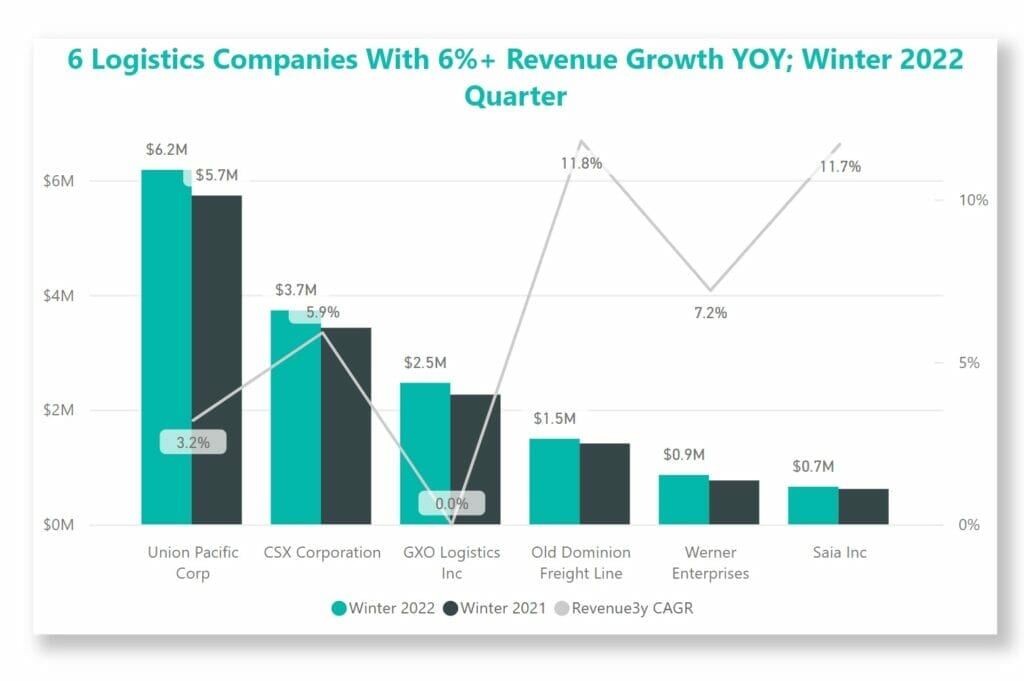

Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Logistics Companies Grew Total Revenues Over 6% YOY in the October – December Quarter, According to Latest Earnings Releases.

Of the publicly traded home builders who released earnings results in January/February, the following 6 companies grew revenues 6%+ YOY: Old Dominion Freight Line, Saia Inc, Werner Enterprises, CSX Corporation, Union Pacific Corp, and GXO Logistics Inc.

Werner Enterprises stood out with the highest growth rate for Winter 2022 revenues at 12.6% followed by GXO Logistics at 9.1%.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Logistics Companies by Revenues

- Top Logistics Companies By Revenue Growth

- Top Logistics Companies By Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Old Dominion Freight Line (ODFL) Stock Forecast

- Expeditors International of Washington (EXPD) Stock Forecast

- Saia Inc (SAIA) Stock Forecast

- Landstar System (LSTR) Stock Forecast

- Matson (MATX) Stock Forecast

- C.H. Robinson Worldwide (CHRW) Stock Forecast

This list includes only some of the largest, U.S. publicly traded logistics companies which are included in the SUPL ProShares Supply Chain Logistics ETF. The following revenues are in $USD thousands:

| Company | Winter ’22 Revenues | Winter ’21 Revenues | YOY |

| Werner Enterprises | $ 861,491 | $ 765,221 | 12.6% |

| GXO Logistics Inc | $ 2,467,000 | $ 2,262,000 | 9.1% |

| CSX Corporation | $ 3,730,000 | $ 3,427,000 | 8.8% |

| Union Pacific Corp | $ 6,180,000 | $ 5,733,000 | 7.8% |

| Saia Inc | $ 655,726 | $ 617,081 | 6.3% |

| Old Dominion Freight Line | $ 1,491,659 | $ 1,410,358 | 5.8% |

Werner Enterprises increased total revenues by posting revenues growth of its Truckload Transportation Services (“TTS”) segment of $71.6 million, and revenue growth of $28.5 million in its Logistics segment.

GXO Logistics closed $182 million of new wins in the quarter, with a revenue retention rate above 95% since its recent spinoff. The company’s sales pipeline reached around $2.1 billion.

CSX Corporation’s increases in revenue can be attributed to higher pricing, increased fuel surcharge, and growth in storage and other revenues. These were offset somewhat by tough weather at the end of December.

Union Pacific Corp increased business volumes (“total revenue carloads”) by 1%. Higher fuel surcharges and prices, as well as volume growth, contributed to its strong top-line growth.

Saia Inc saw decreases in LTL shipments and tonnage per workday (-8.2%, -7.7%), which was offset by increases in LTL revenue per hundredweight and shipment of 14.3% and 15%, respectively.

Old Dominion Freight Line reported a YOY increase of 16.7% in LTL revenue per hundredweight for the quarter, though LTL tons volume was down. The company posted GDP+ growth in sales for the December 2022 quarter along with the rest of the above listed companies.

Key Takeaway

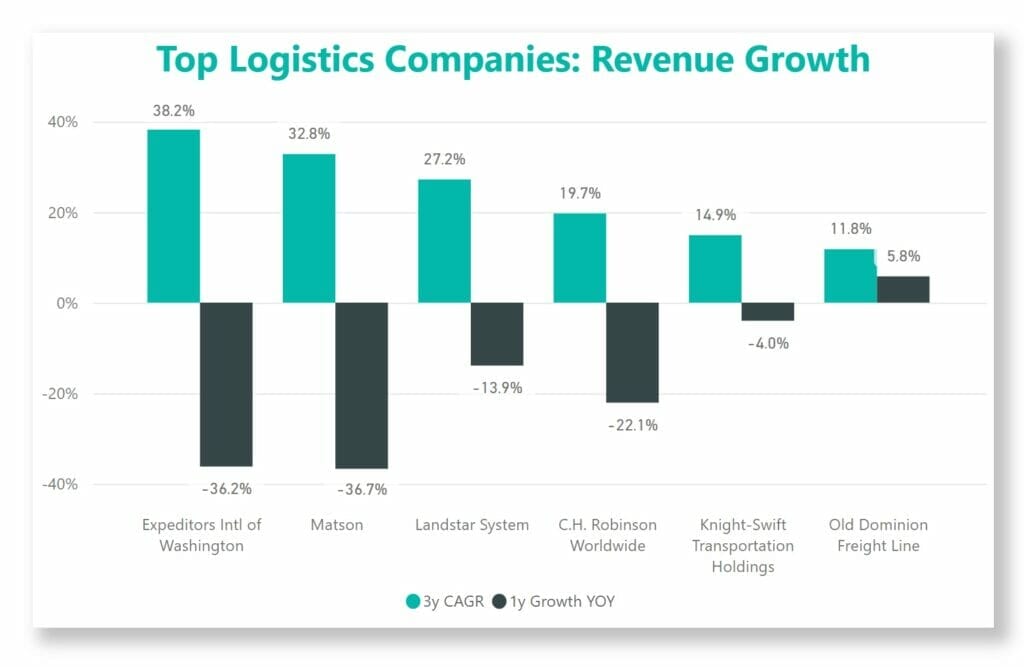

The logistics industry as a whole saw a wide range of revenue and EPS growth results for the quarter. Some companies saw strong YOY decreases in revenues (EXPD, CHRW, LSTR, MATX), though these have maintained strong, industry-leading growth (3y CAGR of 19%+) since before the pandemic despite these recent pullbacks.

Most of the companies listed above have experienced strong top-line growth, but their 3-year stacks are more muted compared to peers. It will be interesting to see if these companies also see a pullback in the next 12 months; analysts certainly expect pressures on profits to the majority.

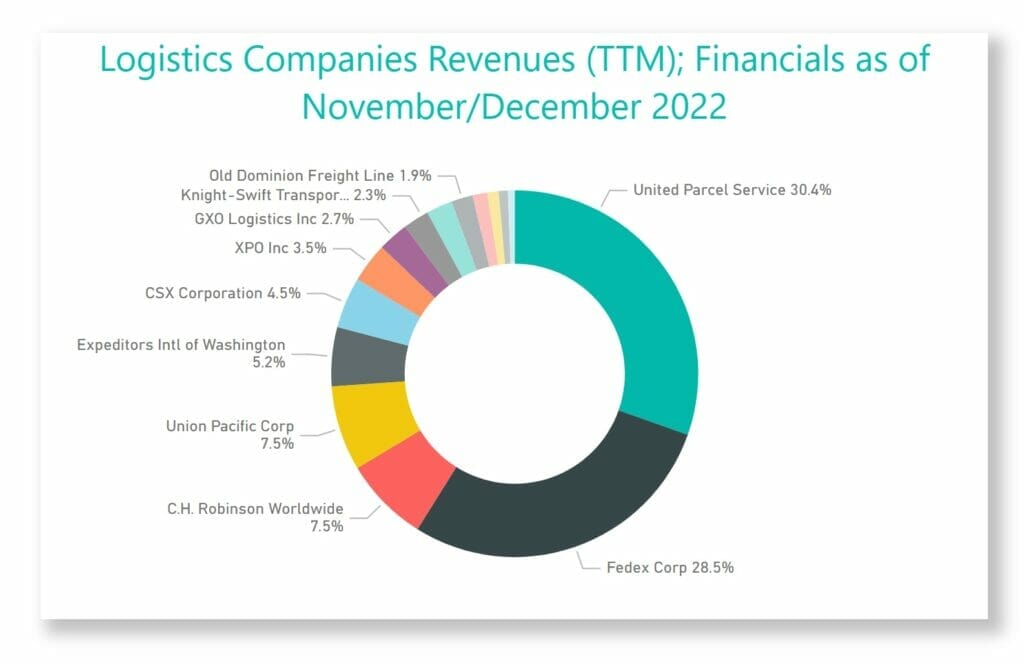

Biggest Publicly Traded Logistics Companies by Revenues

The next chart displays a complete list of all publicly traded home builders based in the United States, as of the end of December 2022.

It’s important to note that not all of these companies compete directly for revenues or in the same direct market. The leaders of the group include United Parcel Service with roughly a 30.4% “market share,” FedEx Corp with 28.5% of the “market” as well, and C.H. Robinson Worldwide with 7.5% of Trailing Twelve Months (TTM) revenue share of these publicly traded logistics companies.

| Company | Revenues (TTM in thousands) | “Mkt Share“ |

| United Parcel Service | $ 100,338,000 | 30.4% |

| Fedex Corporation | $ 94,091,000 | 28.5% |

| Union Pacific Corp | $ 24,875,000 | 7.5% |

| C.H. Robinson Worldwide | $ 24,696,625 | 7.5% |

| Expeditors Intl’ of Washington | $ 17,071,284 | 5.2% |

| CSX Corporation | $ 14,853,000 | 4.5% |

| XPO Inc | $ 11,578,000 | 3.5% |

| GXO Logistics Inc | $ 8,993,000 | 2.7% |

| Landstar System | $ 7,436,742 | 2.3% |

| Knight-Swift Transportation | $ 7,428,582 | 2.3% |

| Old Dominion Freight Line | $ 6,260,077 | 1.9% |

| Matson | $ 4,343,000 | 1.3% |

| Werner Enterprises | $ 3,289,978 | 1.0% |

| Saia Inc | $ 2,792,057 | 0.8% |

| Forward Air Corp | $ 1,973,403 | 0.6% |

Top Logistics Companies By Revenue Growth

Over the last 3 Fiscal Years, no publicly traded homebuilder has grown quarterly revenues faster than Expeditors International of Washington, with a 38.2% annual compounded growth rate.

Werner Enterprises also grew revenues at an accelerated rate in their latest Year-Over-Year quarterly comparison, growing revenue 12.6% from 2021 to 2022.

Matson makes up the #2 spot with a 32.8% compounded annual growth rate; Landstar System and C.H. Robinson Worldwide follow with compounded annual growth rates of around 27% and 20% respectively, between their latest quarterly results, and those 3 years prior (“3y CAGR”).

| Company | 3y Growth (CAGR) | 1y Growth (YOY) |

| Expeditors Intl’ of Washington | 38.2% | -36.2% |

| Matson | 32.8% | -36.7% |

| Landstar System | 27.2% | -13.9% |

| C.H. Robinson Worldwide | 19.7% | -22.1% |

| Knight-Swift Transportation | 14.9% | -4.0% |

| Old Dominion Freight Line | 11.8% | 5.8% |

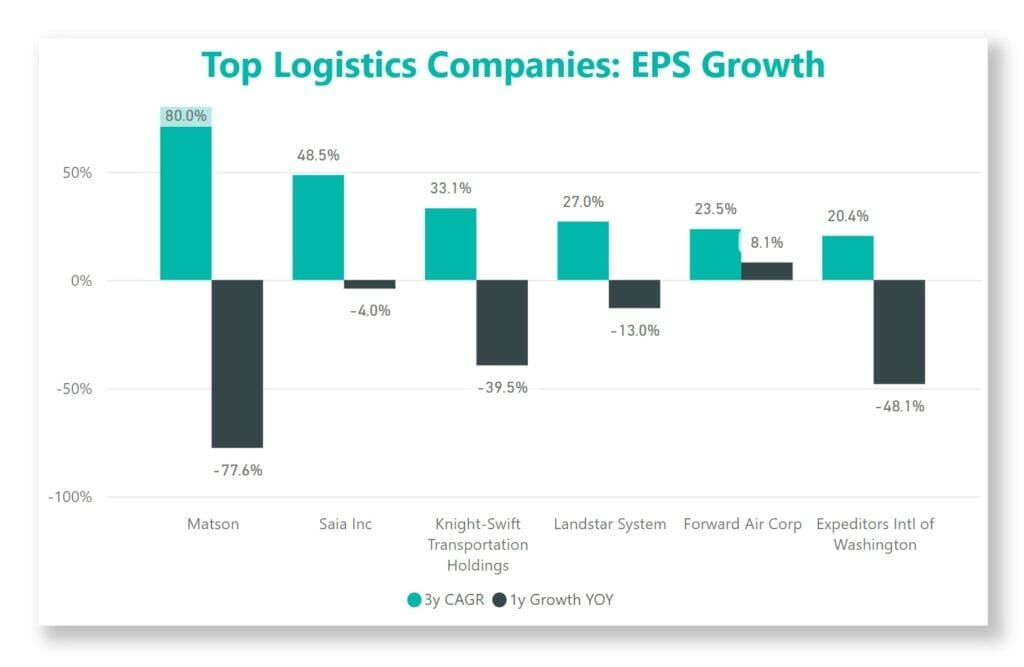

Top Logistics Companies By Earnings (EPS) Growth

Over the last 3 fiscal year periods, Matson had the highest 3-year annual compounded growth rate of 80% in earnings per share.

A total of 6 publicly traded logistics companies have recorded compounded annual EPS growth rates of 20%+ in their last 3 Fiscal Years.

Of the group, Forward Air Corp had the highest 1-year YOY growth rate of EPS at 8.1%.

The highest 3-year EPS CAGR companies included Matson at 80.0%, Saia Inc at 48.5%, and Knight-Swift Transportation Holdings at 33.1%.

| Company | 3y Growth (CAGR) | 1y Growth (YOY) |

| Matson | 80.0% | -77.6% |

| Saia Inc | 48.5% | -4.0% |

| Knight-Swift Transportation | 33.1% | -39.5% |

| Landstar System | 27.0% | -13.0% |

| Forward Air Corp | 23.5% | 8.1% |

| Expeditors Intl’ of Washington | 20.4% | -48.1% |

Key takeaway: Companies in this list, and logistics companies in general, have historically tended to see high fluctuations in Earnings Per Share (EPS) growth, as the cyclical nature of the business can cause margins and revenues to swing more widely than the average company.

Logistic Companies: Revenue, Earnings and Stock Forecast (By Company; Quarter ending December 2022)

| Company | YOY EPS Forecast |

|---|---|

| Old Dominion Freight Line | 4.6% |

| Expeditors Intl’ of Washington | -34.3% |

| Saia Inc | -8.4% |

| Landstar System | -37.7% |

| Matson | -90.8% |

| C.H. Robinson Worldwide | -49.8% |

Old Dominion Freight Line (ODFL) Revenue, Earnings, and Stock Forecast

Old Dominion Freight Line’s revenue over the latest Trailing Twelve Month period was $6.26 billion. Old Dominion Freight Line’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.38 billion.

The Wall Street consensus for Old Dominion Freight Line’s EPS (earnings per share) projection for the next quarter is $2.72. Old Dominion Freight Line’s TTM (trailing twelve months) Earnings Per Share was $12.18 as of the quarter ending December 31, 2022.

Old Dominion Freight Line is expected to see an increase in earnings per share of 4.6% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Expeditors International of Washington (EXPD) Revenue, Earnings, and Stock Forecast

Expeditors International of Washington’s revenue over the latest Trailing Twelve Month period was $17.07 billion. Expeditors’ earnings (Net Income) over the latest Trailing Twelve Month period was $1.36 billion.

The Wall Street consensus for Expeditors International of Washington’s EPS (earnings per share) projection for the next quarter is $1.36. Expeditors’ TTM (trailing twelve months) Earnings Per Share was $8.23 as of the quarter ending December 31, 2022.

Expeditors is expected to see a contraction in earnings per share of -34.3% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Saia Inc (SAIA) Revenue, Earnings, and Stock Forecast

Saia’s revenue over the latest Trailing Twelve Month period was $2.79 billion. Saia’s earnings (Net Income) over the latest Trailing Twelve Month period was $357.4 million.

The Wall Street consensus for Saia’s EPS (earnings per share) projection for the next quarter is $2.73. Saia’s TTM (trailing twelve months) Earnings Per Share was $13.40 as of the quarter ending December 31, 2022.

Saia Inc is expected to see a contraction in earnings per share of -8.4% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Landstar System (LSTR) Revenue, Earnings, and Stock Forecast

Landstar System’s revenue over the latest Trailing Twelve Month period was $7.44 billion. Landstar’s earnings (Net Income) over the latest Trailing Twelve Month period was $430.9 million.

The Wall Street consensus for Landstar System’s EPS (earnings per share) projection for the next quarter is $2.08. Landstar’s TTM (trailing twelve months) Earnings Per Share was $11.74 as of the quarter ending December 31, 2022.

Landstar System is expected to see a contraction in earnings per share of -37.7% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Matson (MATX) Revenue, Earnings, and Stock Forecast

Matson’s revenue over the latest Trailing Twelve Month period was $4.34 billion. Matson’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.06 billion.

The Wall Street consensus for Matson’s EPS (earnings per share) projection for the next quarter is $0.76. Matson’s TTM (trailing twelve months) Earnings Per Share was $26.71 as of the quarter ending December 31, 2022.

Matson Inc is expected to see a contraction in earnings per share of -90.8% YOY in the next quarter based on the consensus of stock market analyst forecasts.

C.H. Robinson Worldwide (CHRW) Revenue, Earnings, and Stock Forecast

C.H. Robinson Worldwide’s revenue over the latest Trailing Twelve Month period was $24.70 billion. C.H. Robinson’s earnings (Net Income) over the latest Trailing Twelve Month period was $940.50 million.

The Wall Street consensus for C.H. Robinson’s EPS (earnings per share) projection for the next quarter is $1.03. C.H. Robinson’s TTM (trailing twelve months) Earnings Per Share was $7.29 as of the quarter ending December 31, 2022.

C.H. Robinson Worldwide is expected to see a contraction in earnings per share of -49.8% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data was sourced from publicly available filings and releases, and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Andrew Sather at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Related posts:

- Publicly Traded Home Builders Report: Spring 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Home Builders Grew Total Revenues Over 16% YOY in...

- Publicly Traded Home Builders Report: Winter 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Home Builders Grew Total Revenues Over 19% YOY in the October – December...

- Industry Breakdown: 3PL Logistics “The amateurs discuss tactics: the professionals discuss logistics.” –Napoleon Bonaparte Military leaders understand that without logistics, successful campaigns would never win the wars. In World...

- AT&T (T) 10Q Summary First Quarter 2020 AT&T 10Q Summary First Quarter 2020 AT&T Inc announced its first-quarter earnings on April 20, 2020. What follows is a summary you can read to...