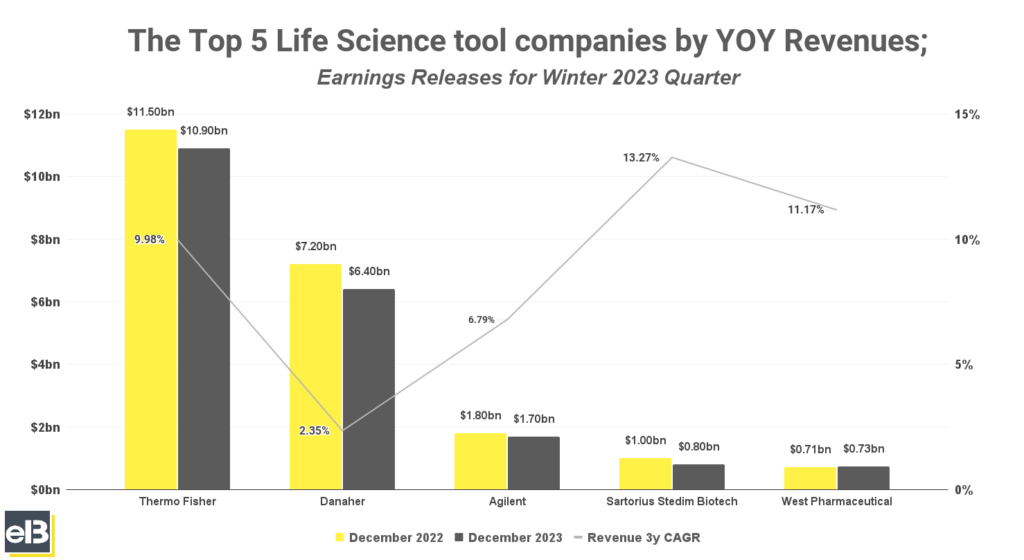

Latest Winter earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues in the high to low teens YOY in the October – December Quarter, according to the Latest Earnings Releases.

Of the publicly traded Life Science tool companies who released earnings results, the following top 5 companies decreased revenues -5.00% YOY on average: Thermo Fisher, Danaher, Agilent, Sartorius Stedim Biotech, and West Pharmaceuticals.

West Pharmaceutical stood out with a slight increase in revenues at 3.3% followed by Thermo Fisher with a decrease of -4.90% YOY.

Merck KgAa is not covered here as it has not reported its latest quarterly earnings.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Life Science Tools by Market Share

- Top Life Science Tools Provider by Revenue Growth

- Top Life Science Tools Provider by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Thermo Fisher (TMO) Stock Forecast

- Danaher (DHR) Stock Forecast

- Agilent (A) Stock Forecast

- Sartorius Stedim Biotech S.A. (DIM) Stock Forecast

- West Pharmaceutical Services (WST) Stock Forecast

The list below only includes the top 5 Life science tools companies by market capitalization. The next section will include all >$5B market cap publicly traded life science companies.

| Company | December 2022 | December 2023 | YOY |

| Thermo Fisher | $11,450 | $10,886 | -4.90% |

| Danaher | $7,134 | $6,405 | -10.80% |

| Agilent | $1,756 | $1,658 | -5.60% |

| Sartorius Stedim Biotech | $953 | $780 | -20.60% |

| West Pharmaceutical | $708 | $732 | 3.30% |

Thermo Fisher reported a -4% decrease YoY in core organic growth in the latest quarter; however, +1% growth for the full year 2023. Growth came from solid performance in analytical instruments, clinical research, and pharma services. Meanwhile, diagnostics and healthcare dragged the performance, with revenue declining in the high teens and was 30% lower for the full year.

Danaher saw revenue decline by -10.80% YoY, while non-GAAP core revenue decreased by 11.5%. However, management expressed better-than-expected revenue in each segment, especially led respiratory revenue at Cepheid. The company recently closed an acquisition of Abcam, a leading protein research tool provider.

Agilent had a -5.60% YoY decrease in revenue last quarter with -6.40% decrease in core revenue growth. This performance was largely due to the ongoing sequential stabilization experienced in China and secular growth drivers in applied markets globally.

Sartorius Stedim Biotech showed a -20.60% YoY decrease in the latest quarterly revenue, attributing the decline to continued inventory destocking, relatively low customer production levels, and muted investment activities in the industry. However, order intake is gradually picking up and management expects it to continue.

West Pharmaceutical Services saw organic net sales increase by 1.4% while revenue grew 3.3% driven by continued demand on their proprietary products’ high-value product (HVP) and contract manufacturing components. However, the company continues to experience headwinds from pandemic-related sales but expects it to wind down entirely in the next quarter.

Key Takeaway

Last quarter’s theme continues among the life science companies mentioned: a destocking trend, lower demand, the current macroeconomic environment, and the slowdown of China’s economy. However, most management says that the bottom has passed and the cycle will turn in the next quarters as they saw renewed growth in order backlogs.

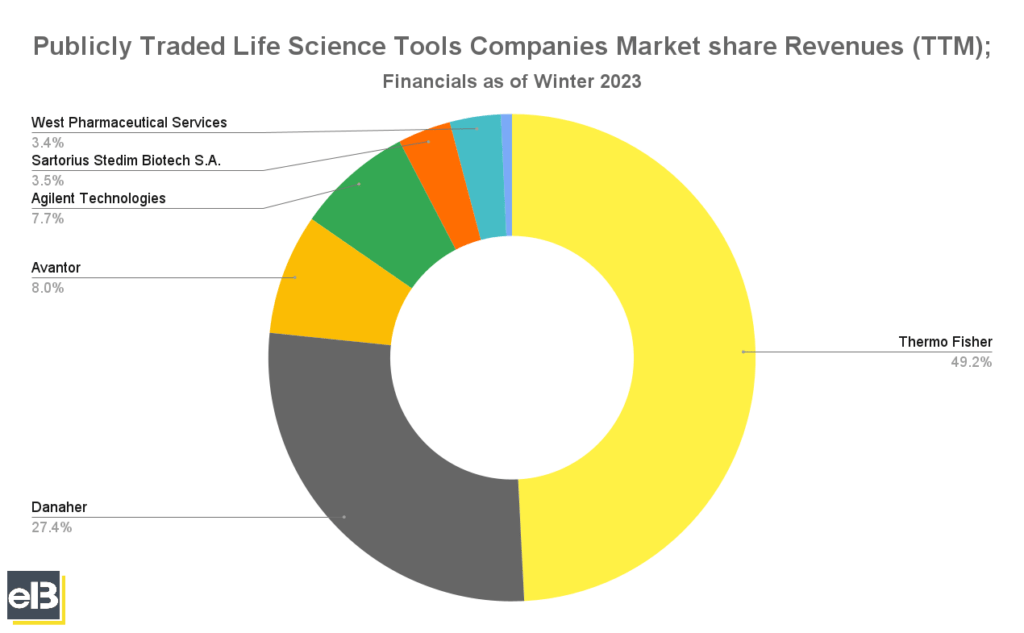

Biggest Publicly Traded Life Science Tools by Market Share

The chart below shows the list of publicly traded life science tool providers with market caps of >$5B as of February 2024.

Leading the group is Thermo Fisher with roughly 49.2% market share, followed by Danaher with 27.4%, and trailing behind is Avantor with 8.0% of Trailing Twelve Months (TTM) revenue share of all publicly traded life science tools providers.

| Company | Revenues (TTM in Thousands) | Mkt Share |

| Thermo Fisher | $42,857,000 | 49.2% |

| Danaher | $23,890,000 | 27.4% |

| Avantor | $6,967,200 | 8.0% |

| Agilent Technologies | $6,735,000 | 7.7% |

| Sartorius Stedim Biotech | $3,064,142 | 3.5% |

| West Pharmaceutical | $2,949,800 | 3.4% |

| Repligen Corp | $638,764 | 0.7% |

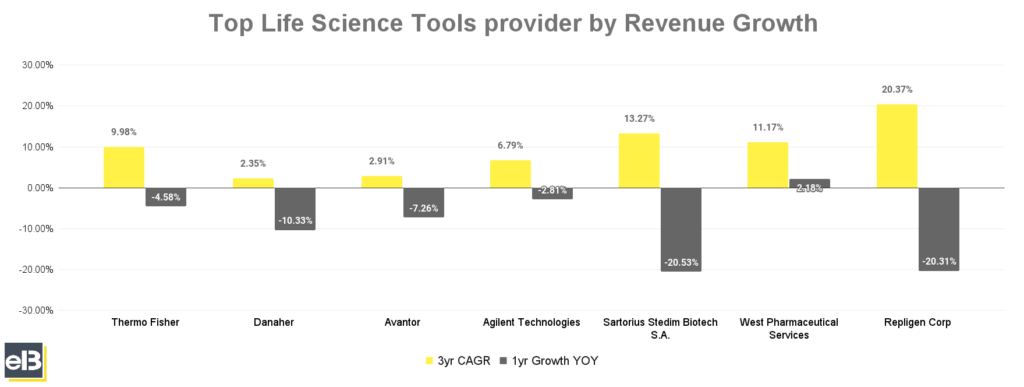

Top Life Science Tools Provider by Revenue Growth

Repligen Corp. is ahead of its peers in the life science tools industry in the previous three fiscal years with its 20.37% CAGR in revenues.

West Pharmaceuticals, on the other hand, is ahead in boosting its YOY growth, with the only company growing its revenue by 2.18% from 2022-2023.

West Pharmaceutical retakes a spot with number two in 3yr CAGR with 11.17% while the other two Life Science companies, Sartorius Stedim Biotech and Thermo Fisher, trail behind with 13.27% and 9.98% 3yr CAGR, respectively.

| Company | 3yr CAGR | 1yr CAGR YOY |

| Thermo Fisher | 9.98% | -4.58% |

| Danaher | 2.35% | -10.33% |

| Avantor | 3.00% | -7.26% |

| Agilent Technologies | 6.79% | -2.81% |

| Sartorius Stedim Biotech S.A. | 13.27% | -20.53% |

| West Pharmaceutical Services | 11.17% | 2.18% |

| Repligen Corp | 20.37% | -20.31% |

Key Takeaway

The pandemic tailwinds are almost non-existent in the 3-year CAGRs of publicly traded life science companies as demand normalizes and the industry slows down, brought by high interest rates and a softer capital environment for new biotech ventures to spring up.

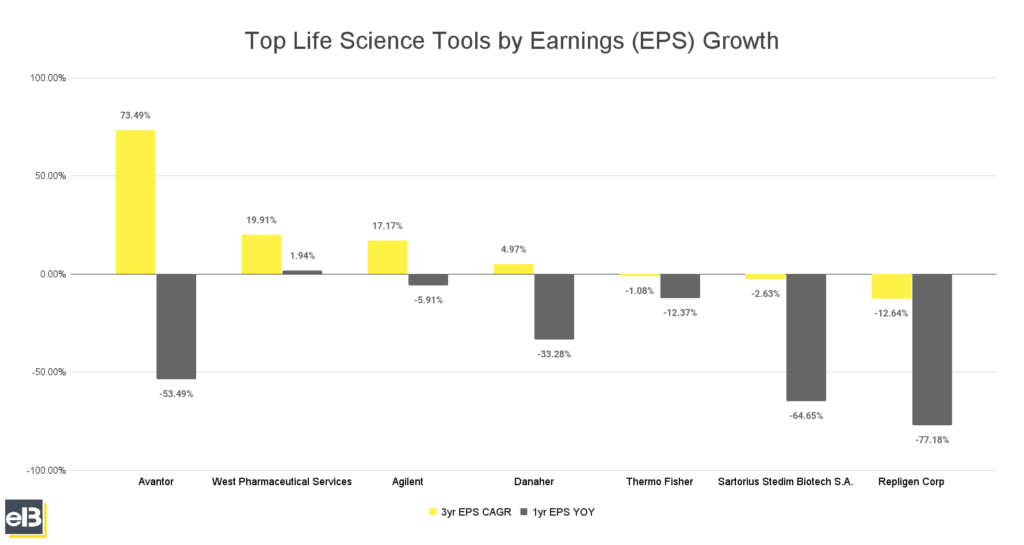

Top Life Science Tools Provider by Earnings (EPS) Growth

In the last three fiscal years, Avantor took the spot and saw the highest 3 year annual compounded growth rate of 73.49% in earnings per share.

EPS growth of publicly traded life science tool providers in the graph below is mixed with the smaller companies by market cap that recorded high double-digit EPS growth, with the top 3 seeing their three-year annual EPS growth rates of almost 36%+ on average.

Meanwhile, West Pharmaceutical had the highest 1-year EPS YOY growth rate among the list of 1.94%.

The list’s highest 3-year EPS CAGR companies include Avantor at 73.49%, West Pharmaceutical at 19.91%, and Agilent at 17.17%.

| Company | 3yr EPS CAGR | 1yr EPS YOY Growth |

| Avantor | 73.49% | -53.49% |

| West Pharmaceutical Services | 19.91% | 1.94% |

| Agilent | 17.17% | -5.91% |

| Danaher | 4.97% | -33.28% |

| Thermo Fisher | -1.08% | -12.37% |

| Sartorius Stedim Biotech S.A. | -2.63% | -64.65% |

| Repligen Corp | -12.64% | -77.18% |

Life Science Tools Companies Revenue, Earnings and Stock Forecast (Quarter ending December 2023)

| Company | YOY EPS Forecast |

| Thermo Fisher | -5.50% |

| Danaher | -27.70% |

| Agilent | -6.30% |

| Sartorius Stedim Biotech S.A. | 13.70% |

| West Pharmaceutical Services | -33.67% |

Thermo Fisher (TMO) Revenue, Earnings, and Stock Forecast

Thermo Fisher’s revenue over the latest Trailing Twelve Month period was $42.9 billion. Thermo Fisher’s earnings (Net Income) over the latest Trailing Twelve Month period was $6.0 billion.

The Wall Street consensus for Thermo Fisher’s EPS (earnings per share) projection for the next quarter is $4.75. The company’s TTM (trailing twelve months) Earnings Per Share was $15.50 as of the quarter ending December 30, 2023.

Thermo Fisher is expected to see a contraction in earnings per share of –5.50% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Danaher (DHR) Revenue, Earnings, and Stock Forecast

Danaher’s revenue over the latest Trailing Twelve Month period was $23.9 billion. Danaher’s earnings (Net Income) over the latest Trailing Twelve Month period was $4.8 billion.

The Wall Street consensus for Danaher’s EPS (earnings per share) projection for the next quarter is $1.71. The company’s TTM (trailing twelve months) Earnings Per Share was $6.40 as of the quarter ending December 30, 2023.

Danaher is expected to see a contraction in earnings per share of -27.70% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Agilent Technologies (A) Revenue, Earnings, and Stock Forecast

Agilent’s revenue over the latest Trailing Twelve Month period was $6.7 billion. Agilent’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.24 billion.

The Wall Street consensus for Agilent’s EPS (earnings per share) projection for the next quarter is $1.19. The company’s TTM (trailing twelve months) Earnings Per Share was $4.20 as of the quarter ending December 30, 2023.

Agilent is expected to see a contraction in earnings per share of -6.30% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Sartorius Stedim Biotech S.A. (DIM) Revenue, Earnings, and Stock Forecast

Sartorius Stedim’s revenue over the latest Trailing Twelve Month period was $3.1 billion. Sartorius Stedim’s earnings (Net Income) over the latest Trailing Twelve Month period was $0.3 billion.

The Wall Street consensus for Agilent’s EPS (earnings per share) projection for the next quarter is $0.99. The company’s TTM (trailing twelve months) Earnings Per Share was $3.70 as of the quarter ending December 30, 2023.

Sartorius Stedim is expected to see an expansion in earnings per share of 13.70% YOY in the next quarter based on the consensus of stock market analyst forecasts.

West Pharmaceutical Services (WST) Revenue, Earnings, and Stock Forecast

West Pharmaceutical Services’ revenue over the latest Trailing Twelve Month period was $2.94 billion. West Pharmaceutical Services’ earnings (Net Income) over the latest Trailing Twelve Month period was $0.59 billion.

The Wall Street consensus for West Pharmaceutical Services’ EPS (earnings per share) projection for the next quarter is $1.31. The company’s TTM (trailing twelve months) Earnings Per Share was $8.00 as of the quarter ending December 30, 2023.

West Pharmaceutical Services is expected to see a contraction in earnings per share of -33.67% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data mentioned here in this article was sourced from publicly available filings and releases, and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Life Sciences Industry Report: Summer 2023 Results Latest Summer earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues -5.22% YOY in the June – August Quarter, According...

- Publicly Traded Life Sciences Industry Report: Autumn 2023 Results Recent Autumn earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues -4.37% YOY in the July – September Quarter, according...

- Publicly Traded Home Builders Report: Winter 2022 Results Public financial data collected by investment newsletter provider Sather Research, LLC showed that 6 Publicly Traded Home Builders Grew Total Revenues Over 19% YOY in the October – December...

- Publicly Traded Home Builders Report: Winter 2023 Results Publicly available financial data collected by investment newsletter provider Sather Research, LLC showed that five Publicly Traded Home Builders by Market Cap grew Total Revenues on...