. The good news is that the language isn’t that much different from many of the companies in the market. And once we learn that language, valuing an MLP is no different than Walmart.

In today’s post, we will learn:

- What Is a Master Limited Partnership (MLP)?

- Taxes and the MLP

- Important Metrics for an MLP

- How to Value a Master Limited Partnership

Ok, let’s dive in and learn more about MLPs and how to value an MLP.

What Is a Master Limited Partnership (MLP)?

An MLP, according to Investopedia:

“Master limited partnerships (MLPs) are a business venture that exists in the form of a publicly traded limited partnership. They combine the tax benefits of a private partnership—profits are taxed only when investors receive distributions—with the liquidity of a publicly-traded company (PTP).

A master limited partnership trades on national exchanges. MLPs are situated to take advantage of cash flow, as they are required to distribute all available cash to investors. They can also help reduce the sector.”

The introduction of MLPs began in 1981, but by 1987 Congress started to put some restrictions on MLPs as the concern for lost revenues via taxes, because MLPs do not pay federal income taxes.

In 1987 Congress limited MLPs to real estate and natural resources sectors, such as REITs and midstream oil services, for example.

Setup of MLPs

As with REITs, MLPs offer ownership in the company through “units,” which are the same as shares, which offer voting rights.

The sector the majority of MLPs operate in is the oil & gas sector, particularly the midstream space, as mentioned earlier.

Midstream MLPs are businesses that specialize in gathering, processing, storage, and transportation of oil, gas, and refined petrochemicals.

We will focus on midstream MLPs in today’s post; these MLPs derive the majority of their cash flows from long-term fixed contracts, which helps reduce the volatility that you see with the major oil & gas companies such as Exxon, who are at the mercy of the craziness of commodity (oil) prices.

Think of an MLP as a tollbooth where the operators whose stable cash flows allow for generous dividend payouts that are hopefully more stable than the large oil & gas companies.

The major difference between MLPs and regular corporations is that MLPs act as a “pass-through” entity, which indicates that the partnership doesn’t pay corporate taxes because it passes the tax obligations and cash flows to the unitholders or shareholders.

But probably, the biggest difference between MLPs and corporations is the fact that MLPs pass the majority of its cash flows as distributions, which is great for investors; however, funding growth investments will have to come via a different avenue.

MLPs pay out the majority of their earnings in distributions, which means that the company must rely on debt and equity issuances as the means of growth for the company.

Because of this business structure, you can expect to see the unit counts to rise over time, and the debt levels to remain higher than say, Target.

MLPs have two classes of partners:

- General Partners – these are the owners responsible for the day-to-day operations of the MLP. They receive pay based on the partnership’s performance, and the general partners own 2% of the company.

- Limited partners – these are the unitholders or shareholders of the company and provide equity for the MLP’s operations. The limited partners receive distributions quarterly, like dividends.

Taxes and the MLP

As we mentioned above, the IRS treats the MLP as a limited partnership in regards to tax purposes, where limited partnerships have a pass-through tax structure.

Which means that taxing all of the profits and losses pass through to the limited partners, the unitholders.

In other words, the MLP is not responsible for corporate taxes for its revenues, like most corporate entities. Instead, the unitholders or shareholders are only responsible for their income taxes on each unitholders stake in the company.

The benefits of this tax scheme offer a significant advantage in terms of taxes for the MLP. For example, profits are not subject to the double taxation of corporate and unitholder income taxes. Currently, Target pays corporate taxes, and shareholders must pay income taxes from their income from both the dividends and gains from sales if the stock appreciates.

Additionally, deductions such as depreciation and depletion also pass through to the limited partners, which means that limited partners can use those deductions to reduce their taxable income.

For an MLP to maintain its pass-through status, it must distribute at least 90% of its qualifying income. Income considered qualifying would include income from exploration, production, or transporting natural resources such as natural gas or oil.

For example, all but 10% of an MLP’s income must come from natural resources, commodities, or real estate activities. Of course, those qualifying income sources limits the types of businesses that may operate MLPs.

Distributions come in the form of dividends, and like most other corporations, distribute those dividends quarterly, but some offer them monthly.

The difference here is that the treatment of the distributions is as a return on capital, as opposed to a dividend, which means the unitholder doesn’t pay income tax on the returns. The income is tax-deferred until the unitholder would sell their portion. When the sale happens, the earnings receive the lower capital gains tax rate, as opposed to the higher levels of personal income tax.

Of course, these additional tax benefits offer significant tax advantages over other corporations and help entice investors to consider investing in MLPs.

At tax time, instead of receiving the usual 1099-Div for your Walmart dividends, you receive a K-1 for tax time as distributions are classified return on capital as opposed to income. Don’t be afraid of the different forms; with online services such as Turbotax, the forms are relatively simple. But of course, with any questions regarding taxes, it is best to consult a tax professional.

The return on capital consideration of distributions means the IRS treats them like long-term capital gains. When you sell the MLP, Uncle Sam will collect his portion of those deferred taxes because the capital gains will be higher than the return on capital.

For example, if you paid $10 for your unit of the MLP and the MLP paid a distribution of $3, your cost basis would now be $7, rather than the $10 you paid for the unit.

Likewise, if you sold your unit for $12, your gain would be $5 ($12 sale price minus the cost basis of $7, from above), which encompasses the return on capital from distributions you have received but weren’t taxed on yet.

MLPs and Retirement Accounts

When considering whether adding MLPs to your tax-advantaged accounts, there is one idea to keep in mind.

Consider the fact that you stand to benefit from the possible significant amount of deferred taxes that come from owning the MLP. If you own them in a tax-deferred IRA, then you won’t benefit from this advantage. The reason is that when you eventually withdraw funds from the IRA, the IRS will tax you at the top marginal rate, except for those funds in a Roth.

That means the benefit of effective tax rates and the MLP at the same rate of qualified dividends or long-term capital gains doesn’t apply to tax-deferred accounts such as an IRA. Which tells us that holding an MLP in a Traditional IRA is not a benefit, but it would work in a Roth or a regular brokerage account.

Important Metrics for MLPs

Similar to a REIT, the MLP universe has several of its own metrics that we need to understand to allow ourselves to value an MLP.

Many of the metrics that we use to value “normal” corporations, such as the P/E ratio, is not useful when analyzing an MLP. The main reason for this discrepancy is the handling of the earnings from a tax standpoint.

The main ingredients of the metrics to analyze an MLP are:

- Distributable cash flow

- Distribution coverage ratio

- Debt/EBITDA ratio

- Credit rating

Let’s uncover each of these a little more.

Distributable cash flow

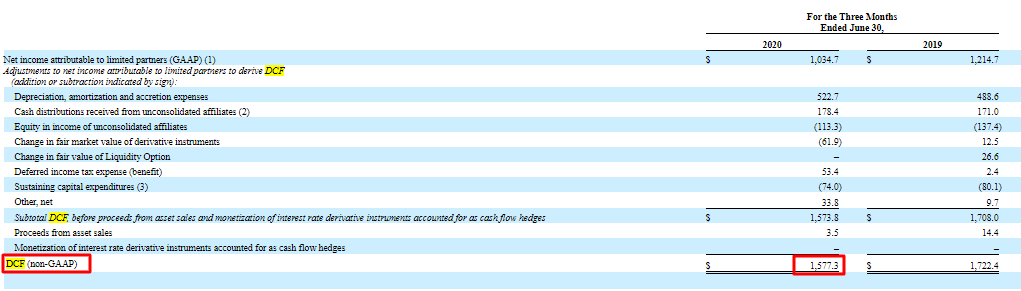

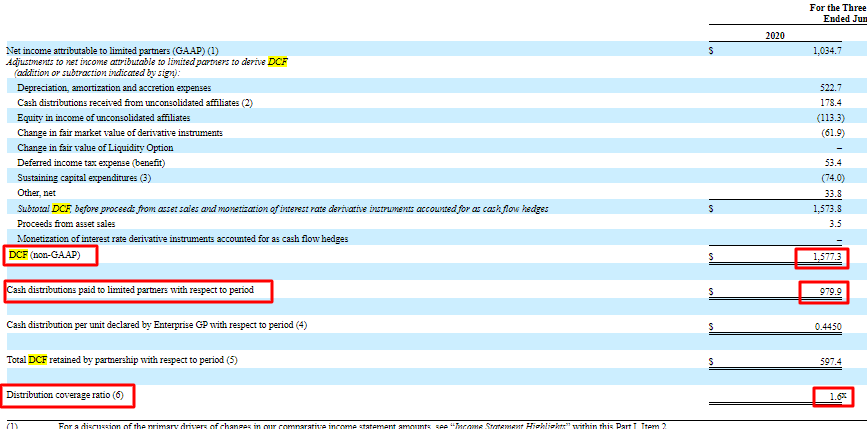

Distributable cash flow is arguably the numero uno when it comes to analyzing an MLP, also referred to as the DCF, not to be confused with the discounted cash flow model.

DCF for MLPs is similar to free cash flow and helps fund the distributions long-term.

Calculating the distributable cash flow varies from MLP to MLP, but the general formula is Adjusted EBITDA minus maintenance capex.

Luckily for us, almost every MLP I scoured researching this article lists the distributable cash flow in its quarterly and annual reports.

Remember that this is a non-GAAP number, which means it is not audited, nor is it accepted by the accounting agency, FASB.

The adjusted EBITDA, or earnings before interest, taxes, depreciation, and amortization, tells us how much cash is left over after paying all the costs associated with operating the business.

On the other hand, maintenance capex tells us how much an MLP must invest in keeping its infrastructure, such as its pipelines and storage tanks, from deteriorating or becoming obsolete.

The above items illustrate the biggest difference between distributable cash flows and free cash flows.

Corporations, because they pay for both growth and maintenance out of its retained earnings, they generally don’t issue new equity to pay for those items. Evaluating regular companies means calculating free cash flow by subtracting both maintenance capex and growth capex from operating cash flow.

Because MLPs fund its growth from both debt and equity issuances, growth capex is instead excluded from its cash flow calculations.

To find the DCF per share, we would simply divide the DCF by the shares outstanding, same as earnings per share or any other metric.

Distribution Coverage Ratio

The second most important ratio to consider is the distribution coverage ratio, which tells us the ratio of distributable cash flows over distributions paid to all unitholders.

The distribution is sustainable by operations if it is above 1.0x, all on its own. However, because MLPs distributable cash flows are somewhat fluid, with many MLPs tying its operations around commodity prices, especially in natural gas liquids, or NGL operations, it is better to look for a ratio above 1.1x.

A major red flag is if you see a DCR of less than 1.0x for a year or more, which indicates that the distribution is unsafe or unsustainable and is at risk of a cut in the future. Avoid these MLPs at all costs because a major factor involved in investing in MLPs is the distribution; it is the show we all come to see.

Source: EPD 10-Q 2nd Q 2020

Again, most MLPs make it easy for us to determine the DCF for the company; you can CTRL-f and type in “distribution coverage ratio,” and you will find links to the information you seek.

As a side note, you must embrace the CTRL-f function to search financial reports, it is the most amazing source of ease to search for specific details, and it eliminates so much stress. I highly recommend you try it out.

Also, while researching for this article, I came across a website that allows you to search its database for both the DCF and DCR metrics. You can find it below:

Again, because this information is non-GAAP, you won’t find it in the three primary financial documents, but you will find it in the notes or management’s discussion sections.

Debt/EBITDA ratio

Debt is one of the major funding sources of growth for MLPs, along with equity offerings, and therefore, studying the relationship between cash flow and debt is important when analyzing MLPs.

When the debt burden becomes overwhelming, many bad things happen, such as a cut of the distribution, or even worse, bankruptcy.

Credit ratings generally like to see a debt to EBITDA ratio of 4.5x or less. Additionally, MLP debt covenants, rules that govern how much debt a company can carry, are usually tied to its credit facilities, which state a finite limit to this ratio for MLPs.

The finite limits state that if the MLP goes over those limits, the debt may be called early, which can cause a liquidity crisis. If the MLP is forced to pay back those loans before they were planning, it puts the MLP in danger of losing its investment-grade credit rating. Which, if lost, would put the MLP at risk of having to borrow on the junk-bond markets, which carries much higher costs associated with the debt.

To calculate the debt-to-EBITDA, we divide the EBITDA from the above chart by the total debt carried by the company on the balance sheet.

Debt-to-EBITDA = Total Debt / EBITDA

- Total Debt – $29,610 TTM

- EBITDA – $7,710 TTM

Debt-to-EBITDA = $29,610 / $7,710

Debt-to-EBITDA = 3.84x

That tells us that Enterprise Products Partners LP (EPD) carries a debt-to-EBITDA ratio of 3.84 for its TTM (trailing twelve-month numbers).

Looking a little deeper to see a trend, five years worth of debt/EBITDA ratios for Enterprise Products Partners:

- 2016 – 4.69x

- 2017 – 4.45x

- 2018 – 3.67x

- 2019 – 3.55x

- TTM – 3.84

It is always interesting to look at trends; we can see that the company has improved its ratio over the last three years.

Understanding the relationship between EBITDA and distributions and debt is helpful to find conservative companies that pay out a steady distribution with conservative lending to ensure the payout continues long into the future.

How to Value a Master Limited Partnership

Now that we have a good understanding of the structure, tax benefits, and metrics surrounding MLPs, the last piece of the puzzle before diving deeply into the analysis is MLP valuation.

The good news is many of the same techniques and models we use to value MLPs are exactly the same as other “normal” corporations. We can use tools such as the dividend discount model, discounted cash flow models, and the sum of parts valuations using the EBITDA multiples.

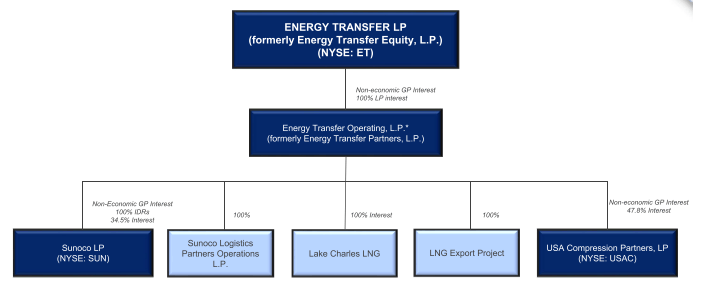

Our guinea pig for our MLP valuation exercises is Energy Transfer (ET), and most of the information I will take directly from the quarterly or annual reports so you can follow along.

Dividend Discount Model (DDM)

A natural fit to value MLPs is the dividend discount model, as the main attraction to invest in an MLP is the dividend component, along with the tax benefits.

For today’s illustration, I am not going to walk through an explanation of the dividend discount model; rather, if you are unfamiliar with this model, please follow the link below:

I will share the inputs I will use to value our MLP for you to follow along at home.

Inputs for the dividend discount model valuation for Energy Transfer:

- Beta – 2.55

- Risk-free rate – 0.70%

- Risk premium – 5.79%

- Dividend payout ratio – 2.3

- Retention ratio – 0

- Current annual dividend – $1.22

- Return on equity – 7.19

Based on all the numbers from above, the valuation based on the dividend discount model comes out to $7.89 per share.

Discounted Cash Flow (DCF)

The discounted cash flow model uses several assumptions in the model, growth of earnings or distributable cash flow, discount rate, and terminal rate.

We can use our distributable cash flow as the earnings of the MLP, and then plug in our other numbers into the model.

Again, if you are unfamiliar with the discounted cash flow model, please follow the link below to learn more about the DCF.

Here are the inputs for our model; I am going to use the online DCF calculator available from gurufocus.com for our example.

- WACC – 7.42

- Distributable Cash Flow per share – 0.46

- Growth rate of DCF – 10%

- Terminal rate – 3%

After plugging in the numbers, we arrive at a value of $9.31 based on a discounted cash flow model.

Sum of the Parts (SOTM)

Next up, we will take a look at a sum of the parts valuation for Energy Transfer, based on the fact that Energy Transfer breaks up its business into key segments and discusses and analyzes the business based on those segments.

If you are unfamiliar with this valuation method, please refer to the below link for more detailed information.

Energy Transfer sets up the company into different segments:

- NGL (Natural Gas Liquids) Pipelines and Services

- Crude Oil Pipelines and Services

- Natural Gas Pipeline and Services

- Petrochemical and Refined Products Services

Per the latest 10-k, Energy Transfer breaks out the segmented data by gross margins, which is perfect for our valuation.

From the 10-k, the gross margins per sector:

- NGL Pipeline – $4,069.8

- Crude Oil Pipeline – $2,087.8

- Natural Gas Pipeline – $1,062.6

- Petrochemical – $1,069.6

Now we will assign an EV/EBITDA multiple to each sector based on the research I have done regarding the MLP sectors. Once we have the multiple, we multiply that by the gross margin and then divide the total value by the shares outstanding.

- NGL Pipeline – $4,069.8 x 9.11x = $37,068.59

- Crude Oil Pipeline – $2,087.8 x 4.9x = $10,226.3

- Natural Gas Pipeline = $1,062.6 x 6.75x = $7,168.5

- Petrochemical – $1,069.6 x 4.3x = $4,599.28

And next, we add all those values together, and then subtract the total debt of the company, and finally divide them by the shares outstanding.

ET SOTP Value = $37,068.59 + $10,226.3 + $7,168.5 + $4,599.28

ET SOTP Value = ($59,062.67 – $51,028) / 2,628

ET SOTP Value = $3.06

Ok, now that we have calculated the valuation for our MLP, Energy Transfer, let’s put them all together to analyze.

- DDM – $7.89

- DCF – $9.31

- SOTP – $3.06

The current market price, as of the writing of the post, September 14, 2020, is $5.86 per share.

As we can see from our process, the valuation of Energy Transfer ranges between a low of $3.06 and a high of $9.31, which indicates the company is probably slightly undervalued. But this is a great exercise when you are screening for companies; once you find a great prospect running the company through its paces, valuation wise is a great exercise.

Remember, the more practice you do, the better you will get at valuing different companies.

Final Thoughts

MLPs are great dividend investments; once you understand the language of the MLP and the structure of the company, it is much easier to value.

MLP valuations are no different from “regular” such as Target, Walmart, and Microsoft. The biggest issue is identifying the different metrics associated with the MLP, and once you have those identified, it is simply a matter of plugging in the numbers into your familiar models.

MLPs, similar to REITs have a slightly different structure business-wise, which lends them to income investors, or investors looking for great yields. MLPs do carry higher levels of debt, and share buybacks are less of a method of returning value to shareholders, but the dividends and share appreciation are attractive.

That is going to wrap up our discussion for today.

As always, thank you for taking the time to read this post, and I hope you find something of value on your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- How to Use Enterprise Multiple to Put a Valuation on a Company Updated 4/4/2024 There are many ways to value a company, including discounted cash flows, dividend discount models, value ratios, price multiples, and more. In today’s...

- Explaining the DCF Valuation Model with a Simple Example Updated 9/15/2023 Discounted Cash Flow (DCF) valuation remains a fundamental value investing model. Using a DCF continues as one of the best ways to calculate...

- Sum of the Parts Valuation – When a Company Has Many Business Segments Valuation is part art, part math, and valuing a company encompasses many moving parts. Suppose we want to value a company and notice several different...

- Residual Income Valuation Method – CFA Level 2 Valuing a company using the residual income method is an interesting technique not many retail investors are aware of which is covered in CFA Level...