Updated 6/24/2023

“Price is what you pay; value is what you get.”

A company’s evaluation involves determining the value of its assets, liabilities, and equity. Most of us are familiar with assets such as accounts receivable and liabilities such as debt. But how many of us understand equity and how to determine the value of that equity?

The book value of equity tells us how much we pay for our investment because, as owners, that is what we “own.” When the company repurchases shares, it buys back its equity, which helps improve our ownership value. Dividends are distributions of the equity of the company to shareholders.

Both methods are great ways to generate shareholder returns, but let’s look a little closer at a company’s equity to understand better what we own and its value.

In today’s post, we will learn:

- What is the Book Value of Equity?

- Market Value vs. Book Value of Equity

- The Parts that Makeup Equity

- How to Calculate Book Value of Equity From the Balance Sheet

Okay, let’s dive in and learn more about the book value of equity.

What is the Book Value of Equity?

The book value on a company’s balance sheet represents the funds that belong to shareholders. It is all the company’s money for shareholders and is available for distribution in buybacks or dividends.

The classic accounting formula to balance the balance sheet is as follows:

Assets = Liabilities + Shareholders’ Equity

The assets must equal the sum of the company’s liabilities and shareholder equity. That means determining the value of the company’s equity is subtracting liabilities from assets, which will give us shareholder equity.

Assets – Liabilities = Shareholders equity

Sometimes book value of equity is confused with the market cap, which denotes its value based on the number of outstanding shares and market price.

Berkshire Hathaway market cap = $285.42 per share x 2,299.9 million shares outstanding = $656.43 billion

But, looking at the current balance sheet, we see the company has a current shareholder’s equity of $456.17 billion.

When most analysts refer to the company’s book value, they refer to a combination of debt and equity. In general, the companies expected to grow revenues and profits have a lower book value of equity than their market value of the equity. The company’s assets can increase revenues and profits, and the market values growth.

On the flip side, if a company has higher shareholder equity than its market cap, it is not expected to have much future growth.

When we calculate ratios such as return on equity (ROE) or debt to equity, the equity figure we use for those calculations comes from the book value of the equity.

Those metrics help us determine the value of the company’s income and debt levels compared to the shareholders’ equity, the company’s owner’s portion.

We observed with Berkshire Hathaway the company has a market cap higher than its equity, but this is not always the case, even with strong, profitable companies, for example:

Company | Market Cap | Shareholders’ Equity |

Starbucks (SBUX) | $132.1 billion | $(7.79) billion |

Starbucks has a negative book value of equity because it has negative shareholders’ equity. They have used their retained earnings to buy back shares over the past few years and have drained their equity.

The negative equity doesn’t mean Starbucks is on the verge of bankruptcy, but it could lead to trouble if it continues for an extended period.

Looking at another company, Oracle, we can see its shareholders’ equity has taken a downward trend over the last five years:

- 2017 – $53.8 billion

- 2018 – 46.3 billion

- 2019 – $21.7 billion

- 2020 – $12.7 billion

- TTM – $9.6 billion

All because the company diverts its retained earnings to share repurchases, partly to give back to the shareholders but also to keep the earnings per share at a reasonable number and not give investors another reason to flee.

With the company experiencing flat to slow revenue growth, they need earnings to continue growing, and one way to accomplish this is to reduce the share count.

All the more reason to understand the book value of equity and look at more than just the company’s top-line growth. I would bet without looking too closely; management compensation is tied to earnings growth too.

Market Value Vs. Book Value of Equity

In general terms, the market value of a company is the value of the company in the market. For example, if Berkshire trades at $284.92 and has outstanding shares of 2,299.9 million, the company has a market cap of $656.6 billion. That equals the market value of the company.

But that market value encompasses all the aspects of the company, such as its assets, cash, revenues, costs of operations, and debt. The market value of a company depends on what the market is willing to pay for Berkshire. If the market is willing to pay less, the market value drops, and vice versa.

The book value of the equity equals the company’s value after subtracting all the assets and liabilities. Equity or shareholders’ equity tends to move far less than the company’s market value.

For example, if you own a volatile stock like Palantir, you will see wild fluctuations in the market value from day to day. But the company’s equity value only changes every quarter and remains gradual.

As we mentioned earlier, the market value tends to remain higher than the book value of the equity. The market value is a function of the daily actions in the market. In contrast, the book value of equity equals an accounting function and will only adjust during each quarterly or annual report. Another way to think about the book value of equity is it represents the company’s value in the event of a liquidation. In that circumstances, the shareholders would receive the value at the sale of the equity.

The book value of the company’s equity is a part of the price-to-book value ratio or the price-to-book calculations.

The price-to-book and book value per share calculations are common valuation techniques used in the analysis of financials, such as banks and insurance companies.

The Parts That Makeup Equity

The company’s equity comprises a few main parts; in this section, I would like to take a quick look at each line item better to understand the makeup of the equity of Amazon.

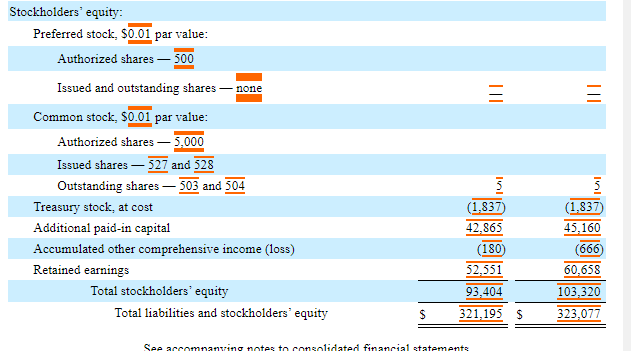

The above snippet is from the company’s latest quarterly report (10-q) dated March 31, 2021.

There are four major components of the equity of Amazon: the owner’s contributions, that’ us, the investors.

Common stock and Additional Paid-in Capital

The common stock is the portion of equity capital at the par value of the shares, $0.01, which equals $5 million, which we can see as the total amount of shares issued equals 5,000 million. The extra paid-in capital remains above the par value of the common stock issued. The additional paid-in capital can grow when Amazon issues shares or shrink when repurchasing shares.

Treasury shares

Treasury shares or stock, which we shouldn’t confuse with the Treasury stocks from the US government, are reacquired Amazon stock. These previously outstanding shares are repurchased from shareholders by Amazon. Once the purchase is complete, the outstanding shares on the market decrease, but the company holds its balance sheet. We don’t consider them when distributing dividends or earnings per share calculations.

Treasury shares reduce the value of the company’s equity on the balance sheet, and the balance sheet will tell us if the value of the shares is at cost or par. In Amazon’s case, they list at the cost of $1.837 billion. A fun fact, Amazon has not changed its treasury stock since 2012; it has remained at the current level since then.

Retained Earnings

Retained earnings are the portion of Amazon’s net income or bottom line that is not paid out in dividends. When Amazon generates a profit, it grows the retained earnings; when they experience a loss, it shrinks the retained earnings.

When a company generates profits, it gives the management more options to reinvest in the business, pay down debt, or distribute dividends.

A growth company like Amazon prefers to use its earnings to reinvest in the company, as it can generate a better return than issuing a dividend.

Looking more closely at Amazon’s retained earnings, we can see a growth of 46.59% annually, higher than the equity at 31.15%.

Retained earnings is a good line item to pay attention to because it tells us what the management is doing regarding growth or returning capital to shareholders.

Retained earnings comprise most of the shareholders’ equity of companies, along with paid-in capital.

Any monies not paid to shareholders remain in the retained earnings account, often building up over time. Amazon doesn’t pay a dividend currently, and

Other comprehensive Income

Other comprehensive income comprises revenues, expenses, gains, and losses not included in the income statement. These revenues, gains, expenses, and losses are not realized yet. They stem from investments in bonds, equities, foreign exchange hedges, pension plans, and other miscellaneous items.

Because of accounting standards, none of the above can be listed on the income statement. A common example is the bond portfolio that a company carries that has not matured and hasn’t redeemed them.

Typically, the OCI (other comprehensive income) is not a large part of the book value of equity. Instead, it points out other methods of income or losses for the company.

How to Calculate Book Value of Equity From the Balance Sheet

There are several ways to calculate the book value of equity. The first and easiest is subtracting liabilities from assets, and the amount leftover is the book value of the equity. For example:

Item | Amount |

Total assets | $323,077 billion |

Total Liabilities (-) | $219,757 billion |

Shareholders’ Equity | $103,320 billion |

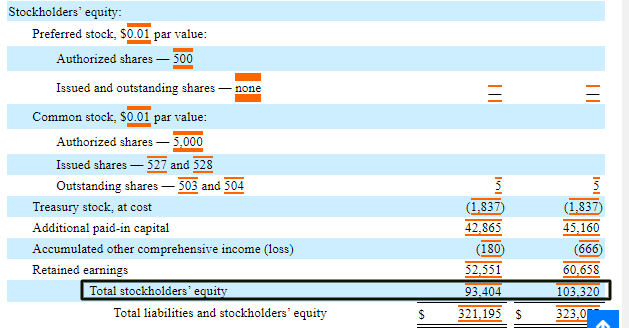

Super easy, huh? You can also look at the bottom of the balance sheet of Amazon and find the line item:

Even easier, huh?

But, to understand the components of the book value of equity, we should take the extra step and outline the items in a quick chart to see how it breaks down.

Item | Amount |

Preferred stock | $0 |

Common stock | $5 million |

Treasury stock | $(1,837) million |

Paid-in capital | $42,865 million |

Other comprehensive income | $(180) million |

Retained earnings | $52,551 million |

Shareholders’ equity | $103,320 |

Notice we arrive at the same number that Amazon reports on the balance sheet, but looking at the individual numbers gives us a sense of what the company is doing with “our” money.

Remember, shareholder equity equals the investor’s money; it is our portion of the company’s value. If the management reinvests poorly, we need to know distributing a dividend would give us a better return than wasting it on poor projects.

It is important to study the balance sheet to help investors determine what drives the business’s growth, where the growth comes from, and what management does with those funds.

For example, Amazon and Jeff Bezos remain amazing capital allocators, and he and the company drive growth from its revenues, which all compounds and drives even more growth. Warren Buffett does the same for Berkshire and notices neither company pays dividends.

In his shareholder letters, Buffett explains multiple times that finding a company that allocates capital well remains one of the hidden secrets to finding great companies. One of his best investments, Coke, had a CEO who had superb capital allocation for the company and helped grow them into the superpower they remain in the beverage business.

Investor Takeaway

Understanding the company’s book equity helps us determine whether the market under or overvalues the company. It also tells us at a quick glance whether it equals a strong company with a positive value. We need to dig deeper to understand its situation if we see negative book value of equity, such as with Starbucks. Sometimes, it might mean a short-term issue; in others, it might equal a red flag.

With the rise in intangible assets and internet-based companies such as Facebook, Netflix, and Googe, some of the importance of assets has shifted. Companies like Facebook generate revenues differently from Lockheed Martin and treating them similarly is not logical.

There is a trend among analysts to treat expenses such as research and development (R & R&D), which means that the company’s assets impact each company differently.

The book value of equity tells us how much net income is left over, how much paid-in capital the company retains from its IPO, or different stock offerings, all of which give them additional funds to grow the company.

Studying the book value of equity can tell us how well a company allocates its capital, and finding a CEO who does this well will lead to growth for the company and you as the investor.

With that, we will wrap up our discussion on the book value of equity.

As always, thank you for taking the time to read this post, and I hope you find something of value in your investing journey. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Simple Balance Sheet Structure Breakdown (by Each Component) “Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets.” Peter Lynch The ability...

- Other Comprehensive Income, OCI, AOCI: The Basics, with 10-K Examples Edited for clarity: 9/21/22 As a company creates income, this changes its shareholder’s equity. Add investment securities and it can get hairy. The Statement of...

- Interpreting Off-Balance Sheet Items: Analyzing Risks in the Finance Industry There are two main types of off-balance sheet items for investors to consider. One regards future obligations, and one regards potential off-balance sheet risks. These...

- Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT) Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large balance of marketable...