When we think of spending money, we are usually most concerned with how much we spend. However, determining how you spend your money is essential. That little piece of plastic you swipe at the register makes a difference. This post will cover credit and debit card advantages and disadvantages.

Spoiler: Overall, the winner is a credit card. Read below to learn exactly why.

Click to jump to a section:

- What is a Debit Card?

- What is a Credit Card?

- Debit Card Advantages

- Debit Card Disadvantages

- Credit Card Advantages

- Credit Card Disadvantages

Let’s define a few things before we dive into the credit vs. debit comparison.

What is a Debit Card?

A debit card is a direct link to your checking account. Any money spent on a debit card is immediately withdrawn from your bank account.

This also means you cannot spend more than is available in your bank account. If you have $1,000 in a checking account, the most you could spend on your debit card is $1,000.

You must have a checking account with a bank or third party to use a debit card. They won’t link to a savings account as these are designed to hold onto funds for longer.

Debit cards usually don’t have any fees associated with them. Since it is a simple link to your checking account, there is little maintenance to deal with on the bank’s end.

What is a Credit Card?

Credit cards are significantly more complicated than debit cards.

A credit card gives you access to a loan, up to a limit, from a bank or third party. The size of this loan is determined by several factors associated with your credit score, such as how reliably you pay back loans, how many loans you have, how long you have been loaning for, and a dozen other considerations.

Not only are credit cards affected by your credit score, but they can directly affect your credit score. Keeping in good standing with your credit card can significantly impact raising your credit to help you in other areas of your financial life. A high credit score can help with lower interest rates and even being approved to rent where you want.

The limit on a credit card is a credit limit. A credit limit is a soft limiter because you can technically spend past it. However, doing so will significantly damage your credit since you appear risky to future creditors.

Credit cards can be spent anywhere that debit cards can. Either method is the same from the merchant’s point of view.

Since credit cards tap into a pool of credit instead of a bank account, they must be paid off periodically. Usually, this will be done using a checking account. These payments are due by a specified date, and interest is charged if the debt is not paid on time.

Credit cards usually offer additional perks to entice customers to use their network. This is because credit card companies make money off users who fail to pay off their debts in time in the form of interest. Interest is direct profit for the credit card company.

Read more to learn about credit cards pros and cons.

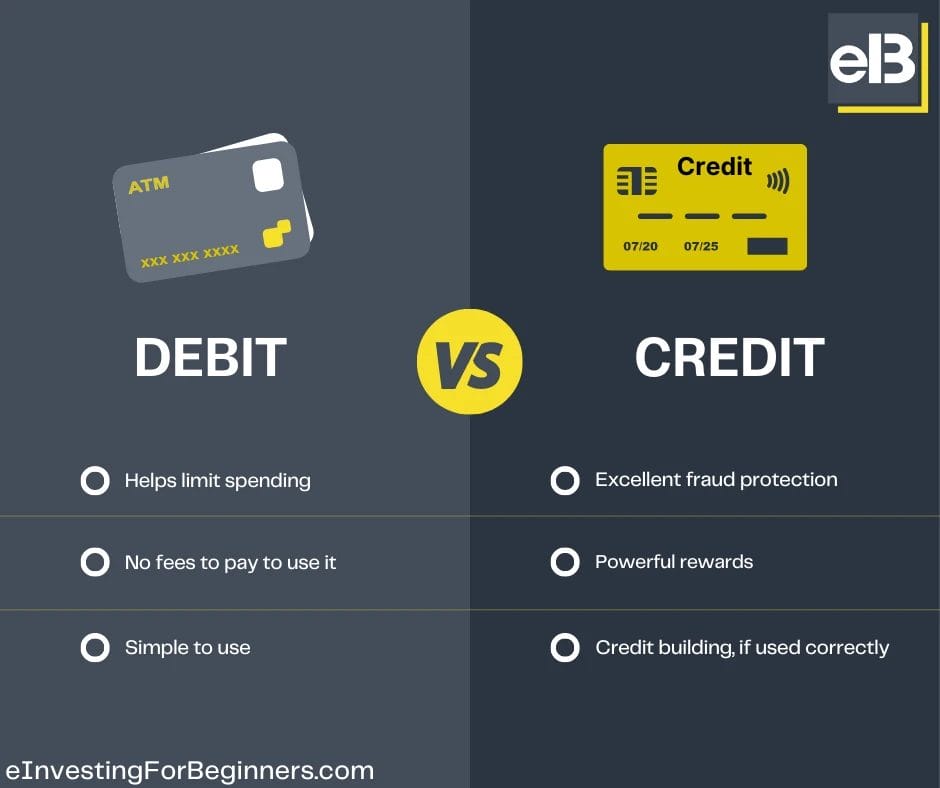

Debit Card Advantages

Lock Down Your Spending

Balancing your finances and spending is difficult as it is. It can be helpful to see spending immediately impact your bank account. This removes the temptation to keep spending, feeling like your money isn’t decreasing as you spend.

With a debit card, a $10 meal immediately shows up in your checking account. However, the $10 is taken out of your credit limit on a credit card, and your checking account remains untouched for now. A glance at your bank account would show no change and make you more comfortable making additional purchases.

Plus, immediate withdrawal means that you can’t spend beyond your means. Reaching the bottom of your checking account charges hefty overdraft fees and halts additional purchases.

If you want to lock down your spending and need outside influence to keep you in line, a debit card can be helpful.

No Fees

Debit cards are available with a checking account with no additional fees. If all you need is direct access to your bank account, a debit card offers that.

If you are trying to save money, additional fees can eat into that goal. An extra $10/month may not sound like much, but every little bit makes a difference when trying to tighten your belt.

Convenience

Debit cards are a substitute for a paper check. Compared to these, debit cards are incredibly convenient. A swipe or tap, and you’re on your way.

In addition, debit cards are required for ATM transactions. A debit card is a must-have if you often deposit or withdraw cash from ATMs.

Debit Card Disadvantages

Lack of Fraud Protection

Because of the immediacy of spending through a debit card, it can be challenging to reverse. Alerting your bank within two business days may limit your liability for fraudulent charges to $20. Waiting past this can raise your liability to $200. If you wait over 60 days, you can be liable for all fraudulent spending.

Nowadays, most debit cards offer immediate closure through the bank’s app or website. However, this requires you to keep an eagle eye on your account. Missing even a few transactions can quickly add up to thousands in fraudulent spending.

I have personally had my debit card fraudulently charged a couple of times. My bank was kind enough to cover the fraudulent charges completely, but I was lucky. I saw the payment notifications pop up, alerting me quickly enough to freeze the card and contact my bank immediately.

Make sure you have notifications turned on for debit cards. That simple popup on your phone can easily save you thousands.

Debit cards are not a good choice for online spending. It is far too easy for a computer virus or sketchy website to scrape your card info and go on a shopping spree.

Overdraft Fees

Not all banks charge overdraft fees nowadays. However, most do.

Overdraft fees occur when you spend more than is available in your account. Typically, this is a charge of $35 per transaction past your balance.

This may not sound outrageous, but this applies even if you bought an $8 lunch. Paying four times the cost of your transaction just in fees is a massive loss.

Always leave a cushion at the bottom of your checking account to ensure you don’t incur overdraft fees. Or, if this is a concern for you, sign up with a bank that offers lower or no overdraft fees.

Lack of Credit Building

Having good credit is incredibly helpful. It can lower interest rates on mortgages and auto loans, get you approved for renting even past the 3x rent rule, have higher credit limits, and many others.

However, a debit card won’t help you achieve this. Since a debit card is directly withdrawn from your bank account, no loan is used. You aren’t proving to any creditors that you can handle paying off debt reliably.

Using a debit card won’t hurt your credit at all. But it also won’t help it.

Credit Card Advantages

Fraud Protection

Credit cards have fantastic fraud protection. Most large companies nowadays offer zero liability protection. You will not be responsible for any fraudulent charges on your account.

Any time you purchase on a semi-questionable website or at a semi-questionable merchant, use your credit card. Even if someone manages to steal it, you will be safe.

Rewards

One of a credit card’s most directly beneficial aspects is the rewards. These rewards are usually cashback but may also include points, travel points, discounts, exclusive deals, signup bonuses, etc.

While some of these rewards are just baiting you to spend money, cashback and signup bonuses are especially useful.

Good credit cards give you cashback on every purchase, with higher cashback on specified categories. For example, there is 1.5% back on everything and 3% back on groceries.

Though these percentages are low, they add up over time. Plus, that $10 meal would be $10 regardless of whether you get cashback, so why not get $.30 back? When you spend thousands on a credit card each month, cashback can quickly turn into $50 every single month back.

Signup bonuses come as a lump sum when you sign up or spend a specified amount in a specified time frame. Assuming it is within your normal spending range, that is free money. These bonuses are usually hundreds of dollars.

Keep an eye out for even more powerful rewards through branded credit cards. For example, most generic credit cards give around 1.5% cashback. However, if you get an Amazon-branded credit card, you can get 5% back on Amazon purchases.

Credit Building

As mentioned, credit is essential. The level of your credit can affect many aspects of your life. A credit card is a fantastic way to build it.

Credit cards can help build your credit when you pay them in full and on time, maintain a low balance, have several cards open, and many other factors. To learn more surprising tips on using a credit card to build credit, read this post.

Not Limited by Bank Account

Credit cards can help you make large purchases that exceed your checking account but not your credit limit. Charging it to a credit card gives you time to move money around to pay off the card when the charge comes due.

Some people prefer to keep money in multiple bank accounts. If you fall into this category, a credit card could help you cover large purchases more easily.

Delayed Payments

You don’t actually pay for credit card charges until they come due monthly or if you decide to pay them off early. This delay can be helpful.

Especially if you run a business, having a short-term loan on funds (a month long in this case) gives you access to your money for longer. With a credit card, you can use that money to reinvest in the business. With a debit card, you immediately lose capital.

A credit card may help if your business has the capability of a quick turnaround on invested capital.

However, make sure that you do have the money to cover the purchase. If you fail to pay it off completely at the end of the month, you will be charged heavy interest rates.

Credit Card Disadvantages

Complicated Structure

Credit cards are not as simple to use and manage as debit cards. You have to track how close you are to your limit (<30% at most), when payments are due, and maximize your cash back.

Though these headaches are all worth the benefits, they are sometimes frustrating.

Ability to Overspend

Where people most often get in trouble with credit cards is overspending. Credit cards become a sort of emergency fund that allows them to spend beyond their means simply because they have the credit limit to cover it.

Overspending on credit cards and falling into debt is one of the leading causes of financial struggle in America. Sadly, this is what credit card companies hope for. They make their real money when you fail to pay and owe them interest.

Falling into debt hurts you financially since you have to prioritize paying it off. This also limits you from other money-making opportunities such as investing.

The best way to manage this is to treat your credit card like a debit card. Keep a rough estimate of what you have spent on it in your head, and subtract that from your bank account.

Another great way to avoid this is to pay it off more frequently. This will keep you well below your limit and help line up your credit card and bank account.

High Interest Rates on Carried Balance

You carry a balance when you fail to pay off your credit card completely when it comes due. Credit card companies charge interest on this carried balance, penalizing you for not paying them back. Depending on your credit, these interest rates are usually at least 20%, sometimes 30%.

There is a myth that carrying a balance is good for your credit. This myth is 100% wrong and only helps the credit card companies you pay interest to.

The real danger is in compounding. Failing to pay off $100 once will cost you at least $20. If you let that single charge ride another month, it would go from $120 in carried balance to $144 ($120 + 20%).

Compounding is great for building wealth in the stock market. However, compounding credit card interest rates is even better at eliminating your wealth.

Conclusion

All in all, credit cards are better for most situations.

Apart from security, credit cards primarily win due to their rewards. Credit card rewards directly save you money on every single purchase. Even if you have good credit already, there is no reason to pay more for the same item by using a debit card.

Evan Raidt

Evan is a personal finance blogger passionate about bringing beginner investors into the stock market world.

Related posts:

- Credit Cards? Pshh. Let’s Break Down the Debit Card Advantages and Disadvantages In the personal finance community, there are many varying opinions on all topics imaginable. And as you might anticipate, some of them can get pretty...

- A Deeper Look at all of the Credit Card Pros and Cons that Exist We now live in a world where most people solely use credit cards, cash is a blast from the past. Check out these credit card...

- Evaluating the Allegiant Credit Card Perks and if it Makes Sense for You When it comes to choosing a credit card and rewards program, there are a ton of different options to choose from. Keep reading to see...

- Understanding all the Visa Perks on Different Credit Card Options With so many different credit card options available, it’s important to weigh all the possibilities. Check out the Visa perks on these different cards and...