Updated 9/27/2023

When most think of payment systems or rails, we think of Visa, Mastercard, or American Express. The real-time payment system gets lost in the hype and excitement of the emerging fintech world. But, real-time payments are getting an upgrade and will lead to more innovation for businesses and investors.

Systems such as Zelle and FedNow are leaders in the real-time payments arena and lead businesses to adopt this method of processing payments.

Understanding how businesses work is fundamental to identifying great investments, and this post is part of explaining different business systems and how they work. To value any company, we need to understand how they make money, and today’s post is part of understanding the payments revolution that is going on today.

The pandemic accelerated a process already underway, and real-time payments are part of that process.

In today’s post, we will learn:

- What Are Real-Time Payments?

- What Are Examples of Real-Time Payments?

- Payment Flow of Real-Time Payments

- The Impact of P2P Payment Apps and Real-Time Payments

Okay, let’s dive in and learn more about real-time payments.

What Are Real-Time Payments?

Real-time payments, or RTP, happen almost instantaneously, initiating and settling in seconds. The real-time payment rail is a digital infrastructure that enables real-time payments. The ideal real-time payment infrastructure has 24x7x365 access, meaning they are online to process payments anytime needed, including weekends and holidays.

The U.S. leader in real-time payments is The Clearing Houses’ RTP network. FedNow, the Federal Reserve’s real-time solution, will also be a real-time network. FedNow anticipates launch sometime in 2023.

Other examples of real-time payment networks include:

- UPI in India

- Faster Payments in the U.K.

- Pix in Brazil

Let’s define a few terms for payments before going a bit further:

Payment rails are any platform or network that enables payments, the most famous being Visa and Mastercard’s payment protocol.

Real-time payments are what they sound like; they happen in real-time or nearly so, with initiating, clearing, and settling happening in seconds.

For banks to connect to these real-time payment networks, they must operate 24x7x365 and are available for transfers anytime. “Open-loop” is an important feature, meaning payments connect directly to a personal account instead of relying on a prepaid balance.

The system must include a data-rich messaging format, which gives clear and nuanced information and helps to avoid unresolved errors and processing delays. Real-time payment networks can ensure stronger participant security by utilizing strong formatting standards on the protocol.

It is important to understand the difference between real-time payments and faster payments. We should not use them interchangeably because while they are similar, there are some important differences.

Faster payments post and settle payments faster than traditional payment rails, but faster doesn’t always mean immediate.

Other solutions, such as Visa and Mastercard, push payments with message transactions within seconds or minutes, but because push payments don’t settle transactions quickly, they are considered faster but not real-time payments.

The biggest detail to understand is that all real-time payments are a form of faster payments; not all faster payments are in real-time.

These real-time payments bring real value to businesses. The first is obvious: they are fast, really fast, meaning payments that settle quickly and quickly allow access to the funds. And instant access is a game-changer for businesses that need access to those funds quickly.

Real-time payments bring another change to the payment rails, which is end-to-end communication. Before, communication flowed in one direction, from the payer to the payee. If both parties wanted to communicate information, the system required them to do so outside the payment rails.

Real-time payments eliminate that headache by connecting the payment and payment data in a single transaction.

Other hindrances, such as lag time or lack of transparency on the arrival of funds, can impact cash flow, liquidity, and risk management for merchants and exist in fragmented communication processes. But with the creation of real-time payment networks, much of that headache disappears.

Another bonus is that real-time payments are final, meaning the sender can’t recall them, which helps improve communication for the merchant.

What Are Examples of Real-Time Payments?

Let’s look at some common examples of real-time payments and how they work.

Most people will consider mobile payments on Venmo, Zelle, and Square’s Cash App networks. But, these, at this time, are not real-time payments yet.

Cash App

When you request cash on Square’s app, you think you are getting the funds immediately from your bank account. But, instead of the open loop we spoke of earlier, they occur over a “closed loop.”

Users can exchange funds immediately within Square’s close loop, but if they want to retrieve money from within the close loop, they will have to go outside the loop, typically via ACH.

But, many payment facilitators or payfacs are looking at real-time payments as a means of users transferring between their eWallets and checking accounts, for example. It wouldn’t make the eWallet open loop but would allow for an easier connection to other open loops, such as real-time payments.

Zelle

Next would be the Zelle system.

Zelle, founded in 2017 and is operated by the Early Warning Services LLC, a company owned by several large U.S. banks:

- Bank of America

- Capital One

- Truist

- JP Morgan

- PNC Bank

- US Bank

- Wells Fargo

Zelle is an independent transfer system linked to a large banking network, including credit unions, and has recently integrated with The Clearing House’s real-time network. The collaboration allows Zelle’s payments to transfer to The Clearing House’s network. If the payee or payer’s bank is not part of the real-time network, Zelle allows them to settle in minutes, but it is technically not real-time.

Wire Transfers

Wire transfers are not part of the real-time payment network; while these payments settle instantly, they are low-volume, high-value transactions, which differs from real-time payments, which are smaller, high-volume transactions.

The difference is in the amount and frequency of the use. For example, using a wire transfer to send your friend money for a shared purchase of $50 is expensive and takes time to complete. Using a wire transfer to send the initial deposit for your home purchase makes much more sense.

ACH Transfers

ACH transfers are also not real-time payments. The updated system improves the transfer time from the original 3-day period to a single day. The settlement of ACHs comes in batches, meaning they settle at the end of the business day by compiling the transactions and then sending them out in one batch instead of processing them individually like a real-time payment.

Actual Real-Time Payments

Some of the more common use cases for real-time payments are:

- B2B real-time payments

- P2P real-time payments

- Payroll

- Request for Pay

Banks that want to work with the real-time payment network connect via technology provided by some of the larger core banking providers, such as:

- FIS

- Fiserv (FISV)

- Jack Henry (JKHY)

- ACI Worldwide (ACI)

These providers allow connections between banks, payment providers, and payfacs, enabling the growth of real-time payment networks.

The second big player in the real-time space is the coming service, FedNow, built by the Federal Reserve. In 2019, the Federal Reserve Board announced they were getting into the real-time payment arena with the Federal Reserve banks developing their real-time payment rail.

The Fed then announced it would be live sometime in 2023 or 2024, which they updated recently to 2023.

They recently opened a pilot program in January 2021, the FedNow pilot program, which includes over 200 banks and processors that will test, help develop, and become early adopters of FedNow.

Some of the big contributors will be:

- ACI Worldwide

- Fiserv

- Finastra

- Jack Henry

As with The Clearing House’s system, the FedNow real-time network will operate 24x7x365 and allow for near-instantaneous payments while using a secure protocol, ISO 20022; all real-time providers adopted that.

Payment Flow of Real-Time Payments

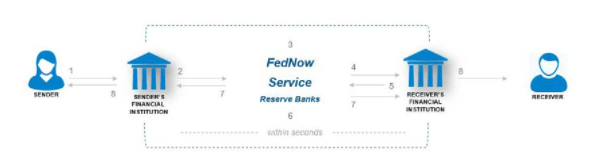

Below is a great example of the payment flow of real-time payments from the Federal Reserve website explaining the FedNow program and its benefits in great detail. I include it entirely because it lays out the process extremely well.

- “In step 1, a sender (i.e., an individual or business) initiates a payment by sending a payment message to its financial institution through an end-user interface outside the FedNow Service. The sender’s financial institution is responsible for screening the payment according to internal processes and requirements.

- In step 2, the sender’s financial institution submits a payment message to the FedNow Service.

- In step 3, the FedNow Service validates the payment message, for example, by verifying that the message meets message format specifications.

- In step 4, the FedNow Service sends the contents of the payment message to the receiver’s financial institution to seek confirmation that the receiver’s financial institution intends to accept the payment message. At this point, the receiver’s financial institution will have the opportunity to confirm or deny that it maintains the specified account.

- In step 5, the receiver’s financial institution sends a positive response to the FedNow Service, confirming that it intends to accept the payment message. Steps 4 and 5 are intended to reduce the number of misdirected payments and resulting exception cases that can occur in high-volume systems.

- In step 6, the FedNow Service debits and credits the designated master accounts of the sender’s and receiver’s financial institutions (or their correspondent financial institutions), respectively.

- In step 7, the FedNow Service sends a payment message forward to the receiver’s financial institution with an advice of credit and in parallel sends an acknowledgement to the sender’s financial institution, notifying it that settlement is complete.

- In step 8, the receiver’s financial institution credits the receiver’s account. As a term of the FedNow Service, the Federal Reserve Banks anticipate requiring the receiver’s financial institution to make funds available to the receiver almost immediately after step 7. This crediting to the receiver’s account as well as the debiting of the sender’s account by their respective financial institutions happens outside the FedNow Service.”

Again, even though the example represents the FedNow payment flow, it also represents how real-time payments work. Remember that this takes seconds to flow through the system, which is amazing.

The Impact of P2P Payment Apps and Real-Time Payments

Peer-to-peer payments, or P2P, have increased, accelerating through the pandemic and changing how we buy, sell, or pay for everything. Apps such as Venmo, Cash App, Zelle, and PayPal replace cash, checks, or IOUs; cash is dead and is becoming the buzzword.

These apps allow us to split the check by transferring money immediately to our friends instead of carrying cash or going to an ATM to withdraw cash and then hassle about getting exact change. We can even use these apps to pay bills, rent, share an Uber, or split dinner.

Statistics show that consumers are increasingly adopting the use of P2P apps:

- 54% of consumers have used PayPal in the past year

- Venmo use increased by 14% among consumers

- 13% of consumers have used Zelle

So, what does this have to do with real-time payments?

All of the above apps integrate with the real-time network of The Clearing House, allowing those apps to transfer over their network from the app to the consumer’s bank account. For example, Venmo started enabling instant transfers on its platform through The Clearing House’s real-time payment network in 2019.

These real-time payments powered by the increasing use of apps such as Venmo improve the networks and strengthen the consumers’ reliance on these apps.

For merchants, more rich data enables better communication and real-time cash flow management.

For example, in the old days in the restaurant business, the restaurant had to wait until the end of the day to send their whole batch to the payment processor, who would route it through their bank and wait for the settlement to gather the funds and then send all of that back to the restaurant. The process took up to three days, which meant managing your cash flow was challenging.

As an example of the rate of how much real-time payments are accelerating:

- Over 130 banks in the U.S. are in the process of implementing real-time payments, up five times from September 2019.

- Over half of all demand deposit accounts (checking or savings accounts) in the U.S. are now connected to The Clearing House’s network.

- Globally, over 56 countries now have a live real-time payment rail, up from 14 countries only six years ago.

The head of real-time payments for FIS, Raja Gopalakrishnan, stated, “The continued adoption and evolution of real-time capabilities all over the world signals that real-time is no longer a nice-to-have or an afterthought; it must be a priority.”

A recent study from ACI Worldwide found that 77% of merchants surveyed believe that real-time payments will replace physical payment cards.

Investor Takeaway

After exploring the idea of real-time payment, there is little doubt that the movement towards quicker payments is underway and will likely accelerate until all payments are real-time, at least on the consumer level.

Adopting real-time payments is also financially beneficial for those enabling these payments. For example, Fiserv is one of the largest processors of Zelle’s peer-to-peer network, with 600 of 765 banks on Zelle using Fiserv’s core banking system. These banks pay Fiserv a per-transaction fee each time funds move from one bank account to another.

As more and more banks and payment facilitators like Square, PayPal, Ayden, and Stripe adopt these real-time payment networks, the more money the enablers of real-time payments will make. These companies that enable these payments will see accelerations of volumes across their payment rails.

It will also change how businesses manage their cash flow in real-time instead of waiting for that float to hit their accounts. Business expenses such as taxes, payroll, and bills can now be budgeted for and managed in real time, allowing quicker payments to vendors and employees.

As someone interested in payments and how they work, understanding real-time payments will give you a leg up as more and more financial institutions, merchants, and processors adopt these “new” payment rails.

And with that, we will wrap up today’s discussion on real-time payments.

As always, thank you for taking the time to read today’s post, and I hope you find in it something of value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Pin Debit Networks: A Guide to This Unknown World Updated 9/25/2023 In a survey recently released by the Federal Reserve Bank of Atlanta, U.S. consumers use their debit cards to make payments 68% of...

- Peer-To-Peer Payments: What To Know Updated 9/27/2023 “Mobile devices, high-speed data communication, and online commerce are creating expectations that convenient, secure, real-time payment and banking capabilities should be available whenever...

- How Visa Makes Money: A Business Model Breakdown Updated 10/12/2023 Visa Inc (V) is one of the leading payment brands globally and its cousin Mastercard (MA). Visa provides payment services to over 200...

- Key Players in the Payment Processing Flow Updated 11/9/2023 Analysts expect global payment revenues to grow to $2.5 trillion by 2025, according to McKinsey, after returning to their historical 6 to 7...