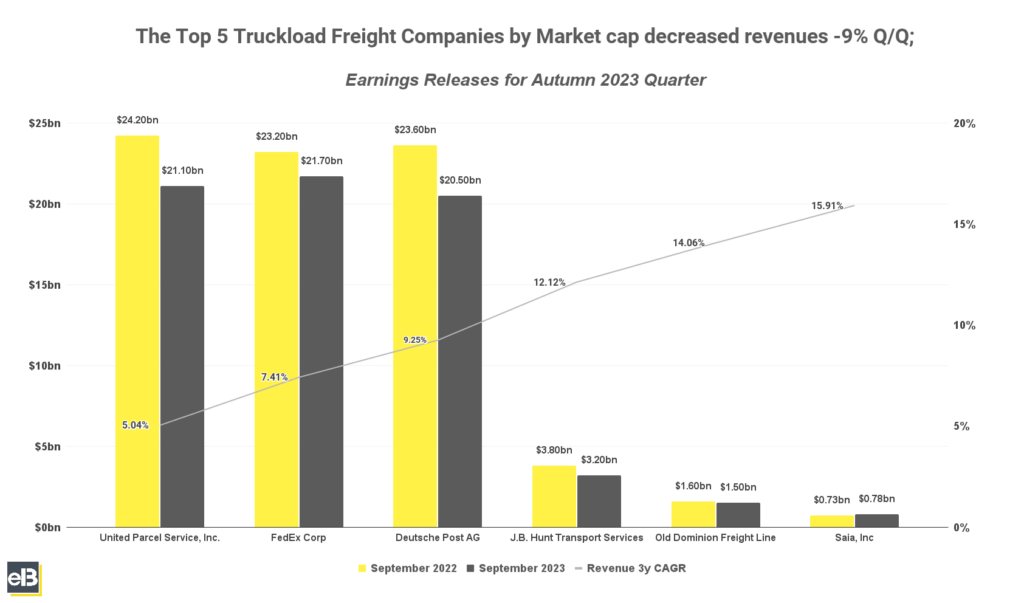

Recent Autumn earnings results of the Top 5 Publicly Traded Truckload Freight companies by Q/Q Revenues decreased by -9% on average across the board in the July-September quarter, according to their latest earnings releases.

Of the publicly traded Truckload Freight companies who released Autumn 2023 earnings results, the following top 5 companies by market cap decreased revenues -9% Q/Q on average: United Parcel Service, FedEx Corp, Deutsche Post AG, J.B. Hunt Transport Services, and Old Dominion Freight Line.

The 6th company by market cap, Saia, Inc., stood out with an increase of 6.20% Q/Q of revenues.

Old Dominion Freight Line showed the smallest decrease in revenues Q/Q at -5.50% followed by FedEx Corp at -6.70%.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Truckload Freight Companies by Market Share

- Top Truckload Freight Companies by Revenue Growth

- Top Life Science Truckload Freight Companies by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- United Parcel Services, Inc. (UPS) Stock Forecast

- FedEx (FDX) Stock Forecast

- Deutsche Post AG (DHL) Stock Forecast

- J.B. Hunt Transport Service (JBHT) Stock Forecast

- Old Dominion Freight Line (ODFL) Stock Forecast

The list below only includes the top 6 Truckload Freight companies by market capitalization. The next section will include all >$2Bn market cap publicly traded truckload freight companies.

| Company | September 2022 | September 2023 | YOY |

| United Parcel Service, Inc. | $24,161 | $21,061 | -7.92% |

| FedEx Corp | $23,242 | $21,681 | -6.50% |

| Deutsche Post AG | $23,555 | $20,507 | -10.40% |

| J.B. Hunt Transport Service, Inc. | $3,838 | $3,163 | -10.13% |

| Old Dominion Freight Line | $1,603 | $1,515 | -5.12% |

| Saia, Inc. | $729 | $775 | 1.18% |

United Parcel Service, Inc. reported a -12.8% decrease Q/Q revenues in their latest Q3, 2023 while operating profit was $1.3 billion, or down –56.9% compared to last third quarter of 2022. Management pointed out the unfavorable macro-economic conditions negatively impacted global demand driven by a -11.5% decrease in average daily volume.

FedEx Corp saw revenues decrease by 9% Q/Q, with operating income decreasing by -59% during the latest quarter which was driven by lower fuel surcharges and shipments. However, the company is optimistic in their other segments excluding Freight as aggressive cost reductions benefitted the company last quarter.

Deutsche Post AG recorded a -19.3% Q/Q decrease in revenues because of negative currency effects and lower fuel surcharges. However, their Supply Chain segment booked a 6.3% increase in revenue growth driven by new business, contract extensions and growing e-commerce business.

J.B. Hunt Transport Service, Inc. reported a -17.6% Q/Q decrease in revenues citing the high teens contraction in revenue per load plus a -38% decrease in volumes of cargo hitting the business last quarter.

Old Dominion Freight Line saw Q/Q revenues decline by -5.5%, primarily due to the -6.9% decrease in Less-than-Truckload (LTL) tons per day but was partially offset by a 3.1% increase in LTL revenue per hundredweight. The company commented that the continued softness in the domestic economy reflected the latest quarter.

Saia, Inc. reported an increase of 6.2% in revenues last quarter compared to Q3, 2022 with operating income increasing $128.4 million, or a 0.1% increase. This was driven by an increase of 12.2% LTL shipments per workday and LTL revenue per hundredweight increase of 8.4%. Management pointed out they benefited heavily from the shutdown of a large LTL competitor, thus the big step-up in volume.

Key Takeaway

The recent quarter earnings weakness in the Truckload Freight industry showed the continued decline in volumes of cargo being delivered given the high baseline brought about by the pandemic the previous years. Also, lower fuel surcharges hit the biggest companies in the list as fuel prices normalize compared to last year.

Data also shows that companies are continuing to optimize operating costs with the ones who are already in good operating shape showing better results than their peers.

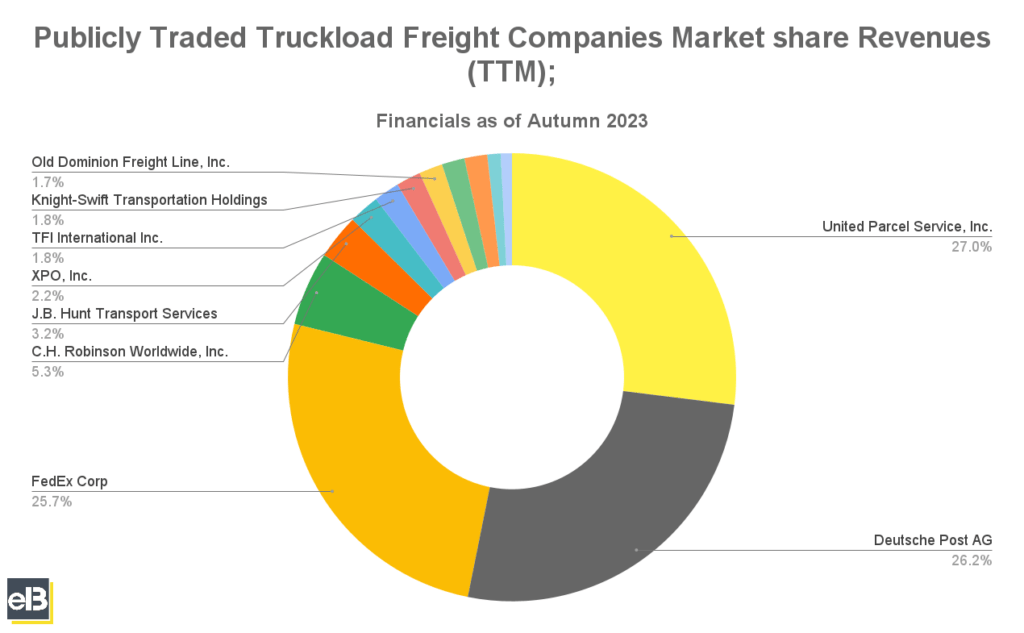

Biggest Publicly Traded Truckload Freight Companies by Market Share

The below chart shows the list of publicly traded Truckload Freight Companies with meaningful market caps of >$2Bn as of December 2023.

Leading the group is United Parcel Service with roughly 26.9% market share, followed Deutsche Post AG with 26.2%, and just behind is FedEx Corp with 25.7% of Trailing Twelve Months (TTM) revenue share of all publicly traded truckload freight companies.

| Company | Revenues (TTM in thousands) | Mkt Share |

| United Parcel Service, Inc. | $93,074,000 | 26.9% |

| Deutsche Post AG | $90,444,778 | 26.2% |

| FedEx Corp | $88,594,000 | 25.7% |

| C.H. Robinson Worldwide, Inc. | $18,441,377 | 5.3% |

| J.B. Hunt Transport Services | $11,158,236 | 3.2% |

| XPO, Inc. | $7,635,000 | 2.2% |

| TFI International, Inc. | $6,359,000 | 1.8% |

| Knight-Swift Transportation Holdings | $6,131,764 | 1.8% |

| Old Dominion Freight Line | $5,862,261 | 1.7% |

| Landstar System, Inc. | $5,698,873 | 1.7% |

| Schneider National, Inc. | $5,688,900 | 1.6% |

| Werner Enterprises | $3,323,045 | 1.0% |

| Saia, Inc. | $2,786,027 | 0.8% |

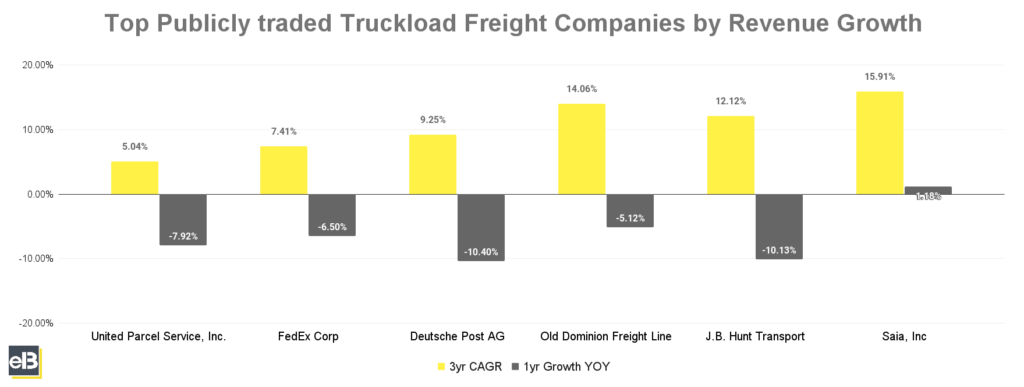

Top Truckload Freight companies by Revenue Growth

In the previous three fiscal years, Saia, Inc. lead ahead among its peers in the truckload freight industry with 15.91% CAGR.

On the other hand, Saia, Inc. is also leading in boosting its year-over-year annual revenue growth of 1.18% from 2022-2023.

Old Dominion Freight Line takes the number two spot in 3yr CAGR with 14.06%, while trailing behind is J.B. Hunt Transport and Deutsche Post AG with 14.06% and 9.25% 3yr CAGR, respectively.

| Company | 3yr CAGR | 1yr Growth YOY |

| United Parcel Service, Inc. | 5.04% | -7.92% |

| FedEx Corp | 7.41% | -6.50% |

| Deutsche Post AG | 9.25% | -10.40% |

| Old Dominion Freight Line | 14.06% | -5.12% |

| J.B. Hunt Transport Service, Inc. | 12.12% | -10.13% |

| Saia, Inc. | 15.91% | 1.18% |

Key Takeaway

As data above shows, the three fiscal years of growth has been decelerating with most of the companies in the list having their YOY revenue growth depressed. Most of the company’s management pointed out the continuing macroeconomic conditions globally slowed down volumes. However, they remain optimistic as the companies continue to optimize cost to combat the pulled-forward revenues from the pandemic.

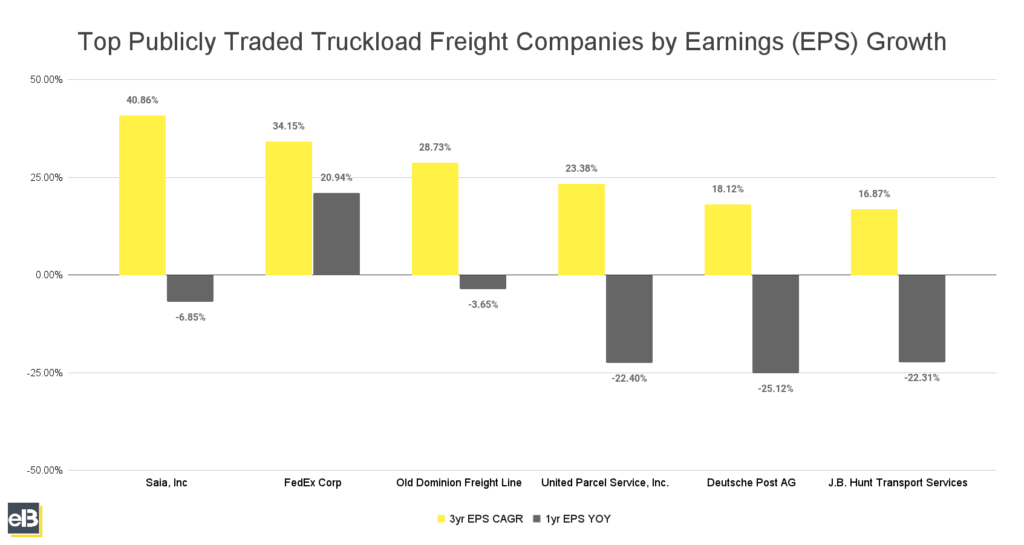

Top Truckload Freight Companies by Earnings (EPS) Growth

In the previous three fiscal years, Saia, Inc. saw the highest 3 year compounded annual growth of 40.86% in earnings per share.

All publicly traded truckload freight companies in the list recorded high double digit EPS growth with an average of 20%+ in their last three fiscal years.

Among the companies in the above graph, FedEx Corp had the highest 1-year EPS YOY growth rate of 20.94%.

The highest 3-year EPS CAGR companies in the list are Saia, Inc. at 40.86%, FedEx Corp at 34.15%, and Old Dominion Freight Line at 28.73%.

| Company | 3yr EPS CAGR | 1yr EPS YOY |

| Saia, Inc. | 40.86% | -6.85% |

| FedEx Corp | 34.15% | 20.94% |

| Old Dominion Freight Line | 28.73% | -3.65% |

| United Parcel Service, Inc. | 23.38% | -22.40% |

| Deutsche Post AG | 18.12% | -25.12% |

| J.B. Hunt Transport Services | 16.87% | -22.31% |

Truckload Freight Companies Revenue, Earnings and Stock Forecast (Quarter ending September 2023)

| Company | YOY EPS Forecast |

| United Parcel Service, Inc. | -30.65% |

| FedEx Corp | 31.93% |

| Deutsche Post AG | -17.09% |

| J.B. Hunt Transport Services, Inc. | -6.98% |

| Old Dominion Freight Line | -1.36% |

United Parcel Service, Inc. (UPS) Revenue, Earnings, and Stock Forecast

United Parcel Service, Inc’s revenue over the latest Trailing Twelve Month period was $93.1 billion. United Parcel Service, Inc’s earnings (Net Income) over the latest Trailing Twelve Month period was $8.6 billion.

The Wall Street consensus for United Parcel Service, Inc’s EPS (earnings per share) projection for the next quarter is $2.51. The company’s TTM (trailing twelve months) Earnings Per Share was $9.90 as of the quarter ending September 30, 2023.

United Parcel Service, Inc is expected to see a contraction in earnings per share of -30.65% YOY in the next quarter based on the consensus of stock market analyst forecasts.

FedEx Corp (FDX) Revenue, Earnings, and Stock Forecast

FedEx Corp’s revenue over the latest Trailing Twelve Month period was $88.6 billion. FedEx Corp’s earnings (Net Income) over the latest Trailing Twelve Month period was $4.2 billion.

The Wall Street consensus for FedEx Corp’s EPS (earnings per share) projection for the next quarter is $4.20. The company’s TTM (trailing twelve months) Earnings Per Share was $16.50 as of the quarter ending September 30, 2023.

FedEx Corp is expected to see an expansion in earnings per share of 31.93% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Deutsche Post AG (DHL) Revenue, Earnings, and Stock Forecast

Deutsche Post AG’s revenue over the latest Trailing Twelve Month period was $89.4 billion. Deutsche Post AG’s earnings (Net Income) over the latest Trailing Twelve Month period was $4.3 billion.

The Wall Street consensus for Deutsche Post AG’s EPS (earnings per share) projection for the next quarter is $0.94. The company’s TTM (trailing twelve months) Earnings Per Share was $3.60 as of the quarter ending September 30, 2023.

Deutsche Post AG is expected to see a contraction in earnings per share of -17.09% YOY in the next quarter based on the consensus of stock market analyst forecasts.

J.B. Hunt Transport Services (JBHT) Revenue, Earnings, and Stock Forecast

J.B. Hunt Transport Services’ revenue over the latest Trailing Twelve Month period was $13.2 billion. J.B. Hunt Transport Services’ earnings (Net Income) over the latest Trailing Twelve Month period was $0.8 billion.

The Wall Street consensus for J.B. Hunt Transport Services’ EPS (earnings per share) projection for the next quarter is $1.79. The company’s TTM (trailing twelve months) Earnings Per Share was $7.50 as of the quarter ending September 30, 2023.

J.B. Hunt Transport Services’ is expected to see a contraction in earnings per share of -6.98% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Old Dominion Freight Line (ODFL) Revenue, Earnings, and Stock Forecast

Old Dominion Freight Line’s revenue over the latest Trailing Twelve Month period was $5.9 billion. Old Dominion Freight Line’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.2 billion.

The Wall Street consensus for Old Dominion Freight Line’s EPS (earnings per share) projection for the next quarter is $2.88. The company’s TTM (trailing twelve months) Earnings Per Share was $11.30 as of the quarter ending September 30, 2023.

Old Dominion Freight Line is expected to see a contraction in earnings per share of -1.36% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data mentioned here in this article was sourced from publicly available filings and releases, and processed by investment newsletter provider, Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Logistics Companies Report: Winter 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Logistics Companies Grew Total Revenues Over 6% YOY in the October – December...

- Publicly Traded Home Builders Report: Autumn 2023 Results Publicly available financial data collected by investment newsletter provider Sather Research, LLC showed that five Publicly Traded Home Builders by Market Cap grew Total Revenues on...

- Publicly Traded Home Builders Report: Winter 2023 Results Publicly available financial data collected by investment newsletter provider Sather Research, LLC showed that five Publicly Traded Home Builders by Market Cap grew Total Revenues on...

- Publicly Traded Waste Management Industry Report: Autumn 2023 Results According to their latest earnings releases, the Autumn earnings results of the Top 4 Publicly Traded Waste Management companies by YoY revenues increased by 5%...