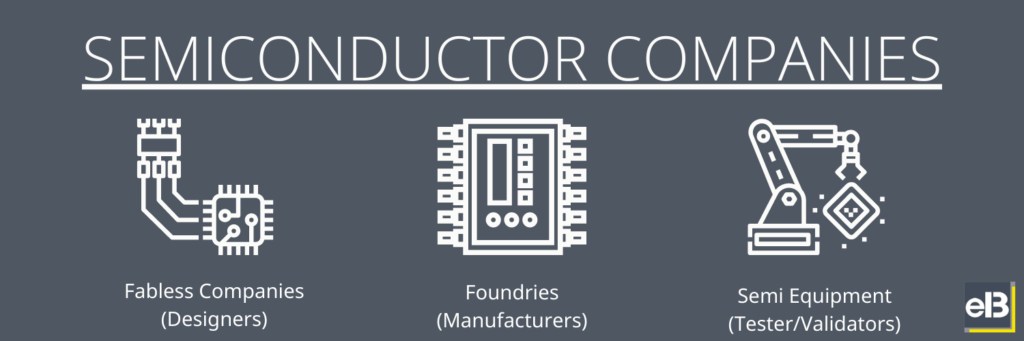

Technology hardware today is largely driven by semiconductors. And it is the semiconductor equipment companies who support the manufacturing of semiconductors through systems that test and verify the final product.

It is important to note that today, semiconductor manufacturers and semiconductor equipment providers are two different industries. There are specialized companies that do one or the other.

A list of the largest semiconductor equipment companies includes:

- ASML Holding N.V. (ticker: $ASML)

- Applied Materials (ticker: $AMAT)

- Lam Research (ticker: $LRCX)

- KLA Corporation (ticker: $KLAC)

A list of the largest semiconductor manufacturers, which buy semiconductor equipment, include:

- Taiwan Semiconductor Manufacturing Company (ticker: $TSM)

- Samsung Electronics (traded in Korea)

- GLOBALFOUNDRIES (ticker: $GFS)

To complete the semiconductors circle, there are also companies which specialize in just the designing of semiconductors, who then outsource the actual manufacturing to the specialized manufacturers. These include:

- NVIDIA Corporation (ticker: $NVDA)

- Broadcom (ticker: $AVGO)

- Advanced Micro Devices (ticker: $AMD)

- QUALCOMM (ticker: $QCOM)

A few companies, like Intel (ticker: $INTC) and Texas Instruments (ticker: $TXN), both design and manufacture semiconductors in-house, and so the economics of their business model can be different than a pure play designer (or “fabless companies”) or pure play manufacturer (or “foundries”).

Distinguishing these pieces of the value chain is critical if you are wanting to estimate the market shares of these semiconductor companies.

You cannot simply take the revenues of every company in the semiconductor market (using a broad semiconductor list of companies such as the components of the iShares Semiconductor ETF); those numbers will tell you little about a company’s actual competitors and market positioning.

Next, we will tackle the basics of the semiconductor manufacturing process, which explain how semiconductor equipment companies make money.

The Basics of Semiconductors

In a nutshell, semiconductors are key pieces of physical technology. They serve as the brains, eyes, and ears—processing and storing information which enables the hardware to do what it’s supposed to.

Semiconductors can be impossibly precise, built on microscopic layers of metal.

Most are designed with billions of these microscopic transistors which are placed in a way to interact with little bursts of electricity.

Semiconductors today are designed on computers, then shipped to the foundries (or “fabs”) that take these software designs and turn that into the physical product (or “semiconductor chip”).

Once the semiconductor chip is created, it must be tested by equipment to make sure that it functions in the way that the designer intended. Since the designs and machines involved in the manufacturing process are so complex, the equipment to test the final product is also complex and can cost millions of dollars for a single system.

Why These Companies Are So Profitable

One last thing to understand about the semiconductor industry is its unrelenting drive to continually innovate. Companies are always striving to make semiconductor chips that are smaller, faster, and more efficient.

This phenomenon has been described by “Moore’s Law”, which was an idea from one of the pioneers of semiconductors, Intel’s co-founder Gordon Moore.

Moore’s Law, according to semiconductor software provider Synopsys, is simply summarized as:

“Moore’s law is a term used to refer to the observation made by Gordon Moore in 1965 that the number of transistors in a dense integrated circuit (IC) doubles about every two years.”

The integrated circuit is what semiconductor chips are comprised of. So, this phenomenon enables technology hardware manufacturers to produce better products with increasing functionality and features continuously.

As I wrote in my March 2022 issue of The Sather Research eLetter, you don’t have to look any further than the amazing capabilities of AirPods to see how innovation in semiconductors enables more functionality.

AirPods are incredibly small yet can connect wirelessly through Bluetooth, and intelligently charge in a small carrying case.

The continuous advancement of semiconductor technology means new semiconductor equipment systems have been in constant demand—this should continue for as long as semiconductors are made smaller, faster, and more efficient.

Semiconductor Equipment Stocks Overview

Just as there are semiconductor companies that specialize in either design, manufacturing, or testing, there are also companies that specialize in specific types of semiconductor chips.

With semiconductor equipment companies, they tend to serve two major applications:

- Logic

- Memory

Logic chips can encompass a wide range of semiconductor designs. You can think of these like the “brains” of the hardware, computing and converting data in a myriad of ways and applications.

Memory chips are basically what they sound like; memory chips store data. This data can be stored over the long term (like on a hard drive), or just for a short time to help with processing power (like the RAM of a computer).

ASML Holding N.V. (ticker: $ASML)

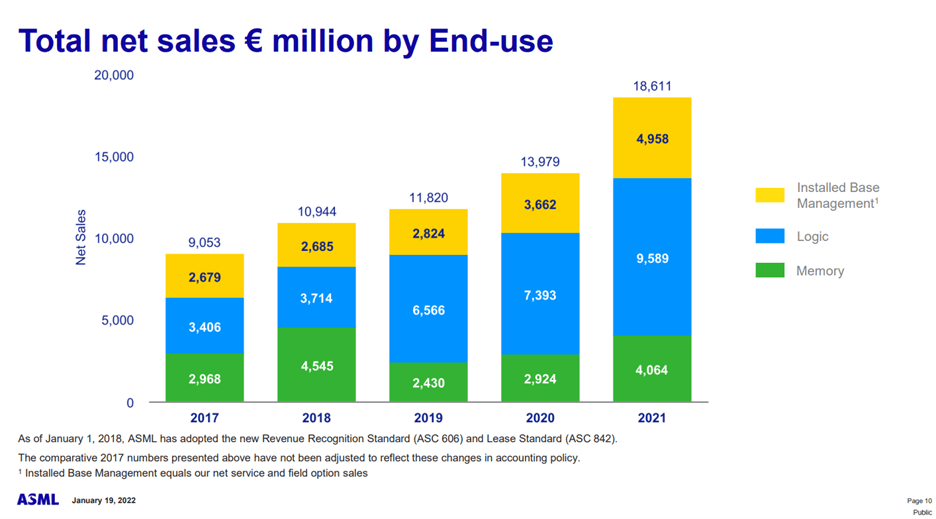

Let’s first take the biggest semiconductor equipment company by market capitalization today, ASML, and show their latest revenue breakdown:

You can see that more of their revenues come from logic than memory chips. This means they are providing advanced equipment to the fabs that are specializing in these kinds of semiconductors.

You might also note that a large portion of their revenues in 2021 came from “Installed Base Management”. This displays another revenue driver for semiconductor equipment companies.

Again, because these machines are so complex, it sometimes makes sense for the same company who manufactured the equipment to maintain the equipment for the fab. Not only can this save time for the fab, but it can also save money, as they can deploy capital in the other very capital intensive aspects of the manufacturing process.

Investors tend to like service-based revenues such as these because they are often recurring, and can be a more reliable and consistent source of revenue over the long term.

Applied Materials (ticker: $AMAT)

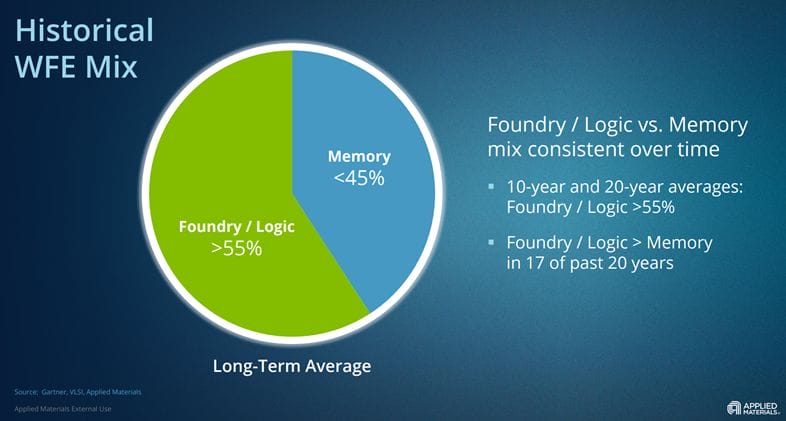

From $AMAT’s latest investor presentation, we can see that the company has also maintained a heavier weighting of revenues from logic customers, though it is much more balanced than ASML.

However, the company also discloses that 3 of the years over the past 20 have seen the opposite mix, which follows one of the natural orders of semiconductors.

The semiconductor industry, in general, runs on cycles, where there are flurries of orders and expansion followed by a “pulling back” period.

This means that the revenues for semiconductor companies can swing wildly through the cycles, and both logic and memory can (and do) run on different cycles depending on many other factors, which explains why the revenue mix for a company like Applied Materials can fluctuate from year-to-year.

Lam Research (ticker: $LRCX)

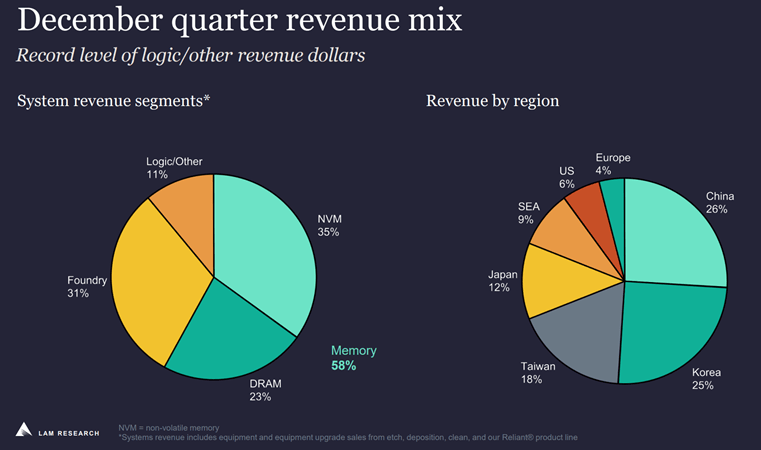

In a distinguishing characteristic from its other peers, Lam Research tends to drive the majority of revenues from the Memory market. So its earnings tends to fluctuate with the memory chip cycle rather than the logic cycle.

We can see from the company’s slide that they further distinguish their Memory segment between NVM and DRAM—DRAM being an example of the type of memory I described before that deals with short-term storage rather than long term.

Notice the large portion of revenues which come from Asia for the company; this is a key characteristic I will touch on below as it can greatly affect the overall results for the semiconductor equipment companies.

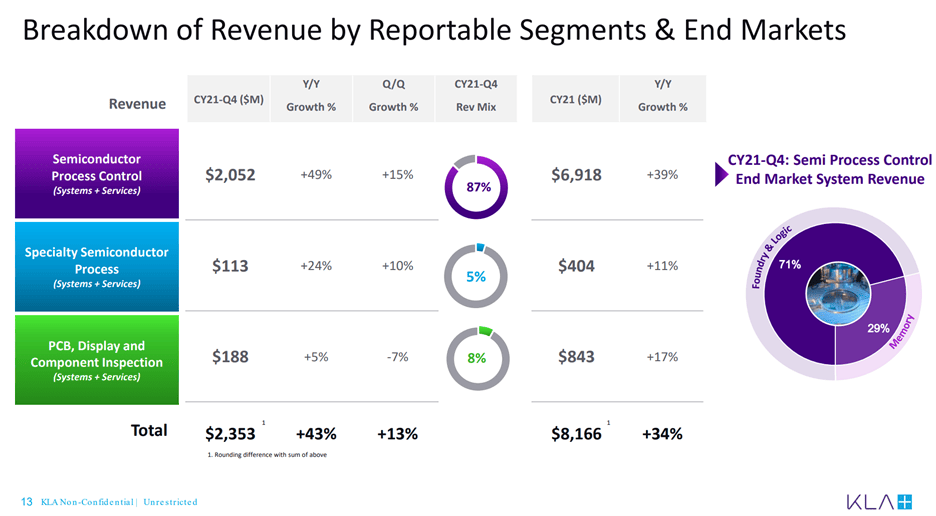

KLA Corporation (ticker: $KLAC)

Finally, we have KLA Corporation, which not only has a large exposure to Foundry & Logic but also boasts of a leading market share in Process Control.

Remember that each of these companies systems can be unique, and so comparing market shares won’t always be apples-to-apples.

There are a myriad of details to discover surrounding each company’s equipment, whether we are talking about more advanced technology features like etching, lithography, or metrology. Some of these details could play a role in the success of these companies, their market shares, and potential competitive advantages, and should require further investigation for investors who are serious in buying semiconductor equipment stocks.

Risks for Semiconductor Equipment Companies

Because semiconductor manufacturing has been so complex and capital intensive, there are only a few companies that are on the leading edge. With the foundries, the only game in town is really Taiwan Semiconductor Manufacturing Company (also known as TSMC) and Samsung.

Most of TSMC’s fabs were built in Taiwan; the majority of Samsung’s are in South Korea.

This means that much of the manufacturing of the most advanced semiconductors runs through two Asian countries which are far away from U.S. investors.

Much of the semiconductor supply chain runs through Taiwan, South Korea, and also China; as a result, many customer orders for semiconductor equipment companies like ASML and KLA Corp run directly into these countries. An overwhelmingly large portion of revenues for many of these companies are based on operations in Southeast Asia.

The way this supply chain is constructed carries inherent geopolitical risk for investors in these companies.

In particular, relations between the United States and China have become strained in recent years, and this creates uncertainties as it relates to the profitability of some semiconductor companies.

For example, Chinese company Huawei was banned from U.S. technology in 2020 and could not utilize the services of TSMC, because TSMC’s manufacturing process included U.S. technology from companies like the semiconductor equipment manufacturers discussed above.

With China’s close ties and geography to key countries in Southeast Asia, a further straining of US-China relations could upend other companies’ business models completely.

Tariffs, bans, and sanctions can all negatively impact a company’s profitability, and is a major reason why investors should proceed with caution if wanting to invest in these type of companies.

Semiconductor Complexity Magnifies Supply Risk

Because advanced semiconductor technology is so capital intensive and time consuming, the supply chain risk doesn’t appear to be changing anytime soon.

As an example of this—it can take several years for a company to build a new fab for manufacturing and have it ready for operations.

In addition, there are strict capacity limits to semiconductor manufacturing. A fab can only produce so many chips at a time, and foundries like TSMC have seen their most advanced manufacturing at full capacity as demand has outstripped capacity.

There’s also the fact that the design process for cutting edge semiconductors can be extremely difficult.

Most semiconductor progress comes in iterative steps; a company will take design concepts from a previous technology and apply it to the next technology step, adjusting for hiccups and physical limitations as they are discovered.

So, it’s very hard, if not impossible, to jump from one technology step to a much smaller one; progress tends to be more efficient if a company climbs one step at a time rather than jumping far ahead all at once.

It takes much technology know-how, which can include patents and other kinds of trade secrets, to get from one cutting edge design to the next.

All of this process and research takes money to accumulate, lots of it.

That’s just on the design side.

When you include the foundries and the extraordinarily expensive machines and equipment systems needed to run at full capacity, you have huge barriers to entry which can greatly hinder disruption in these value chains.

That means these overall dependencies, both the risks and benefits, are ones that are likely to impact investors for a while to come.

Investor Takeaway

Hopefully this breakdown has helped you navigate some of the intricate pieces of this industry. With better understanding and deeper knowledge, you can start getting better at evaluating industry market share and changes in competitive positioning.

If this felt like a firehose, don’t worry too much. Knowledge like this compounds, and the more you learn about the semiconductor equipment companies—their peers, customers, and suppliers—the better you can understand the bigger picture.

This means that the lessons build on themselves; each time you try and learn about a semiconductor company or specialty industry, it will become easier as you build on a mental model from your previous efforts.

As an investor in individual companies, it’s your responsibility to attain a circle of competence, which means a thorough understanding of the business model and what makes it tick.

Hopefully this post and others on our site can help you through this.

Above all, remember the fundamental principles of investing…

Invest with a margin of safety, emphasis on the safety… Don’t forget to diversify… And always, always, always, buy and hold for the long term.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Should I Invest in Companies with Good Gross Margins? To make money, you need to spend money. Companies have to operate on the same principle and successful businesses find a way to generate revenues...

- The Meaning of a Cyclical Industry Explained for Beginners The economy moves in cycles. Good times and bad. Because of this, the stock market also tends to move in cycles. A cyclical industry is...

- Biofuel Industry Overview: Stocks to Watch (Biodiesel and Renewable Diesel) Some of the hottest renewable energy stocks which are working to fight climate change can be found in the biofuel, or biodiesel and renewable diesel,...

- Berkshire Hathaway 10Q Summary First Quarter 2020 Berkshire Hathaway reported its first-quarter earnings on May 2, 2020. This report is a summary of those first-quarter results and will not attempt any analysis...