Business strategy is not binary. High gross margins are good, but just because they are higher doesn’t always mean a company has a better strategy. Other components of gross margin, such as inventory turns, can reveal business models with better profits and cash flows even while targeting lower margins.

Before exploring the basics of inventory turns and gross margins, let me work backwards with an example to show just how integrated these two metrics are.

For beginners to these basic terms, refer to the basics of the industry turns formula below and then come back up to read this compelling example.

When Higher Gross Margin isn’t Better

To illustrate the importance of inventory turns, I’ll borrow an example from the great book about business failures called The Innovator’s Dilemma, covering the rise of the discount store versus the established department store retailers.

As companies generally tend to do in standard corporate strategy, managements will aggressively target higher margin markets, and move “up market”.

In the case of department stores (during the rise of Kmart and Target), this meant catering to more affluent customers and higher ticket items such as lavish home furnishings.

A few shrewd discounters saw an opportunity in the gaps where everyone was rushing away from.

Instead, these discounters targeted the young, blue collar wives, who weren’t generally seen as great profit generators due to the lower (gross) margin profile. But the key to success for the discounters was their greater inventory turns, which led to equal ROI on lower margins.

An example of the differences between the various industry players:

Department Stores

- Gross margin = 40%

- Inventory turns = 4x

- Return on Inventory Investment = (40 x 4)

- ROII = 160%

Variety Stores

- Gross margin = 36%

- Inventory turns = 4x

- Return on Inventory Investment = (36 x 4)

- ROII = 144%

Discounters

- Gross margin = 20%

- Inventory turns = 8x

- Return on Inventory Investment = (20 x 8)

- ROII = 160%

Turned out that many variety stores ended up struggling or folding with the arrival of the discounters (Kmart, Target, etc), and their inefficient business models undoubtedly played a part.

It’s amazing to see how lower gross margins can still lead to higher return for the right kind of business model, all because of higher inventory turns as a form of a competitive advantage.

This type of a strategy might not lead to a lot of fanfare from analysts, unless those analysts are focusing on free cash flows and ROIC rather than margins.

How Higher Inventory Turns Lead to Higher ROIC

If we think of inventory investment as just another component of Invested Capital (it is), then we can see how a company’s ROIC can be positively affected by higher inventory turns, and thus how a lower gross margin business can actually earn a higher ROIC than its competitors.

Another way to think of this…

Inventory is a cash flow statement line item (change in working capital), and inventory becomes an asset on the balance sheet as part of Invested Capital. Thus, a higher ROII means lower inventory costs, which both directly increase free cash flows and reduce Invested Capital for ROIC.

Where Wall Street might not approve of a company’s entry into lower margin markets, a forward thinking leadership could buck that trend and sustain lower margins (and/or profitability) to unlock higher future free cash flows and ROIC.

The King of Inventory Turns: Jeff Bezos

I’ve been analyzing the medical distribution industry composed of the following 3 major players: McKesson (MCK), AmerisourceBergen (ABC), and Cardinal Health (CAH). One of the major risks for this industry is obviously Amazon, the master retail distributor with over 100 fulfillment centers in the U.S. alone and decades of experience of squeezing out competitors.

With news that Amazon’s Jeff Bezos joined in partnership with Warren Buffett and Jamie Dimon to create a non-profit healthcare company in 2019, the headlines risks have continued to press down the price of these medical distribution stocks over the last 5 years.

Even more recently, Amazon announced its foray into the pharmaceutical business with their offering called Amazon Pharmacy.

Now, evaluating the “Amazon risk” with the wrong mindset might lead to a poor analysis of the true risk of this factor.

With much of Amazon’s recent success with Amazon Web Services (AWS), a segment with more operating profit than its entire retail business, and AWS’s operating margins of 26.3% in 2020, an analyst might think that Amazon is out to grab similar high margin markets.

It seems that all businesses logically do that.

And so an investor looking at the medical distribution businesses might not find cause for concern of Amazon taking their lunch, with operating margins in the 1% range.

But like any good investor, Jeff Bezos loves free cash flow.

So much so, that with every annual letter to shareholders, Jeff attaches the original 1997 Letter to Shareholders in which he described the constant mission of Amazon.com, as quoted:

“It’s All About the Long Term

We believe that a fundamental measure of our success will be the shareholder value we create over the long term. This value will be a direct result of our ability to extend and solidify our current market leadership position. The stronger our market leadership, the more powerful our economic model. Market leadership can translate directly to higher revenue, higher profitability, greater capital velocity, and correspondingly stronger returns on invested capital…

When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we’ll take the cash flows…

We will balance our focus on growth with emphasis on long-term profitability and capital management. At this stage, we choose to prioritize growth because we believe that scale is central to achieving the potential of our business model.”

Knowing that Bezos has suffered through low margins in his retail business for great future free cash flow, and that the medical distribution business model actually produces decent ROIC even despite its terrible margins, should warn investors to the potential bloodbath ahead.

For example, here’s the historical ROIC for the big 3 medical distributors compared to Amazon (10Y median):

- MCK – 12.5%

- ABC – 17.9%

- CAH – 14.0%

- AMZN – 13.3%

The extent to which Amazon can eat this market would likely depend on the costs to build special distribution centers and pharmacy relationships with similar (future) ROIC characteristics. This is something that could possibly be estimated by looking at historical capex per new distribution center with the major players, among other calculations, which is beyond the scope of this article.

But if this thesis were to be true, that higher inventory turns can lead to high FCF even despite super low margins, then examining these businesses should show that characteristic.

How to Calculate Inventory Turns

The inventory turns formula is simple. The higher the number, the more frequently a company turns over their inventory. As an example, if the inventory turns ratio = 2, the company sells its entire inventory 2x in one year.

Inventory Turns = (Cost of Goods Sold) / (Inventory)

You can also calculate Inventory Turns, over an annual inventory period, as the following:

Inventory Turns = (Cost of Goods Sold) / (Average Inventory)

Where, Average Inventory = (Beginning Inventory + Ending Inventory) / 2

Now let’s calculate the inventory turns for each of the 3 major distributors (for 2020).

- MCK = 13

- ABC = 15

- CAH = 11

ABC might have a competitive advantage over the other two players in the industry due to its inventory efficiency, though a more thorough analysis would consider multiple years and other key factors between their business models, geographies, etc.

Major Takeaways about Gross Margin

You can see that the higher the Cost of Goods, the higher the inventory turns. Since COGs is part of the Gross Margin formula (since Revenue minus COGs = Gross), you can see that a higher COGs naturally pushes the inventory turns ratio higher.

Which makes sense, because more goods need to be sold in order to have higher inventory turns.

Going back to the example of Jeff Bezos, he never made his focus on higher inventory turns for greater free cash flows a mystery. From the 2004 letter to shareholders (which I highly recommend as a perfect teaching example of the difference between GAAP earnings and Free Cash Flow):

“Our Most Important Financial Measure: Free Cash Flow Per Share

Amazon.com’s financial focus is on long-term growth in free cash flow per share.

Amazon.com’s free cash flow is driven primarily by increasing operating profit dollars and efficiently managing both working capital and capital expenditures. We work to increase operating profit by focusing on improving all aspects of the customer experience to grow sales and by maintaining a lean cost structure.

We have a cash generative operating cycle because we turn our inventory quickly, collecting payments from our customers before payments are due to suppliers. Our high inventory turnover means we maintain relatively low levels of investment in inventory—$480 million at year end on a sales base of nearly $7 billion.”

I bolded a few key parts in there to illustrate the powerful effect of inventory turns. If the medical distributors think that they aren’t immune to the threat of Amazon’s competitive advantages, they might have an interesting surprise waiting for them.

Calculating Inventory Turns from a 10-k (Example)

Now let’s pull up a company 10-k to show how we can check our work with the inventory turns formula presented in this article. In the (Internet) age of endlessly free information, checking our work is a critical part of checking our sources.

I just happened to be studying Bezo’s letters at the same time I’ve been reading The Innovator’s Dilemma (which Bezos called one of his favorite books by the way), and so I knew about this quote in his 2001 letter:

“Inventory turns increased from 12 in 2000 to 16 in 2001”.

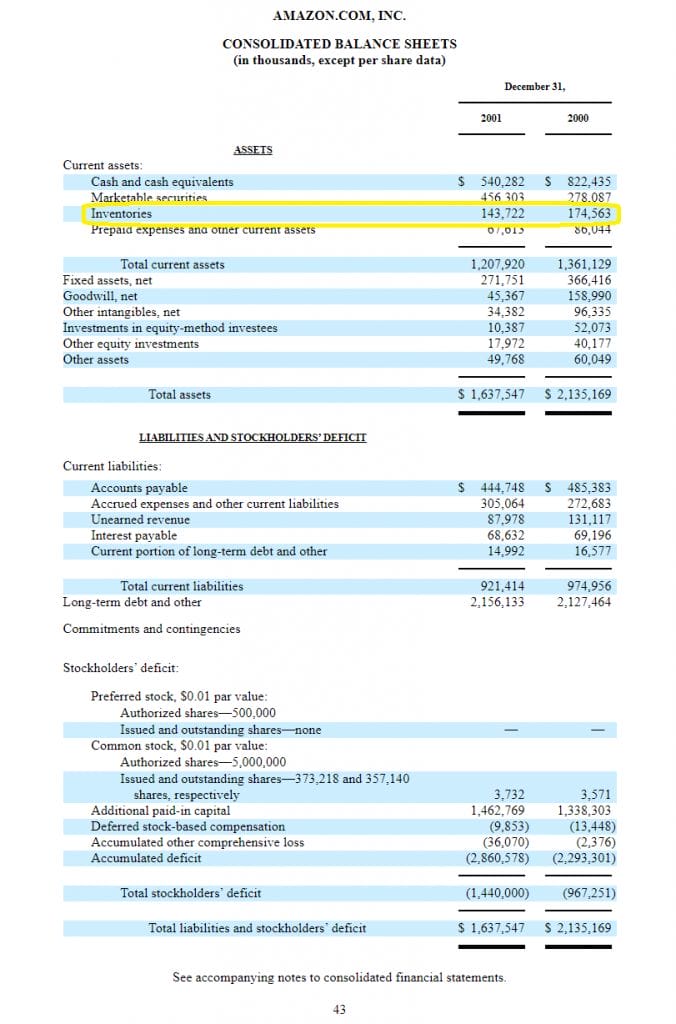

Let’s pull up the 2001 10-k for Amazon and check our formula. Using “ctrl+f” to search for the Consolidated Balance Sheets, we can find inventory by looking under the Current assets section of the balance sheet (all numbers in thousands):

Inventories 2001 = $143,722.

Then, moving to the Income Statement, we can find the 2001 Cost of Goods (Cost of Sales), which equals $2,323,875.

2001 AMZN Inventory Turns = COGs / Inventory

2001 AMZN Inventory Turns = (2,323,875) / (143,722)

2001 AMZN Inventory Turns = 16.2 = 16

Thank goodness, it was not rocket science after all. This simple calculation illustrates that Amazon turned over its inventory 16 times per year in 2001, which is more than once a month.

Comparing it back to the example shared at the beginning of this article, from the discounters and department stores back before Amazon was even invented, we see a stark contrast in the efficiencies of the various business models—which helps explain why Amazon has been so successful.

And the focus on future free cash flow has indeed played out for Amazon and its results—the CEO wasn’t lying about his plans.

Over the last 10 years Amazon has been able to grow FCF by an astounding 24.4% CAGR, shattering all sorts of businesses throughout the stock market not only today but throughout history.

Suddenly the extremely high valuations for Amazon start to make more sense, as we’ve truly witnessed one of the greatest business success stories of our time.

And it’s very possible that this can continue for the company, as it can take its polished inventory turns model and apply it to other similar low margin businesses, like medical distribution.

Since distribution is generally a business whose primary competitive advantage comes from scale, and the recent ROICs for the top players in this industry have been healthy, a market like this could turn out to be another fantastic long term capital investment for Amazon for future free cash flows—but one that would require the same disciplined, long term approach to fight low margins and profits in order to build that market leadership.

That is, if they decide to attack distribution channels, rather than just content themselves to eating all of the traditional pharmacies.

Investor Takeaway

That was a lot of fun talking about one of the greatest businesses around, and applying an analysis based on their recent big moves. Now back to the crux of our discovery.

All by itself, lower or higher gross margins are not superior to the other.

A lower gross margin business with higher inventory turns can actually have a superior business model and cash flow profile to a higher gross margin business, even with the same growth rate in revenues.

It all comes down to the balancing act between the numbers and how they ultimately impact Return on Invested Capital, future free cash flows, or any other measure of the capital efficiency of a business and its management.

The best way to master the numbers?

Constant practice, and a curious and open mind.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Defining a Good FCF Margin Formula: Basics, Examples, and Analysis Updated 4/6/2023 FCF margin is a valuable tool for understanding how much free cash a company can generate from its revenues. In general, a higher...

- The 3 Main Profitability Ratios Used; with Average Industry Profitability Stats Updated 3/6/2024 Profit remains the goal of every business worldwide, but how do we track a company’s profitability and compare it to another’s? Profitability margins...

- Days Sales in Inventory (DSI): Evaluating Quality of Earnings and Inventories Updated: 5/22/2023 Days Sales in Inventory, or DSI, can a great ratio to evaluate inventory management. It can also sometimes signal future demand (and thus...

- Free Cash Flow Yield – Finding Gushing Cash Flow for Future Growth Cash is king, and free cash flow acts as the engine’s oil. Determining free cash flow and its different uses remains a fantastic way to...