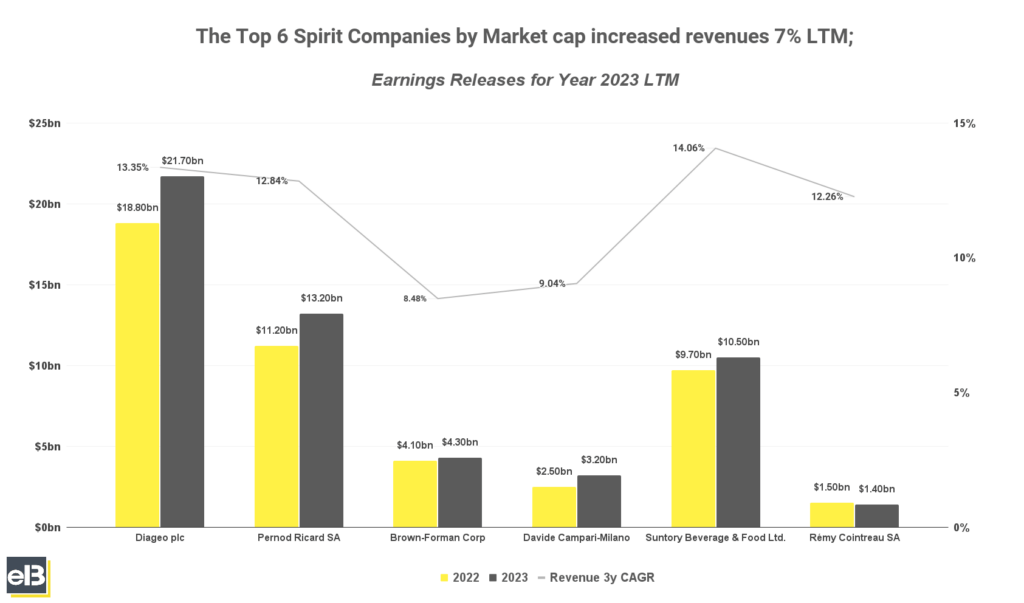

Recent 2023 earnings results of the Top 6 Biggest Publicly Traded Spirits Industry companies increased LTM revenues by 7% on average across the board according to their latest earnings releases.

Of the publicly traded Spirits Industry companies who released 2023 earnings results so far, the following top 6 companies by market cap increased revenues by 7% LTM on average: Diageo plc, Pernod Ricard SA, Brown-Forman Corp, Davide Campari-Milano N.V., Suntory Beverage & Food Ltd., and Rémy Cointreau SA.

Davide Campari-Milano showed the highest increase in revenues LTM at 19.30% as of October 2023 quarter reporting, while Rémy Cointreau SA reported a sharp decrease of -14.10% in LTM revenues of the same respective quarter.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Spirits Companies by Market Share

- Top Spirits Companies by Revenue Growth

- Top Spirits Companies by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Diageo plc (DEO) Stock Forecast

- Brown-Forman Corp (BF.B) Stock Forecast

- Davide Campari-Milano N.V. (CPR) Stock Forecast

- Suntory Beverage & Food Limited (2587) Stock Forecast

- Rémy Cointreau SA (RCO) Stock Forecast

- Pernod Ricard SA (RI) Stock Forecast

The list below only includes the top 6 Publicly traded Spirits companies by market capitalization of >$5 billion.

| Company | October 2022 | October 2023 | YoY |

| *Diageo plc | $18,809.3 | $21,732.7 | 11% |

| *Pernod Ricard SA | $11,211.1 | $13,244.2 | 13% |

| Brown-Forman Corp | $4,134.0 | $4,272.0 | 3.3% |

| *Davide Campari-Milano N.V. | $2,544.6 | $3,162.9 | 19.3% |

| Suntory Beverage & Food Ltd. | $9,905.6 | $10,455.0 | 10.9% |

| Rémy Cointreau SA | $1,503.9 | $1,393.5 | -14.1% |

Diageo plc reported a 10.8% increase YoY revenues in their latest June 2023, and organic net sales grew 6.5% while reported volume declined by -7.4% The better reported net sales reflect strong organic net sales growth and favorable impacts from foreign exchange. Management emphasized the continued expansion of organic operating margin by 15 bps despite a challenging cost environment, showing their brand power and pricing.

Pernod Ricard SA saw revenues increase by 13% YoY from June 2023, backed by strong pricing execution and favorable foreign exchange impact mostly from USD appreciation versus EUR. The company also has resilient volumes, growing at 1%.

Brown-Forman Corp recorded a 3% YoY revenue increase while operating income decreased -4%. Management pointed out the negative impact of the higher base of comparison from previous YoY earnings as they rebuilt inventory hampered by prior glass supply challenges.

Davide Campari-Milano N.V. reported a 19.3% YoY increase in revenues from June 2023, citing the positive business momentum that has continued since the beginning of the year mainly driven by aperitifs, tequila, and bourbon, which is thanks to solid brand power in a still resilient consumer environment.

Suntory Beverage & Food Ltd. saw YoY revenues increase by 10.9%, primarily due to strong sales volume, especially in Japan, where it exceeded the market growth. Overseas sales volume also remained resilient despite unfavorable weather in Europe and deteriorating business confidence in Vietnam.

Rémy Cointreau SA reported a decrease of -22% in revenues on an organic basis based on the latest LTM earnings results, reflecting continued strong destocking in the United States which included high inventories linked to a sharp normalization of consumption and also rising interest rates. The company plans to implement a €100 million cost-cutting measures to mitigate short-term effects.

Key Takeaway

The latest data available among the biggest publicly traded Spirits companies show how consumer trend-sensitive the businesses are, as shown in the continued destocking in major geographies like the U.S., which reflected in the slowdown of earnings in most and affected others more.

Recent data also shows how the rise in inflation affected consumers in general and companies with the most diversified spirits portfolios were affected the least.

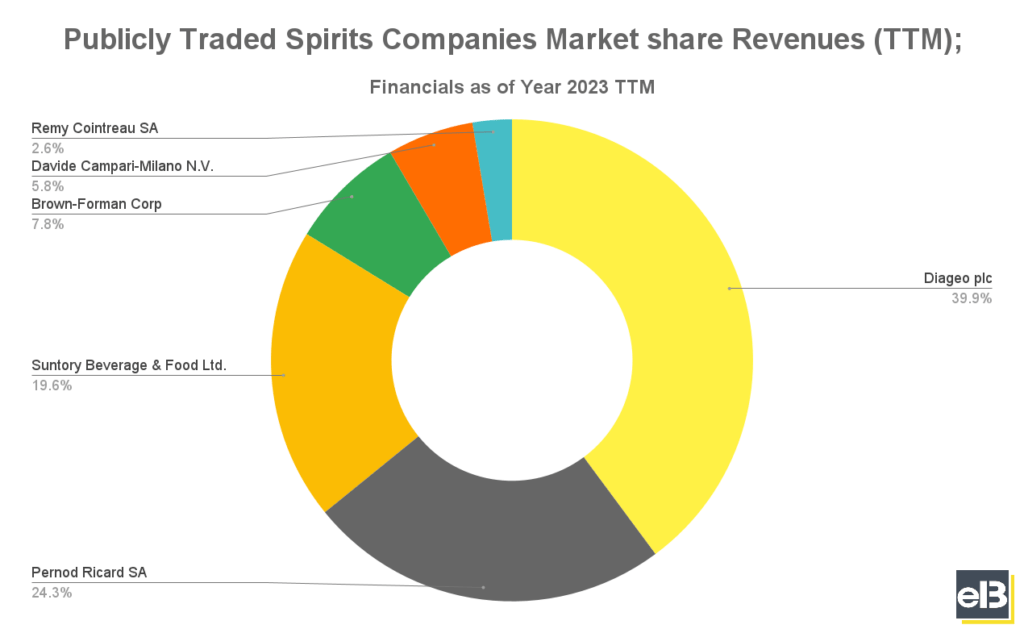

Biggest Publicly Traded Spirits Companies by Market Share

The below chart shows the list of publicly traded Spirits Companies with meaningful market caps of >$5Bn as of January 2024.

Ahead of the group is Diageo plc with roughly 39.9% market share, followed by Pernod Ricard SA with 24.3%, and trailing behind is Suntory Beverage & Food Ltd. with 19.6% of Trailing Twelve Months (TTM) revenue share of all publicly traded spirits companies.

| Company | Revenues (TTM in thousands) | Mkt Share |

| Diageo plc | $21,856,799 | 39.9% |

| Pernod Ricard SA | $13,321,260 | 24.3% |

| Suntory Beverage & Food Ltd. | $10,765473 | 19.6% |

| Brown-Forman Corp | $4,272,000 | 7.8% |

| Davide Campari-Milano N.V. | $3,181,319 | 5.8% |

| Rémy Cointreau SA | $1,446,712 | 2.6% |

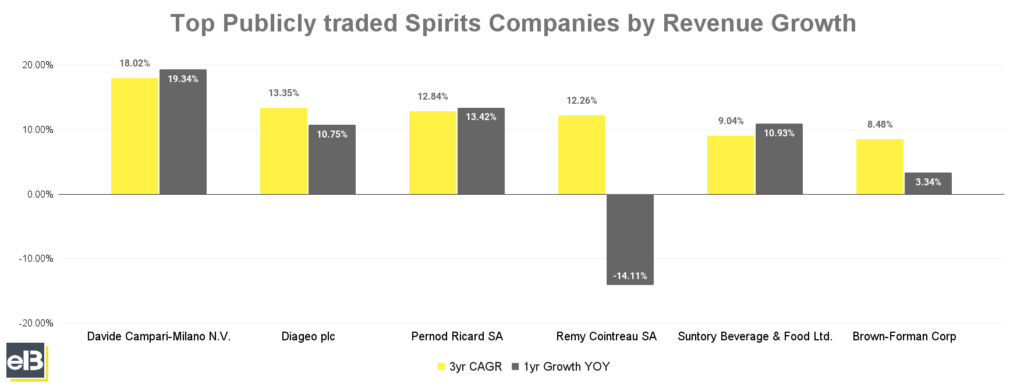

Top Spirits Companies by Revenue Growth

In the previous three fiscal years, Davide Campari-Milano N.V. led ahead among its peers in the spirits industry with an 18.02% CAGR of revenues.

Also, Davide Campari-Milano N.V. still leads ahead in boosting its year-over-year annual revenue growth of 19.34% from 2022 to 2023.

Diageo plc takes the number two spot in the 3-year CAGR with 13.35%, while just behind is Pernod Ricard SA and Rémy Cointreau SA with 12.84% and 12.26% 3yr CAGR, respectively.

| Company | 3yr CAGR | 1yr Growth YoY |

| Davide Campari-Milano N.V. | 18.02% | 19.34% |

| Diageo plc | 13.35% | 10.75% |

| Pernod Ricard SA | 12.84% | 13.42% |

| Rémy Cointreau SA | 12.26% | -14.11% |

| Suntory Beverage & Food Ltd. | 9.04% | 10.93% |

| Brown-Forman Corp | 8.48% | 3.34% |

Key Takeaway

The three fiscal years of growth of top Spirits companies have been decelerating because of the continued normalization of consumer trends and destocking in the United States. The effect is more apparent in the 1-year revenue growth, with Rémy Cointreau SA posting a negative revenue growth due to its large exposure in cognac. Meanwhile, others have a more resilient spirit portfolio exposure that slowed down revenue deceleration. However, most remain optimistic as most of the management in the above list expect a normalized consumption trend and pivot away from destocking.

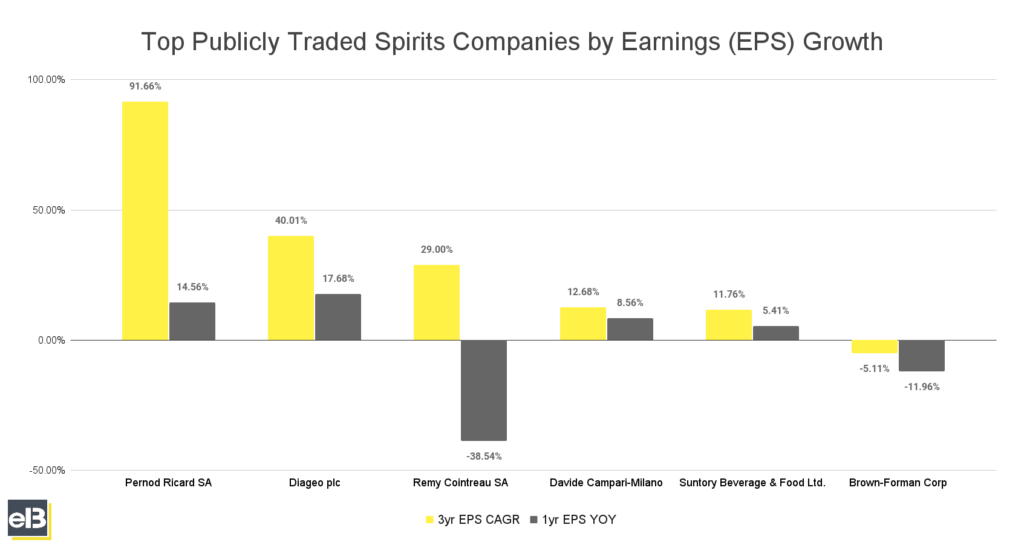

Top Spirits Companies by Earnings (EPS) Growth

In the last three fiscal years, Pernod Ricard SA saw the highest 3-year compounded annual growth of 91.66% in earnings per share.

The EPS growth of top publicly traded Spirits companies is mixed with the lowest and posting negative 3yr EPS growth of -5.11% is Brown-Forman Corp.

Diageo had the highest 1-year EPS YoY growth rate of 17.68% among the spirits companies in the above graph.

The list’s highest 3-year EPS CAGR companies are Pernod Ricard SA at 91.66%, Diageo plc at 40.01%, and Rémy Cointreau SA at 29.00%.

| Company | 3yr EPS CAGR | 1yr EPS YoY |

| Pernod Ricard SA | 91.66% | 14.56% |

| Diageo plc | 40.01% | 17.68% |

| Rémy Cointreau SA | 29% | -38.54% |

| Davide Campari-Milano | 12.68% | 8.56% |

| Suntory Beverage & Food Ltd. | 11.76% | 5.41% |

| Brown-Forman Corp | -5.51% | -11.96% |

Spirits Companies Revenue, Earnings and Stock Forecast (Respective next quarters)

| Company | YoY Revenue Forecast |

| Diageo plc | -4.02% |

| Brown-Forman Corp | 3.85% |

| Davide Campari-Milano N.V. | 4.33% |

| Suntory Beverage & Food Limited | -1.35% |

| Rémy Cointreau SA | -26.57% |

| Pernod Ricard SA | 3.35% |

Diageo plc (DEO) Revenue, Earnings, and Stock Forecast

Diageo plc’s revenue over the latest Trailing Twelve Month period was $21.7 billion. Diageo plc’s earnings (Net Income) over the latest Trailing Twelve Month period was $4.7 billion.

The Wall Street consensus for Diageo plc’s revenue projection for the next half year, June 2024, is $20.98B. The company’s TTM (trailing twelve months) Earnings Per Share was $2.10 as of the half-year earnings ending June 2023.

Diageo plc is expected to see a contraction in revenues of -4.02% YoY in the next half-year earnings based on the consensus of stock market analyst forecasts.

Brown-Forman Corp (BF.B) Revenue, Earnings, and Stock Forecast

Brown-Forman’s revenue over the latest Trailing Twelve Month period was $4.3 billion. Brown-Forman’s earnings (Net Income) over the latest Trailing Twelve Month period was $0.8 billion.

The Wall Street consensus for Brown-Forman’s revenue projection for the next quarter, January 2024, is $1.12B. The company’s TTM (trailing twelve months) Earnings Per Share was $1.60 as of the quarter ending October 30, 2023.

Brown-Forman Corp is expected to see an expansion in revenues of 3.85% YoY in the next quarter based on the consensus of stock market analyst forecasts.

Davide Campari-Milano N.V. (CPR) Revenue, Earnings, and Stock Forecast

Davide Campari-Milano’s revenue over the latest Trailing Twelve Month period was $3.2 billion. Davide Campari-Milano’s earnings (Net Income) over the latest Trailing Twelve Month period was $0.4 billion.

The Wall Street consensus for Davide Campari-Milano’s revenue projection for the next half year, June 2024, is $914.28M. The company’s TTM (trailing twelve months) Earnings Per Share was $0.30 as of half-year earnings June 2023.

Davide Campari-Milano is expected to see an expansion in revenues of 4.33% YoY in the next half-year earnings based on the consensus of stock market analyst forecasts.

Suntory Beverage & Food Limited (2587) Revenue, Earnings, and Stock Forecast

Suntory Beverage & Food Limited’s revenue over the latest Trailing Twelve Month period was $10.5 billion. Suntory Beverage & Food Limited’s earnings (Net Income) over the latest Trailing Twelve Month period was $0.5 billion.

The Wall Street consensus for Suntory Beverage & Food Limited’s revenue projection for the next quarter is $2.75B. The company’s TTM (trailing twelve months) Earnings Per Share was $1.80 as of the quarter ending September 30, 2023.

Based on the consensus of stock market analyst forecasts, Suntory Beverage & Food Limited is expected to see a contraction in revenues of -1.35% YoY in the next quarter.

Rémy Cointreau SA (RCO) Revenue, Earnings, and Stock Forecast

Rémy Cointreau SA’s revenue over the latest Trailing Twelve Month period was $1.4 billion. Rémy Cointreau SA’s earnings (Net Income) over the latest Trailing Twelve Month period was $0.2 billion.

The Wall Street consensus for Rémy Cointreau SA’s revenue projection for the next quarter is $349.18M. The company’s TTM (trailing twelve months) Earnings Per Share was $3.80 as of the September 30, 2023 quarter.

Rémy Cointreau SA is expected to see a revenue contraction of -26.57% YoY in the next quarter based on the consensus of stock market analyst forecasts.

Pernod Ricard SA (RI) Revenue, Earnings, and Stock Forecast

Pernod Ricard’s revenue over the latest Trailing Twelve Month period was $13.2 billion. Pernod Ricard’s earnings (Net Income) over the latest Trailing Twelve Month period was $2.5 billion.

The Wall Street consensus for Pernod Ricard’s revenue projection for the next half year, June 2024, is $2.95B. The company’s TTM (trailing twelve months) Earnings Per Share was $9.60 as of the half-year earnings ending June 2023.

Based on the consensus of stock market analyst forecasts, Pernod Ricard is expected to see an expansion in revenues of 3.35% YoY in the next half-year earnings.

Methodology

All data mentioned here in this article was sourced from publicly available filings and releases and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus revenue estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for further commentary, concerns, questions, or feedback. Alternatively, you can contact the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Logistics Companies Report: Winter 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Logistics Companies Grew Total Revenues Over 6% YOY in the October – December...

- Publicly Traded Analog Semiconductor Industry Report: Autumn 2023 results Latest Autumn earnings results of the Top 5 Publicly Traded Analog Semiconductor companies by Q/Q Revenues were mixed across the board, with some decreasing significantly...

- Publicly Traded Analog Semiconductor Industry Report: Summer 2023 results Recent Summer earnings results of the Top 5 Publicly Traded Analog Semiconductor companies by Q/Q Revenues were mixed across the board, however, we saw increasing...

- Publicly Traded Truckload Freight Industry Report: Autumn 2023 Results Recent Autumn earnings results of the Top 5 Publicly Traded Truckload Freight companies by Q/Q Revenues decreased by -9% on average across the board in...