Controlling costs remains one of the more important jobs of management. They must control the costs of producing revenues, which reflect their profits.

One of the best ways to control costs is to ensure the costs of goods sold remain under control. As companies expand, sometimes these costs grow, as seen by Google and Microsoft.

But as times get harder, companies must scale back to preserve profitability. Cutting or controlling direct costs such as labor and material costs can help.

Whenever a new management team takes over, one of the first areas is to see changes in the cost of goods sold. Companies will look to streamline costs, including the cost of goods sold.

In today’s post, we will learn:

- What are Costs of Goods Sold (COGS)?

- How to Calculate Cost of Goods Sold

- Accounting for Cost of Goods Sold

- What’s Not Included in Cost of Goods Sold?

- Comparing Cost of Goods Sold to Revenue & Operating Expenses

- Limitations of Cost of Goods Sold

Okay, let’s dive in and learn more about the cost of goods sold.

What are Costs of Goods Sold (COGS)?

We refer to the direct costs of producing a business’s products as its cost of goods sold (COGS). The cost includes the labor and materials employed to make the goods in this sum. It doesn’t include indirect costs like those associated with the sales staff and distribution.

The phrase “cost of sales” is another name for “cost of goods sold.”

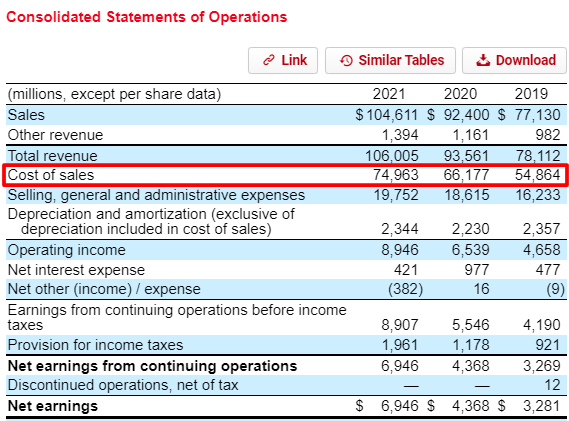

We can calculate a company’s gross profit by subtracting COGS from its revenues. COGS remains a crucial financial statement statistic we can find on the income statement. Gross profit offers us a measure of profitability that assesses how well a business manages its workers and resources during production.

Companies account for COGS as a business cost on the income statements because it remains a cost of doing business. Analysts, investors, and managers can predict the company’s bottom line with the help of the cost of products sold. Net income will go down if COGS rises. Although this change is helpful for tax considerations, the company will make less money for its owners.

Thus, companies work to keep their COGS low to increase their net profits.

The only costs included in the metric are those related to the production of the goods, such as labor, materials, and manufacturing overhead. Cost of goods sold (COGS) equals the cost of purchasing or making the things that a company sells during a period.

Below, we have some common examples of costs of goods sold:

- Raw materials

- Freight-in costs

- Purchase returns and allowances

- Factory labor

- Items purchased for resale

- Storage costs

- Factory overhead

For instance, COGS for an airline producer (Boeing) would include the labor expenses necessary to assemble the plane and the material prices for the parts that go into creating the plane. Costs associated would exclude those with moving the planes and hiring salespeople.

Additionally, Boeing would not consider these costs when computing COGS for the planes not sold, whether the costs are direct or indirect. In other words, COGS covers the direct costs associated with producing the products that customers purchase during the year.

Ask yourself: “Would this expense have been an expense even if the company generated no sales?” as a general rule to determine if an expense qualifies as COGS.

An easy way to think about COGS: consider the business model and how they produce what they sell.

For example, Boeing needs materials and people to build the physical planes. They also need R&D and salespeople to sell those planes.

If Boeing needed to cut costs in labor, they would need to decide if it is in production or sales, for example, which would impact where those adjustments would sit on the income statement, either in COGS or operating expenses.

How to Calculate Cost of Goods Sold

The formula to calculate costs of goods sold (COGS) equals:

COGS = Beginning Inventory + Purchases – Ending Inventory

The COGS account on the income statement represents sold inventory. The stock left over from the prior year, or the goods that weren’t sold, serves as the initial inventory for the next fiscal year.

A manufacturing or retail business must include any further acquisitions or productions in its starting inventory. The products that weren’t sold are deducted from the total of the initial inventory and new purchases at the end of the year. The cost of products sold for the entire year is the final result of the computation.

The current assets account is an account on the balance sheet. Inventory is a sub-item under this account. We only see a company’s financial situation depicted on the balance sheet at the end of an accounting period. This indicates the company records the ending inventory as the amount of inventory they record under current assets.

Accounting for Cost of Goods Sold

The corporation’s inventory costing method will determine the cost of goods sold.

We have three methods a company can use to record inventory, known as FIFO, LIFO, and the average cost method. Expensive or one-of-a-kind products use a specific identification procedure.

The three accounting methods most companies use:

- LIFO (last-in, first-out)

- FIFO (first-in, first-out)

- Average cost method

Finished inventory units produced first under FIFO comprise COGS, meaning they incurred those costs first. Finished inventory units produced last under LIFO comprise COGS, meaning those costs were incurred later or most recently. Consider a situation where a business bought supplies to make four products.

The production of the first three units costs $5. However, the final unit now costs $10 to construct due to escalating material costs. The business sold three units within the following time frame. According to FIFO, COGS would make the first three units made, which would equal $5 x 3 = $15.

According to LIFO, COGS would consist of the final three units produced, which would add to $20 ($10 x 1 + $5 x 2).

To get the unit cost of products available for sale under the weighted average, the total cost of items for sale divides by the number of units for sale.

To determine the cost of items sold, multiply this by the actual quantity sold. The weighted average per unit in the case mentioned above is $25 / 4 = $6.25. Therefore, the COGS for the three units sold is $18.75.

What’s Not Included in Cost of Goods Sold?

A lot of service businesses have no cost of goods sold at all. Generally accepted accounting standards (GAAP) define COGS as the cost of inventory products sold within a specific period. However, GAAP doesn’t address COGS directly in its rules.

Not only do service businesses not have any products to offer, but they also do not maintain any inventory. There is no way to deduct COGS costs if companies don’t include them on the income statement.

Some examples of these types of service businesses include:

- Accounting firms

- Law firms

- Real estate appraisers

- Business advisors

- Professional dancers

The above list includes businesses we might consider pure service businesses, and thus no costs of goods sold.

We have several examples of different business models that don’t have the cost of goods sold.

For example, the banking and insurance business has no COGS on its income statements because they generate revenue from interest income and fees; they have no cost of goods sold.

You could argue that companies like Visa and Mastercard also have zero costs of goods sold because they generate revenue from fees. For example, Visa’s latest gross margins, which equals revenues minus cost of goods sold, equals 97.5%. And Mastercard lists zero costs of goods sold on their income statement, equaling 100% gross margins.

All of these sectors do not publish COGS even though they incur costs on a regular basis to supply their services and have business expenses. They instead have what is known as “cost of services,” which doesn’t count towards a cost of goods sold deduction.

As businesses and the economy move towards lighter asset models, the focus remains on the internet. We will see a growing number of companies with a smaller cost of goods sold or an increase in gross margins or profits among a larger group of companies.

We will also see companies trying to control costs in those types of businesses, focusing on reducing head counts or labor.

For example, Amazon, Google, Meta, and Microsoft announced they would lay off many employees. Some of these will fall into the sales, R&D, and admin categories. But some will fall into the production side, and as the lines blur in these types of companies, we will have to readjust how we look at profit margins and costs.

Other costs excluded from the cost of goods sold include interest expense and capital expenditures.

For example, interest is a company’s cost when it takes on debt. They may use the debt to fund a new project or expand, but the interest they pay doesn’t impact a company’s direct sales.

Likewise, capital expenditures such as buying a plant, buying more equipment, and reinvesting in new projects to grow don’t fall under the cost of goods sold umbrella.

For example, if a company reinvests its cash flows, the money spent can go towards a wide range of items, such as new computers, new software, research & development, and hiring new sales teams. All of these will grow the company in the long term, but hiring new sales associates takes time to bring them online, train, and deploy effectively.

Comparing Cost of Goods Sold to Revenue & Operating Expenses

For ongoing contract services, expenses of revenue exist, including those for raw materials, direct labor, shipping, and commissions given to sales staff.

Nevertheless, companies cannot claim these goods as COGS without a physically created good to sell, even instances of “personal service businesses” that do not include COGS in their income statements provided on the IRS website. Doctors, attorneys, carpenters, and painters are a few of these.

We have many examples of service-based businesses selling things.

For instance, while selling presents, food, beverages, and other products, hotels and airlines primarily provide services like transportation and accommodation. No one would argue these consist of goods, and these businesses undoubtedly have an inventory of them. These two industries can include COGS in their revenue statements and deduct them from taxes.

Cost of goods sold (COGS) and operating expenses are both expenses businesses incur to run their operations; however, the companies break out the expenses on the income statement. Operating expenses (OPEX) are costs not directly related to creating goods or services, in contrast to COGS.

Under operating expenses, we will find SG&A (selling, general, and administrative expenses) as typical operational expenses. SG&A costs are expenses like overhead costs that are not directly related to a product. The following are some examples of operating expenses:

- Utilities

- Office Supplies

- Rent

- Sales and marketing

- Legal costs

- Payroll

- Insurance costs

- Bonuses

Limitations of Cost of Goods Sold

Accountants can easily manipulate the cost of goods sold by adjusting what they want to falsify their financial records. They may modify it by:

- Overvaluing current inventories

- Allocating higher costs to manufacturing than those incurred.

- Overvaluing discounts or mis-stating those discounts

- Overstating returns to suppliers

- Adjusting the ending inventories compared to the current levels

- Not writing off old or obsolete inventory

When companies underreport COGS due to artificially inflated inventory, the gross profit margin will be larger than it is, resulting in an inflated net income.

When examining a company’s financial records, investors can identify questionable inventory accounting by looking for signs of inventory accumulation, such as an increase in inventory that is more rapid than reported sales or total assets.

Some of the bigger blowups in the markets centered around companies like Enron, Lehman Brothers, and Luckin Coffee. These companies used financial shenanigans to mislead investors.

They used accounting trickery to adjust debt amounts, “made” up revenues, and adjusted inventory levels, all to mislead investors and make their financials look “better.”

Investor Takeaway

The direct cost of creating a good, which includes the cost of the labor and materials used to make the good, is known as the cost of goods sold.

COGS has a direct impact on a company’s profits because it reduces revenue. For businesses to achieve larger profitability, COGS management is essential. A business may be more successful if it can lower its COGS through improved supplier negotiations or increased production process efficiency.

Finding competent management teams includes looking for companies who control their costs, driving more profits.

We want to find profitable companies, and companies with good profit margins indicate a good business and a capable management team. If the company carries lower gross margins than competitors, you might want to investigate why. These remain part of the process of finding great companies.

We can use the cost of goods sold to measure how well a company manages its costs compared to its historical performance and competitors.

And with that, we will wrap up our discussion regarding the cost of goods sold.

Thank you for reading, and I hope you find something of value. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- What are Selling, General, & Administrative Expenses? In the tech world, SG&A costs occupy a large part of the company’s costs. For many companies, these costs will inevitably occupy a high cost...

- What’s the Difference Between Revenue and Profits? An investor must comprehend how revenue enters a corporation and transforms into profit. Here’s how it all works, including instances of unusual cost structures. Revenues...

- Beginner’s Guide to Total Current Assets You can use total current assets to assess a company’s financial standing. Today’s post will teach us the formulas to use and what to do...

- Difference Between Operating Leverage and Economies of Scale “Do you know the difference between operating leverage and economies of scale? Seriously, take a moment to define the terms clearly (I did not know...