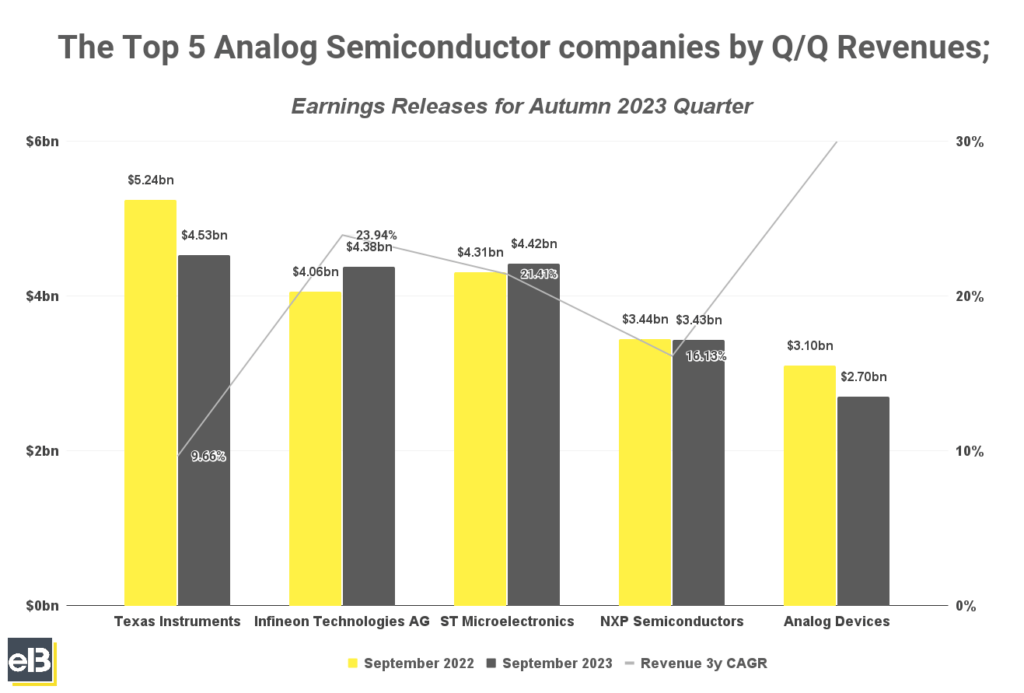

Latest Autumn earnings results of the Top 5 Publicly Traded Analog Semiconductor companies by Q/Q Revenues were mixed across the board, with some decreasing significantly while one remained almost flat in the July-September quarter, according to their latest earnings releases.

Of the publicly traded Analog Semiconductor companies who released Autumn 2023 earnings results, two companies among the rest in the list increased their Q/Q revenues by 1%+, which are Infineon Technologies and ST Microelectronics.

Analog Devices had the most contraction in Q/Q revenues at -16.4% followed by Texas Instruments trailing behind at -13.5%.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Analog Semiconductor companies by Market Share

- Top Analog Semiconductor companies by Revenue Growth

- Top Analog Semiconductor companies by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Texas Instruments (TXN) Stock Forecast

- Analog Devices (ADI) Stock Forecast

- NXP Semiconductors (NXPI) Stock Forecast

- Infineon Technologies AG (IFX) Stock Forecast

- Microchip Technology (MCHP) Stock Forecast

The list below only includes the top five Analog Semiconductor companies by revenues. In the next section, all relevant >$15B market cap publicly traded analog semiconductor

| Company | September 2022 | September 2023 | YOY |

| Texas Instruments | $5,241 | $4,532 | -10.29% |

| Infineon Technologies AG | $4,059 | $4,386 | 14.71% |

| ST Microelectronics | $4,305 | $4,416 | 14.21% |

| NXP Semiconductors | $3,445 | $3,434 | 1.81% |

| Analog Devices | $3,247 | $2,716 | 15.59% |

Texas Instruments reported a -13.5% decrease Q/Q revenues in their latest Q3, 2023 and with sequential revenue flat. During the recent quarter, however, automotive growth continued while industrial weakness broadened.

Infineon Technologies AG saw revenues increase by 1% Q/Q, pointing the good performance at increasing revenues in the automotive, green industrial, and connected secure systems segments of the business.

ST Microelectronics recorded a 2.5% Q/Q increase in revenues because of the continued growth in the automotive segment, which is partially offset by lower revenues in personal electronics.

NXP Semiconductors reported a -0.3% Q/Q decrease in revenues citing continued strength in their automotive and core-industrial segments while the communications infrastructure business was below their expectations and offset recent quarterly revenue.

Analog Devices saw Q/Q revenues decline by -16.4%, citing expected customer inventory digestion or destocking to weigh in the business. However, their Industrial & Automotive segment continued to show strength by driving new record revenues.

Key Takeaway

The latest quarterly revenues of the semis mentioned is mixed, at best, which shows how the weighting of different exposures to the semiconductor industry of each business affects their earnings. However, the common theme among all is the continued demand growth and robustness of the Industrial and Automotive industries, which were the same the previous quarter.

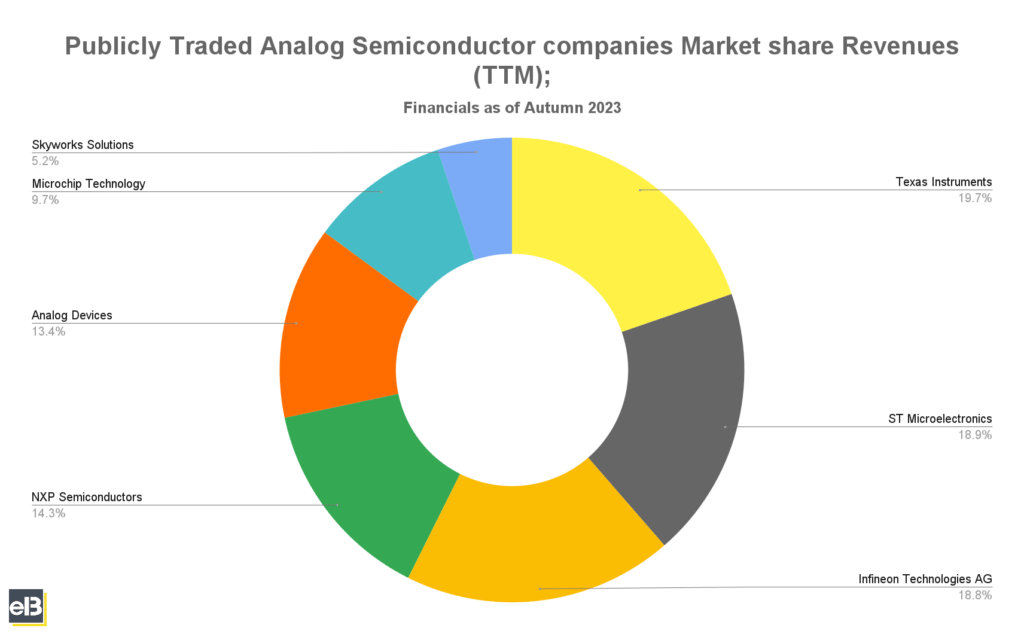

Biggest Publicly Traded Analog Semiconductor companies by Market Share

The graph shown below is composed of >$15B market cap publicly traded analog semiconductor companies as of November 2023.

Leading the group is Texas Instruments with roughly 19.7% market share, followed shortly by ST Microelectronics with 18.9%, and peeking a bit just behind is Infineon Technologies AG with 18.8% of Trailing Twelve Months (TTM) revenue share of all publicly traded analog semiconductor companies.

| Company | Revenues (TTM in Thousands) | Mkt Share |

| Texas Instruments | $18,112,000 | 19.7% |

| ST Microelectronics | $17,385,000 | 18.9% |

| Infineon Technologies AG | $17,241,780 | 18.8% |

| NXP Semiconductors | $13,166,000 | 14.3% |

| Analog Devices | $12,305,539 | 13.4% |

| Microchip Technology | $8,944,800 | 9.7% |

| Skyworks Solutions | $4,772,400 | 5.2% |

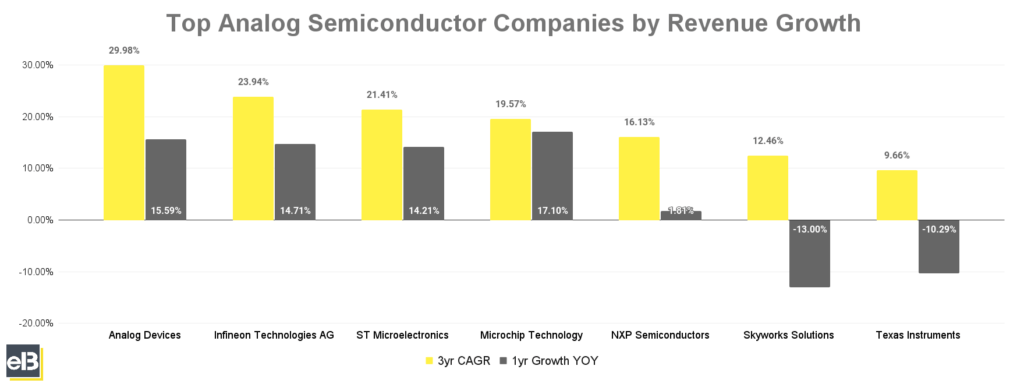

Top Analog Semiconductor companies by Revenue Growth

In the previous three fiscal years, Analog Devices lead ahead among its peers in the analog semiconductor industry with 29.98% CAGR.

Meanwhile, Microchip Technology is leading in boosting its year-over-year annual revenue growth of 17.10% from 2022-2023.

Infineon Technologies AG takes the number two spot in 3yr CAGR with 23.94%, while trailing behind is ST Microelectronics and Microchip Technology with 21.41% and 19.57% 3yr CAGR, respectively.

| Company | 3yr CAGR | 1yr Growth YOY |

| Analog Devices | 29.98% | 15.59% |

| Infineon Technologies AG | 23.94% | 14.71% |

| ST Microelectronics | 21.00% | 14.21% |

| Microchip Technology | 19.57% | 17.10% |

| NXP Semiconductors | 16.13% | 1.81% |

| Skyworks Solutions | 12.46% | -13.00% |

| Texas Instruments | 9.66% | -10.29% |

Key Takeaway

In the data above, it shows that the past three fiscal years have been a huge tailwind for analog semiconductor companies with the pandemic supply chain issue exacerbating further the outsized demand. However, YOY revenue growth seems to decelerate already – not noticeably at first glance, but only on some companies, particularly Skyworks Solutions and Texas Instruments.

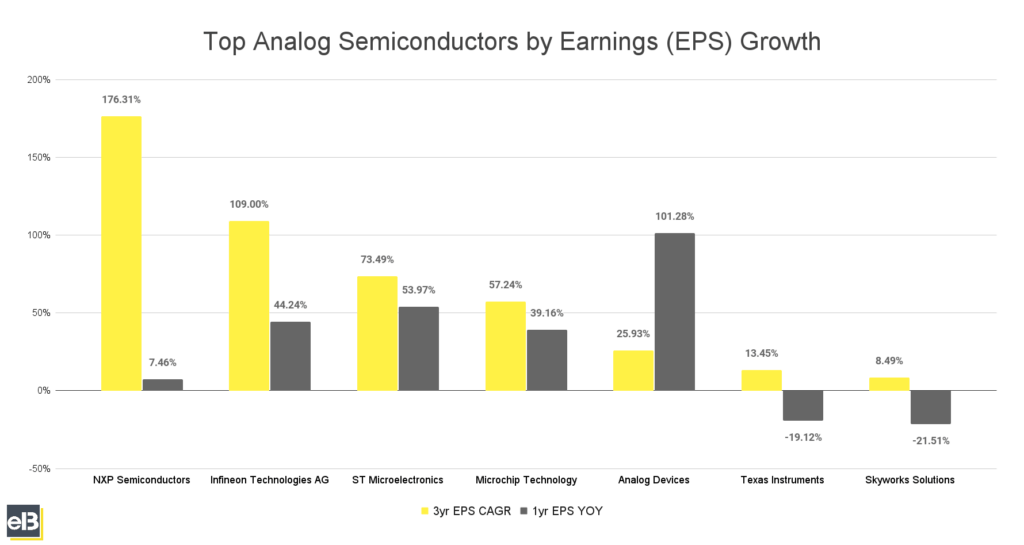

Top Analog Semiconductor companies by Earnings (EPS) Growth

In the previous three fiscal years, NXP Semiconductors saw the highest 3 year annual compounded growth rate of a whopping 173% in earnings per share. Context behind it is provided in caption of the graph below.

All publicly traded analog semiconductor companies in the list recorded high double digit EPS growth with an average of 45%+ excluding NXP Semiconductors.

Among the companies in the above graph, Analog Devices had the highest 1-year EPS YOY growth rate of 101.28%.

The highest 3-year EPS CAGR companies in the list excluding NXP Semiconductors are Infineon Technologies AG at 109%, ST Microelectronics at 73.49%, and Microchip Technology at 57.24%.

| Company | 3yr EPS CAGR | 1yr EPS YOY |

| NXP Semiconductors | 176.31% | 7.46% |

| Infineon Technologies AG | 109.00% | 44.24% |

| ST Microelectronics | 73.49% | 53.97% |

| Microchip Technology | 57.24% | 39.16% |

| Analog Devices | 25.93% | 101.28% |

| Texas Instruments | 13.45% | -19.12% |

| Skyworks Solutions | 8.49% | -21.51% |

Key Takeaway

As the data shows above, the previous three fiscal years has been a great tailwind for the analog semiconductor industry because of the recent supply chain issue worsening the pulled forward demand of the pandemic.

However, when looking at the YOY EPS growth, results are mixed with other companies showing sharp deceleration in EPS while others are still on the rise. This shows how the exposure of each company’s analog semiconductor portfolio in different industries greatly affects revenues with Industrials and Automotive still continuing its upward trend like the previous quarter.

Analog Semiconductor Companies Revenue, Earnings and Stock Forecast (Quarter ending September 2023)

| Company | YOY EPS Forecast |

| Texas Instruments | -31.93% |

| Analog Devices | -37.99% |

| NXP Semiconductors | -2.14% |

| Infineon Technologies AG | -23.54% |

| Microchip Technology | -27.62% |

Texas Instruments (TXN) Revenue, Earnings, and Stock Forecast

Texas Instruments’ revenue over the latest Trailing Twelve Month period was $18.1 billion. Texas Instruments’ earnings (Net Income) over the latest Trailing Twelve Month period was $7.1 billion.

The Wall Street consensus for Texas Instruments’ EPS (earnings per share) projection for the next quarter is $1.49. The company’s TTM (trailing twelve months) Earnings Per Share was $7.80 as of the quarter ending September 30, 2023.

Texas Instruments is expected to see a contraction in earnings per share of -31.93% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Analog Devices (ADI) Revenue, Earnings, and Stock Forecast

Analog Devices’ revenue over the latest Trailing Twelve Month period was $12.3 billion. Analog Devices’ earnings (Net Income) over the latest Trailing Twelve Month period was $3.3 billion.

The Wall Street consensus for Analog Devices’ EPS (earnings per share) projection for the next quarter is $1.71. The company’s TTM (trailing twelve months) Earnings Per Share was $6.60 as of the quarter ending September 30, 2023.

Analog Devices is expected to see a contraction in earnings per share of -37.99% YOY in the next quarter based on the consensus of stock market analyst forecasts.

NXP Semiconductors (NXPI) Revenue, Earnings, and Stock Forecast

NXP Semiconductors’ revenue over the latest Trailing Twelve Month period was $13.1 billion. NXP Semiconductors’ earnings (Net Income) over the latest Trailing Twelve Month period was $2.8 billion.

The Wall Street consensus for Analog Devices’ EPS (earnings per share) projection for the next quarter is $3.65. The company’s TTM (trailing twelve months) Earnings Per Share was $10.90 as of the quarter ending September 30, 2023.

NXP Semiconductors is expected to see a contraction in earnings per share of -2.14% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Infineon Technologies AG (IFX) Revenue, Earnings, and Stock Forecast

Infineon Technologies AG’s revenue over the latest Trailing Twelve Month period was $17.7 billion. Infineon Technologies AG’s earnings (Net Income) over the latest Trailing Twelve Month period was $3.3 billion.

The Wall Street consensus for Infineon Technologies AG’s EPS (earnings per share) projection for the next quarter is $0.54. The company’s TTM (trailing twelve months) Earnings Per Share was $2.50 as of the quarter ending September 30, 2023.

Infineon Technologies AG is expected to see a contraction in earnings per share of -23.54% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Microchip Technology (MCHP) Revenue, Earnings, and Stock Forecast

Microchip Technology’s revenue over the latest Trailing Twelve Month period was $8.9 billion. Microchip Technology’s earnings (Net Income) over the latest Trailing Twelve Month period was $2.5 billion.

The Wall Street consensus for Microchip Technology’s EPS (earnings per share) projection for the next quarter is $1.13. The company’s TTM (trailing twelve months) Earnings Per Share was $4.60 as of the quarter ending September 30, 2023.

Microchip Technology is expected to see a contraction in earnings per share of -27.62% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data mentioned here in this article was sourced from publicly available filings and releases, and processed by investment newsletter provider, Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Analog Semiconductor Industry Report: Winter 2023 Results Recent Winter earnings results of the Top 5 Publicly Traded Analog Semiconductor companies by YoY revenues were mostly down across the board in the October-December...

- Publicly Traded Analog Semiconductor Industry Report: Summer 2023 results Recent Summer earnings results of the Top 5 Publicly Traded Analog Semiconductor companies by Q/Q Revenues were mixed across the board, however, we saw increasing...

- Everything a Beginner to Semiconductor Equipment Companies Wants to Know Technology hardware today is largely driven by semiconductors. And it is the semiconductor equipment companies who support the manufacturing of semiconductors through systems that test...

- Publicly Traded Life Sciences Industry Report: Autumn 2023 Results Recent Autumn earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues -4.37% YOY in the July – September Quarter, according...