Buy Now, Pay Later. The “new” payment scheme trend many analysts project will generate $100 million in sales in 2021. The buy now, pay later scheme has become the new payment method, with BNPL becoming the new hip way. Many BNPL companies such as Affirm (AFRM), Afterpay, and Klarna lead this new field.

Many other companies continue to climb aboard the new way consumers pay. Companies such as PayPal, Square, Monzo, Revolut, Amazon, Walmart, and Mastercard have started offering BNPL options at checkout or partnering with BNPL companies to offer this service to their customers; even the mighty Apple started climbing aboard.

The percentage of US Gen Z-ers using BNPL has grown 6x from 6% in 2019 to 36% in 2021. Millennials have more than doubled their use to 41%, and Gen X-ers have tripled their usage; even the Boomers have gotten into the act.

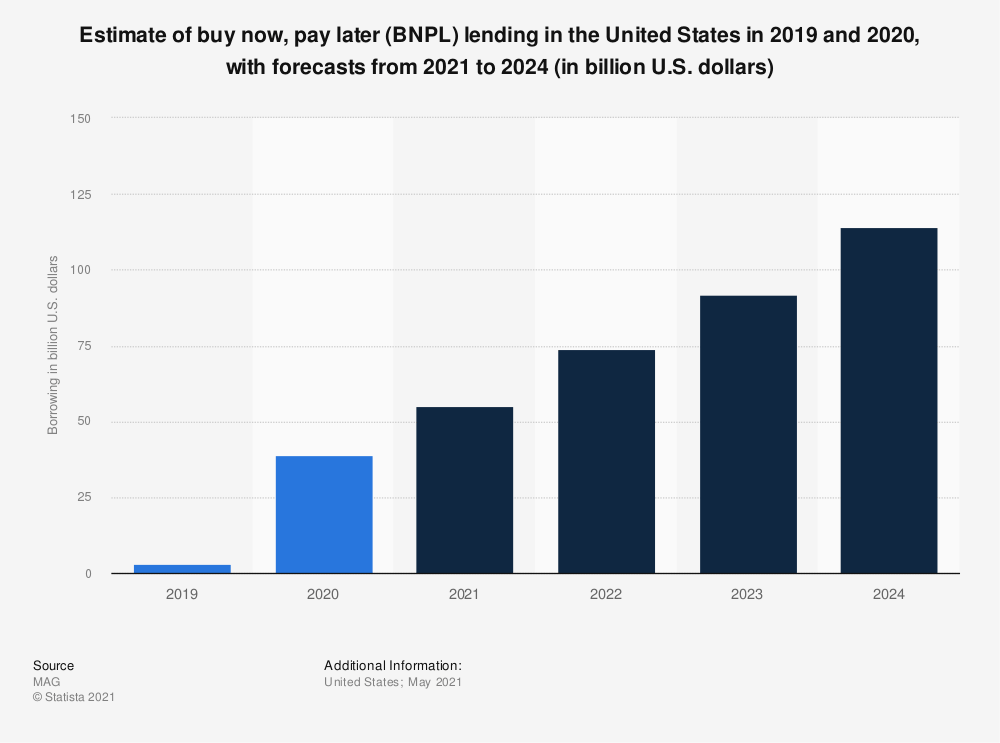

Consumers’ use of BNPL for Peloton bikes, Nike shoes, or the latest TV grew from $20 billion in 2019, to $24 billion in 2020, to over $100 billion in 2021. Many observers believe that BNPL and the companies that enable the service are here to stay. They also believe it will disrupt the credit card industry and enable those unable to get credit in the standard method and access those benefits.

And as investors, it is in our best interest to understand this “new” payment program, how it works, and who some of the major players are to make the best investment decisions.

In today’s post, we will learn:

- What is BNPL (Buy Now, Pay Later)?

- What Are The Benefits of BNPL?

- What Are The Downsides of BNPL?

- Top Companies Offering BNPL

- Investor Takeaway

Okay, let’s dive in and learn more about BNPL companies.

What is Buy Now, Pay Later (BNPL)?

According to Investopedia, Buy Now, Pay Later (BNPL) is:

“a type of short-term financing that allows consumers to make purchases and pay for them at a future date, often interest-free. Also referred to as point of sale installment loans, BNPL arrangements are becoming an increasingly popular payment option, especially when shopping online.”

Buy Now, Pay Later is a payment arrangement between the consumer and merchant that takes place at checkout, online, or in person.

It allows the consumer to purchase an item without paying for it at checkout. For example, if you buy a pair of shoes from Nike, you can arrange through the BNPL app at the point of sale or online to make three to five payments over a prearranged period.

Many experts expect the BNPL market to continue growing, with revenues growing from $44 billion in 2020 to over $100 billion in 2024. While many experts agree the usage will grow, some believe sales will slow as the adoption continues to flatten over time.

Right now, the younger generations lead the adoption, with the older cohorts sticking to “old school” credit cards and other traditional credit products.

The number of overall users of BNPL products is projected to grow to 59.3 million in 2022, with 45% of users claiming BNPL offers better payment arrangements than credit cards.

Many BNPL companies such as Affirm or Klarna enable these sales by integrating their apps in the checkout process.

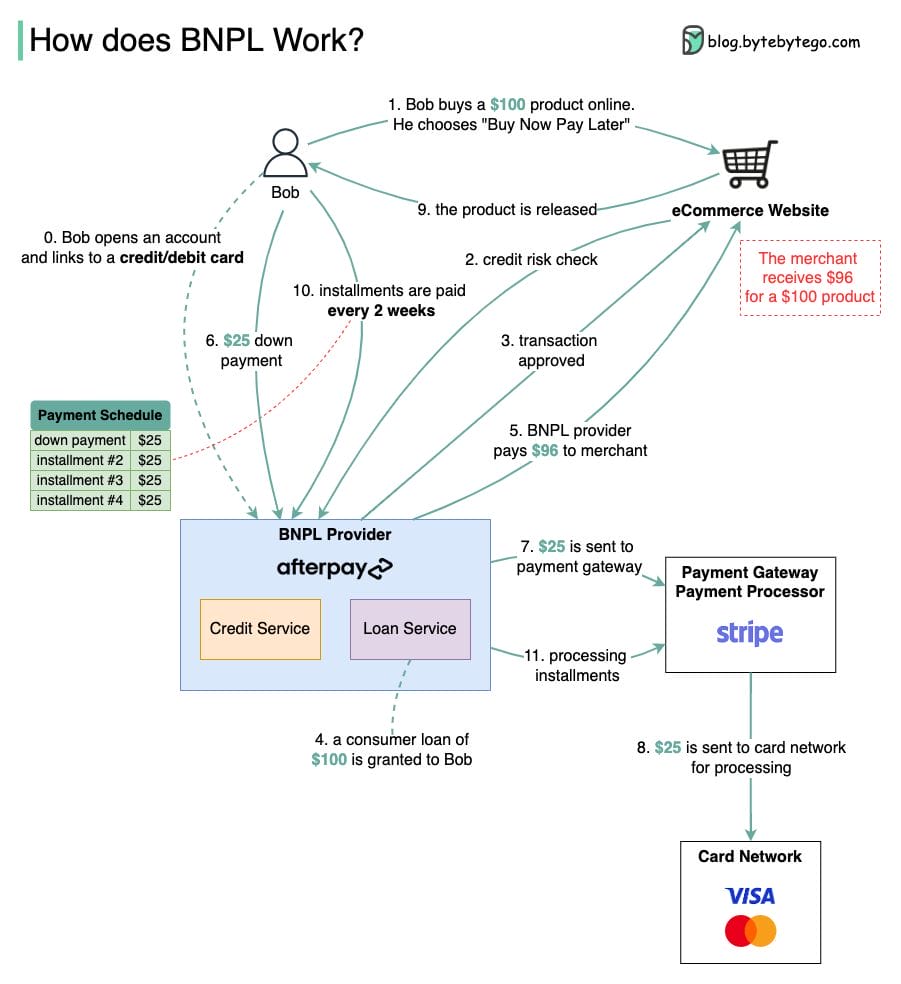

Not all BNPL companies operate the same or have the same terms and conditions, but the general breakdown of the process is:

- You purchase at a retailer and choose the buy now, pay later option at checkout.

- If approved in mere seconds, you make a minimum payment, as much as 25% of the total purchase.

- We then pay off the remaining balance in a series of interest-free payments.

- We have multiple options to pay our balance via check or bank transfer, using debit cards or bank accounts.

As we can see, the nature of BNPL is similar to buying with a credit card. With both, we delay the payment, and with the credit card, our only requirement is to make the minimum payment due on our credit balance. Interest will accrue on any balance we carry on the credit card until paid in full.

By contrast, BNPL loans typically don’t charge interest or fees, but they have a fixed loan repayment schedule, generally in weeks or months. When you checkout, you will know the payment schedule and amounts due when you finish the transaction.

The buy now, pay later programs are similar to any unsecured loan such as a personal loan, mortgage, or auto loan. Fixed payments represent the total cost of the loan, including any interest due. The BNPL option differs from credit products such as the credit card, which has a compound interest that calculates on balance, making those cards dangerous.

The buy now, pay later arrangements are a new twist on an old program from my parent’s era. It is a lay-away program with new clothes. Back in my parents’ day, you would go to K-mart or Sears, pick out your Christmas presents, pay for them over time, and receive the presents once they paid the balance.

Most BNPL companies do a “soft pull” on your credit for approval, which doesn’t affect your credit rating. But, some companies will do a hard pull on your credit, which might affect your credit and is something to consider if you have a big purchase coming up, such as buying a home.

Not everything is eligible for buy now, pay later; it is typically for bigger purchases such as electronics, furniture, jewelry, or clothing. Some BNPL companies also have limits on the amount you can borrow; for example, Affirm has a limit of $17,500.

What Are the Benefits of BNPL?

The BNPL program offers many benefits for both consumers and merchants, which is why it is taking off in such a big way.

For merchants:

- BNPL offers another checkout option for consumers. The ease of the approval process and the ability to split up consumer payments lead to more satisfaction for merchants and consumers.

- Using BNPL increases the checkout average for merchants because it encourages consumers to level up on their purchases.

- BNPL encourages upselling for consumers. It is quite easy to talk someone into buying those pairs of shoes if they know they can split the payment over a longer period.

All of the above benefits for merchants are online or offline (in-store), which helps them offer bigger ticket items, control inventories, and manage their ordering.

And using BNPL for merchants removes the credit risk by shifting that to the BNPL companies, which are now on the hook for collecting the money. The merchant collects the money upfront, with Affirm keeping a percentage of the transaction as their fee and then collecting the funds.

For consumers, the benefits are:

- Ease of use for consumers when checking out. The different apps on either the website or POS in the store offer different payment options, or you can buy products through the BNPL apps like Afterpay. All of these companies make the application process quick and easy, with approval in seconds, so you know whether you can use the service or not.

- BNPL also offers access to credit for those who may not qualify for a credit card or other credit products. It removes some of the anxiety of buying larger ticket items without having high credit scores.

- Consumers were relying on credit cards for larger purchases and then paying off the balance over time-incurred interest charges. With BNPL options, some fees go away, leading to consumer savings.

- BNPL services also allow access to stores previously unavailable for those without great credit. Or to plan vacations by using BNPL to make payments on the trip.

- The largest advantage or benefit, by far, is the transparency around fees. Most, if not all, of the BNPL companies, advertise no late fees, prepayment fees, annual fees, or hidden charges, all of which remain attractive to consumers today.

There are also services outside of retail that are growing at a tremendous pace, such as:

- Healthcare

- Travel

- Automotive

Now, we can use BNPL to pay for our medical bills, plan for that trip to Hawaii, or get our car repaired. As the BNPL revolution continues to pick up steam, we will see more merchants offer these services to attract consumers.

What Are the Downsides of BNPL?

As with any service relating to money, nothing comes for free. And the same applies to BNPL.

For consumers, there are a lot of considerations you need to think about, such as:

- Lots of credit pulls will affect your credit over a longer period. And early studies are revealing that consumers with lots of credit products are also adopting BNPL. All of this will increase household debt, which could have bigger impacts down the road. One thing to consider before using BNPL is if you can buy a home, hold off until approved because the credit hits could impact your score and approval.

- At this time, there is no aggregation of different BNPL service providers. In other words, if you have multiple loans across different merchants, it cannot be easy to manage the payments, which is one of the benefits of a credit card – all your charges in one place.

- Some companies charge fees, and you need to read the fine print to understand what you are committing to before buying.

- Missing any payments will risk losing access to BNPL in the future, affecting your credit.

It’s early innings on the BNPL growth, but many experts worry that BNPL will encourage consumers to buy things they can’t afford and encourage overbuying, leading to defaults and worsening credit.

For merchants, there are two main risks. First are the fees BNPL companies charge, which is double the credit card processors’ rates. Those high rates could lead to lower profitability for the merchants.

The second risk is that defaults will lead to consumer backlash against the merchants, as consumers will blame Walmart for talking them into taking this loan they can’t pay back, not the app on the POS that allowed them to make the purchase, all of which could injure the reputation of the merchant.

For the companies offering BNPL, it is early innings too, and some analysts worry that making access to credit easy for consumers will lead to a rise in defaults on those loans. Right now, the current default rate on bank loans is around 1.32%. Reports from Reuters state that over one-third of all consumers using BNPL have missed at least one payment, and analysts worry as the adoption continues to escalate, so will the defaults.

Those defaults will impact the BNPL companies’ profitability and ability to guarantee loans.

And as defaults rise, regulation – which isn’t in the picture yet – will rear its ugly head. And the ease of use might dry up for consumers, merchants, and BNPL providers.

Fun fact: back in the early 60s, when Visa was starting as BankAmericard, the originator of the idea of offering credit to the public at large discovered, to his chagrin, that consumers were not likely to pay their debts, and the default rates were sky high at first until Bank of America established credit requirements.

Top Companies Offering BNPL

Let’s look at some of the public or soon-to-be public companies offering BNPL.

Affirm (AFRM)

Affirm is one of the leaders in the BNPL space since it went public in 2021 and has seen nothing but rising revenues and more and more publicity as they sign bigger client after big client. Some of the merchants that have adopted the service are:

- Peloton

- Amazon

- Walmart

Affirm was founded by Max Levchin, part of the PayPal Mafia that left the company to found other successful businesses (along with Elon Musk, Peter Thiel, Reid Hoffman, etc.).

The company, founded in 2012, has financed over 17 million transactions and offers a credit limit of $17,500 that can be paid over time with interest rates ranging from 0% to 30%. Affirm offers loan terms of three, six, or 12 months without extra fees.

Some of the pros and cons:

Pros | Cons |

No Late Fees | Some transactions charge interest |

Online or in-store purchases | Requires a credit check |

Purchase limit of $17,500 | No physical card |

Choose payment schedule |

Afterpay (Square) SQ

Afterpay is an Australian company that operates globally, whereas Affirm is in the US only at this point. Afterpay launched in 2015 and now has over 15 million customers. Afterpay works through their app, allowing consumers to buy products from up to 85,000 merchants.

Afterpay offers credit limits starting at $500 and rises with use and credit scores. They also offer no fees if you pay your payments on time.

Recently, Square announced that they were buying Afterpay for $29 billion, and they intend to fold Afterpay into their Cash App to allow BNPL services to their Cash App users.

Pros | Cons |

Smart credit limits to help stay under a budget | Afterpay may decline the offer |

Sends reminders for payments | Late fees can be up to 29% of the purchase |

No fees if payments are timely | Each purchase needs approval |

Klarna (KLAR)

Klarna is a BNPL company based out of Sweden; the company is not publicly listed in the US yet but is planning to go public soon. The company began in 2005 and has spread to Europe and the US. Klarna does not pull your credit when you choose the Pay in 4 option, and like Afterpay, it doesn’t charge any fees or interest if you pay your payments on time. The company also offers shorter loans, less than a month, and longer-term loans at 36 months, but these come with interest.

The above three companies are the leading BNPL companies as a pure-play, others are starting to gain steam, but Affirm, Afterpay, and Klarna are the leaders.

PayPal

PayPal is one of the leaders in online payment processing and peer-to-peer payments. As a part of its desire to become a super-app encompassing all of its customers’ financial needs, the company is adopting BNPL services.

PayPal offers Pay in 4 services through millions of online merchants, such as Best Buy, Coach, and others, for transactions spanning $30 to $600. To use the Pay in 4 services, you must have an account with PayPal and be in good standing to qualify for interest-free payments.

PayPal is not a pure-play BNPL company, but it is a well-known name with a good reputation and great relationships across millions of merchants, offering additional options to consumers. Other advantages include all payments within the app, paying the bill directly from your PayPal account, and continued relationships will increase benefits.

Other companies that are offering BNPL services include:

- Apple

- Mastercard

- Monzo

- Revolut

- Adyen

Because of the ease of creating these apps, and the already established relationships with merchants and banks, many BNPL companies see the ease of sliding into the payment options for consumers.

Many payment companies will continue to adopt these services by building in-house or partnering with others, such as Affirm, as in Amazon’s case.

BNPL is also a boon for payment facilitators and rails such as Visa and Mastercard because most bills are paid via their bank debit card, whether Bank of America Visa or Square Visa. The rise of BNPL means more payments across the payment rails of companies like Visa or Mastercard, which helps them grow their revenues.

Investor Takeaway

The future of BNPL companies is still in the early innings. No one knows where this trend will go, but many think that some pure-play BNPL companies will merge into other companies, like Square’s purchase of Afterpay.

For the BNPL companies to stand out, they must differentiate themselves and create unique shopping experiences to survive. Companies like Afterpay were on their way to becoming shopping destinations via their app.

BNPL companies will also have to prove that consumers using their products helps increase their checkout average, leading to increased adoption.

They will also need to specialize in the customer journey and expand beyond the BNPL space; master customer payments by offering bonuses, benefits, and additional payment options while increasing the ease of use.

But like any investment, BNPL companies also contain some big risks to consider. The biggest elephant in the room is how much adoption will lead to increased defaults and how that will reverberate across the BNPL world.

With all the options available to invest in the BNPL space, you can either choose pure-play BNPL companies like Affirm or companies such as Square or PayPal to get your foot in the space without some of the additional risks.

And with that, we will wrap up our discussion on BNPL companies.

Thank you for taking the time to read today’s post, and I hope you find some value. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- The Future of Debit Card Processing, What It Is and How It Works Updated 10/27/2023 In 2020, the Federal Reserve Bank of Atlanta conducted a Survey of Consumer Choice, which reported that: Evidence also shows that increasing debit...

- Peer-To-Peer Payments: What To Know Updated 9/27/2023 “Mobile devices, high-speed data communication, and online commerce are creating expectations that convenient, secure, real-time payment and banking capabilities should be available whenever...

- Key Players in the Payment Processing Flow Updated 11/9/2023 Analysts expect global payment revenues to grow to $2.5 trillion by 2025, according to McKinsey, after returning to their historical 6 to 7...

- The History of American Express and their Business Model Updated 11/24/2023 American Express’s history helped shape the finance structure, along with its unique business model. Warren Buffett thinks so highly of American Express that...