Updated – 12/6/23

Today, I want to help you overcome the biggest hurdle beginning investors face: buying your first stock. Buying just 1 share of your favorite company when buying your first stock is like taking your first baby steps into the market.

I can’t stress enough how important buying your first stock is, as you can read and read until your eyes turn blue, but you won’t start to see progress towards your results until you take action.

Trust me, from a guy who has been there before, buying your first stock gives you a sense of empowerment and excitement of being part of the stock market.

Table of Contents

- Dollar Cost Averaging

- Stay Away from the “Psychics”

- Remember: Don’t Try to Time the Market

- Time for Action: Buying Your First Stock

Before going over buying your first stock, I am going to reveal the absolute best stock strategy you can use and most wealthy investors use. It is called: Dollar Cost Averaging.

Dollar Cost Averaging

What do the investing greats have to say about dollar cost averaging? The godfather of value investing and Warren Buffett’s mentor, Benjamin Graham, wrote in his book The Intelligent Investor that dollar cost averaging:

enables you to put a fixed amount of money into an investment at regular intervals… You buy more – whether the markets have gone (or are about to go up), down, or sideways.

Warren Buffett called this book “by far the best book on investing ever written” and it is the resource many investors refer to for guidance.

Dollar cost averaging is simply investing the same amount of money every month, year, or week, into the stock market– with the effect of forcing the investor to buy more when stock prices are lower and buy less when stock prices are higher.

By dollar cost averaging, the investor is always invested and will not be devastated by the losses from trying to time the market.

Stay Away from the “Psychics”

In your investing life, beware the analysts who claim they know the exact time to buy low or sell high.

In retrospect, everyone believes they would’ve been able to predict the highs and lows of the market, but in reality, it is, in fact, impossible.

Trying to profit from timing the market will drive you nuts and always leave you regretting your decisions. Most investors will sell too early and miss out on bigger gains or will sell because stocks have fallen significantly, which is the absolute worst time to sell.

Or, investors will often feel good about their investments when they are doing well and will, as a consequence, buy a lot more at a time when stocks are very high already and there is very little upside.

Dollar cost averaging gives you the necessary, patient discipline to stay in the market for the long term and through the ups and downs.

How does this strategy help you buy more when prices are low and buy less when prices are high? Take this simple example.

Say a stock’s price is $10 today, and you are buying $500 of stock a month in a dollar cost averaging strategy. So, the first month you buy 50 shares of this stock. Let’s say next month the price has dropped to $5.

Instead of getting pissed that the shares have fallen so much and cursing the world, the smart investor sees this as an opportunity to buy more stock at a discount.

So, again, you invest $500 in month 2, knowing that you are in for the long term, and you end up buying 100 shares. Let’s say in month 3 the price is still at $5 and you are buying 100 more shares. Finally in month 4 the price recovers and is now at a whopping $15.

Compare where’d you be if you had, or hadn’t, dollar cost averaged.

With dollar cost averaging, you have 250 shares of stock now worth $15, and you are sitting pretty with some nice gains.

Let’s say you didn’t use dollar cost averaging and invested all $1500 at once. You’d have only 150 shares, and when the price dropped to $5, you might’ve sold at the worst possible time, unable to stomach any more losses.

Remember: DON’T Try to Time the Market

While this might seem like an extreme example, you’d be surprised how often this happens to investors, which is why many shun the market after being burned like this.

Little do they know that a simple strategy such as dollar cost averaging reduces the possible downside and keeps you disciplined and invested long term.

If the price had instead gone up initially instead of down… yes, investing all of it at the beginning might have been best in the short term for you now, but over many trades and years of investing, you’d find you’re getting burned more often than you are gaining.

Plus, how would you know when to sell? No one is able to predict the future no matter how much convincing you may hear, and the true answer is no one knows. That’s why it’s important to stay long term invested while taking some profits along the way, without getting greedy or attempting to sell at the highs or buy at the lows.

Market timing will lead you to despair, and those who claim otherwise have yet to be burned by it but eventually will.

Time for Action: Buying Your First Stock

Now that I’ve shown you why to invest, how the stock market works, and the best investing strategy you can use, my next recommendation is to get your feet wet and take the first step toward taking control of your future by buying your first stock.

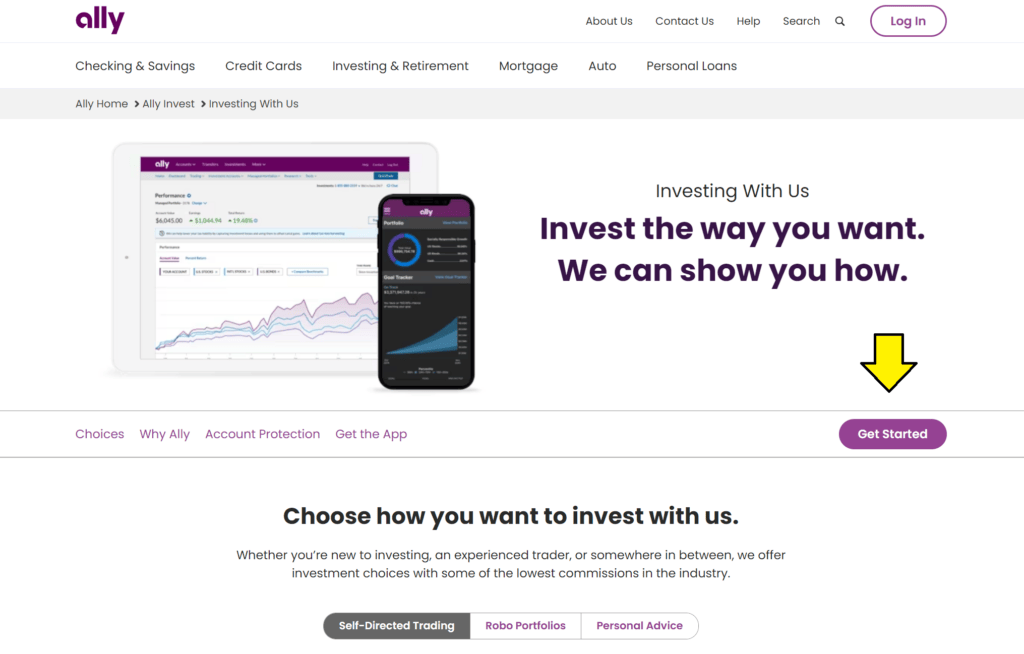

A great online broker I can recommend for buying your first stock is called Ally, and let me tell you why. It is simple, as these screenshots will show you.

On the first page, hit Get Started to open an account:

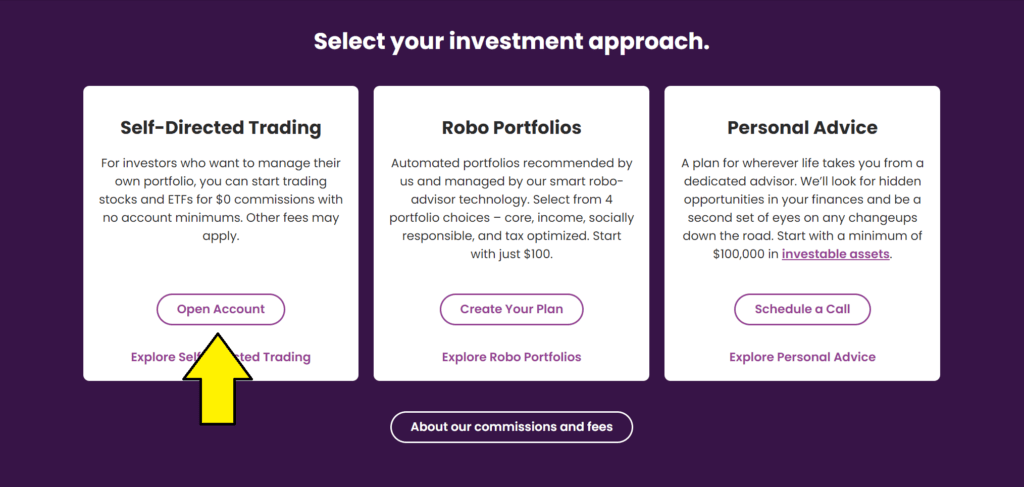

Because we are just wanting to get your feet wet, you can open a Self-Directed Trading account. Think of it like a checking account for stocks.

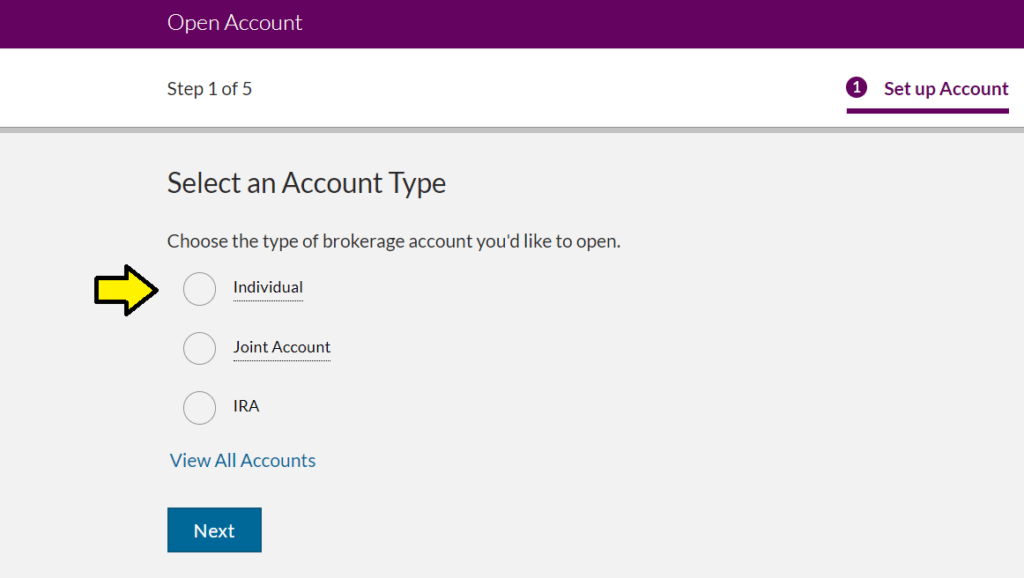

Next, type in your name and email. You will then get this prompt:

Assuming you are not familiar with retirement accounts and are just wanting to get started to get familiar with investing, go for an Individual Brokerage Account:

Enter your personal information, including your DOB, Country of Citizenship, Marital Status, and Number of Dependents. Then, your Social Security number.

Next is your Address. Then, a phone number and security question for your login. There will then be a screen for your Employment information. Note that they are just making sure here that you aren’t affiliated with insiders at certain companies (that there are no conflicts of interest). Being unemployed should NOT keep you from being able to open an account.

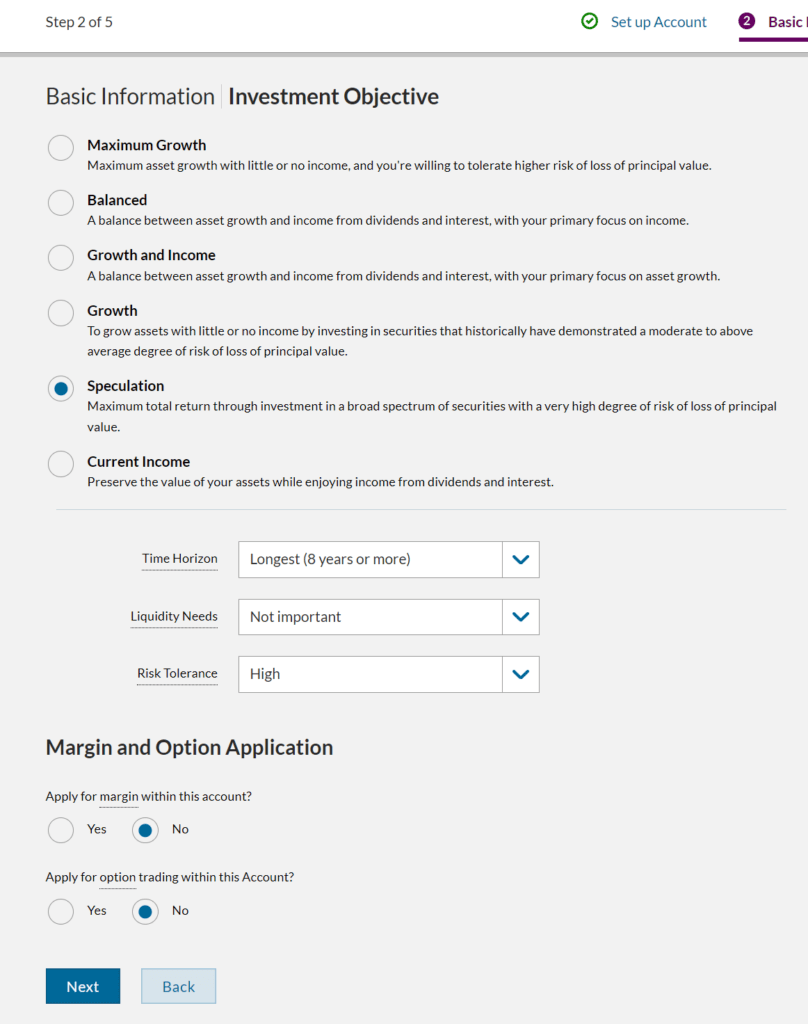

Next, they will want some personal information; one big reason is to know whether they feel comfortable approving you for advanced types of trading (like options or margin).

Next is information on your goals and experience:

I’d highly recommend NOT applying for margin as a beginner. That means borrowing money to trade. It is like playing with fire!!

Next, you can choose to enroll in securities lending or not. The page has more information on it.

We are on the home stretch now.

After clicking through a few more confirmation prompts, you will submit your application. It should not take too long to get approved.

Once you are, congratulations! 🎉

The last step is to fund your account (you can easily link your checking account by signing into your online banking). And then, buying your first share!

Let me show you just how easy it is.

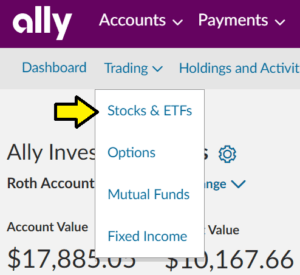

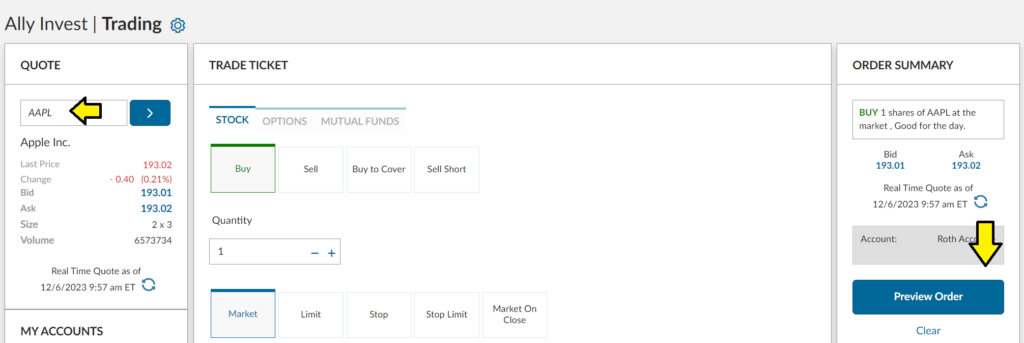

On the homepage of your account, click the Trading tab and then click Stocks & ETFs.

Say you wanted to buy a stock like Apple. Type the ticker into the Quote box. Then, input the Quantity (number of shares). Hit preview order.

Hit Place Order and that’s it, you’re done! Told you it was easy.

Moving Forward

I hope this quick picture guide was helpful and informative. I only recommend services that will help investors on their way to wealth, and getting your feet wet with Ally is one of the best first ways.

Once you have ownership of a stock, you gain a sense of empowerment and can truly understand that the market isn’t as foreign and foreboding as some might’ve thought.

Once you’ve completed this step, be sure to continue with the Investing for Beginners guide. You will learn how to evaluate stocks in order to make the best decisions for your investing journey.

This was step 3 of our guide 7 Steps to Understanding the Stock Market. A reminder of all the posts which comprise the 7 steps of this guide:

1. Stock Market Basics: Why to Invest

2. Understanding How the Stock Market Works

3. Learning How to Invest in Stocks

4. Learn About Stocks With the P/E Ratio

5. Two Stock Market Factors To Trade On: P/B and P/S Ratios

6. Finding the Best Stocks for Beginners: Looking for Dividends and Growth

7. The Best Way to Avoid Risk and Putting it all Together!

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- The 8 Stock Market Secrets to Success That I Wish I Knew When I First Started Updated – 12/14/23 To get to the secret of success in the stock market takes just a few easy to remember, short phrases which are...

- NEWSFLASH: Data Showing That It’s OK to Buy High, Sell Low Would you rather buy low, sell high, or buy high, sell low? Obviously, we’d all like to buy low and sell high, but sometimes that...

- Stock Repurchases: How They Work and Their Effect on Earnings Updated 3/6/2024 In today’s market, share repurchases are the choice that most public companies use to return value to their shareholders. Investing giants such as...

- Tesla and Apple Did It – Is it Time for a Google Stock Split? Stock splits are a really unique thing nowadays and with so many companies doing it lately, it makes me wonder if it’s also time for...