When diving into the world of investing, one of the most effective tools you can master is the creation of a one-pager for stock analysis. Creating a concise document allows you to quickly grasp the essentials of a potential investment and make informed decisions.

In today’s post, we will learn:

Okay, let’s dive in and learn how to create a one-pager.

How to Create a One-Pager

Here’s how we can create a one-pager using the following guidelines. These sections will allow us to quickly determine what the company does, their competitive advantage, and the fair value.

- Company Overview: Start with a brief description of the company. Include the sector, the core operations, and any recent news that impacts its business model.

- Financial Highlights: Zero in on the key financial metrics such as revenue growth, profit margins, earnings per share (EPS), and return on equity (ROE). These indicators provide a snapshot of the company’s financial health and performance.

- Valuation Metrics: Compare the company’s current valuation with industry standards. Use ratios like price-to-earnings (P/E), price-to-book (P/B), and price-to-sales (P/S) to evaluate whether the stock is overvalued or undervalued.

- Competitive Advantage: Identify the company’s competitive edge. Does it have a superior product, a stronger brand, or a more efficient distribution network? Understanding what sets the company apart is crucial.

- Risks: Outline the main risks associated with the investment. This could include sector-specific risks, regulatory changes, or broader economic factors.

- Investment Thesis: Finally, articulate your investment thesis. Why do you believe this stock is a good (or bad) investment? Support your viewpoint with data and insights gathered from your analysis.

The one-pager for stock analysis is not just a summary; it’s your investment compass. By distilling complex information into a digestible format, you equip yourself to make smarter, more strategic investment decisions.

Bill Miller’s 90 Second Egg Timer Pitch

Bill Miller is an acclaimed investor renowned for his tenure at Legg Mason, where he notably beat the S&P 500 index for 15 consecutive years. Known for his value investing style, Miller focuses on underappreciated assets, demonstrating a unique blend of analytical rigor and bold contrarianism. He famously invested in Amazon early, and was also an early adopter of Bitcoin.

Bottom line: when he speaks, we should probably listen.

He created a simple framework to come to a decision for a company based on what he deems worthwhile.

If focuses on the necessary items, such as how the company makes money, risks, and value. I first discovered this idea reading through the class notes for Joel Greenblatt’s course at Columbia. He had Miller come in and illustrate how it would work.

How To Pitch A Stock In 90 Seconds or Less, by Bill Miller

- No more than five positive points

- No more than three negative points

- What is it worth?

- What are the risks?

So how can we put these ideas to work? Let’s work through it with Brown & Brown, the insurance company.

Example Using Brown & Brown

“Insurance policies… are the most complex contract that you’ll ever enter into without the help of a lawyer.”

– Hyatt Brown, Chairman at Brown & Brown

Brown & Brown (BRO) is the sixth largest insurance broker based on 2022 revenues.

It primarily operates in the U.S., with less than 7% of revenues from international markets. Its insurance offerings span property and casualty, employee benefits, personal insurance, and specialized flood insurance products.

Brown & Brown operates under a decentralized model, remains family-run after 84 years, and primarily competes in the middle market.

These aspects distinguish it from competitors, maintaining local branding for acquired firms and encouraging employee stock ownership.

The insurance brokerage industry, particularly for businesses like Brown & Brown, plays a critical consultative role due to businesses’ complex and customized insurance needs. This importance, along with high recurring revenue, low capital expenditure, strong EBITDA margins, and high barriers to entry, underscores the industry’s resilience and value, even in economic downturns.

Brown & Brown stands out for its high insider ownership, approximately 35%, largely by the Brown family, and significant employee ownership.

The company has cultivated a strong corporate culture emphasizing employee stock ownership at a discount, fostering loyalty and wealth accumulation for its employees, which is a key factor in its success.

The insurance brokerage industry has consolidated significantly, with Brown & Brown emerging as a top-five broker (US) by revenue, highlighting its growth potential.

Despite its current size, Brown & Brown has ample room for expansion compared to industry giants like Marsh and Aon, partly due to its strategy of making numerous smaller acquisitions.

How They Make Money:

Brown & Brown generates revenue primarily through commissions and fees for selling insurance products.

As an intermediary, Brown & Brown connects insurance carriers with customers without taking on underwriting risks. They earn commissions, typically 10% to 15% of the premiums. Due to their complexity, commercial lines yield higher commissions than personal lines. Fluctuations in exposure units and premium rates drive growth.

In the world of insurance brokers, the key revenue drivers boil down to a couple of critical elements: the fluctuation in exposure unit (which you can think of as the total dollar value covered) and shifts in premium rates (which are just a fancy way of saying price changes).

When we talk about exposure units, we’re referring to the number of customers, how many items each customer insures, and any changes in the value of those items.

For a company like Brown & Brown, they’ve shared that price changes account for about one-third to one-quarter of their growth.

The rest?

Changes in exposure units drive that. Besides premiums, brokers make money through fees for additional services, like managing third-party claims. This part of their business is crucial but often not highlighted enough.

Pricing in the insurance brokerage world is much like a seesaw, always shifting based on the balance—or imbalance—between supply and demand for insurance coverage.

Let’s take a natural disaster as a prime example. Say a hurricane or flood just rolled through.

The aftermath?

Insurers would face hefty payouts, especially if they weren’t too strict with their underwriting standards. As a result, some carriers might decide to stop covering such risks in the future, leading to a tighter supply of insurance.

This mismatch between eager buyers and scarce coverage is what’s known as a hard market.

Insurance brokers often find themselves in a sweet spot during these hard market phases.

Why?

Because their commissions are typically tied to the premiums’ value. When prices soar, so do their earnings through increased organic revenue growth. This is a clear example of how market dynamics can influence financial flows within the insurance sector, showing just how interconnected things are.

The insurance brokerage industry has seen considerable consolidation, and Brown & Brown actively participates in acquisitions. Acquisitions are a big part of their strategy.

Brown & Brown’s acquisition strategy focuses on cultural fit and operational alignment, with significant capital allocated towards acquiring brokerage businesses that complement or expand their existing services and market reach.

This strategy is sustainable due to organic revenue growth in both normal and hard markets and numerous private equity firms active in this space.

Brown & Brown currently generates around mid-single-digit organic growth throughout the P&C insurance pricing cycle.

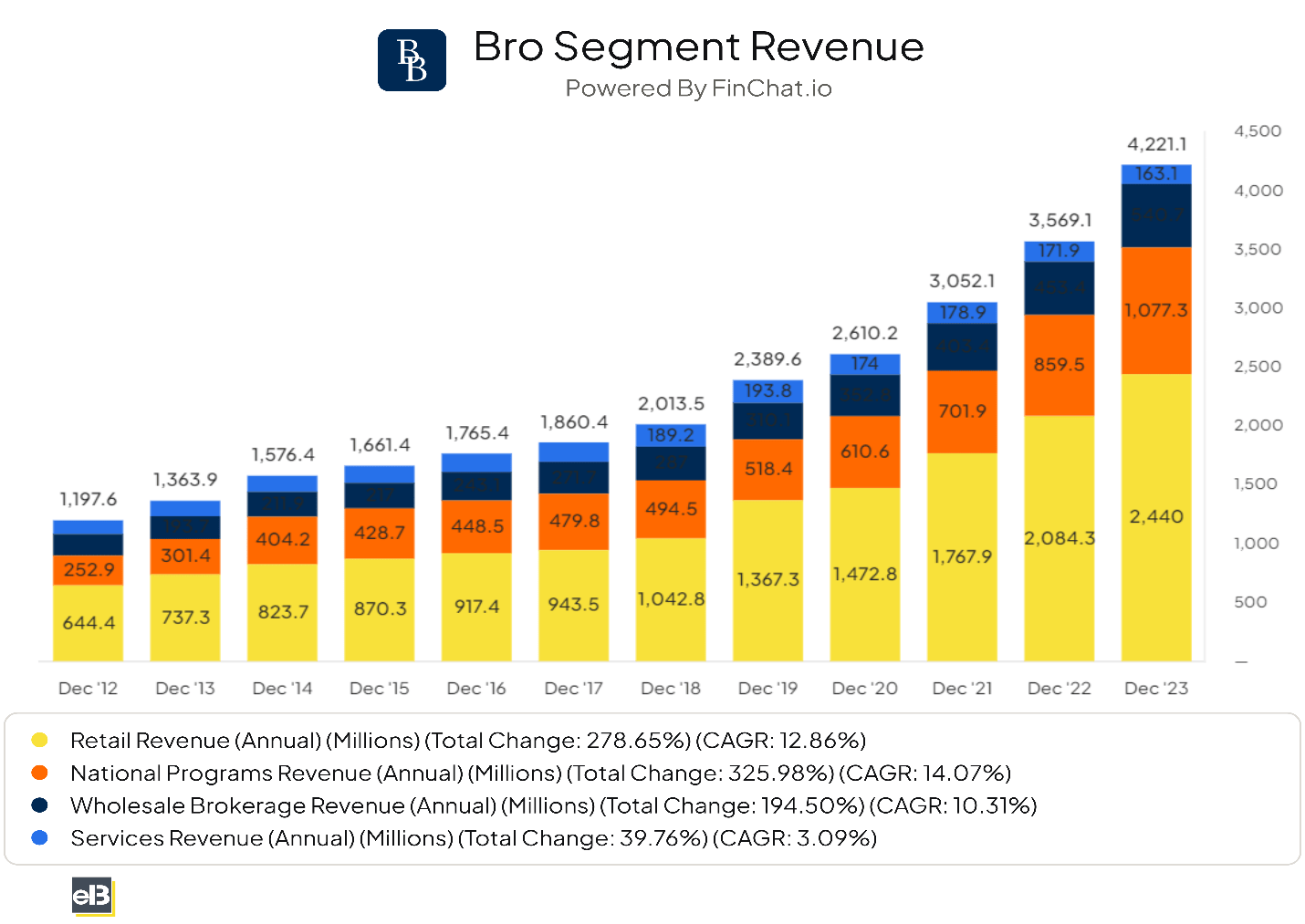

The company operates through four segments:

- Retail – Direct sales of insurance products to businesses and individuals (58% of total revenues).

- National Programs – Specialized insurance programs and products for professional, business, and trade associations (25% of total revenues).

- Wholesale Brokerage – Distribution of insurance products to other brokers, acting as an intermediary (13% of total revenues).

- Services – Provides insurance-related services, such as third-party claims administration and comprehensive medical utilization management (4% of total revenues).

What Their Product Solves:

Brown & Brown offers risk management solutions that protect clients against financial losses due to accidents, natural disasters, lawsuits, and other liabilities.

Their services help businesses and individuals navigate the complexities of insurance coverage, ensuring they are adequately protected while potentially saving on premiums.

Their specialized programs for various industries address unique risks, providing tailored solutions that generic insurance packages might not cover.

Main Costs:

- Employee Compensation and Benefits – As a service-oriented company, a significant portion of expenses goes toward salaries, bonuses, and employee benefits.

- Operating Expenses – This includes costs related to office maintenance, technology infrastructure to support its brokerage and services operations, and marketing.

- Acquisition Costs – Brown & Brown actively acquires smaller firms to expand its market presence and service offerings, incurring related expenses.

Customers:

Brown & Brown serves a wide range of customers, including:

- Small to large businesses across various industries seeking commercial insurance

- Individuals needing personal insurance products like home, auto, and life insurance

- Professional and trade associations looking for group insurance programs

- Government entities requiring specialized risk management solutions

Competitive Advantage:

Established insurance brokers, including Brown & Brown, enjoy substantial competitive advantages such as brand recognition, long-term client relationships, and contractual barriers like non-compete clauses.

These factors contribute to high barriers to entry for new competitors and safeguard the incumbents’ market share and profitability.

Legal documents and government intervention in proposed mergers, like that between Aon and Willis Towers, reveal the competitive strengths and regulatory recognition of the insurance brokerage industry’s complexities. These dynamics further affirm the strategic positioning and growth potential of companies like Brown & Brown within this lucrative and protected sector.

The company has demonstrated favorable returns on incremental capital, ranging from 12% to 22% annually over the past five years, facilitated by strong organic growth and strategic acquisitions.

Competitors:

Major competitors include other insurance brokers and risk management service providers like:

- Marsh & McLennan (MMC)

- Willis Towers Watson (WTW)

- Aon plc (AON)

- Gallagher (AJG)

These firms compete in service offerings, customer experience, market reach, and technological innovations.

Positive Points:

- Diverse Revenue Streams – Operations across different segments reduce dependence on any single market.

- Strong Acquisition Strategy – Continual expansion through strategic acquisitions has broadened its market presence and service capabilities.

- Specialized Programs – Tailored insurance solutions for specific industries and associations create competitive advantages.

- Solid Financial Performance – Strong financial results demonstrate operational efficiency and effective growth strategies.

- Experienced Management Team – Leadership with deep industry knowledge and strategic vision guides long-term growth.

- Lack of underwriting risk – Because of their business model, they don’t carry the same level of underwriting risk as other providers, such as Allstate.

Negative Points:

- Regulatory Risks – The insurance industry faces strict regulations affecting profitability and operational flexibility.

- Market Competition – Intense competition from large global firms and niche local providers pressures margins.

- Economic Sensitivity – Economic downturns can reduce demand for insurance products, impacting revenue.

Valuation:

We can determine its fair value Using various methods to value Brown & Brown.

Using the TTM P/E Ratio, we can see that it is a fair value compared to others in the industry.

- BRO = 26.53

- MMC = 26.07

- AON = 24.3

- WTW = 25.8

- AJG = 52.36

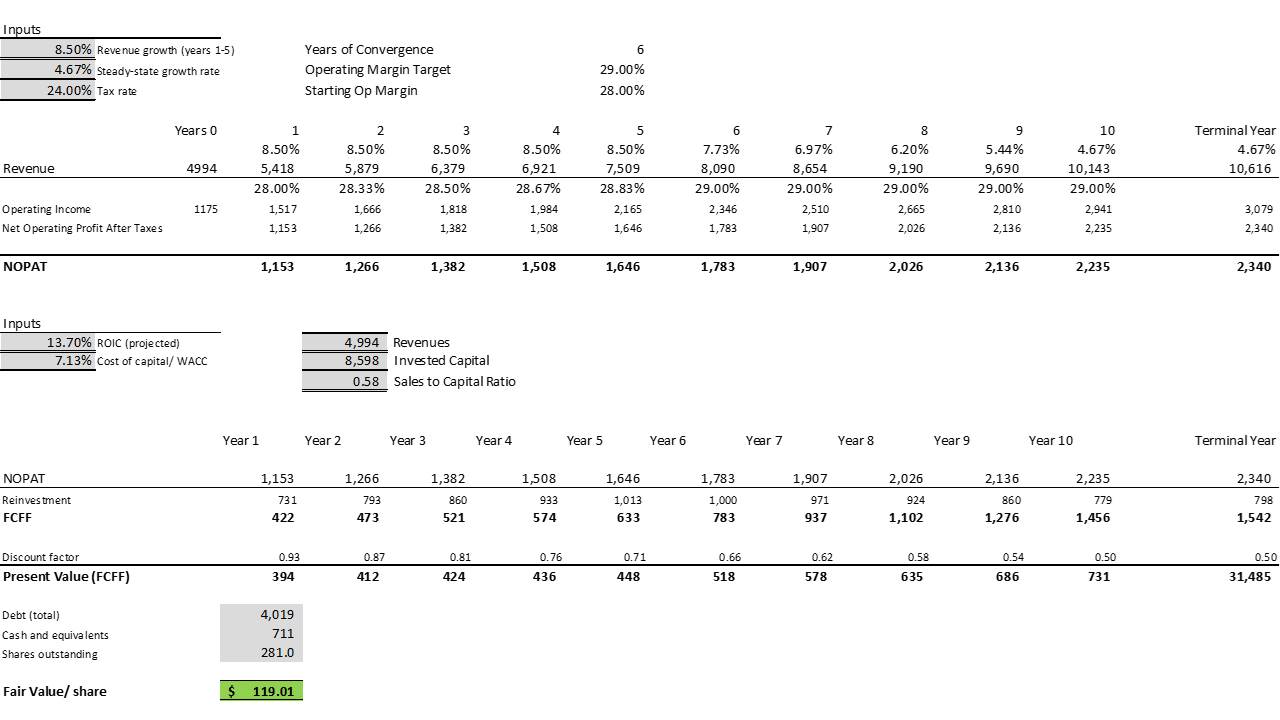

Using a DCF, my favorite method, with the following inputs, we get:

- Revenue growth = 8.5%

- Operating margins = 28%

- ROIC = 13.7%

- WACC (discount rate) = 7.13%

- Sales to Capital Ratio = 0.58

After applying all the inputs, we get a value of $119.01, compared to the current market price of $81 (April 17, 2024), giving us a safety margin of 46%.

Risks:

No matter how great any company is, they will have risks. Here are some Brown & Brown faces:

- Economic Downturns – Lower economic activity can reduce insurance spending by businesses and individuals.

- Regulatory Changes – New regulations or changes in existing ones could increase operational costs or limit business practices.

- Cybersecurity Threats – Any data breach or cyber-attack could have severe reputational and financial consequences in an information-heavy industry.

In conclusion, Brown & Brown, Inc. is a well-established player in the insurance brokerage and risk management industry, with diversified operations helping to mitigate market-specific risks.

One reason for my enthusiasm for the company is that while it is growing, there remains quite a large opportunity in the insurance market. Experts estimate BRO has a $90 billion opportunity, and with only $4 billion+ in 2023 and 5% of the market, it has a long runway.

Its growth strategy, focusing on acquisitions and specialized service offerings, positions it well for future expansion.

However, regulatory, economic, and competitive challenges highlight the importance of strategic agility and innovation in maintaining its market position.

Full disclosure: I am long BRO.

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- A Deep Dive into the Inner Workings of Compounding Machines: Understanding Their Competitive Advantage A Deep Dive into the Inner Workings of Compounding Machines: Understanding Their Competitive Advantage As an investor, you always seek ways to maximize your returns...

- How Buffett’s Purchase of National Indemnity Propelled Berkshire Hathaway Studying Warren Buffett’s past investments remains a great way to learn. Over the years, Buffett’s investments have changed, but not a ton. He still looks...

- 8 Steps to Decoding Investment Moats “In business, I look for economic castles protected by unbreachable ‘moats.'” ~ Warren Buffett, 2007 Shareholder Letter Finding companies with competitive advantages or moats are...

- Decoding the Revenue DNA: An In-Depth Analysis of Revenue Streams Revenue is the most important factor in investing. And most investors focus on revenue growth and profits. But we should also consider the different revenue...