A Tactical Asset Allocation plan is a plan that can allow you the opportunity to have a ton of success if implemented properly, but it takes a lot of knowledge and understanding of what is going on in the market and some serious market discipline.

So, what exactly is a Tactical Asset Allocation plan?

Essentially, you’re going to focus on investing more on asset classes than actual investment selection. For instance, you would be focusing on investing in stocks, bonds, cash and potentially commodities.

In essence, your goal when implementing this plan is to take advantage of the gains of certain asset classes while the others aren’t performing nearly as well. Let me show you how it works:

1 – Decide your asset allocations

For the sake of this discussion, and since I am younger and willing to be riskier, I am going to start in 70% stocks, 20% bonds and 10% cash. You can add commodities if you’d like but I am choosing not to include them purely for example purposes.

2 – Decide your investments

So now that my asset allocations have been determined, I need to actually invest in those classes. In this type of strategy, your goal isn’t to try to find the best performing individual stock or ETF – your goal is simply to make sure that you stay diversified so you can take advantage of the market as a whole. To do so, I would recommend investing primarily in ETFs or Index funds that give you exposure to many different companies. Some examples would be the following:

ETFs – I would recommend using something that replicates the S&P 500, the Russell 2000, and then maybe try to get some different sector exposure, for instance maybe eyeing tech, industrials, and utilities. Again, these are all just examples. You can logon to your brokerage firm to see a full list of all of the different ETFs that are available to you. I use Fidelity and they have nearly 2200 different options and they are a commission free broker so that makes things just that much easier – but make sure you’re watching the management fee that’s charged when looking at these ETFs! Some can be well above 1%.

Bonds – With bonds being a much small percentage of your portfolio, you won’t need as many investments to make up this field. I would focus on some bonds with either short/intermediate/long term indexes just to make sure that you have sufficient exposure.

Cash – This is the easiest one! Just put your cash into a money market fund and be ready to pounce on the opportunity when it presents itself.

Ok, now that we have our asset allocations and our investments picked out, let’s see how this might actually work:

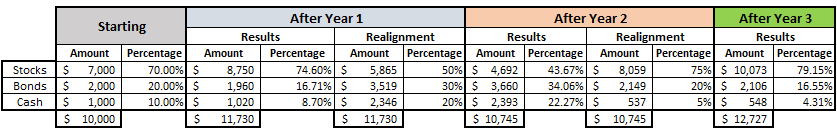

Let’s imagine that you’re going to invest $10,000 in this Tactical Asset Allocation profile. You’re going to start with an asset allocation that is 70% ($7000) stocks, 20% ($2000) bonds and 10% ($1000) cash. Then the following happens

Year 1 – stocks experience a great year. The market is up 25% and your investment of $7000 is now $8750. Your bonds dropped in value by 2% down to $1960 and your cash grew by 2% and is now sitting at $1020, so your total portfolio is now $11,730.

You have a feeling that the market is about to take a downturn, so you decided to change your allocations for Year 2. You drop your stocks down to 50% ($5865) of the total value of your portfolio, bonds are now 30% ($3519) and cash is 20% ($2346).

Year 2 – As anticipated, the market downturn did occur, and the stocks dropped by 20% while bonds increased 4% and the cash held steady at a 2% increase. So, your portfolio is now only worth $10,745 made up of $4692 (43.67% stocks), $3660 (34.06%) bonds and $2393 (22.27%) cash.

Now for year three, you’re thinking the market is going to rebound in a big way so you’re ready to get after it and be risky again! You decide to move 75% of your portfolio into stocks, 20% into bonds and you now only have 5% leftover in cash.

Year 3 – You were right! The market did rebound in a big way. The market performed the same as it did in Year 1, so your stocks grew 25%, bonds shrunk by 2% and the cash grew by 2%. All in all, you now have $10,073 in stocks, $2106 in bonds and $548 in cash!

Below shows the math and how everything worked out:

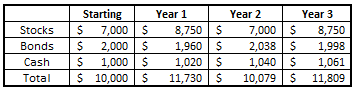

Not too shabby of a return right there! Now, you’re probably wondering how this might compare if you had just left your money where it was…check out below:

Also, not bad returns at all! If you had just left your money in the original asset allocations, you would now have 18% more than you initially invested.

But if you had used a Tactical Asset Allocation plan you would have gained more than 27% over your initial investment or double the return than if the money had just sat there and never changed.

I know that this can seem like market timing a bit, and I totally get that. I think that when you start making major swings in your allocations like I just outlined, you can set yourself up for some potential failure, but that just comes down to your risk tolerance.

Instead of speculating this much, I would recommend simply rebalancing each year (or maybe more often) to capture changes that have occurred in the market.

For instance, if your 70/20/10 blend of stocks/bonds/cash has changed to 75/18/17, then maybe you need to rebalance back to the original plan. This will help make sure that you’re always properly aligned and will help keep you from getting too far ahead of yourself and almost forces you back to being conservative.

I don’t have a problem with being a little speculative with a small amount of your money, so if you want to put some of your money into something a little riskier and try to time the market, feel free! But be prepared to lose a whole lot of it. You always just need to make sure that you’re prepared for the worst to happen when you start doing this.

My biggest piece of utilizing a Tactical Asset Allocation plan is simple – be tactical; not reckless.

Related posts:

- How Tactical Asset Allocation Works – (With Example Portfolios) Asset allocation is arguably more important than which stocks you pick. For most investors, focusing on your asset allocation is a lot more important than...

- Strategic Asset Allocation: Unique in Nature, Critical for an Uncertain Future “You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.” Ray Dalio Today we...

- Why Diversification is Important in Investing (Timeless Principle) Diversification is important in investing because you don’t want a single mistake to destroy your portfolio. Even the best investors (and businesses) make mistakes, it’s...

- 442,823 Reasons to Avoid Fidelity Target Date Funds I oftentimes hear people say that target date funds are a great way for the “hands-off” investor to get some exposure to the market, but...