Berkshire Hathaway, run by the legendary Warren Buffett, is a multinational conglomerate and a beacon of long-term value investing.

Today’s journey will delve into the diverse portfolio, encompassing insurance, energy, and renowned consumer brands, that defines Berkshire Hathaway’s remarkable success under Buffett’s visionary leadership.

Join us as we unravel the secrets of financial success in this exploration of Berkshire Hathaway’s enduring legacy.

In today’s post, we will learn:

- What is Berkshire Hathaway?

- What is Berkshire Hathaway’s Overall Business Strategy?

- How Does Berkshire Hathaway Make Money?

- What is Berkshire Hathaway’s Business Structure?

- Major Holdings and Acquisitions

Okay, let’s dive into the Berkshire Hathaway business breakdown.

What is Berkshire Hathaway?

Berkshire Hathaway stands tall as a giant in the business world, a name synonymous with success and strategic acumen.

Led by the iconic Warren Buffett and Charlie Munger, this conglomerate has etched its mark across industries, weaving a tale of growth and prosperity.

Historical Evolution of Berkshire Hathaway

In the small town of New Bedford, Massachusetts, Berkshire Hathaway’s story began in the textile industry.

Picture a bustling mill in the early 20th century, where the hum of machinery and the scent of raw cotton filled the air. Here, Berkshire Hathaway, initially a textile manufacturing company, took its first steps.

The company’s journey started with a focus on textiles. However, the textile industry was challenging, marked by fierce competition and economic shifts.

As the years unfolded, Berkshire faced the daunting reality that its original path might not lead to enduring success.

Enter Warren Buffett, a name synonymous with Berkshire Hathaway’s triumphs.

In the mid-20th century, Buffett recognized the need for a transformation. Though once the backbone of Berkshire, the textile industry was no longer sustainable in the face of global economic changes. With visionary foresight, Buffett steered the company from the uncertain world of textiles towards a more diversified future.

Under Buffett’s leadership, Berkshire Hathaway underwent a remarkable transition. The once textile-centric entity expanded its horizons, becoming a diversified conglomerate interested in many industries.

Buffett’s investment philosophy played a crucial role in reshaping Berkshire Hathaway.

Instead of putting all eggs in one basket, he advocated for a diversified approach, spreading investments across various industries and companies. This strategy aimed to mitigate risks and capitalize on opportunities, creating a resilient and dynamic conglomerate.

He started buying businesses like National Indemnity to help diversify Berkshire away from textiles. The one acquisition started the company down the path they are on today.

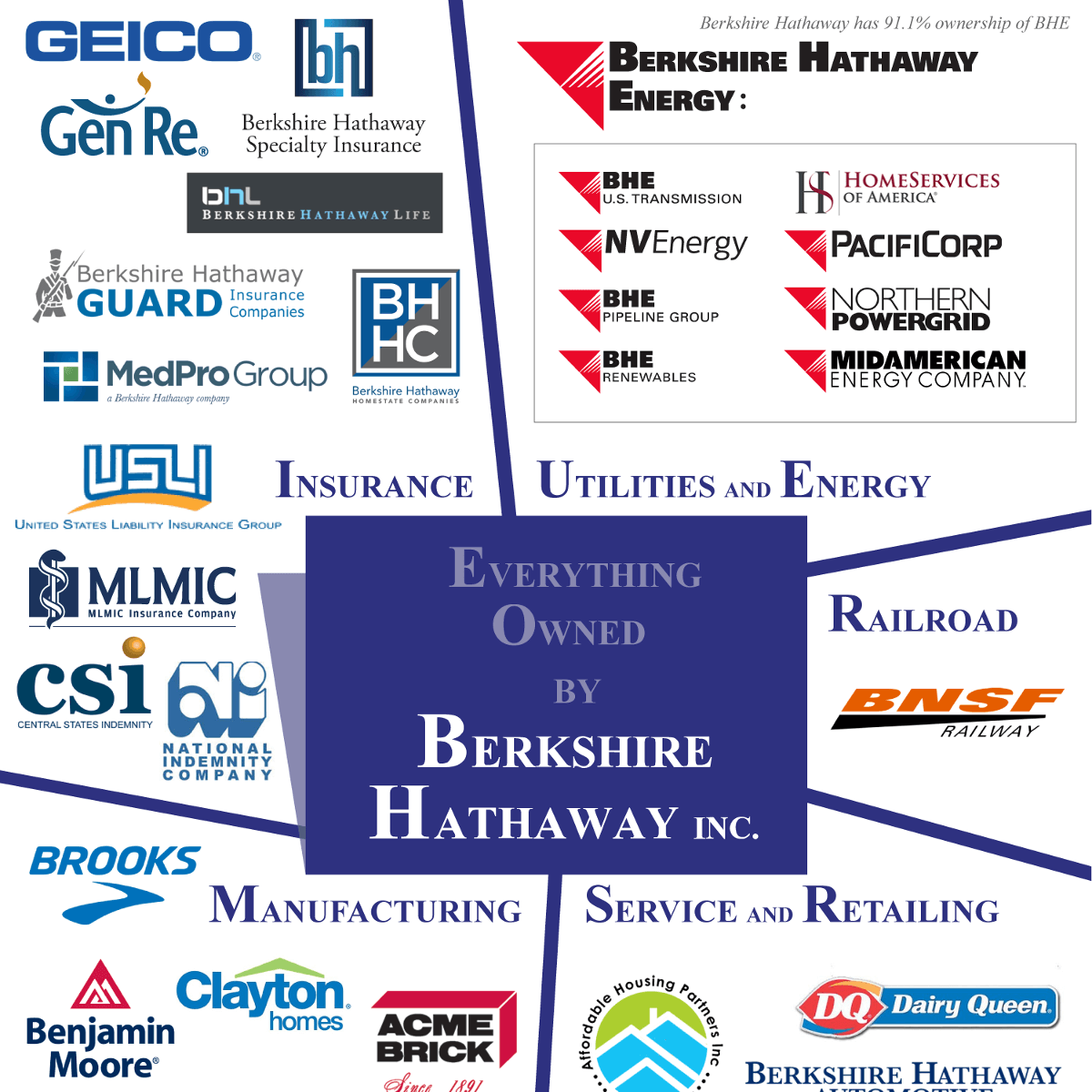

Today, when one thinks of Berkshire Hathaway, textiles are a distant memory. The company’s portfolio spans:

- Geico

- Berkshire Energy

- Dairy Queen

- Investment portfolio

- BNSF

- Much more

Fun fact: Buffett has mentioned numerous times his acquisition of Berkshire Hathaway was one of his biggest mistakes. At the time, the company was a mess in a dying industry.

What is Berkshire Hathaway’s Overall Business Strategy?

Under the sage guidance of Warren Buffett, Berkshire Hathaway has meticulously crafted a business strategy that distinguishes it as a beacon of stability and success in the corporate landscape.

Berkshire’s core strategy revolves around principles emphasizing:

- Long-term value creation

- Diversified investments

- Acquisitions and investments

- Conservative Financing and Liquidity

1. Long-Term Value Investing:

Berkshire Hathaway’s bedrock lies in the philosophy of long-term value investing.

Unlike the short-term fluctuations that captivate many in the financial world, Buffett advocates for a patient and strategic approach.

The company seeks investments with enduring value, focusing on businesses with strong fundamentals and sustainable growth prospects. This commitment to long-term vision has been pivotal in Berkshire’s ability to weather economic storms and emerge resilient.

We can see these principles play out in investments such as:

- Geico

- National Indemnity

- See’s Candies

- BNSF

- American Express

- Coca-Cola

2. Diversification Across Industries:

One of the hallmarks of Berkshire Hathaway’s strategy is diversification.

Rather than putting all its eggs in one basket, Berkshire has strategically spread its investments across various industries.

Berkshire owns a wide range of businesses:

- Insurance

- Consumer brands

- Real estate

- Railroads

- Renewable energy

- Investment portfolio

From insurance and energy to consumer brands and beyond, this diversified portfolio safeguards against industry-specific risks.

These wide-ranging, diversified investments provide continuing revenue growth and reinvestment opportunities. They also enable the company to pivot according to the changing economic conditions.

3. Acquisitions and Investments:

Berkshire Hathaway’s strategy extends beyond merely holding stocks.

Buffett actively seeks opportunities for acquisitions and investments in companies that align with its principles.

He spends the majority of his time reading anything he can get his hands on — newspapers, financial statements, books, and industry-specific publications.

Buffett and Munger spend their time reading and thinking in preparation for opportunities as they arise.

For example, many of their acquisitions or investments come from a phone call or conversations with an owner.

One of the strengths of Berkshire’s business model is decentralization. Buffett and Munger prefer to let the managers run the companies, leaving them to do what they do best: allocate capital.

The basic business model for the company includes a hands-off approach to its subsidiaries. These companies run themselves, without interference from the mother ship, and send their cash to Buffett and Munger to allocate.

The hands-off approach and the integrity of Buffett and Munger offer a perfect place for business owners to sell their babies, too.

4. Conservative Financing and Strong Liquidity:

Another aspect of Berkshire Hathaway’s strategy is conservative financing.

The company maintains a strong financial position and ample liquidity, ensuring it is well-prepared to navigate uncertainties and capitalize on opportunities.

This approach reflects Buffett’s aversion to excessive debt and his preference for financial prudence, allowing Berkshire to act decisively in different market conditions.

Berkshire Hathaway sits on a pile of cash of about $158 billion. Part of this relates to their insurance operations, but much of the cash waits for allocation, per Warren and Charlie.

Most of their company acquisitions occur via cash. Buffett abhors diluting shareholders and, thus, prefers to buy a company via cash considerations.

How Does Berkshire Hathaway Make Money?

Berkshire Hathaway generates revenue and profits through diverse business activities, reflecting its status as a conglomerate with interests spanning various industries.

Berkshire Hathaway operates from six segments:

- Insurance

- Manufacturing

- McLane Company

- Service and Retailing

- Berkshire Hathaway Energy

- BNSF

Here are the primary ways in which Berkshire Hathaway makes money:

1. Insurance Operations:

Berkshire Hathaway owns a collection of insurance companies, including GEICO Berkshire Hathaway Reinsurance Group and National Indemnity.

On a surface level, these companies collect premiums from policyholders in exchange for assuming the risk of potential future claims. The premiums collected, minus the amount paid out in claims and operating expenses, contribute to Berkshire’s earnings.

But Berkshire benefits in another way from its insurance operations. The creation of insurance float.

Insurance float equals “other people’s money,” according to Warren.

The easiest way to visualize float is the insurance business operates on customers paying premiums for car insurance, for example. It can take years for Geico to pay out on a claim. In the meantime, the time gap between receiving premiums and paying out claims is the float.

Most insurance companies generate gaps in incoming cash and outgoing cash and they invest those in long-dated bonds, which pay lower rates.

But Buffett operates differently; he uses the float to invest in Apple, American Express, and Coca-Cola. These investments generate far greater returns for Berkshire and its shareholders.

And because Buffett and the company run a SUPER profitable insurance business, they generate excess cash, which they can hold in case they need to pay out claims.

2. Manufacturing:

Berkshire Hathaway’s manufacturing segment comprises various companies contributing to its financial strength.

- Precision Castparts

- Marmon Group

- Iscar Metalworking

- Lubrizol

- MiTek

These entities engage in diverse manufacturing activities, crafting products from industrial components to consumer goods.

Precision Castparts, a major aerospace and industrial manufacturing player, exemplifies the significance of this sector within Berkshire.

The manufacturing segment adds substantial revenue through product sales, fostering innovation and operational excellence.

3. McLane Company

As a subsidiary of Berkshire Hathaway within the Services and Retail segment, the McLane Company specializes in supply chain services, particularly distribution and logistics.

McLane plays a pivotal role in optimizing the movement of goods by focusing on diverse industries such as convenience stores, mass merchants, drug stores, and chain restaurants.

Leveraging advanced technologies and a national network of distribution centers, the company ensures efficient and timely delivery of products, emphasizing accuracy and cost-effectiveness.

McLane’s client base spans retailers and restaurant chains, relying on the company’s expertise in streamlining supply chain processes.

Operating in alignment with Berkshire Hathaway’s broader strategy, McLane contributes to the overall efficiency and competitiveness of the businesses it serves, reflecting a commitment to excellence in distribution and logistics services.

4. Service and Retailing

Berkshire Hathaway’s Services and Retailing segment encompasses diverse businesses, reflecting the company’s commitment to varied industries. This segment includes companies such as:

- See’s Candies

- Nebraska Furniture Mart

- Florsheim Jewelers

- Pampered Chef

- Many others

Due to Berkshire Hathaway’s strategic acquisitions and divestitures, the exact composition may evolve.

By embracing a broad spectrum of services and retail ventures, Berkshire Hathaway ensures resilience and adaptability in the ever-changing business landscape, reflecting its core principles of long-term value creation and diversification across different sectors.

5. Berkshire Energy

Berkshire Hathaway’s Energy segment is a crucial component of its diversified portfolio, reflecting its commitment to the power and utility sector. The energy sector, to me, offers the greatest opportunity for upside for Berkshire.

This segment comprises various subsidiaries engaged in the generation, transmission, and distribution of energy.

Notable entities include

- MidAmerican Energy

- NV Energy

- Berkshire Hathaway Energy Renewables

The companies within this segment operate in different regions, contributing to the provision of electricity and related services.

With a focus on traditional and renewable energy sources, Berkshire Hathaway’s Energy segment aligns with the conglomerate’s commitment to sustainability and long-term value creation. Investments in wind, solar, and other clean energy initiatives underscore the segment’s forward-looking approach.

One thing to note is that Berkshire Energy’s wind portfolio is the largest in the US.

As the energy landscape continues to evolve, Berkshire Hathaway’s strategic presence in this sector positions it as a key player in meeting the world’s growing energy needs.

6. BNSF

BNSF Railway, a vital component of Berkshire Hathaway’s diverse portfolio, plays a pivotal role in the transportation and logistics sector.

As one of North America’s largest freight railroad networks, BNSF’s prospects are promising. The railway is poised for growth, driven by its strategic position in transporting goods crucial to the global economy.

BNSF’s commitment to innovation, efficiency, and sustainability positions it for continued success, especially as the demand for reliable and environmentally-conscious freight transportation rises.

The ongoing investments in technology, infrastructure, and the adoption of advanced operating practices demonstrate BNSF’s dedication to enhancing its services.

With the ever-increasing need for efficient freight solutions, BNSF’s extensive network and forward-thinking approach position it for sustained growth, making it a cornerstone of Berkshire Hathaway’s long-term success in the transportation industry.

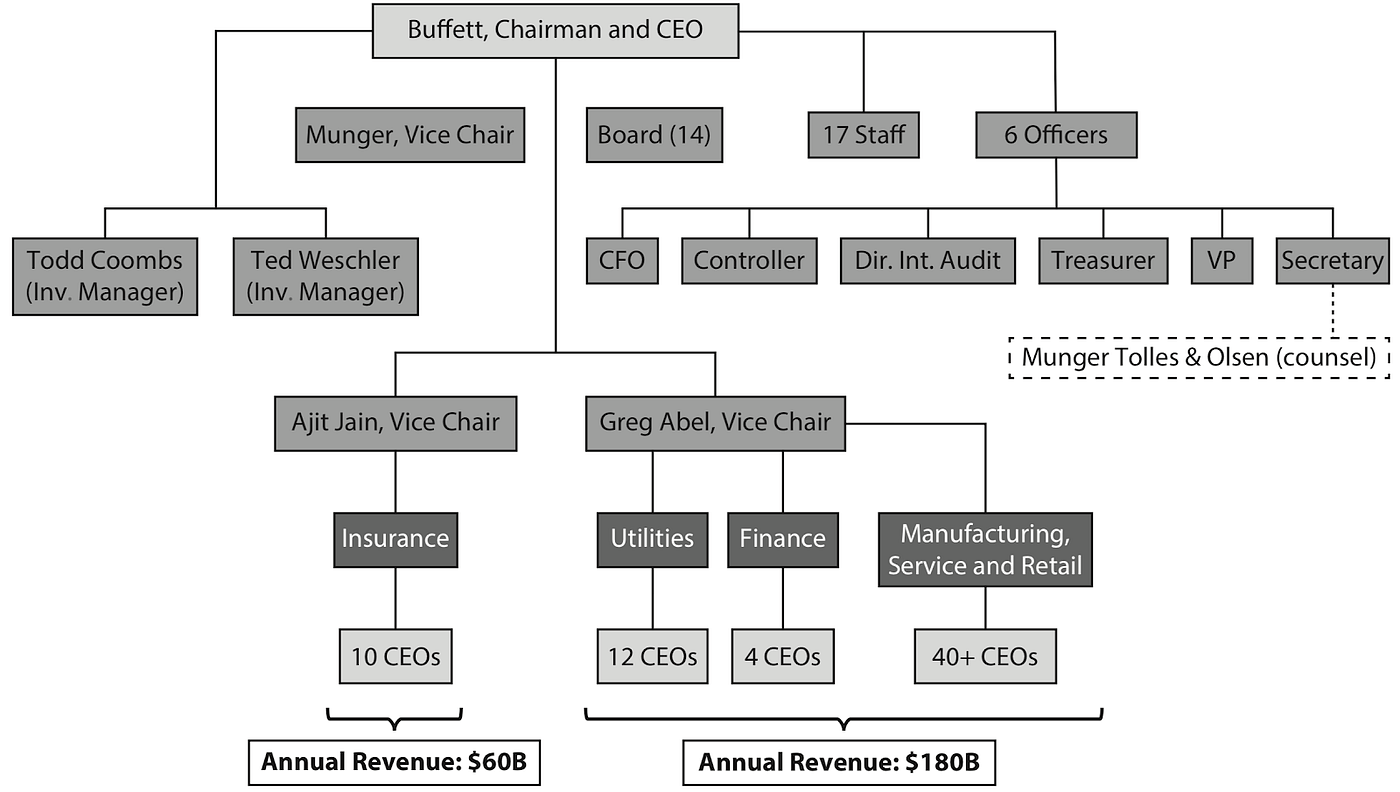

What is Berkshire Hathaway’s Business Structure?

Berkshire Hathaway’s management style is a bit like a well-coordinated team rather than a traditional top-down structure.

Imagine a sports team where each player knows their position and plays a crucial role. That’s how Berkshire’s decentralized management works – giving individual companies the freedom to make decisions independently.

Buffett and Munger have allowed each business to operate independently while sending the profits back to them to allocate for Berkshire.

Advantages:

One big advantage of this team-style approach is flexibility. Each company can quickly adapt to changes without waiting for approval from higher-ups.

It’s like having many small boats that can change direction swiftly rather than one big ship that takes time to turn. This flexibility helps Berkshire stay nimble in a fast-paced business world.

Challenges:

However, every game plan has its challenges. One challenge is making sure everyone is on the same page. With different companies making their own decisions, keeping communication strong is important. Sometimes, without a clear playbook from the top, there might be variations in how companies get things done. Balancing independence with unity can be tricky.

Berkshire’s decentralized management is like having a strong lineup of individual players who know the game well. The challenge is ensuring they all play together smoothly to score big wins for the team.

Major Holdings and Acquisitions

Berkshire Hathaway, led by the legendary Warren Buffett, has etched its name in the annals of business success through a strategic blend of acquisitions and investments.

The company’s multifaceted approach is akin to a carefully curated portfolio, where each acquisition and investment represents a unique piece contributing to the tapestry of Berkshire’s triumphs.

Acquisitions: See’s Candies and GEICO

Iconic brands like See’s Candies and GEICO exemplify Berkshire’s acquisition strategy.

In 1972, Berkshire Hathaway acquired See’s Candies, a California-based confectionery company. This sweet deal satisfied the taste buds of millions and showcased Berkshire’s knack for acquiring well-established businesses with enduring consumer appeal.

Under Berkshire’s ownership, See’s Candies continued its tradition of delivering quality confections while contributing to the company’s overall profitability. Every year for many decades, the company raises prices after the holidays, exemplifying its pricing power.

See’s was the first example of Charlie Munger’s influence on Warren’s investment evolution.

Before the See’s acquisition, Warren was a “cigar butt” type of investor. But Charlie helped him see investing in quality companies for a fair price would yield longer sustainable profits.

On the insurance front, Berkshire’s acquisition of GEICO in 1996 marked a strategic move that reverberates today.

GEICO, known for its innovative approach to auto insurance and memorable advertising (little green gecko), became a linchpin in Berkshire’s insurance portfolio.

Through careful management and integration, Berkshire transformed GEICO into a major player in the insurance market, highlighting the conglomerate’s insight in identifying and nurturing businesses with long-term potential.

Geico has also provided Berkshire with a bounty of float we referenced earlier.

Investments: Apple and American Express

Berkshire Hathaway’s investment philosophy, epitomized by stakes in companies like Apple and American Express, reflects Warren Buffett’s timeless wisdom of value and resilience.

In 2016, Berkshire invested significantly in Apple, the tech giant that redefined the consumer electronics landscape.

This move surprised many, as Berkshire had historically been cautious about investing in technology companies. However, Buffett’s belief in Apple’s brand strength, customer loyalty, and consistent cash flow demonstrated his adaptability and foresight.

As Apple continued to innovate and dominate the tech market, Berkshire’s investment flourished, showcasing the conglomerate’s ability to identify opportunities outside its traditional comfort zones.

The relationship with American Express is a testament to Berkshire Hathaway’s steadfast commitment to enduring value.

Dating back to the 1960s, when Berkshire started accumulating shares of the financial services company, this investment has stood the test of time.

Even amid changes in the financial landscape, American Express maintained its status as a reputable and resilient institution. Berkshire’s substantial stake in the company provided consistent returns and exemplified Buffett’s trust in businesses with enduring competitive advantages.

The Berkshire Magic: Unifying Diversification

What sets Berkshire Hathaway apart is its ability to unify diverse acquisitions and investments seamlessly into a harmonious whole.

The decentralized management structure allows acquired companies like See’s Candies and GEICO to retain their identities while benefiting from Berkshire’s financial strength and strategic guidance. It’s akin to a family of businesses, each contributing its unique flavor to the conglomerate’s success story.

Moreover, Berkshire’s approach to investments, illustrated by Apple and American Express, reflects a timeless commitment to companies with strong fundamentals and enduring value.

Buffett’s principle of investing in businesses he understands, coupled with a long-term horizon, has consistently proven successful. Whether it’s a technological powerhouse or a financial stalwart, Berkshire’s investment choices reflect a keen understanding of market dynamics and a focus on businesses with intrinsic resilience.

Investor Takeaway

Understanding Berkshire Hathaway is paramount for investors seeking insights into successful business strategies and investment philosophies.

Warren Buffett’s company is a rich case study offering valuable lessons in sustainable wealth creation.

By dissecting Berkshire’s diverse portfolio, encompassing iconic acquisitions like See’s Candies and GEICO and strategic investments in companies like Apple and American Express, investors gain a nuanced understanding of business longevity, adaptability, and risk management.

Studying Berkshire Hathaway unveils the significance of a diversified approach, showcasing the benefits of both acquisitions and investments. It underscores the importance of identifying businesses with enduring consumer appeal, as seen with See’s Candies, and recognizing opportunities beyond traditional comfort zones, exemplified by the investment in Apple.

Moreover, Berkshire’s commitment to businesses with strong fundamentals and competitive advantages, as evident in American Express, underscores the timeless principles of value investing.

You aren’t doing it right if you aren’t studying Warren Buffett and Berkshire Hathaway.

With that, we will wrap up our business overview of Berkshire Hathaway.

Thank you for taking the time to read today’s post. I hope you find something of value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

.

Related posts:

- From Textiles to Tycoons: The Story of Berkshire Hathaway Berkshire Hathaway is one of the world’s most renowned and successful companies, and its story is nothing short of legendary. Founded in 1839 as a...

- What the Berkshire Hathaway Owner’s Manual Says About Buffett’s Approach Ever wonder what blueprint Warren Buffett uses? Or how he manages his company or decides what companies to invest in or buy outright? Well, we...

- Warren Buffett’s Dream Investment: See’s Candies Warren Buffett has bought some great businesses in his career, including Coca-Cola, American Express, and Apple. But his dream business is See’s Candies, the chocolatier...

- Graham and Doddsville: A Group of the Greatest Investors of All Time Updated 6/24/2023 “While they differ greatly in style, these investors are, mentally, always buying the business, not the stock. A few of them sometimes buy...