I oftentimes hear people say that target date funds are a great way for the “hands-off” investor to get some exposure to the market, but you know me – I always go into things just a little bit skeptical. To understand better, I took a deep dive and guess what – I found 442,833 reasons to avoid Fidelity target date funds!

Investopedia defines a target date fund as, “mutual fund or exchange-traded funds (ETFs) structured to grow assets in a way that is optimized for a specific time frame.”

In general, you might see that a brokerage firm will offer you a different fund ranging in 5-year multiples, such as 2020, 2025, 2030, 2035, and so on. The general thought process is that you can put your money into these target date funds and then never need to touch it again, because the asset allocation is being automatically adjusted for you as time goes on.

So, you might start off with a certain stock/bond ratio, and then as years go on and you get closer to that date, the fund will move more into bonds and money markets and less into stocks. The overarching concept is that it will slowly become more and more conservative, which is in general a very good idea as people get closer to retirement.

I almost view this as a “fluid” ETF. Like an ETF where you can simply invest it and forget it, this acts the same way; but I would say is a bit more advanced due to the asset allocations.

It’s important to note that just because it’s more “advanced”, that doesn’t mean that it is better. These target date funds aren’t calling you up every year and saying, “uh, hey Andy – do you think you’re going to retire at 50? 90? Are you dead broke and need the money now? How are things going?”

They’re not. It’s on you to know the innerworkings of how your assets are going to shift over time and decide on if it’s a worthwhile investment or not. But don’t worry – I’m here to break it down for you!

So, before we get into the details, there’s really a few things that I like to look at when I am evaluating an ETF:

- The overarching goal

- Asset Allocation

- Fees

- Past Performance

- Holdings of the portfolio

- We will remit this as the target date funds are made up of mutual funds

The Overarching Goal

Fidelity states that they have three main goals for their investors that use target date funds:

- Diversification: Investing across different asset classes and securities may help reduce risk while offering growth potential.

- Asset Allocation: The strategies’ investment mixes adjust to target retirement dates—gradually becoming more conservative over time.

- Automatic Rebalancing: This feature allows the strategies to maintain the target allocation, so portfolio weightings don’t shift as the market changes.

Personally, I am 100% onboard with all these strategies with the one caveat that I have already mentioned – asset allocation! Which leads me to my next point…

Asset Allocation

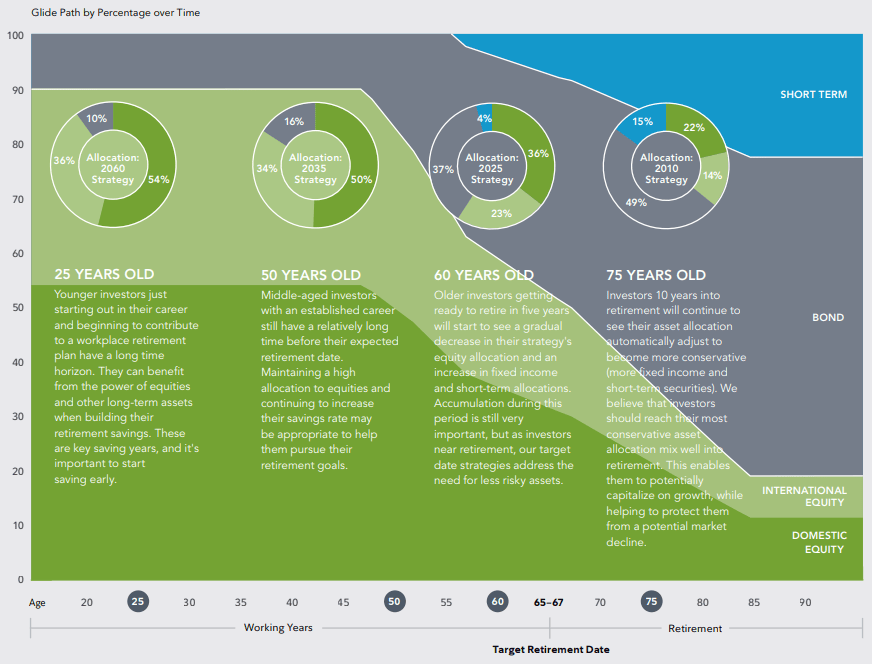

Fidelity has a nice breakdown of what they think your asset allocation should be at various ages assuming a target retirement of 65-67:

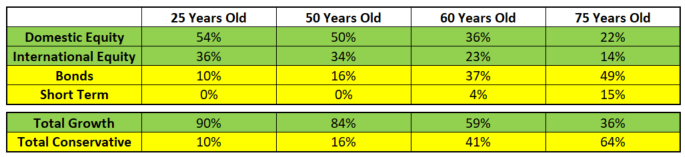

I’ve broken it down into a little bit simpler chart below where the green highlights represent the “growth” or equity positions in the target date fund and the safer investments are in yellow to represent a “conservative” approach:

As anticipated, the closer that you get to retirement, the more conservative that these investments get – makes total sense to me. And truthfully, I don’t have any “huge” beefs with this, except for in some of the early years.

Personally, I think that there is literally 0 reason to have bonds in a retirement account when you’re 25 years old. I mean like 0.0000% of a reason, especially in this case where you’re going to be planning to retire between 65-67.

When you have 40 years to retirement, I think that you need to be in some very risky stocks to try to hit that homerun. You have a ton of time to make up for any “strikeouts”, but you should be looking for that “home run”. Now, I completely understand if you don’t want to be in risky investments and even for myself, I limit my speculative investments to a small portion of my total portfolio, but I don’t have any bonds in there.

The point of bonds for an investor is to minimize downside and to provide some sort of ratable income, both of which are things that you shouldn’t be worrying about when you’re investing at such a young age.

When you invest in bonds, it’s not like you’re going to minimize the downside and keep the same upside – you’re simply just going to stay more stable in both outcomes. If the market goes down, you’ll be happy you’re in bonds. If it goes up, you’ll be mad.

And over the course of 40 years, I am going to guess that the market is going to go up. I mean, it has increased 10% on average for the last 100 years or so, but what do I know?

I wanted to go back and take a deep dive on what the history of investing in a stock & bond portfolio would really look like and truthfully, the results were pretty eye opening to me.

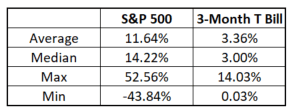

As a high-level view, the S&P 500 average annual return (including dividends) since 1928 is 11.64%, significantly outperforming the 3-Month T Bill per Aswath Damodaran, one of Dave’s favorite teachers.

But you can clearly see that the worst year for the S&P 500 is way worse than the worst year for the 3-Month T Bill rates, so that’s where the sense of conservatism comes in.

But remember – I am not saying that bonds are bad or that they shouldn’t be in your portfolio. I am saying that if you’re 25 and plan to retire at 65-67, then they shouldn’t be in your portfolio.

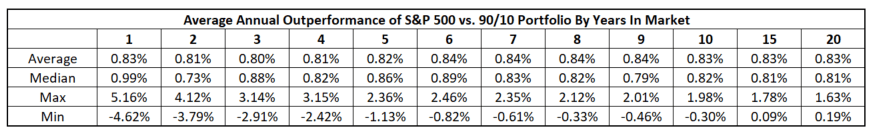

The chart below will show you the average outperformance of the S&P 500 vs. a 90/10 portfolio (90% S&P 500; 10% 3-Month T Bill) over the course of various timeframes. The numbers across the top of the second row are the amount of years that your money was invested, so ‘1’ means the average annual outperformance while 10 means the average outperformance over a decade. Essentially, the longer the time period, the more likely that investment should be to outperform the 3-Month T Bill.

Check it out:

So if you invested solely in the S&P 500 vs. someone else that invested in a 90/10 blend, the worst year you would have is you’d outperform their portfolio by 4.62%, while the best year is one where you’d outperform by 5.16% – essentially a wash to me.

However, you can see that the average & median annual returns (look at the ‘1’ column) are between .83% – .99%. That might not seem like a big deal, but over 40 years it can really add up.

If you invested $10K and assumed it earned that 11.64% return for 40 years, you would have $1,028,800. WOW!

But, if it had returned that .83% less, you might think it would be just slightly lower, right? Wrong.

Your total would be $740,426 – a mere 72% of the total vs. the S&P 500. So, just that 10% in bonds that caused you to have not even a 1% worse return cost you 28% of your total value. How?

Compound Interest. That’s how. And that’s why fees really, really matter as well because it’s essentially a very similar effect.

Now if we go look back at that chart again, you can see that once you hit the 15 year column, the “Min” is a positive .09%, meaning that the 100% S&P 500 portfolio literally never underperformed the 90/10 portfolio over a 15 year span.

I mean…. like never.

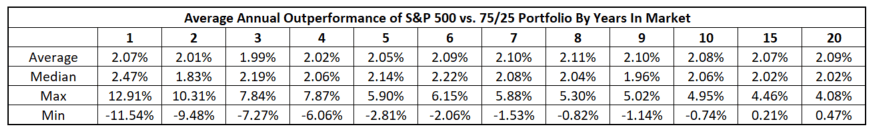

And guess what – as you add more bonds into your portfolio, you’ll start to notice a sense of widening on both ends and a tightening in the middle.

What I mean is that you’ll see a larger max outperformance/min underperformance in a 1-year span, while seeing a thing tighten up a bit on the average outperformance by year. Look at a 75/25 portfolio below:

Again, the thing that sticks out to me is that when you’re in the 15-year window, the “Min” is a positive .21%, meaning that it never underperformed the 75/25 portfolio. Any specific timeframe starting to stand out to you? ?

If it was me, I would have literally 0 bonds in my portfolio until I was a minimum 11 years away from needing to pull down on those funds. As you can see, 11 years is the first year that there’s a Min that’s below the average, meaning that you’re still going to be better off with a pure S&P 500 portfolio:

The 75/25 shows a very similar story as well:

So, do I like the asset allocations that these target date funds put you in? Absolutely not.

I understand why an investor that’s 50, 55, 60, 65 and so on may want to add some bonds purely to protect them from having their accounts go down. I understand that loss aversion bias is a thing and the losses hurt way more than the gains feel good.

But I am also here to say that mathematically it’s a less efficient plan.

Now, the worst thing that you can do is be 100% in stocks and then panic sell at the bottom and lock-in those losses, so you need to know yourself.

I can only advise for myself and what I will say is that I would not touch bonds unless I was saving for a short-term goal or I was within 5-10 years of pulling out retirement funds.

Remember my earlier comment about fees, though? I think it’s time to key in on that!

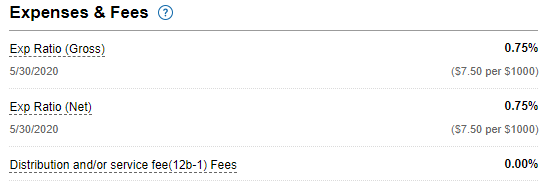

Fees

I took a look at the Fidelity Freedom 2040 Fund (Ticker is FFFFX) which you can see on their website and the fees were .75%:

While that doesn’t seem awful, the fees on an S&P 500 ETF like SPY is .09%, so you’re paying .66% more to have an underperformance vs. a pure S&P 500 portfolio.

Lose-lose.

Past Performance

“Andy – we already talked about this”

But did we? ?

I love Fidelity and I think they do a really good job about giving their investors great info, including some really nice graphs to show you the past performance so you don’t have to get into the numbers like I do (although you should!)

In the graph below you can see that that 2040 Fund outperformed the S&P 500 in the past year but hasn’t done so in any other time period, and hopefully you’re not using a Target Date Fund as a short-term growth engine…

Look at how your money would’ve grown since 2012:

Yep, that’s the S&P 500 at the top.

You can find all of this data on their website even if you’re not an investor with them, but I truly think they’re the top of their class when it comes to brokerage firms.

Summary

So, in summary – should we invest in Fidelity Target Date Funds? Well, I think that 100% comes down to your mentality. If you’re a hands-off investor that is a little more conservative and would sacrifice gains to minimize losses, feel free.

Personally, I trust the history of the stock market and think that it’s not worth it to invest in them. I don’t want to touch bonds with a 10-foot pole until I’m 5-10 years away from retirement, and I don’t want to pay a higher expense ratio to underperform the market.

All-in, after fees, your $10K investment in SPY would’ve turned into $992,764 in 40 years while your Fidelity Target Date Fund would’ve turned into $549,941… so if you’re 25, why not make $442,823 more (81%!) and avoid these target date funds?

Seems like a simple answer to me!

If you still want to be a hands off investor, just check out an S&P 500 ETF that you can invest in and forget about until you get closer to retirement, or if you want to be a stock picker like myself, I got you covered on that as well!

Related posts:

- How Tactical Asset Allocation Works – (With Example Portfolios) Asset allocation is arguably more important than which stocks you pick. For most investors, focusing on your asset allocation is a lot more important than...

- Strategic Asset Allocation: Unique in Nature, Critical for an Uncertain Future “You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.” Ray Dalio Today we...

- What are the Different Types of Mutual Funds, and What do They Mean? Mutual funds are a great vehicle for growing your money. Keep reading to find out more about them and what types of mutual funds may...

- How to Create an All-Weather Portfolio Like Billionaire Ray Dalio Updated 6/7/2023 Investing in uncertain times is a scary proposition, and any investor should wonder: is there a way to avoid the ups and downs...