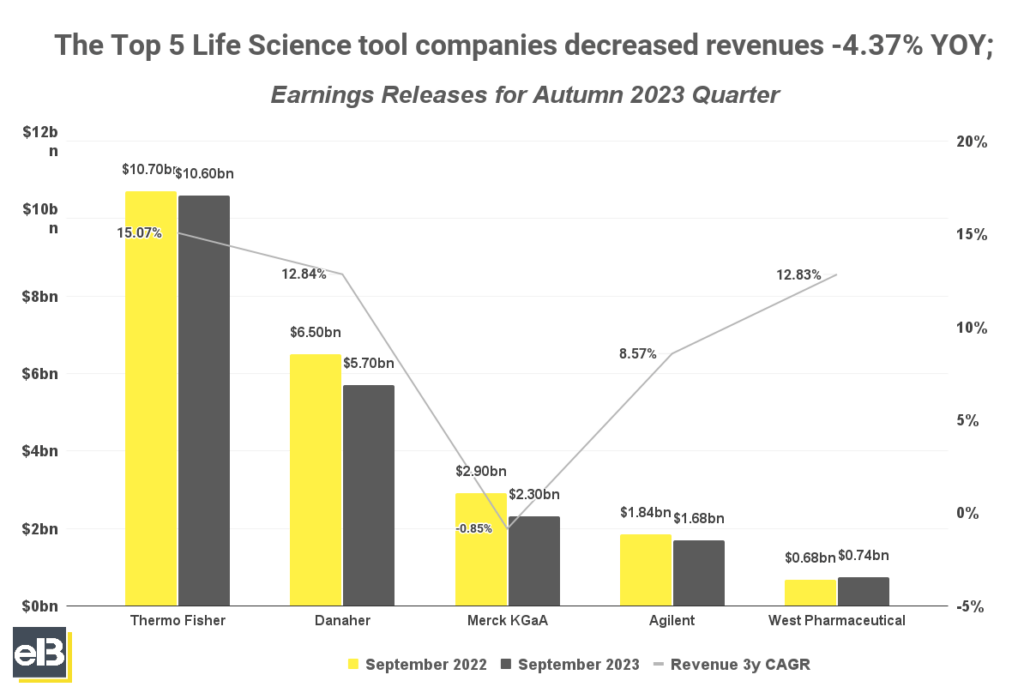

Recent Autumn earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues -4.37% YOY in the July – September Quarter, according to Latest Earnings Releases.

Of the publicly traded Life Science tool companies who released earnings results, the following top 5 companies decreased revenues -4.37% YOY on average: Thermo Fisher, Danaher, Merck KGaA, Agilent, and West Pharmaceuticals.

West Pharmaceutical stood out with a small increase in revenues at 8.8% followed by Agilent Technologies with slight decrease at -0.22% YOY.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Life Science Tools by Market Share

- Top Life Science Tools Provider by Revenue Growth

- Top Life Science Tools Provider by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Thermo Fisher (TMO) Stock Forecast

- Danaher (DHR) Stock Forecast

- Merck KGaA (MKKGY) Stock Forecast

- Agilent (A) Stock Forecast

- West Pharmaceutical Services (WST) Stock Forecast

The list below only includes the top 5 Life science tools companies by market capitalization. I will include all >$5B market cap publicly traded life science companies in the next section.

| Company | September 2022 | September 2023 | YOY |

| Thermo Fisher | $10,677 | $10,574 | -1.0% |

| Danaher ex VLTO | $6,455 | $5,624 | -12.87% |

| Merck KGaA | $2,926 | $2,392 | -18.25% |

| Agilent | $1,849 | $1,688 | -8.7% |

| West Pharmaceutical | $686 | $747 | 0.6% |

Thermo Fisher reported a –1% decrease Q/Q in organic growth in latest Q3, 2023, citing the continued macroeconomic environment in the life science industry weighing down on earnings.

Danaher saw a Non-GAAP core revenue decline by -11.5% Q/Q, with the reported revenue meeting their expectations especially in the Biotechnology segment while higher respiratory testing revenue offset some of their losses in Life Sciences.

Merck KGaA saw a -8% Q/Q decrease in core business sales due to continued destocking and COVID-19 fading and weak China macroeconomy.

Agilent reported a -9.7% Q/Q decrease in core organic growth attributing the decline to a lower demand for instrumentation, particularly in China and the Pharma end market.

West Pharmaceutical Services saw organic sales increase by 5.7% driven by high demand on their proprietary products’ high-value product (HVP) and strong contract manufacturing components. They are still observing a slowdown in restocking trends and have revised their guidance.

Key Takeaway

The recurring theme in all the declines in revenue among the life science companies mentioned was the same last quarter: a destocking trend, lower demand, current macroeconomic environment and the continued slowdown of economy of China.

Organic growth, meanwhile, is mixed with other companies having a high exposure to a product picking up demand while others are still being battered by the continued destocking of their customers.

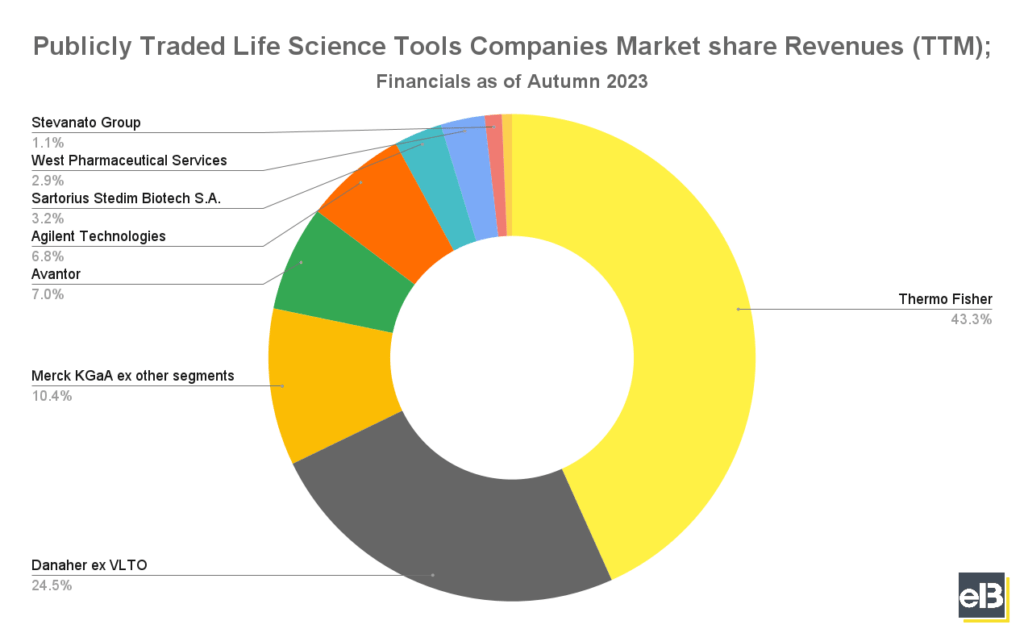

Biggest Publicly Traded Life Science Tools by Market Share

The below chart shows the list of publicly traded life science tools providers with market caps of >$5B as of September 2023.

Leading the group is Thermo Fisher with roughly 43.3% market share followed by Danaher excluding Veralto with 24.5% and trailing behind is Merck KGaA ex other segments with 10.4% of Trailing Twelve Months (TTM) revenue share of all publicly traded life science tools providers.

| Company | Revenues (TTM in Thousands) | Mkt Share |

| Thermo Fisher | $43,421,000 | 43.3% |

| Danaher ex VLTO | $24,619,000 | 24.5% |

| Merck KGaA ex other segments | $10,446,240 | 10.4% |

| Avantor | $7,039,400 | 7.0% |

| Agilent | $6,833,000 | 6.8% |

| Sartorius Stedim Biotech S.A. | $3,208,306.22 | 3.2% |

| West Pharmaceutical Services | $2,926,500 | 2.9% |

| Stevanato Group | $1,145,969.42 | 1.1% |

| Repligen Corp | $669,783 | 0.7% |

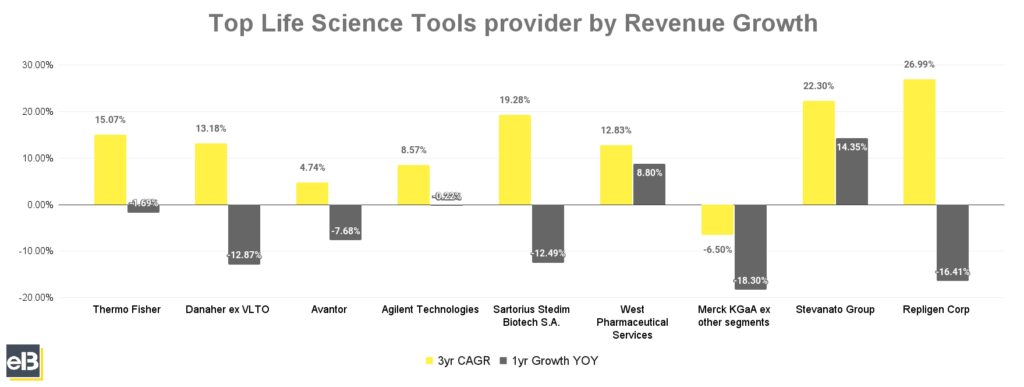

Top Life Science Tools Provider by Revenue Growth

In the last three fiscal years, Repligen Corp. is ahead among its peers in the life science tools industry with it’s 26.99% CAGR in revenues.

Stevanato Group, on the other hand, is ahead in boosting its YOY growth, with the only company growing it’s revenue mid-single digits 14.35% from 2022-2023.

Stevanato Group takes a spot again with a number two in 3yr CAGR with 22.30% while the other two large Life Science companies, Thermo Fisher and Danaher ex VLTO, trail behind with 15.07% and 13.18% 3yr CAGR respectively.

| Company | 3yr CAGR | 1yr CAGR YOY |

| Repligen Corp | 26.99% | -16.41% |

| Stevanato Group | 22.30% | 14.35% |

| Sartorius Stedim Biotech S.A. | 19.28% | -12.49% |

| Thermo Fisher | 15.07% | -1.69% |

| Danaher ex Veralto | 13.18% | -12.87% |

| West Pharmaceutical Services | 12.83% | 8.80% |

| Agilent Technologies | 8.57% | -0.22% |

| Avantor | 4.74% | -7.68% |

| Merck KGaA ex other segments | -6.50% | -18.30% |

Key Takeaway

The last three years of pandemic-boom earnings is slowing down among the Life Science companies and can be seen in their calls with their own pivot to different segments in the industry such as Biologics and Genomics.

Another interesting note is that the leading companies in 3yr CAGRs are all smaller in size compared to the big ones, showing that scaling is easier with a smaller base.

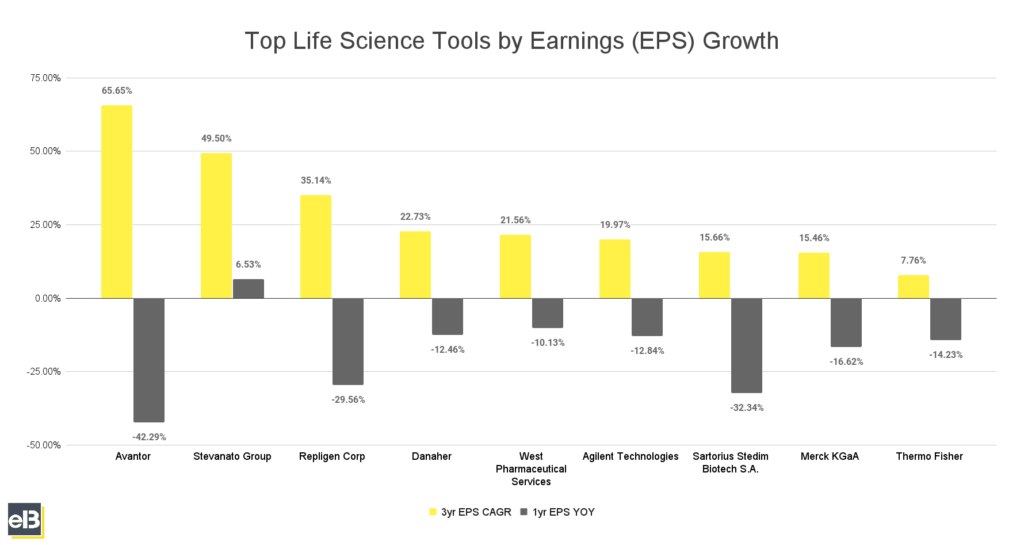

Top Life Science Tools Provider by Earnings (EPS) Growth

In the previous three fiscal years, Avantor takes the spot and saw the highest 3 year annual compounded growth rate of 65.65% in earnings per share.

All publicly traded life science tool providers in the graph below recorded high double digit EPS growth with the top 3 seeing their three year annual EPS growth rates of almost 35%+.

On the other hand, Stevanato Group had the highest 1-year EPS YOY growth rate of 6.53%.

The highest 3-year EPS CAGR companies in the list include Avantor at 65.65%, Stevanato Group at 49.50%, and Repligen Corp at 35.14%.

| Company | 3yr EPS CAGR | 1yr EPS YOY Growth |

| Avantor | 65.65% | -42.29% |

| Stevanato Group | 49.50% | 6.53% |

| Repligen Corp | 35.14% | -29.56% |

| Danaher | 22.73% | -12.46% |

| West Pharmaceutical Services | 21.56% | -10.13% |

| Agilent Technologies | 19.97% | -12.84% |

| Sartorius Stedim Biotech S.A. | 15.66% | -32.34% |

| Merck KGaA | 15.46% | -16.62% |

| Thermo Fisher | 7.76% | -14.23% |

Key Takeaway

Based on the data this quarter so far, the pandemic boom earnings on the Life Science companies mentioned is still buoying it up and it reflects on their respective 3-year EPS CAGR. Meanwhile, we can see the 1-year EPS growth slow down considerably as the COVID tailwind winds down.

Life Science Tools Companies Revenue, Earnings and Stock Forecast (Quarter ending September 2023)

| Company | YOY EPS Forecast |

| Thermo Fisher | 4.54% |

| Danaher | -34.86% |

| Merck KGaA | -27.78% |

| Agilent Technologies | -10.86% |

| West Pharmaceutical Services | 0.46% |

Thermo Fisher (TMO) Revenue, Earnings, and Stock Forecast

Thermo Fisher’s revenue over the latest Trailing Twelve Month period was $43.4 billion. Thermo Fisher’s earnings (Net Income) over the latest Trailing Twelve Month period was $5.9 billion.

The Wall Street consensus for Thermo Fisher’s EPS (earnings per share) projection for the next quarter is $5.65. The company’s TTM (trailing twelve months) Earnings Per Share was $15.33 as of the quarter ending September 30, 2023.

Thermo Fisher is expected to see slight expansion in earnings per share of 4.54% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Danaher (DHR) Revenue, Earnings, and Stock Forecast

Danaher’s revenue over the latest Trailing Twelve Month period was $29.5 billion. Danaher’s earnings (Net Income) over the latest Trailing Twelve Month period was $5.9 billion.

The Wall Street consensus for Danaher’s EPS (earnings per share) projection for the next quarter is $1.87. The company’s TTM (trailing twelve months) Earnings Per Share was $8.00 as of the quarter ending September 30, 2023.

Danaher is expected to see a contraction in earnings per share of -34.86% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Merck KGaA (MKKGY) Revenue, Earnings, and Stock Forecast

Merck KGaA’s revenue over the latest Trailing Twelve Month period was $22.7 billion. Merck KGaA’s earnings (Net Income) over the latest Trailing Twelve Month period was $3.1 billion.

The Wall Street consensus for Merck KGaA’s EPS (earnings per share) projection for the next quarter is $0.39. The company’s TTM (trailing twelve months) Earnings Per Share was $7.00 as of the quarter ending September 30, 2023.

Merck KGaA is expected to see a contraction in earnings per share of -27.78% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Agilent Technologies (A) Revenue, Earnings, and Stock Forecast

Agilent’s revenue over the latest Trailing Twelve Month period was $6.8 billion. Agilent’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.24 billion.

The Wall Street consensus for Agilent’s EPS (earnings per share) projection for the next quarter is $1.22. The company’s TTM (trailing twelve months) Earnings Per Share was $4.20 as of the quarter ending September 30, 2023.

Agilent is expected to see a contraction in earnings per share of -10.86% YOY in the next quarter based on the consensus of stock market analyst forecasts.

West Pharmaceutical Services (WST) Revenue, Earnings, and Stock Forecast

West Pharmaceutical Services’ revenue over the latest Trailing Twelve Month period was $2.9 billion. West Pharmaceutical Services’ earnings (Net Income) over the latest Trailing Twelve Month period was $0.56 billion.

The Wall Street consensus for West Pharmaceutical Services’ EPS (earnings per share) projection for the next quarter is $1.78. The company’s TTM (trailing twelve months) Earnings Per Share was $7.52 as of the quarter ending September 30, 2023.

West Pharmaceutical Services is expected to see a really slight expansion in earnings per share of 0.46% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data mentioned here in this article was sourced from publicly available filings and releases, and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Life Sciences Industry Report: Summer 2023 Results Latest Summer earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues -5.22% YOY in the June – August Quarter, According...

- Publicly Traded Life Sciences Industry Report: Winter 2023 Results Latest Winter earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues in the high to low...

- Publicly Traded Home Builders Report: Spring 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Home Builders Grew Total Revenues Over 16% YOY in...

- Publicly Traded Home Builders Report: Autumn 2023 Results Publicly available financial data collected by investment newsletter provider Sather Research, LLC showed that five Publicly Traded Home Builders by Market Cap grew Total Revenues on...