Dear Forgetful Andrew,

It’s really hard to remember the details when too much time passes. So I’m writing to you now so that hopefully you don’t forget what’s most important when the next bear market comes around.

We just exited through one of the fastest bear markets and recoveries that the stock market has ever seen.

Looking back, I guess it was really a correction, but while we were in it, it looked and felt like a bear market. The entire world was upended by a virus, and the unprecedented lockdowns created (what seemed like) eternal uncertainty. Not just in the economy, but with everyone’s personal lives as well.

Fast forward from the correction, the scare from the temporary freezing of the bond market, and the sky-high surge in unemployment, and now the world has proven it can adapt.

Humankind found a way to adapt, have an economy, and survive, like it never had before.

And perhaps that’s lesson #1 for the next bear market:

- Humans are extremely good at adapting to “the end of the world”

A little over 12 months since we had the pandemic scare, we’re still in the throes of a pandemic, but vaccines have been rolled out and we are rebuilding.

The macroeconomic environment is showing signs of inflation, with the prices of homes, timber, and even corn skyrocketing in recent months. The Fed has committed to keeping the Fed Funds Rate low, and fears about rising interest rates abound.

We just saw the 10-year Treasury cross above 1%, then 1.5%, which triggered a sell-off in the once impenetrable tech growth stocks.

Some policy makers think we should raise interest rates to cool off the roaring hot, rebounding economy—it’s impossible to know what’s going to happen next.

And that’s been the theme throughout 2020 and early 2021; everybody has had their ideas about what’s going to happen next but nobody knows for certain.

With all of the uncertainty that comes with a crisis, we get a tsunami of noise. During uncertainty, we crave explanations and projections.

We want chaos neatly boxed and organized. We want to know that things are progressing back to the plan.

Like the Joker said, “nobody panics when things go ‘according to plan.’ Even if the plan is horrifying!” and, “Upset the established order, and everything becomes chaos.”

Things brings lesson #2 for your next bear market:

- Don’t get distracted by the macro. Focus on the micro (great companies)

As the market is crashing and people are pontificating about the recovery, most of the attention isn’t on analyzing businesses but rather on analyzing events.

This is the time where investors want to hear about the Fed, interest rates, unemployment, GDP—you know, the stuff that’s usually in the background when things are good.

Suddenly, macroeconomists and macro investors are thrust into the spotlight, and their ability to analyze the latest events takes the center stage in the media and online.

People will suddenly become interested in history (myself included), and will want to study previous crises and doomsday events (the Spanish Flu, the Great Depression, etc).

Don’t waste your time on this noise!

If I had one regret with the bear market of 2020, it’s that I spent too much time on the macro and not enough on the micro.

It’s a lesson well learnt.

While I did a great job adding a beaten up tech stock in April 2020, I succumbed to the noise and purchased a grocery stock in May 2020, when there were so many other bargains out there.

Why?

Because all of the attention was on the macro, on events, and all of a sudden defensive stocks were hot.

Stay away from what’s hot!

Great deals in the stock market are likely to come and go in a flash, and if you’re not committing to finding those deals 110% then you might get only 50% of the benefit rather than 100%, which is a shame (and incredibly common mistake of most investors).

But don’t beat yourself up, because lesson #3 for the next bear market is:

- It’s going to be alot harder to buy low than you think. Do it anyway

It’s a cliché as old as time, but everybody wants to buy low and sell high. Pretty much every investor out there thinks that will be the ones to buy “when there’s blood in the streets”.

But even Warren Buffett wasn’t able to take full advantage of the 2020 bear market, and he’s one of the best investors of all-time.

In fact, Berkshire’s latest annual meeting was just held over the weekend, and this was one of the qualms from an investor during the Q&A session. Why wasn’t Berkshire more aggressive when the market had its latest flash sale?

As he explained, Buffett’s #1 priority is to keep his business and investors solvent. For an insurance company facing an unprecedented black swan, this might’ve meant keeping more cash liquid than would’ve been ideal.

It’s easy to play armchair quarterback.

But when the bond market froze up to an extent that even an investment grade company like Berkshire would’ve been unable to issue debt, cash is king and essential for survival.

We were facing the possibility of zero revenues for an incredible amount of businesses because of the pandemic. How can you make revenues when everything is shut down?

Again, with hindsight, we adapted and found a way.

But there was no guarantee we would do so very quickly, and there was plenty of carnage of businesses who did not have the balance sheets to withstand this crisis (Hertz, JC Penney, Chesapeake, etc).

Sometimes the safest thing isn’t the most ideal thing, but Berkshire’s longevity is proof in the pudding that this strategy works over the long term.

What did Berkshire do well during this bear market?

Well, that’s lesson #4 for the next bear market:

- Stay fully invested in the market, especially if you have a long time horizon!!

While Berkshire did sell some airline stocks at close to their lows, their overall contribution to Berkshire’s entire portfolio was extremely minimal.

In effect, Berkshire stayed fully invested through the crash and recovery.

One of the best things I did in my own portfolio was the exact same thing. And wow was it hard.

The first thing you don’t realize until a bear market slaps you in the face is that looking at your portfolio will bring you an emotional toll.

There’s nothing like seeing stocks which used to be up +20%, +30%, or even +50% drop down to 0% or even -50% as the bear grips Wall Street.

Even if you might know it’s not true, you’ll feel like your investment was completely wasted as your total return dips or stays flat.

But remember, remember, remember… it’s not wasted:

- The underlying business has been compounding capital this whole time

- You’ve been compounding capital through dividend reinvestment

Luckily for me, I’ve had this mindset ingrained in me since the beginning, so I stayed invested because there was never any other choice in my mind.

But it did feel awful. I felt like a horrible investor. And this was especially compounded as the market flocked to the stocks they perceived as safe—like the FANGs, and WFH stocks.

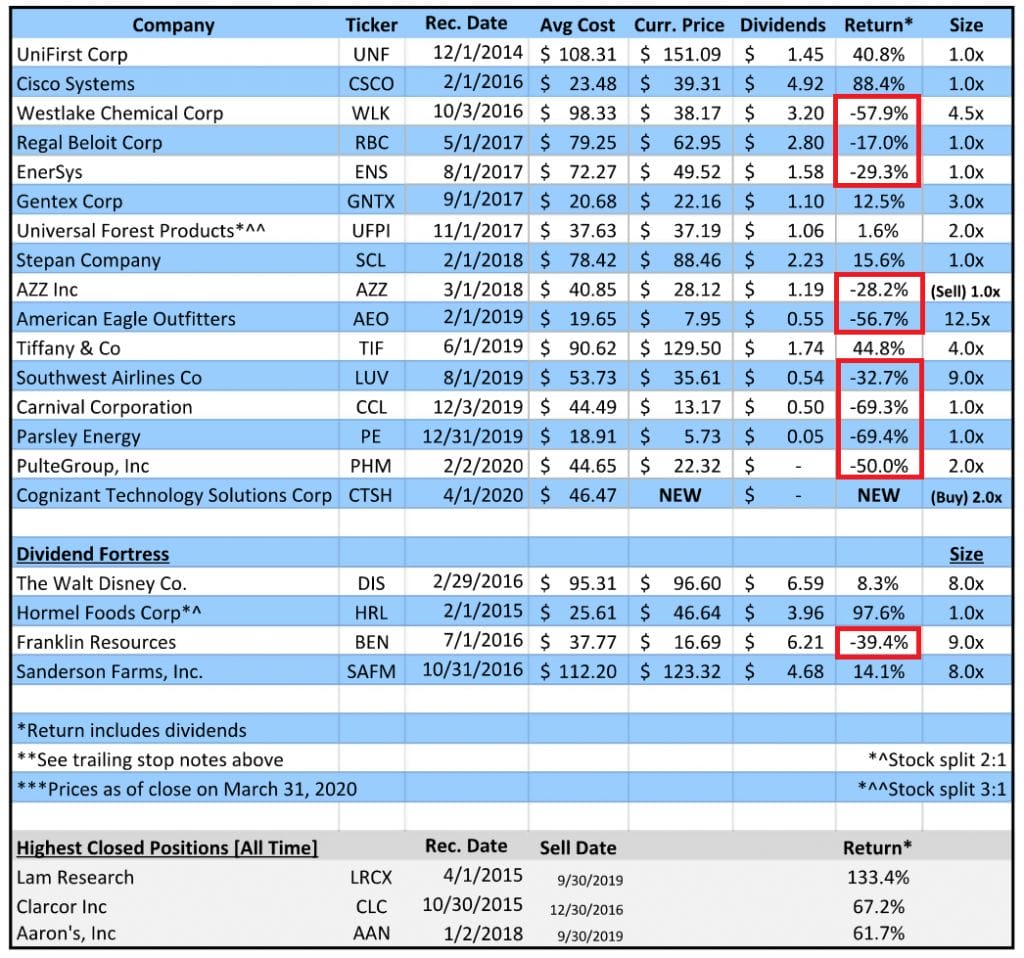

They say a picture says a thousand words. Here’s a screenshot of my portfolio (from The Sather Research eLetter) during the brutal correction, on April 1, 2020:

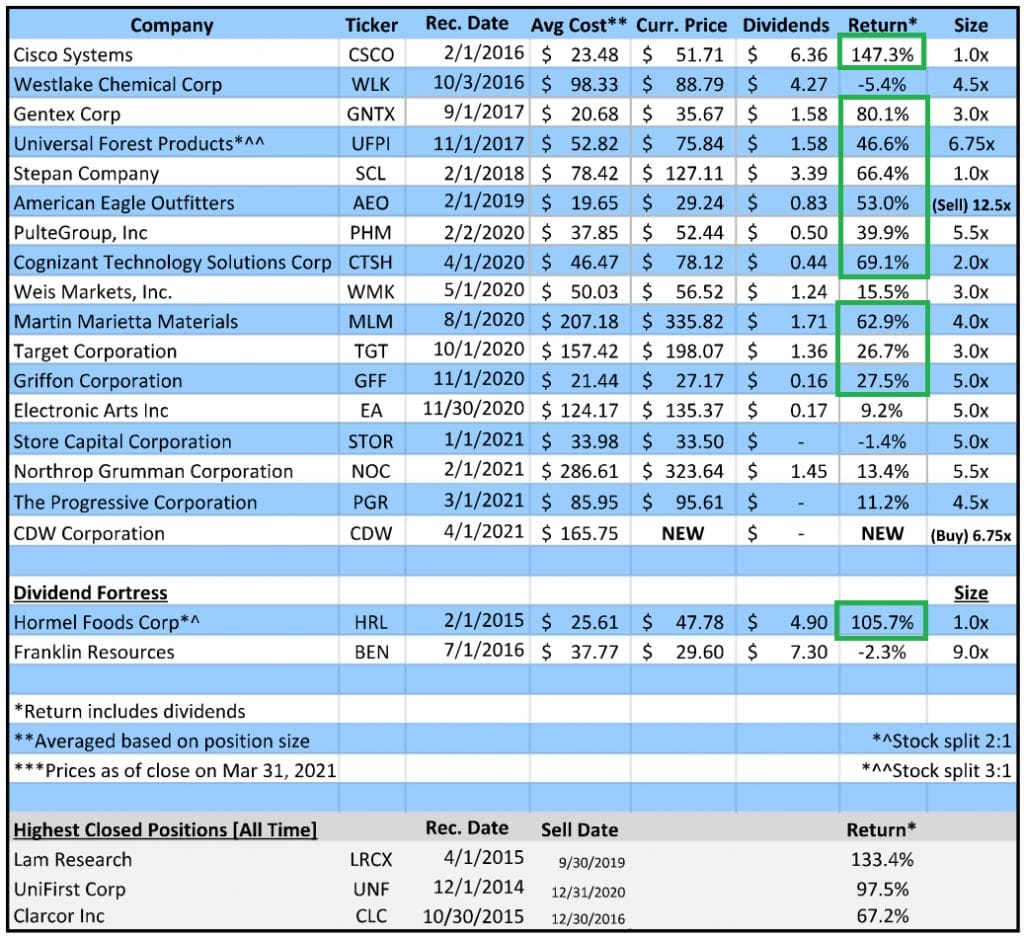

And here’s where we were one year later, April 1, 2021:

Over about a 12 month period, you had to sell Carnival cruise ships, Southwest Airlines, Sanderson Farms, Disney, and American Eagle.

Their businesses had fundamentally changed not just during a possible recession, but for the long term.

What’s key is that you reinvested these funds as fast as you could find the right investment opportunities.

In my case, that meant spreading them out over 1-3 months. That meant selling them slowly, as the facts changed instead of as my opinions on them changed.

And that was the best thing I’ve ever done.

Of course I can’t take all of the credit, as I had plenty of help from podcast co-host and business partner Dave Ahern during the crisis. Having his outside perspective helped take a lot of the emotions out of it, as we both processed the rapidly changing investing landscape.

Dave really emphasized the point to me of deeply analyzing if a business had fundamentally changed, and not worrying about making a complete portfolio transformation all at once.

Slowing down, and thinking over months rather than weeks or days, made all of the difference in the world.

Selling slowly and waiting for the facts to change—that’s called staying invested, through a crash and recovery. That was the right move in a world where the pandemic has significantly altered the businesses of many for years into the future.

But what was also key was understanding the difference between real change and temporary fear. Lesson #5 for the next bear market.

- There’s never a more important time to distinguish between short term and long term turmoil

To say that financials get muddy during a crisis would be an understatement.

Of course companies’ earnings are going to contract during an economic contraction. That’s the definition of a contraction.

This is going to wildly skew traditional value metrics like P/E, P/FCF, especially for those companies which are more cyclical than others.

Because as earnings drop, the P/E rises, etc. So a high P/E isn’t always bad, as long as the turmoil is short term rather than long term.

But you also have to be manically careful about super low P/E’s and P/FCF’s. Value traps are EVERYWHERE during a time like this.

While Wall Street is emotional, it’s also not dumb.

Stocks that are getting beaten down are getting beaten down for a reason. And so when a company has a trailing P/E of 5 because it had a great 2019 but 2020 is about to be a circus, don’t blindly invest because you think Wall Street is dumb and the stock is stupid cheap.

Especially if you are concerned with finding great long term investments.

Speaking of those, that brings us to lesson #6 for the next bear market.

- Now’s the time to load up on the very best businesses

Like I said with lesson #2, there’s going to be so much useless noise at a time like this. Don’t let it distract you.

Go find those best of breed businesses, and evaluate whether this upcoming crisis will radically change their business or not.

This will be the fun part of the bear market.

But it’s also the hardest part.

Turn off CNBC, stay away from stock tickers. It will be incredibly hard to keep away from the action as the exchanges hit their limits and close.

The volatility will be INSANE!

The options market will be INSANE!

Don’t waste your time trading options and trying to make a quick buck!

Spend all of your time massively accumulating a circle of competence on the very best businesses in the world, and pull the trigger if Mr. Market is offering you a fair price for them.

Even the best businesses probably won’t drop to the level of discounting that you’d like. That’s okay.

Take a look at this historical price-based ratios that the company has usually traded at. Compare it to historical market ratios. Remember to adjust for short term mutations.

Once you’re presented an attractive enough price for a best-of-breed business that you can see yourself holding for 10-20+ years, buy it.

Do it.

Do it.

I’m not saying you need to be overly aggressive. Don’t mortgage your home to buy these things. Don’t make drastic changes to your portfolio.

Simply keep the same path that you’ve always done. Continue dollar cost averaging like you always have done, just focus on best-of-breed businesses.

Because history shows us that the stock market will continue falling especially during prolonged bear markets.

Your favorite company could be on sale for the next 5 months, or even 5 years.

Don’t obnoxiously back up the truck, when the stock that’s on sale can (and probably will) fall another -25% or -50% from here.

Every bear market is different, and so just because we had a turbo recovery in 2020 doesn’t mean that the next one will behave the same way.

Finally, there’s lesson #7, our last lesson for the next bear market:

- Don’t worry about being optimal. Just be good enough.

A great many investors have talked about failures of omission—stocks they passed up on and crises they didn’t fully take advantage of.

The fact of the matter is that nobody’s perfect, in an area of life.

It’s not realistic to expect perfection, and especially during a crisis.

Just do what you can and stick to the basics of investing:

- Buy and hold for the long term

- Stay diversified

- Continue dollar cost averaging

- Don’t try to time the market

- Be patient

- Let compound interest do its magic

- Invest with a margin of safety, emphasis on the safety

Maybe now’s a great time to pursue other interests as well. There’s more to life than the stock market.

Don’t let the brutal economy and market take away from the other joys in life. Be grateful if you have a roof over your head, and food to eat, and time to relax.

Even having people to see—that was something you took for granted your entire life, and then suddenly we were all quarantined and six feet apart. Hopefully the world won’t have to go through that again.

Investing is a thinking game, and overworking doesn’t make for better thinking or decisions.

Now’s the time to zoom out and have perspective on the big picture, even if the short term looks so grim.

You’ll never regret finding more balance in your life—this too shall pass.

On the flip side, stay curious, use this as an opportunity to learn and grow. Every new market environment provides new lessons and challenges, and at least that keeps things interesting.

There’s never enough to say, and I’ll leave it at it here.

Your Mentor,

Andrew Sather

A ‘20 Survivor

Related posts:

- Handy Andy’s Lessons – Starting a Dividend Portfolio I’ve decided that I’m going to start a few “hot tip” type blogs and call them “Handy Andy’s Lessons.” This is likely to change because I...

- The 3 Main Elements of Patient Investing: Why It Works Updated – 12/6/23 The nature of the stock market makes patient investing the BEST investing. Smart people have observed this for many decades. Two easy...

- Capital Gains Tax Calculator for Relative Value Investing Turnover of investment holdings is a natural occurrence in any portfolio that triggers realized capital gains and taxes, which can eat into a portfolio’s return....

- Back to the Basics: What is Mr. Market? Why Are Prices So Volatile? Updated – 12/14/23 The stock market is a very emotional place. Why? Because it is made up of humans beings. Fear and greed are felt...