“The real key to making money in stocks is not to get scared out of them.”

-Peter Lynch

Drawdowns are a part of life for every investor. If you own stocks for the long run, you will experience them at some point.

To hold stocks long-term, we must understand drawdowns, their causes, and how to avoid or deal with them.

In today’s post, we will learn:

- What is a Drawdown?

- How Do We Measure Drawdowns?

- What Are the Common Causes of Drawdowns?

- Types of Drawdowns

- Managing Drawdowns: Strategies and Psychological

- Case Studies of Drawdowns

Okay, let’s dive in and learn more about drawdowns.

What is a Drawdown?

A drawdown is how much a stock price declines before recovering from its peak or high point.

We can define a drawdown as a percentage decline of a company’s stock price before returning to the original prices or beyond.

You can think of it as the difference between the peak value of Google and the lowest trough of value.

If you own individual companies, you will experience a drawdown or two. It is a part of investing for the long term and can offer opportunities to buy great companies during a drawdown.

Here are a few examples from Chris Mayer:

- Apple, from its IPO in 1980 through 2012, was a 225-bagger. But you had to sit through a peak-to-trough loss of 80% — twice! And there were several 40% drops.

- Netflix, a 60-bagger since 2002, lost 25% of its value in a single day — four times! And there was a four-month stretch where it dropped 80 percent.

- And Berkshire Hathaway, the best-performing stock in the study, was cut in half four times.

How Do We Measure Drawdowns?

The analysis of drawdowns is an essential element in financial assessment, akin to quantifying the degree of asset value reduction within a specific timeframe.

To illustrate this concept, let us focus on Berkshire Hathaway’s case during the tumultuous market conditions of March 2020, a notable instance of stock price volatility and recovery.

Consider Berkshire Hathaway as an investment portfolio. Its value, similar to financial assets, experiences fluctuations.

Before the market turbulence in March 2020, Berkshire Hathaway reached its zenith, signifying its peak value. In this analogy, the peak represents the highest point of asset valuation.

Conversely, the trough signifies the nadir, comparable to when the asset’s value descends to its lowest point during market downturns.

The calculation of drawdowns entails quantifying the extent of diminution from the peak to the trough. It is akin to determining how much the asset’s value has declined from its peak to its lowest point.

We can express drawdowns in a percentage and a monetary figure.

A percentage drawdown calculates the reduction in value concerning the asset’s peak, while the dollar drawdown assesses the actual monetary losses.

For example, during the market turmoil of March 2020, Berkshire Hathaway’s stock prices experienced a substantial drawdown. Specifically, the stock witnessed a percentage drawdown of approximately 31% from its peak value. In terms of dollar drawdown, this translated to a reduction of around $98 billion in market capitalization during the same period.

However, the stock market, akin to the asset within the portfolio, demonstrates resilience and recovery.

Berkshire Hathaway’s value showcased a resurgence after the drawdown, highlighting the market’s ability to rebound from adverse conditions. Understanding the concept of drawdowns empowers investors to comprehend and navigate market dynamics effectively.

What Are the Common Causes of Drawdowns?

Drawdowns, or declines in the value of investments from their peak to trough, can be attributed to various factors.

These causes can typically be classified into external and internal influences, each with unique implications for investment portfolios.

Let’s explore some of the most prevalent causes of drawdowns.

External Factors:

1. Market Volatility: Market volatility is a primary external factor contributing to drawdowns. Financial markets are subject to fluctuations driven by supply and demand dynamics, geopolitical events, and changes in investor sentiment. These variations can lead to both short-term and prolonged declines in asset prices.

2. Economic Downturns: Economic conditions have a significant impact on investments. Economic downturns, such as recessions, can result in reduced consumer spending, lower corporate earnings, and increased unemployment. These factors collectively contribute to drawdowns in stock prices and portfolio values.

3. Geopolitical Events: Geopolitical events, like trade disputes, international conflicts, or political instability, can have far-reaching investment consequences. These events introduce uncertainty into the global economic landscape, leading to fluctuations in asset values.

Internal Factors:

1. Company-Specific Issues: Internal factors within a company can trigger drawdowns. These may include product recalls, legal disputes, or quality control problems. For example, a pharmaceutical company may experience a drawdown in stock price due to regulatory issues affecting one of its key drugs.

2. Management Decisions: Leadership decisions can be pivotal in causing drawdowns. For instance, a poorly executed merger or acquisition may result in financial challenges and operational disruptions for the involved companies, leading to stock price declines.

3. Financial Challenges: Financial issues, such as high debt levels, liquidity problems, or weak cash flow management, can exert substantial pressure on a company’s stock performance. When a company struggles with managing its finances, investors may lose confidence, causing a drawdown.

Understanding these common causes of drawdowns is crucial for investors.

Individuals can make informed decisions about their portfolios by recognizing the various external and internal factors that can lead to investment losses.

Types of Drawdowns

Understanding drawdowns in investments is not merely about calculating numbers; it’s about comprehending the context and implications of these fluctuations.

Drawdowns come in two primary forms: temporary drawdowns, often referred to as corrections, and prolonged drawdowns, which are commonly known as bear markets.

Let’s delve into the characteristics of each and explore how these events influence portfolio values and investor psychology.

Temporary Drawdowns (Corrections):

Temporary drawdowns, or corrections, are like the occasional bumps on a smooth road. These are typically short-lived, sharp declines in the value of an asset or the broader market.

We can characterize Corrections by a decrease of 10% or more from recent highs, and they can happen relatively swiftly.

Investors often experience corrections as part of the market’s natural ebb and flow. While they can be unsettling, we should consider corrections healthy because they help prevent asset bubbles and realign prices with underlying fundamentals.

During corrections, investors may reevaluate their portfolios and sometimes make minor adjustments, but maintain their long-term strategies.

Prolonged Drawdowns (Bear Markets):

On the other end of the spectrum are prolonged drawdowns, known as bear markets. These are more like a challenging trek through rough terrain.

Bear markets signify a sustained period of declining asset values, commonly defined as a decline of 20% or more from recent highs.

Bear markets can be psychologically taxing for investors, as they often entail prolonged uncertainty, economic downturns, and negative sentiment.

Investors may suffer significant losses during these periods, leading to anxiety and fear. The temptation to abandon long-term strategies and sell investments at an inopportune time is a common response to bear markets.

Impact on Portfolio Values:

Drawdowns, whether temporary or prolonged, directly impact portfolio values. During drawdowns, the value of assets within a portfolio decreases. The decline’s extent depends on the drawdown’s severity and duration.

In the case of corrections, the impact on portfolio values is typically less severe and short-lived. Investors often view corrections as buying opportunities and may use them to rebalance their portfolios.

In bear markets, the impact on portfolio values can be more substantial. A sustained decline can erode a significant portion of an investor’s wealth, necessitating a longer time frame for recovery.

Let’s talk about some history to put all of this in context.

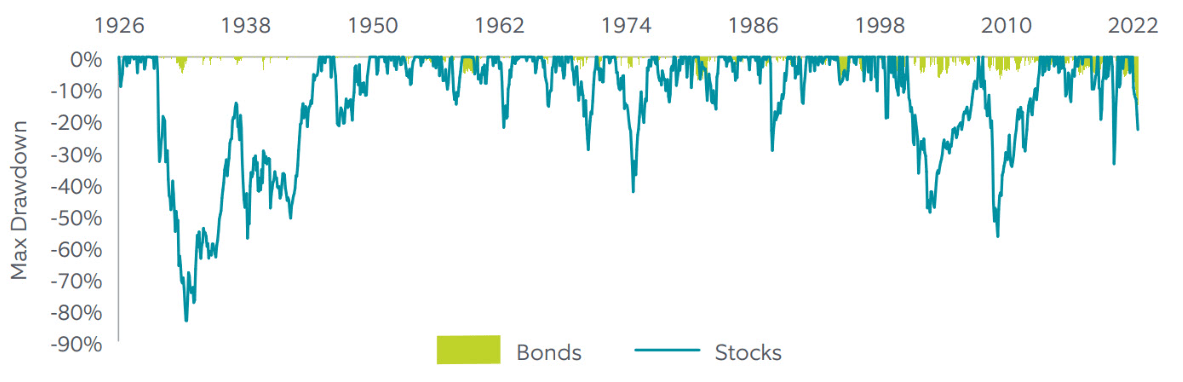

The annualized returns for the stock market from January 1926 to June 2022 equaled 9.6% for stocks. Compare this to the inflation rate of 2.9% during the same period.

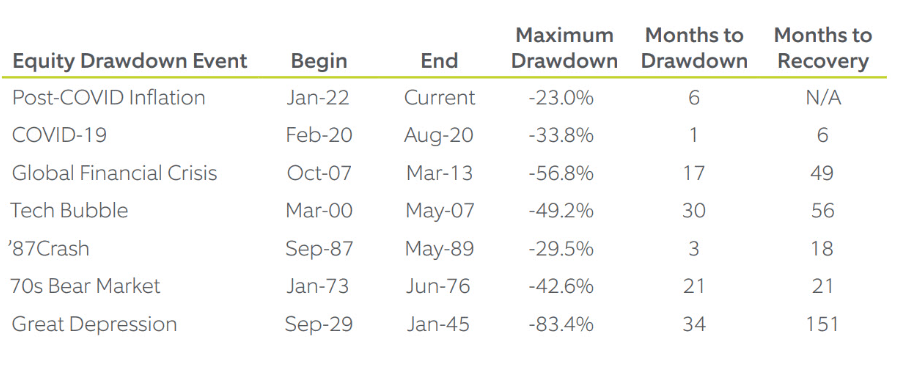

During this same period, the stock market experienced seven major drawdowns. The average drawdowns for stocks during the period equaled 45%, with the biggest drawdown (Great Depression) equaling 83%.

The COVID drawdown was the quickest, only one month, equaling a 33.8% drop and rebounding in only six months. The COVID drawdown was the fastest drop and quickest rebound in history — whiplash at its best.

Managing Drawdowns: Strategies and Psychological

As investors journey through the dynamic world of financial markets, they encounter various challenges, including drawdowns – the decline in the value of their investments.

While these fluctuations are an inherent part of investing, strategies to mitigate drawdown risk and psychological aspects require careful consideration.

Mitigating Drawdown Risk

One effective strategy to reduce drawdown risk is diversification. Diversification involves spreading investments across various assets, such as stocks, bonds, and real estate.

This helps lower the impact of drawdowns on a portfolio. If one asset class experiences a significant decline, other assets may remain stable or increase in value, providing a cushion against losses.

Another key approach is asset allocation.

Asset allocation involves determining the proportion of your investments in different asset classes based on your financial goals, risk tolerance, and time horizon. By carefully allocating assets, investors can create a well-balanced portfolio that aligns with their objectives, reducing the potential impact of drawdowns.

Psychological Aspects of Drawdowns

Drawdowns often trigger a range of emotions in investors, including fear, anxiety, and frustration.

When portfolio values decline, it’s natural to feel concerned about the impact on financial goals and retirement plans.

Moreover, drawdowns can lead to impulsive decision-making, such as panic selling during market downturns. This behavior can have detrimental consequences, causing investors to lock in losses and miss out on potential recoveries.

To navigate the psychological aspects of drawdowns, investors can employ several standard strategies (oldies, but goodies):

1. Develop a Well-Defined Investment Plan: A clear and comprehensive investment plan can help maintain focus during challenging times. The plan should outline financial goals, risk tolerance, and a strategy for managing drawdowns.

2. Long-Term Perspective: Understand that drawdowns are part of the investment journey. Maintaining a long-term perspective can help put short-term fluctuations into context and reduce the temptation to make impulsive decisions.

3. Regular Review and Rebalancing: Review and rebalance your portfolio to align with your asset allocation targets. This ensures that your portfolio aligns with your goals and risk tolerance.

4. Seek Professional Advice: Consider consulting a financial advisor who can provide guidance and support during market downturns. Advisors can offer a rational perspective and help you stay disciplined.

5. Avoid Emotional Decision-Making: Emotional reactions can lead to poor investment choices. Avoid making decisions based on fear or panic. Instead, stick to your investment plan and consult with a financial professional if needed.

Case Studies of Drawdowns

Investing in the financial markets is a dynamic endeavor marked by highs and lows. Drawdowns and asset value declines are an inherent part of this journey.

By examining real-world case studies of companies or stocks that have faced significant drawdowns, investors can uncover valuable lessons and insights into the factors contributing to these challenges.

1. General Electric (GE)

Once an industrial titan, General Electric experienced a substantial drawdown in the early 2000s. General Electric caused the drawdown by its substantial financial services division’s exposure to risky assets.

As the financial crisis of 2008 unfolded, GE Capital faced mounting losses due to these risky investments, leading to a significant drawdown in the company’s stock price.

Lessons from this case include the perils of overexposure to one business segment and the importance of prudent risk management.

2. Enron

Enron’s case is notorious in the annals of financial history.

Enron precipitated the energy company’s drawdown by corporate fraud and accounting scandals. Enron’s stock, once highly sought after, plunged to virtually nothing. This case underscores the importance of transparent financial reporting, ethical business practices, and vigilant oversight.

3. Microsoft and Cisco

During the late 1990s and early 2000s dot-com bubble, tech giants Microsoft and Cisco experienced significant drawdowns.

Both companies were at the forefront of the technology boom, and their stock prices soared remarkably. However, the subsequent drawdown resulted from the dot-com bubble bursting, which revealed the overvaluation of many tech stocks.

Microsoft and Cisco’s stock prices plummeted as investors reassessed the intrinsic value of these companies. In fact, Cisco has not recovered its dot-com price to this day, and Microsoft took over 14 years to recover.

In this case, the drawdown emphasizes the importance of not succumbing to the euphoria of market bubbles and carefully evaluating a company’s fundamentals and growth potential.

It serves as a stark reminder of the perils of speculative investing and the need for due diligence when assessing stocks. Investors can learn from this historical episode to avoid the pitfalls of irrational exuberance and focus on companies’ long-term viability rather than short-term market trends.

4. Lehman Brothers

Lehman Brothers’ drawdown in 2008 was one of the most dramatic episodes during the financial crisis.

The investment bank’s excessive exposure to subprime mortgages and inadequate capital led to its eventual collapse.

This case study highlights the critical importance of prudent risk assessment, capital adequacy, and the systemic risks that financial institutions can pose to the broader economy.

5. Nokia

Nokia, a dominant player in the mobile phone industry, experienced a significant drawdown during the early 2010s. The company struggled to compete in the smartphone market, losing ground to competitors like Apple and Samsung.

This case underscores the need for companies to remain innovative and flexible, adapt to changing consumer preferences, and not rest on past successes.

6. Volkswagen

Volkswagen faced a substantial drawdown when it became embroiled in a global emissions scandal in 2015.

The company admitted to manipulating emissions test results, leading to a sharp decline in its stock price and a loss of trust among investors. The case emphasizes the significance of ethical conduct and corporate responsibility in maintaining investor confidence.

Key Lessons for Investors:

- Diversification is essential to mitigate the impact of drawdowns. Overexposure to a single asset or sector can lead to severe losses.

- Prudent risk management and financial transparency are crucial for companies to weather economic challenges.

- Innovation and adaptability are vital for businesses to stay competitive in evolving markets.

- Ethical conduct and corporate responsibility are integral for maintaining investor trust.

By studying these real-world case studies, investors can glean valuable lessons, avoid potential pitfalls, and make more informed decisions when navigating the intricate landscape of financial markets.

Ultimately, understanding the causes and consequences of drawdowns can lead to more prudent and successful investment strategies.

Investor Takeaway

Understanding drawdowns is vital for investors.

It empowers them to navigate the inevitable peaks and troughs in the financial markets.

Key takeaways include distinguishing between temporary drawdowns (corrections) and prolonged ones (bear markets) and the impact of drawdowns on portfolio values and investor psychology.

By using diversification and asset allocation, investors can mitigate drawdown risks. Moreover, maintaining a disciplined, long-term perspective is essential to withstand emotional fluctuations during market downturns.

In essence, comprehending drawdowns equips investors with the knowledge and strategies necessary to make informed decisions, manage risk, and pursue financial goals with resilience and confidence.

And with that, we will wrap up our discussion of drawdowns.

Thank you for reading today’s post, and I hope you find something of value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and stay safe out there,

Dave

Related posts:

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...

- Mount Rushmore of the Greatest Fundamental Investors in the Stock Market Everything that Andrew and Dave preach on the podcast, and something that I have learned from them and quickly adopted, is the importance of understanding...

- Understanding Where Investment Returns Come From: Yield, Growth, and Multiple Expansion Achieving financial success in the stock market demands a profound grasp of the three sources of investment returns: Yield, Growth, and Multiple expansion. But how...

- How Often to Monitor Portfolio? Controversial Take, But I Say DAILY Anyone and everyone will tell you that you shouldn’t check monitor portfolio performance too often because it is going to cause you to make an...