Everything that Andrew and Dave preach on the podcast, and something that I have learned from them and quickly adopted, is the importance of understanding the numbers when investing so that we can be disciplined fundamental investors.

I mean, Andrew and Dave have really coined the term to “invest with a margin of safety, emphasis on the safety” and the only way that you can truly do that is by finding a company that is undervalued vs their intrinsic value, and they best way to do that is by utilizing the Value Trap Indicator.

Just as I said that I learned this important philosophy from Andrew and Dave, I think that it’s important for us all to find those leaders that we can try to mimic our own investment strategies after, so I figured it was time to narrow down the list…welcome to the Mount Rushmore of the Greatest Fundamental Investors in the Stock Market!

Peter Lynch

I feel like I have to start my list off with Peter Lynch. Not necessarily that he’s my #1 on the Mount Rushmore, but he has had one of the most important roles in shaping me personally as an investor. Lynch has written many books but the two that I love are ‘One Up on Wall Street’ and ‘Beating the Street.’

Both of these books have taught me not only the theory of investing but a great application to actually be able to apply his knowledge to get ahead in the market.

Lynch coined the term 10 Bagger because, well, he had a lot of them. Lynch was able to identify companies that had a great opportunity to become worth 10+ times what he paid for them and to be honest, isn’t that what we’re all hoping to be able to do?

He also created the PEG ratio, which essentially is taking the ever-common P/E ratio and then applying a growth aspect to it, hence the ‘G’ in P/E. He felt that while the current P/E is important, it only shows where the company has been and not necessarily where they’re going.

Two great quotes from Lynch that really sum up everything about him are:

“Know what you own, and know why you own it”

and

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

The first seems obvious, right? But if you’re like me when I first started investing, I couldn’t even tell you what sector some companies were in that I owned. All that I knew was that I heard them on CNBC as a “Final Trade” or on the “Lightning Round” and decided that I liked what was said and I was going to buy them.

Some of the time it worked, sometimes it didn’t – but I was 100% gambling, not investing. Don’t be like me.

And the second quote I love because so many people try to focus on timing the market, but you will likely miss out on gains waiting for the right time to get in. Just keep on dollar-cost averaging and take your gains. Even if you invested at the worst time ever you can make a ton of money, so why try to be an all-star? Just dollar-cost average and you will be just fine!

Benjamin Graham

Benjamin Graham is known as the “Father of Value Investing” so considering my infatuation of value investing, if he were to say, “Andy, I am your father” I don’t think he would be wrong….?

He wrote ‘The Intelligent Investor’ which many consider to be the one of the most important books ever, for any investor. Don’t believe me? Even Warren Buffett called it “the best book about investing ever written.”

To me, it’s one of the books that I can ready multiple times and pick up something new every time. I have ready it twice and am thinking it might be time to read it again. I try to ready it once/year and see what new things that I can take away from it, but my favorite lesson ever from it is when he talks about Mr. Market.

Essentially, he breaks down the mood of the market into terms that anyone can understand.

Graham was a huge advocate for dividend payments as well, and I think that you know that we feel the same way at einvestingforbeginners.com. Not only are dividends a great source of steady income, but if you DRIP them then you’re giving yourself the opportunity to earn compound interest on top of your dividends, which are also being compounded.

It truly is hard for me to decide between my two favorite Ben Graham quotes because there are so many , but if I was forced to do so, I would have the two noted below:

“Buy when most people, including experts, are pessimistic, and sell when they are actively optimistic”

and

“To have a true investment, there must be a true margin of safety. And a true margin of safety is one that can be demonstrated by figures, by persuasive reasoning, and by reference to a body of actual experience.”

The first quote really gets down to a simpler version of what value investing is. You’re buying from pessimists that have the company undervalued and then you’re selling to optimists that are willing to pay more than what the company is truly worth.

And the second quote is everything that Andrew, Dave and I preach – investing is about finding companies that are drastically undervalued and then making sure that there is a strong margin of safety. The way to do this is with numbers, which I would recommend using the Value Trap Indicator, and also thinking about the company on a qualitative basis.

If I had to recommend one book for all investors to buy, it would be ‘The Intelligent Investor.’ Normally I am all about renting books from the library if you can, but this book is one that you can ready many, many times, so do yourself a favor and grab a copy from Amazon.

Warren Buffett

Chances are, you have heard of Warren Buffett before. He, along with Charlie Munger, run Berkshire Hathaway and is commonly referred to as the greatest investor of all time.

Personally, I put Buffett on this list because he focuses on the most important investment strategy in my eyes, and that’s finding companies that are undervalued vs. their intrinsic value. I used to be somewhat of a skeptic of Buffett, but after reading his book, ‘The Essays of Warren Buffett,’ I can say that I have turned from skeptic into a firm believer.

It wasn’t that I thought he was a fraud or anything, but I just naturally have the tendency to have a contrarian view when so many others are all-in on a specific viewpoint.

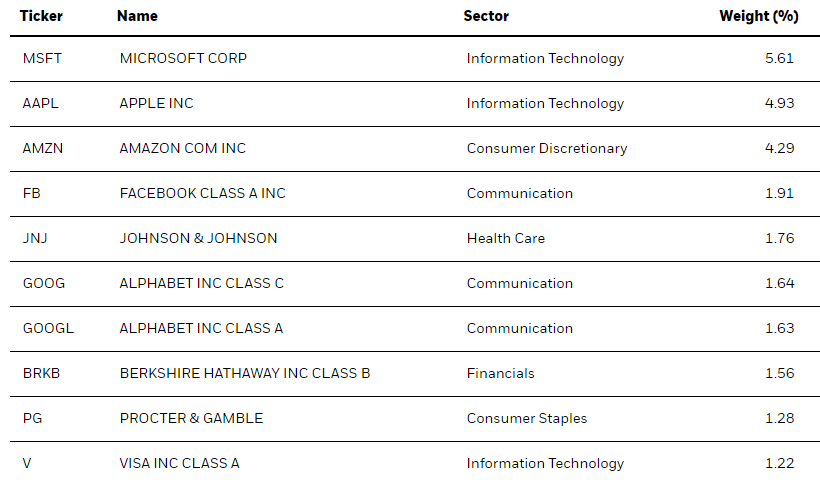

But like I said, I am sold on Buffett. Buffett owns a significant amount of business outright and also invests in many others, including the Top 10 Holdings of Berkshire listed below from Motley Fool:

If I were to sum up Buffett’s investing, it would be by using two of his own quotes:

“If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes”

and

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

I mean, it’s pretty simple, right? Find a great company that is reasonably priced and then think about how you would feel owning that company 10 years from now. Of course, your investing strategy needs to go much deeper than that, but if you can’t get past this step, then it’s likely time to stop thinking about that company!

Something that Buffett has also talked about is that he thinks the average investor shouldn’t actively manage their portfolio and that they should be invested in index funds. Believe it or not, I agree with him, but I think that by you reading this article it means that you’re not willingly allowing yourself to be average – you want to outperform the market!

Statistically speaking, half of us will be below average, so that’s what leads me to put my last member of the Mount Rushmore on this list!

Jack Bogle

Jack Bogle was the founder of Vanguard and is credited with being the father of the index fund, and for that, I think that we all owe him a big thank you. Bogle really focused on the fact that investing wasn’t built for the average person and he created the index fund with the goal of mimicking the stock market but for a much, much smaller fee than what was commonly charged to the average investor.

By mimicking the market and charging lower fees, he felt that this would allow the investor to beat the average investor without actually returning above average gains.

Bogle had 8 rules for investing and to be honest, I agreed with every single one of them:

- Select low-cost funds

- Consider carefully the added costs of advice

- Do not overrate past fund performance

- Use past performance to determine consistency and risk

- Beware of stars (as in, star mutual fund managers)

- Beware of asset size

- Don’t own too many funds

- Buy your fund portfolio – and hold it

Personally, I have ETFs in my portfolio for retirement, but they’re very far and few between. I hate a total market index in IVV, a Tech ETF in FTEC, and an airline ETF in JETS, but that’s it. They’re a very small percentage of my portfolio, but I take some sort of solace in having some exposure to all stocks, but I also know that ETFs can be very, very skewed, so it’s important to know what you’re investing in when you invest in them.

For instance, if you own IVV like I do, then 4-6% of your invested money is in each of MSFT, AAPL and AMZN. If you like all of those companies, that’s fine, but just be aware before blindly buying!

Two of my favorite Jack Bogle quotes are:

“If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.“

And

“Buying funds based purely on their past performance is one of the stupidest things an investor can do.”

I love both of these because the really talk about the mindset and philosophy of an investor. If you can’t stomach the very realistic possibility of losing not only 20%, but 50% of your portfolio, you need to not be in stocks. And if you ignore that advice then you will inevitably sell low, let the market rebound, and then end of buying in much higher – not good.

And the second quote is a great reminder to me personally being so number focused. I tend to really rely on the numbers, data and past performance of a company but that’s nothing more than the past. Sure, it’s a great indicator of how a company performs, but it’s definitely not a for guarantee for the future.

Past performance is absolutely important, but you need to do your due diligence to looking at where the company plans to go in the future, and a lot of that is going to be qualitative data, which admittedly is hard for me to utilize, but something that is absolutely pertinent in your philosophy if you want to be a successful investor!

So, there you have it – my Mount Rushmore of the Greatest Fundamental Investors in the Stock Market! If you were to replicate your investing philosophy after any one of them, even index funds, you won’t go wrong, just beware that you know what is in that index fund when you buy it and continue to monitor it.

My recommendation to you is to create your own Mount Rushmore! And I don’t mean just put four names on a piece of paper, I mean really go out and learn as much as you can about all investors out there and see what investor philosophies really stick and make sense to you.

The best way to learn is from others, and almost all of these investors have books published or a ton of content about their strategies that you can easily learn from.

The ball is in your hands. Are you going to pass or are you going to take your shot?

Related posts:

- Back to the Basics: What is Mr. Market? Why Are Prices So Volatile? Updated – 12/14/23 The stock market is a very emotional place. Why? Because it is made up of humans beings. Fear and greed are felt...

- How Just 1% Outperformance in the Stock Market Can Mean $100,000s For investors looking to put money to work for them, there’s few places better to make a return than the stock market. When combined with...

- Beginner’s Guide to Value Investing and Intrinsic Value, From the Top Investors Updated – 12/6/23 Value investing is all about finding stocks trading at a discount to their intrinsic value. Investors have used this strategy for decades...

- How Benchmarking Performance to an Index Keeps Investors Rational Have you ever heard the saying that “anyone can be a genius in a bull market?” Well, it’s true, if you’re not benchmarking performance of...