Updated 5/1/2024

Earnings manipulations are one of the more sinister aspects of financial accounting. While it isn’t prevalent, it is an aspect of investing that we should be aware of and protect ourselves from, if possible. The Beneish M-Score is a formula we can easily calculate to determine the likelihood of earnings fraud.

The Beneish M-Score correctly predicted the fraud that Enron was committing, but unfortunately, no one on Wall Street was listening. The formula includes eight variables to help us determine manipulation.

In today’s post, we will cover:

- What is the Beneish M-Score

- Understanding the Elements of the Beneish M-Score

- Real-life examples of the Beneish M-Score In Action

Ok, without further ado, let’s dive in.

What is the Beneish M-Score?

According to Investopedia:

“The Beneish model is a mathematical model that uses financial ratios and eight variables to identify whether a company has manipulated its earnings. It is used as a tool to uncover financial fraud.“

The variables are constructed from the data in the company’s financial statements, and once calculated, create an M-Score to describe the degree to which the earnings have been manipulated.”

Professor M. Daniel Beneish of the Kelley School of Business from Indiana University in 1999 first introduced the formula. He published the paper “The Detection of Earnings Manipulations.”

Beneish created a mathematical model based on financial ratios and eight variables to identify whether a company has manipulated earnings.

We use elements from the three main financial statements to plug into the Benish M-Score model to illustrate how much the earnings have been manipulated.

He created the model to uncover financial fraud, and a group of students at Cornell University used the model to predict that Enron was manipulating earnings, which, as I mentioned previously, Wall Street ignored.

Earnings manipulations are rare these days, but having a tool like the Beneish M-Score is a great idea to run as your screen through different investing opportunities.

Let’s learn how the model is set up and what inputs are required.

Understanding the Beneish Model

The basic idea behind the model is that companies are more likely to manipulate their profits if they show declining gross margins and operating expenses and leverage both rising and significant revenue growth.

He revealed that these figures might cause earnings manipulation through various means.

The model uses weighted financial ratios and includes eight different variables.

The Beneish eight variables are:

- DSRI: Day’s sales in a receivable index

- GSI: Gross margin index

- AQI: Asset quality index

- SGI: Sales growth index

- DEPI: Depreciation index

- SGAI: Sales and general and administrative expenses index

- LVGI: Leverage index

- TATA: Total accruals to total assets

We will explore these ratios and their inputs in the next section.

Once these ratios are calculated for each variable, they are weighted in the formula, and once calculated, an M-Score for the company is given.

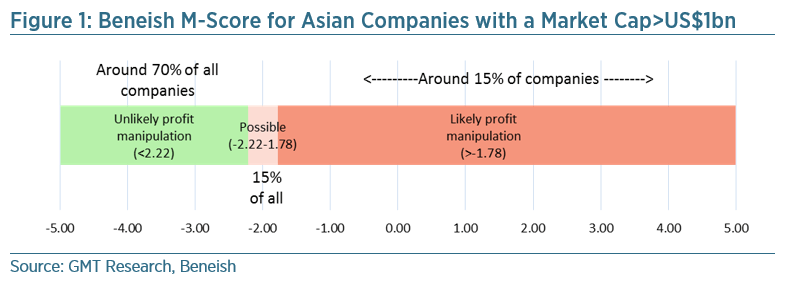

The M-Score moves across a range of results, with an M-Score of less than -2.22, indicating that the company is not manipulating earnings. An M-Score of above -2.22 indicates that a company is likely manipulating earnings to some extent.

The Beneish M-Score model is as follows:

M = -4.84 + 0.92*DSRI + 0.528*GMI + 0.404*AQI + 0.892*SGI – 0.172*SGAI + 4.679*TATA – 0.327*LVGI

Ok, I know that looks like a mouthful, but once we calculate our ratios for each acronym, it will be a matter of adding, subtracting, and multiplying, which I know you can all accomplish.

As mentioned before, we gather information from the financials and calculate our formulas; the information is gathered from all three financials.

Here is the list of the items we need to calculate the Beneish M-Score:

- Accounts Receivable

- Revenue

- Gross Profit

- Total Current Assets

- Total Assets

- Property, Plant, and Equipment

- Depreciation, Depletion, and Amortization

- Selling, General & Admin Expense

- Total Current Liabilities

- Long-Term Debt & Capital Lease Obligations

- Net Income

- Non-operating Income

- Cash Flow from Operations

Don’t worry; I will explain where we find these in the financial statements.

Ok, now we have seen the formula and inputs, let’s start to put this into practice.

Real-Life Examples of the Beneish M-Score In Action

Example: Walmart

The first company I would like to analyze for earnings manipulations is Walmart (WMT). Walmart is a retail company with a market cap of $350.93B and a market price of $123.84.

Remember that this formula is not a valuation technique but is used solely to determine earnings manipulations.

The first step is to gather all the data from the above charts from the financials.

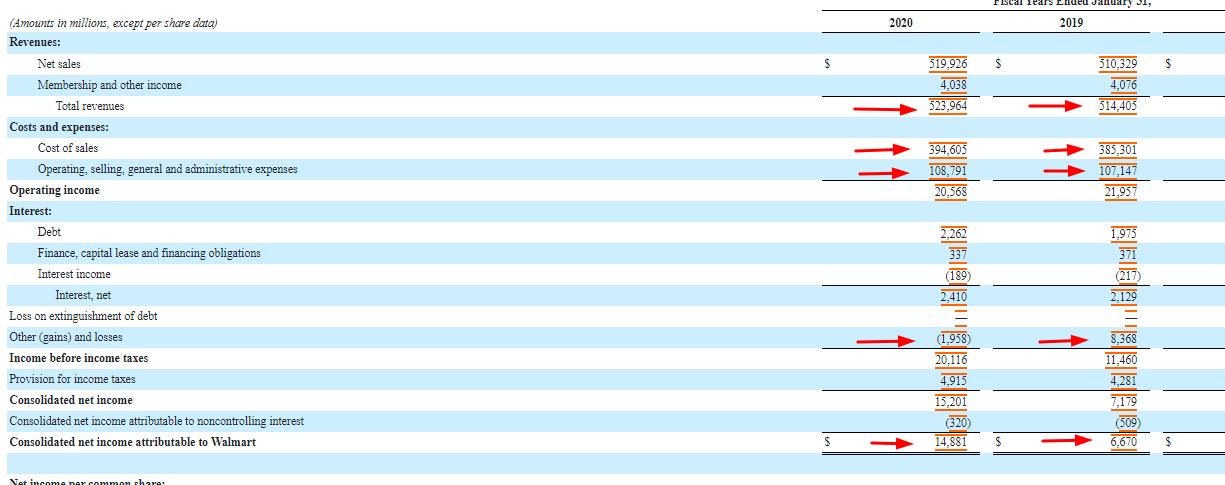

The first financial we will look at will be Walmart’s income statement, and all numbers listed will be in millions unless otherwise stated. We will be analyzing the years 2020 and 2019; it is recommended that you use twelve-month numbers for this model. It can be TTM if you wish, but I will use the 10-ks to make finding the information more realistic.

One comment on the numbers above: the gross profit is not listed directly on the 10-k. To calculate the gross profit, we subtract the cost of sales from the revenues to achieve our number.

For example, Walmart’s revenues in 2020 were $523,964, and the cost of sales was $394,605. That is why I marked the cost of sales as a number to note for our calculations.

Plugin the numbers:

Gross Sales = Total Revenues – Cost of Sales

Gross Sales = 523964 – 394605

Gross Sales = $129,359

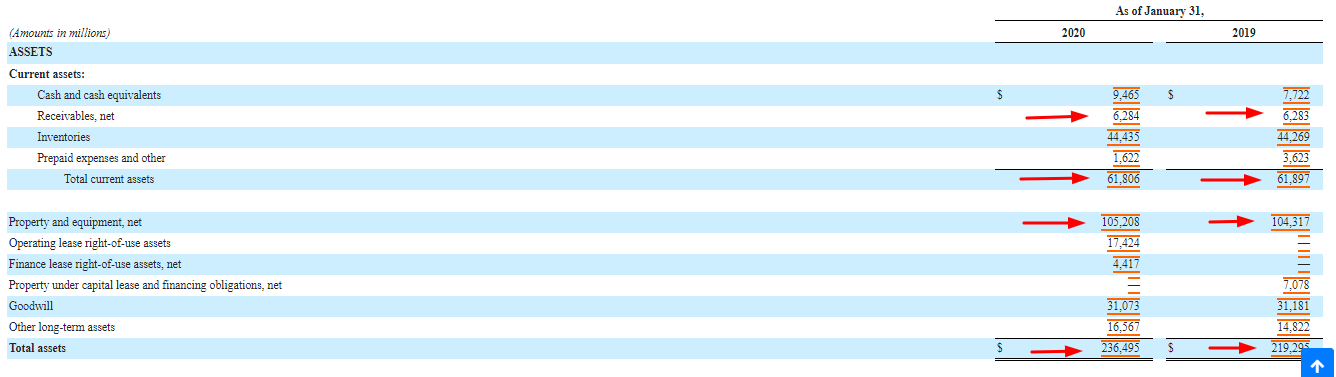

Now we will look at the balance sheet to gather our next round of numbers.

Here is the updated chart with additional numbers added in:

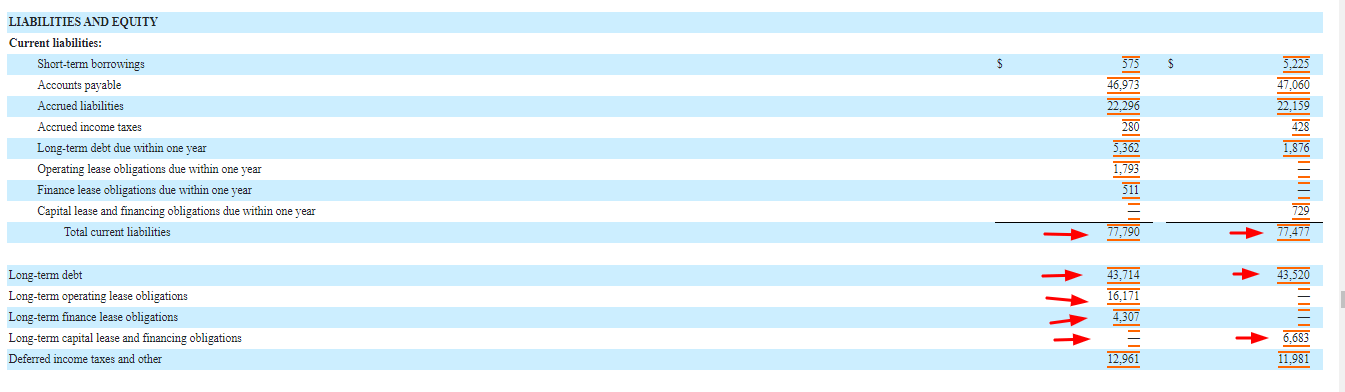

A note on the long-term debt and lease obligations: Again, Walmart doesn’t add them all up, so I added the above-highlighted items to find the final number.

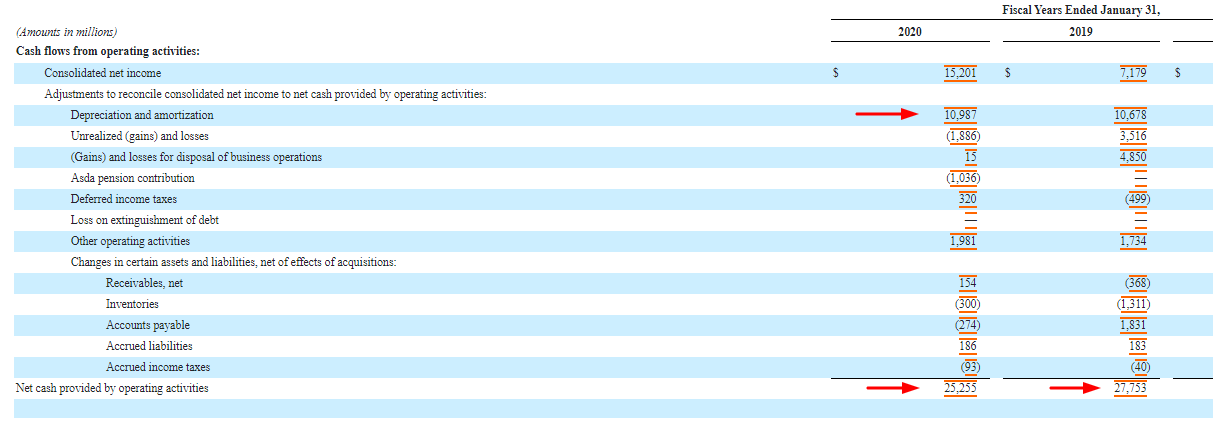

Next, we can move on to the cash flow statement for our last two numbers.

I am adding in the numbers from our cash flow statement.

That completes our investigation of the financial statements; now, we can begin calculating the financial ratios. Before we continue, the last three items listed on the chart above are only for the current year; no comparison is needed.

Next, we will start to calculate our eight ratios, and then we can plug those results into our formula.

1. DSRI = Day Sales in Receivables Index

It is measured as the revenue ratio in accounts receivable in year one versus year two. A big increase in DSRI could be indicative of revenue inflation.

DSRI = ( Receivables 2020 / Revenue 2020 ) / ( Receivables 2019 / Revenue 2019 )

We are pulling the numbers from above.

DSRI = ( 6284 / 523964 ) / ( 6283 / 514405)

DSRI = 0.01199319 / 0.01221411

DSRI = 0.9819

2. GMI = Gross Margin Index

It is measured as the ratio of the gross margin in 2019 versus the gross margin in 2020. Gross margins have deteriorated when this index is above one, for example.

GMI = ( Gross Profit 2019 / Revenue 2019 ) / ( Gross Profit 2020 / Revenue 2020 )

GMI = ( 121904 / 514405 ) / ( 129359 / 523964 )

GMI = 0.25097734 / 0.24688528

GMI = 1.0166

3. AQI = Asset Quality Index

AQI is the ratio of asset quality in 2020 versus 2019. It is measured as the ratio of non-current assets other than property, plant, and equipment (PPE) to total assets.

AQI = ( 1 – ( Current Assets 2020 + PPE 2020 ) / Total Assets 2020 ) / ( 1 – ( Current Assets 2019 + PPE 2019 ) / Total Assets 2019 )

AQI = ( 1 – ( 61806 + 105208 ) 236495 ) / ( 1 – ( 61890 + 104317) / 219295 )

AQI = ( 1 – ( 167014 / 236495 ) / ( 1 – ( 166207 / 219295 )

AQI = ( 1 – 0.7066 ) / ( 1 – 0.7592 )

AQI = 0.2934 / 0.2408

AQI = 1.22

4. SGI = Sales Growth Index

A ratio comparing sales from 2020 to 2019 shows that sales cannot be a measurement of manipulation. Still, growth companies can feel pressure to keep up appearances and may find ways to manipulate. It included changing how they recognize revenue and when it is recognized.

SGI = Revenue 2020 / Revenue 2019

SGI = 523964 / 514405

SGI = 1.0186

5. DEPI = Depreciation Index

DEPI is measured as the ratio of depreciation rate in 2020 versus 2019. A DEPI of greater than one indicates that assets are depreciating slower.

DEPI = ( Depreciation 2019 / ( Depreciation 2019 + PPE 2019 ) ) / ( Depreciation 2020 / ( Depreciation 2020 + PPE 2020 ))

DEPI = ( 10678 / ( 10678 + 104317 )) / ( 10987 / ( 10987 + 105208 ))

DEPI = ( 10678 / 114995 ) / ( 10987 / 116195 )

DEPI = 0.09285 / 0.09455

DEPI = 0.9820

6. SGAI = Sales, General and Administrative Index

The ratio of SGAI in 2020 versus 2019, with SGAI greater than one, indicates that the company is getting less efficient in generating sales.

SGAI = ( SGA 2020 / Sales 2020 ) / ( SGA 2019 / Sales 2019 )

SGAI = ( 108791 / 523964 ) / ( 107147 / 514405 )

SGAI = 0.2076 / 0.2082

SGAI = 0.9968

7. LVGI = Leverage Index

The LVGI is the ratio of total debt to total assets in 2020 versus 2019. An LVGI greater than one indicates an increase in leverage.

LVGI = ( ( LTD 2020 + Current Liabilities 2020 ) / Total Assets 2020 ) / ( ( LTD 2019 + Current Liabilities 2019 ) / Total Assets 2019 )

LVGI = (( 64372 + 77790) / 236495 ) / ((50203+77477) / 219295)

LVGI = ( 142162 / 236495 ) / ( 127680 / 219295 )

LVGI = 0.6011 / 0.5822

LVGI = 1.03

8. TATA = Total Accruals to Total Assets

TATA = ( Net Income – Non-operating Income – Cash Flow from Operations ) / Total Assets

TATA = ( 14881 – 1958 – 25255 ) / 236495

TATA = -0.0521

Phew, we made it. We have calculated all of our ratios to calculate the Beneish M-Score for Walmart.

A refresher on the formula.

M = -4.84 + 0.92*DSRI + 0.528*GMI + 0.404*AQI + 0.892*SGI – 0.172*SGAI + 4.679*TATA – 0.327*LVGI

And our numbers from our ratio calculations:

- DSRI = 0.9891

- GMI = 1.1066

- AQI = 1.22

- SGI = 1.0186

- DEPI = 0.9820

- SGAI = 0.9968

- LVGI = 1.03

- TATA = -0.0521

Now that we have all of our numbers gathered, let’s plug them into the formula.

M = -4.84 + 0.92*0.9891 + 0.528*1.1066 + 0.404*1.22 + 0.892*1.0186 – 0.172*0.9968 + 4.679*-0.0521 – 0.327*1.03

M = -2.610

Wasn’t that fun? It takes a bit to gather the numbers and calculate the formula, but it is relatively easy once you have all the data.

So, what does the above scale tell us?

What the Beneish M-Score Tells Us?

Beneish created a scale to help us determine the likelihood of earnings manipulations. The higher you go on the scale, the more likely you are to manipulate earnings.

For example, here is a scale representation of the results and how a company would fare.

As the scale above shows, Walmart, with its score of -2.61, would not be considered an earnings manipulator.

Here is a list of some of the companies from the S&P 500 and their Beneish M-Scores:

- Berkshire Hathaway (BRK.B) -3.85

- Facebook (FB) -3.04

- Apple (AAPL) -2.82

- Tesla (TSLA) -2.65

- Verizon (VZ) -2.77

- Boeing (BA) 18.46

- McDonalds (MCD) -2.86

- Nike (NKE) -2.54

As we can see, 99% of the companies we scanned are doing well regarding possible earnings manipulations, except for Boeing. After that little scan, it would bear looking further into what is happening with Boeing before deciding to buy any shares.

If the above formulas and ratios seem a bit daunting, there is a fantastic website that has a calculator. You add the numbers from the financials, and it will calculate everything for you.

You can find it here.

I highly recommend calculating these ratios yourself or using the calculator online for one main reason. The more you can get comfortable with a company’s financials and how all the parts fit together, the quicker you will understand any business. You can cheat and find the scores on any financial website, but you can gain valuable knowledge by going to the source directly.

Like any skill, it just takes a little repetition to become a master.

Final Thoughts

In this day and age of technology, there is little room for fraud and earnings manipulation. But it doesn’t mean it doesn’t happen, and using the Beneish M-Score as one of your screening tools is extremely beneficial. I have added it to the list of questions before buying any company.

Typically, I would determine the score before researching the company too deeply, as if they were manipulating earnings. They are not worth my time, and I can move on to another opportunity.

Analysts and hedge funds use the Beneish M-Score to screen for stocks, as it is an all-encompassing tool that looks at many different aspects of the company to determine if the company is reporting its financials on the up and up.

Earnings manipulations can occur but are rare, especially in the US, mainly because of the auditing done and the adherence to GAAP accounting. Another reason I like to focus on the 10-ks is they are audited, where the quarterly reports are not, so you will find a lot of non-GAAP numbers that can skew the results.

Well, that is going to wrap up today’s discussion. I hope you enjoyed the post and found something useful for your investing journey.

If you have any questions, please don’t hesitate to reach out.

Until next time.

Take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- How the Altman Z-Score Formula Can Help Avoid Crippling Bankruptcies Updated 5/1/2024 In this post, you will learn how to use the Altman Z-score to avoid companies on the verge of bankruptcy. This guide will...

- Ratio Analysis: Easy Way for All Investors to Determine Company Health Using ratios for analysis is a time-honored tradition in finance. These ratios can help you compare your company and your performance to others in your...

- The 3 Main Profitability Ratios Used; with Average Industry Profitability Stats Updated 3/6/2024 Profit remains the goal of every business worldwide, but how do we track a company’s profitability and compare it to another’s? Profitability margins...

- Why Inventory Turns Are Key in Evaluating a Company’s Gross Margin Business strategy is not binary. High gross margins are good, but just because they are higher doesn’t always mean a company has a better strategy....