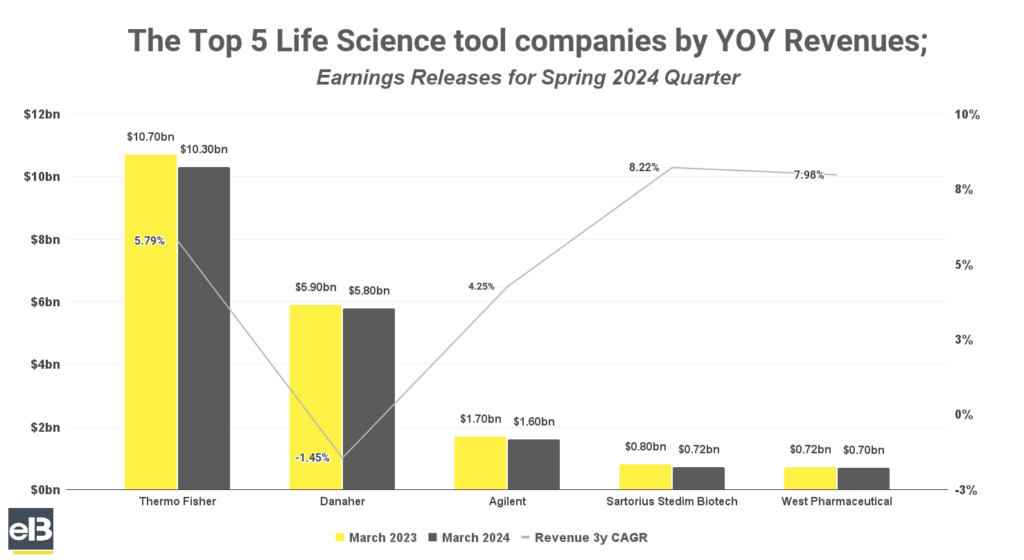

Latest Spring earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues in the high to low single digits YOY in the January – March Quarter, according to their Latest Earnings Releases.

Of the publicly traded Life Science tool companies who released earnings results, the following top 5 companies decreased revenues -8.20% YOY on average: Thermo Fisher, Danaher, Agilent, Sartorius Stedim Biotech, and West Pharmaceuticals.

Danaher stood out with the least decrease in revenues at -2.6% followed by West Pharmaceutical with a decrease of -3.00% YOY.

The following sections are covered in this report [Click to Skip Ahead]:

- Biggest Publicly Traded Life Science Tools by Market Share

- Top Life Science Tools Provider by Revenue Growth

- Top Life Science Tools Provider by Earnings (EPS) Growth

Company revenues, earnings, and stock forecasts covered:

- Thermo Fisher (TMO) Stock Forecast

- Danaher (DHR) Stock Forecast

- Agilent (A) Stock Forecast

- Sartorius Stedim Biotech S.A. (DIM) Stock Forecast

- West Pharmaceutical Services (WST) Stock Forecast

The list below only includes the top 5 Life science tools companies by market capitalization. The next section will include all >$5B market cap publicly traded life science companies.

| Company | March 2023 | March 2024 | YOY |

| Thermo Fisher | $10,687 | $10,345 | -3.40% |

| Danaher | $5,949 | $5,796 | -2.60% |

| Agilent | $1,717 | $1,573 | -8.40% |

| Sartorius Stedim Biotech | $787 | $718 | -8.20% |

| West Pharmaceutical | $716 | $695 | -3.00% |

Thermo Fisher reported a -3.40% decrease YoY revenue while organic revenue declined -4%. However, revenues were a sequential improvement in performance over Q4 2023. In their Diagnostics and healthcare, revenue declined in high single digits. Management noted the reported growth is still impacted by the runoff of COVID-19 testing-related revenue.

Danaher saw revenue decline by -2.60% YoY, while non-GAAP core revenue decreased by -4.0%. However, management was pleased to see improving order trends in their bioprocessing business and believed they continue gaining market share in our molecular diagnostic business at Cepheid.

Agilent had a -8.40% YoY decrease in revenue last quarter with -7.40% decrease in core revenue growth. Its Life Sciences and Applied Markets Group reported a decline of -14.0% in revenues. Management sees the market improving albeit at a slower pace than anticipated.

Sartorius Stedim Biotech showed a –7.60% YoY decrease in the latest quarterly revenue (in constant currencies), attributing the decline to continued reluctance in investments particularly in China and to some extent in Europe which dampened the order intake of their equipment business.

West Pharmaceutical Services saw both revenue and organic net sales decrease by -3.0%. However, management is expecting better second-half revenue growth as order trends and customer inventory reduction timings reinforce this.

Key Takeaway

The recent quarter, although still showed a decline in the overall revenues of publicly traded life science tools companies, was better than anticipated. Sequential orders and book-to-bill ratios of companies improved, with some saying the inventory destocking was largely behind now. Funding in bioprocessing also showed signs of improvement with it back now to 2019 levels.

Meanwhile, China remains soft, with low activity levels and demand remaining weak.

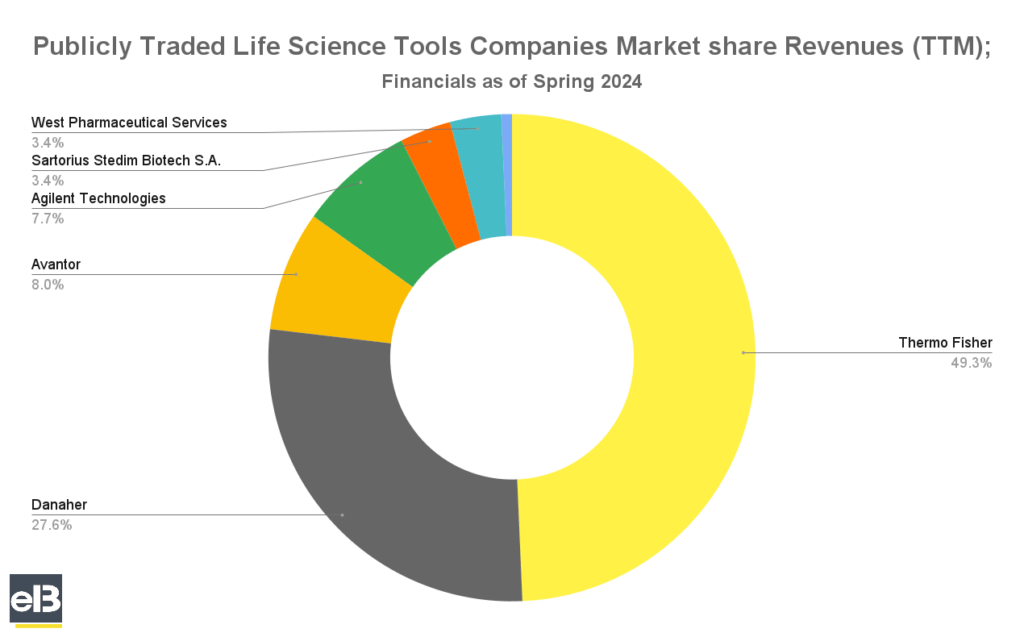

Biggest Publicly Traded Life Science Tools by Market Share

The chart below shows the list of publicly traded life science tool providers with market caps of >$5B as of June 2024.

Leading the group is Thermo Fisher with roughly 49.3% market share, followed by Danaher with 27.6%, and trailing behind is Avantor with 8.0% of Trailing Twelve Months (TTM) revenue share of all publicly traded life science tools providers.

| Company | Revenues (TTM in Thousands) | Mkt Share |

| Thermo Fisher | $42,492,000 | 49.3% |

| Danaher | $23,737,000 | 27.6% |

| Avantor | $6,866,700 | 8.0% |

| Agilent Technologies | $6,591,000 | 7.7% |

| Sartorius Stedim Biotech | $2,931,153 | 3.4% |

| West Pharmaceutical | $2,928,600 | 3.4% |

| Repligen Corp | $607,450 | 0.7% |

Top Life Science Tools Provider by Revenue Growth

Repligen Corp.’s revenues increased 11.95% faster than its peers in the life science tools industry in the previous three fiscal years.

West Pharmaceuticals, on the other hand, is ahead in boosting its YOY growth, with the only company growing its revenue by 1.56% from 2023-2024.

Sartorius Stedim Biotech takes the second spot in 3yr revenue CAGR with 8.22% while the other two Life Science companies, West Pharmaceutical and Thermo Fisher, trail behind with 7.98% and 5.79% 3yr revenue CAGRs, respectively.

| Company | 3yr CAGR | 1yr CAGR YOY |

| Repligen Corp | 11.95% | -21.90% |

| Sartorius Stedim Biotech S.A. | 8.22% | -19.07% |

| West Pharmaceutical Services | 7.98% | 1.56% |

| Thermo Fisher | 5.79% | -3.00% |

| Agilent Technologies | 6.79% | -2.81% |

| Avantor | 1.02% | -6.48% |

| Danaher | -1.45% | -4.69% |

Key Takeaway

The decline in revenue growth of publicly traded life science tools still continued in recent quarter albeit softer than anticipated. As most companies pointed out, the bioprocessing industry is seeing a slow and gradual recovery through the first half of the year while things will get better in the second half.

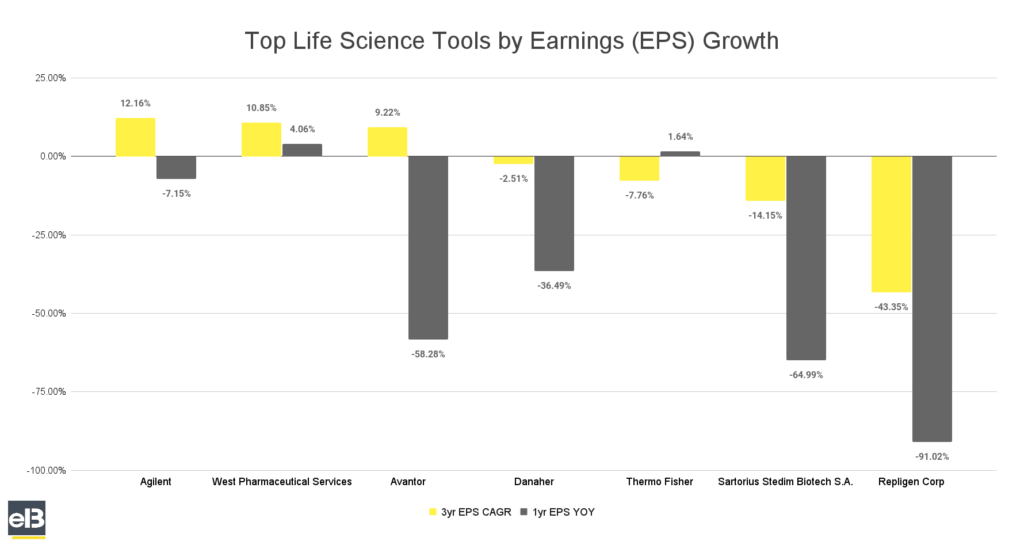

Top Life Science Tools Provider by Earnings (EPS) Growth

In the last three fiscal years, Agilent took the spot and saw the highest 3 year annual compounded growth rate of 12.16% in earnings per share.

The graph below shows that the EPS growth of publicly traded life science tool providers continued to decline, with only the top 3 recording high single-digit EPS growth over the past three years.

Meanwhile, West Pharmaceutical still had the highest 1-year EPS YOY growth rate among the list of 4.06%.

The list’s highest 3-year EPS CAGR companies include Agilent at 12.16%, West Pharmaceutical at 10.85%, and Avantor at 9.22%.

| Company | 3yr EPS CAGR | 1yr EPS YOY Growth |

| Agilent | 12.16% | -7.15% |

| West Pharmaceutical Services | 10.85% | 4.06% |

| Avantor | 9.22% | -58.28% |

| Danaher | -2.51% | -36.49% |

| Thermo Fisher | -7.76% | 1.64% |

| Sartorius Stedim Biotech S.A. | -14.15% | -64.99% |

| Repligen Corp | -43.35% | -91.02% |

Life Science Tools Companies Revenue, Earnings and Stock Forecast (Quarter ending March 2024)

| Company | YOY EPS Forecast |

| Thermo Fisher | -0.49% |

| Danaher | -23.22% |

| Agilent | -11.94% |

| Sartorius Stedim Biotech S.A. | -24.62% |

| West Pharmaceutical Services | -18.07% |

Thermo Fisher (TMO) Revenue, Earnings, and Stock Forecast

Thermo Fisher’s revenue over the latest Trailing Twelve Month period was $42.5 billion. Thermo Fisher’s earnings (Net Income) over the latest Trailing Twelve Month period was $6.0 billion.

The Wall Street consensus for Thermo Fisher’s EPS (earnings per share) projection for the next quarter is $5.12. The company’s TTM (trailing twelve months) Earnings Per Share was $15.70 as of the quarter ending March 30, 2024.

Thermo Fisher is expected to see a contraction in earnings per share of –0.49% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Danaher (DHR) Revenue, Earnings, and Stock Forecast

Danaher’s revenue over the latest Trailing Twelve Month period was $23.7 billion. Danaher’s earnings (Net Income) over the latest Trailing Twelve Month period was $4.4 billion.

The Wall Street consensus for Danaher’s EPS (earnings per share) projection for the next quarter is $1.57 The company’s TTM (trailing twelve months) Earnings Per Share was $6.0 as of the quarter ending March 30, 2024.

Danaher is expected to see a contraction in earnings per share of -23.22% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Agilent Technologies (A) Revenue, Earnings, and Stock Forecast

Agilent’s revenue over the latest Trailing Twelve Month period was $6.6 billion. Agilent’s earnings (Net Income) over the latest Trailing Twelve Month period was $1.20 billion.

The Wall Street consensus for Agilent’s EPS (earnings per share) projection for the next quarter is $1.26. The company’s TTM (trailing twelve months) Earnings Per Share was $4.20 as of the quarter ending March 30, 2024.

Agilent is expected to see a contraction in earnings per share of -11.94% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Sartorius Stedim Biotech S.A. (DIM) Revenue, Earnings, and Stock Forecast

Sartorius Stedim’s revenue over the latest Trailing Twelve Month period was $2.9 billion. Sartorius Stedim’s earnings (Net Income) over the latest Trailing Twelve Month period was $0.3 billion.

The Wall Street consensus for Sartorius Stedim’s EPS (earnings per share) projection for the next quarter is $1.06. The company’s TTM (trailing twelve months) Earnings Per Share was $2.90 as of the quarter ending March 30, 2024.

Sartorius Stedim is expected to see a contraction in earnings per share of –24.62% YOY in the next quarter based on the consensus of stock market analyst forecasts.

West Pharmaceutical Services (WST) Revenue, Earnings, and Stock Forecast

West Pharmaceutical Services’ revenue over the latest Trailing Twelve Month period was $2.93 billion. West Pharmaceutical Services’ earnings (Net Income) over the latest Trailing Twelve Month period was $0.57 billion.

The Wall Street consensus for West Pharmaceutical Services’ EPS (earnings per share) projection for the next quarter is $1.73. The company’s TTM (trailing twelve months) Earnings Per Share was $7.70 as of the quarter ending March 30, 2024.

West Pharmaceutical Services is expected to see a contraction in earnings per share of -18.07% YOY in the next quarter based on the consensus of stock market analyst forecasts.

Methodology

All data mentioned here in this article was sourced from publicly available filings and releases, and processed by investment newsletter provider Sather Research, LLC.

Stock forecasts and analyst consensus EPS growth estimates were sourced from data provided by Seeking Alpha.

Contact Seoshin Chil at [email protected] for any further commentary, concerns, questions, or feedback. Alternatively, you can get in touch with the company during business hours through our contact page, or call 888-978-1348 from Monday – Friday; 9AM EST – 5:00 PM EST.

Seoshin Chil

Seoshin is an active sailor in offshore windfarm vessels but has a passion for studying great businesses and investing in them. Being always at sea does not stop him from doing so!

Related posts:

- Publicly Traded Life Sciences Industry Report: Winter 2023 Results Latest Winter earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues in the high to low...

- Publicly Traded Life Sciences Industry Report: Summer 2023 Results Latest Summer earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues -5.22% YOY in the June – August Quarter, According...

- Publicly Traded Life Sciences Industry Report: Autumn 2023 Results Recent Autumn earnings showed that the Top 5 Publicly Traded Life Science tool companies by market cap decreased total revenues -4.37% YOY in the July – September Quarter, according...

- Publicly Traded Analog Semiconductor Industry Report: Spring 2024 Results Latest Spring earnings results of the Top 5 Publicly Traded Analog Semiconductor companies by YoY revenues continue to go down across the board in the...