Myth #8 that Tony Robbins outlines in his book is that “You gotta take huge risks to get big rewards”. I’m sure that many of you have heard a phrase very similar to this, but is it true? Let’s break down the true risk vs. reward of investing in the market!

Personally, I love the title of this myth because I really do think that a lot of people think this way, but I also think that a majority of those people are those that might not necessarily understand how the stock market works. People believe that the market is nothing more than organized, legalized gambling and that if you risk it all, you can get really, really rich.

Well, this is certainly true in the sense that a high risk can definitely mean a high reward, but you can also get a high reward without having a major risk.

Robbins brings up a very famous quote from Warren Buffett about managing risk. Regarding investing in the market, “Rule No 1: Never Lose Money. Rule No 2: Don’t forget Rule No 1.”

Buffett is widely regarded as the greatest investor of all time and this simple quote really shows the importance that he personally places on protecting his downside when investing. If you can manage to never lose money, then your only other two outcomes are to make money or keep the exact same amount of money you have – both of which sound like decent outcomes! Although we all prefer to make some moolah 🙂

Robbins goes into his “four proven strategies for achieving strong returns while anchored firmly in calmer waters” – let’s dive in!

Structured Notes

Structured Notes are something that is not often available to the common people because the wealthy will take-advantage early on. Essentially, you are loaning money to the bank and in return, you get a certain amount of the upside that the bank receives from their investments; but you limit the downside as you’re guaranteed to get back at least the amount that you put in.

So, you might put in $10K and you’re guaranteed to get at least $10K back at the end of the term. For that guaranteed “protection”, you’re not going to get all of the profits if the market goes up as a sort of payment for that risk mitigation.

The concern with something like this is that these notes are only as sound as the bank that is backing them. While a bank might seem very reliable and one that would have a great balance sheet, Robbins brings up Lehman Brothers that also seemed like a great company until they went bankrupt.

Just because there doesn’t appear to be much downside risk, there still is. You always have to keep that in mind!

Market-Linked CDs

You may be familiar with a typical CD where you’re locking your money up for a certain period of time and in return are receiving an interest payment that typically is right around a high-yield savings account. Truthfully, not a great option considering you cannot access your money if you need it before the term is up, unless you want to forfeit some of the gains that you’ve earned or pay fees.

The Market-Linked CD option is one that gives you that same measly return as a normal CD but also allows you to capitalize on some of the upside in the market.

Robbins gives an example where the rate of the CD is 0.28% but you can capture up to 5% of the market’s returns. So, if the market went up 8%, you would get 5% returns, a significant amount higher than the 0.28% that you initially were going to get and would’ve received if you had simply just stuck with a normal CD.

Fixed Indexed Annuities

These annuities have been around since the mid-90’s and effectively will guarantee your principal to be protected and will not drop in value. Similarly to the other options I have described, you will be able to capitalize on the upside and even turn it into a “paycheck for life” as Robbins describes it.

Essentially, you’re giving your capital away to receive a steady stream of income that you can live off of for years and years and be protected knowing that your principal will still always be there if you need it.

Similar to my earlier example with Lehman Brothers, your main risk with this strategy is if your insurance company isn’t one that will be in business for years to come. If they are, nothing to worry about!

An Annuity Without the Annuity

Robbins doesn’t give a ton of information on this but notes that essentially you’d be paying to have someone manage your portfolio and rebalance it over time. He talks a little bit about index funds and my guess, and it’s purely a guess, is that he will say that if you rebalance your portfolio consistently then regardless of the market conditions, you’re going to be protected because you’re naturally going to move more into stocks when stocks are down and more into bonds when stocks are up, therefore continuously allowing you to be positioned correctly for when the market shifts.

Again, that’s just my prediction as we will find out more later in the book (per his comments) but I believe that’s where the conversation is going.

While I do appreciate where Robbins is going with all of this messaging, I really want to take things in a completely different direction. You see, Robbins is effectively talking about ways to literally not lose money on a year-to-year or short-term basis and about protecting that principal that you might have.

While I do agree that if you can’t stomach “losing” money in the short-term these options might be right for you, I really want to hammer home the point that investing in ultra-conservative asset classes that are going to earn you minimal returns is way more risky than investing in individual stocks themselves.

In fact, I truly don’t think that anyone should hold any bonds, CDs, cash, annuities, or anything even similar to those as an investment diversification unless they’re within 5-10 years of retirement. To be quite blunt, being invested too conservatively is a thousand times more risky than being invested 100% in stocks.

Now let me be very clear – do not hear what I am not saying. I am not saying that you should invest 100% of your portfolio in Bitcoin or the newest SPAC that just hit the market. I am not advising you to be reckless with your investments and get all of your advice from CNBC and only swing for the fences.

What I am saying is that you really should understand what the term “risky” actually means to you and what the “reward” that you’re seeking is. Let me explain.

I’ve said it before and I’ll say it now – I hate bonds. Now, I am 30 and don’t plan to retire soon, but for me, personally – I hate bonds.

If I was 60 and about to retire I wouldn’t hate them at all. They’re a great stabilizer to a portfolio and can really smooth out volatility. That’s something that’s great to have if you’re close to needing to withdraw funds from your portfolio. When you’re 30 years away like I am and in “growth mode”, they’re the riskiest thing I can do.

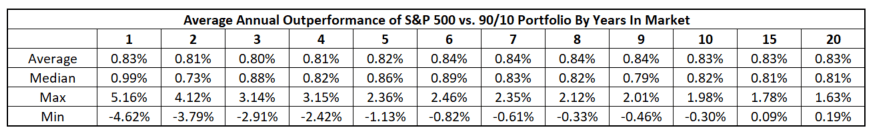

I recently wrote an article on Fidelity Target Date Funds and the overwhelming takeaway to me is that bonds are going to absolutely kill your portfolio. On average, by having only a 10% bond allocation vs. a portfolio that was 100% stocks, you’re going to underperform that all-stock portfolio by about 0.83% each year:

While that might not seem like a massive amount, it really is if you’re going to expand that over this 30-year period that I have been talking about. Don’t believe me?

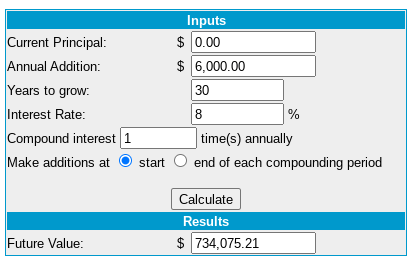

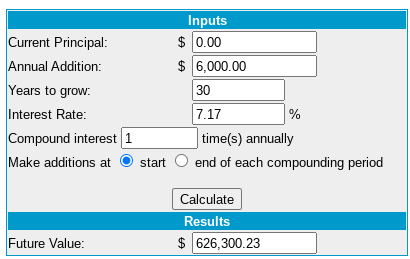

Let’s checkout a realistic scenario where you currently have absolutely nothing invested in the stock market and decide to max out your IRA each year for the next 30 years. Now, I will note here that I like to use 8% as an estimate for my future returns as the S&P 500 has historically returned over 10% and inflation can be in the 2-3% range on average, so you’ll see that the first screenshot from my favorite compound interest calculator shows 8% and the second uses 7.17%, a decrease of that same 0.83% that I mentioned previously:

As you can see, that mere 0.83% ended up giving the 100% stock portfolio nearly $108K more at the end of the 30-year period vs. the 90/10 stock/bond mix.

You see, when you have an extremely long time period to invest, you can afford to take “calculated risks” such as investing in the stock market in 100% stocks.

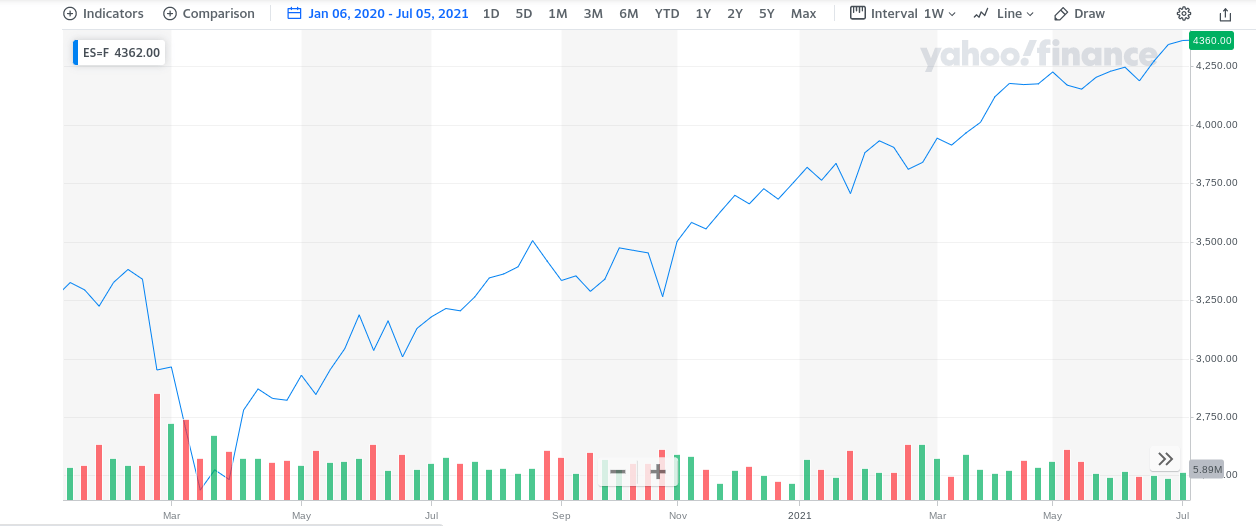

The risky part is not investing in stocks – the risk purely comes from the timeframe that you’re investing. If you’re investing in stocks for the short-term then sure, it can definitely be risky. In March 2020 when COVID was first hitting the US, we saw the market drop by 30%. But if you had just held on you’d be sitting here with a massive pile of cash.

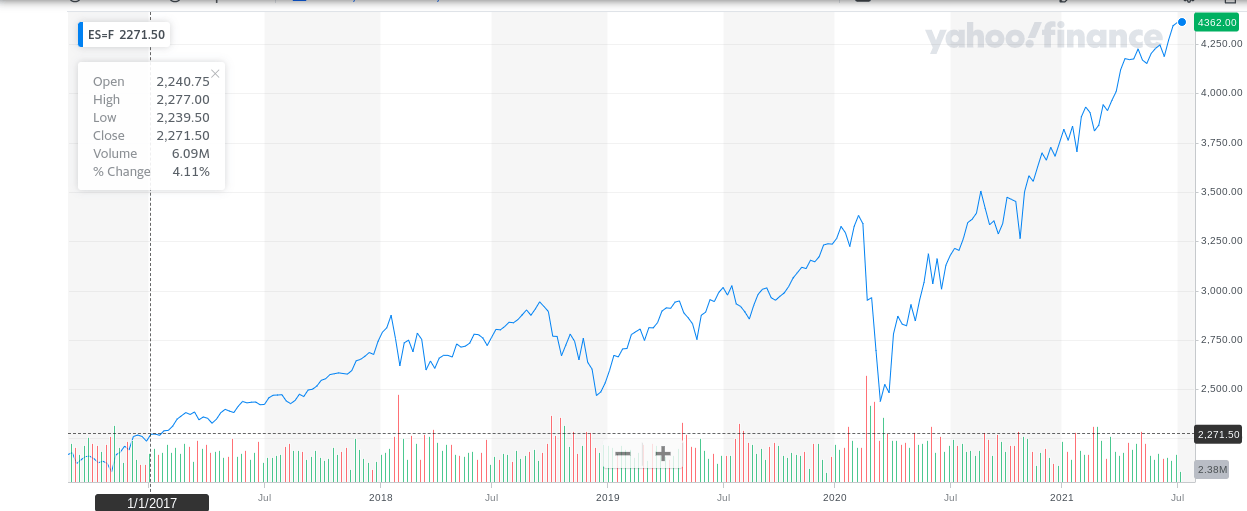

Take a look at the S&P 500 from the beginning of 2020 until July 2021. You can see that massive drop in March that I described but also look at where the S&P 500 is currently:

The S&P 500 is up 31% from it’s PRE-COVID HIGH! Yes, I said from pre-covid. So, if you had literally just held for that massive drop and didn’t do anything, you’d still be up over 30% from where you were a mere 15 months ago. Isn’t that insane?

So, yes, investing in the short-term can be risky but that’s why we don’t suggest that you invest in stocks for the short-term. If you’re looking to save for a short-term goal like a vacation, down payment on a home, wedding, or any other reason in the next few years, there are many better places for you to put your money to minimize the downside of your investment and, truthfully, to make sure that you don’t lose money.

However, if you’re really investing for any time period that is 5+ years (with a higher risk-tolerance) or definitely 10+ years, your money needs to be invested in stocks. Your money being invested in anything conservative that’s earning 3% or less is truly the riskiest thing that you ever could do.

I often hear about how some people have a bit of “dry powder” just sitting on the sidelines where they’re waiting for a good opportunity to find an opportune time to back up the truck and dump all this money into the market. Personally, I don’t hate this strategy as long as you’re not waiting for that “perfect” opportunity and rather just looking for one that seems better than the current.

If you’re just sitting on the sidelines waiting for a 25% drop in the market then you might be waiting for many, many years, passing up multiple percentage points of gains just to buy in at a 25% dip that still is above where you would’ve bought in before.

For instance, let’s pretend that you were going to invest on 1/1/2016 but decided to just hold onto your cash and wait for a better time to invest. Well guess what – that time literally never came!

As you can see, even after some big dips in 2018, 2019, and 2020, you still never got back to that price where you were in 2016, so you’ve just been holding out this entire time for literally nothing.

I have talked before about how I have a rainy day fund but the key difference is that the rainy day fund can be used for anything. I’ve used it to max out my IRA when COVID-19 hit hard in March. I’ve used it to buy gym equipment when we decided to implement a home gym over going to the gym. And I’ve even used it to fund sporting tickets when my team made it further than I anticipated and I wanted to take advantage of them being in the Final Four and watch them play.

As I mentioned, you don’t have to be invested in these absolutely crazy stocks to be able to capture massive returns. The 10% return that the S&P 500 has given over time is an amazing return and one that people should be happy with knowing that the risk is extremely low.

The real risk is trying to time the market or being too conservative and letting your money sit on the sidelines in an inefficient manner.

Do yourself a favor and if you have 10+ years before you need to start pulling on your retirement funds, make sure you’re 100% in stocks. If you’re scared to go into straight stocks, I understand, but at least move that money into an ETF that is a little bit more diversified but still gives you 100% stock returns.

You can always pick an ETF like SPY that mimics the S&P 500 or if you want something that has historically crushed the S&P 500 nearly every single year, take a look at my personal favorite ETF, MTUM, for some even greater gains!

Related posts:

- Building A Portfolio with ETFs: A Beginners Guide Updated 10/12/2023 Successful investing doesn’t have to be complicated; the most important factor is to find a method and strategy that works for you. Whether...

- The Short Ratio, Short Selling, and Short Squeezes Explained Updated 9/25/2023 The short ratio is widely used when understanding the short selling behind a stock. It can tell you how many fund managers or...

- Index Funds vs. Stocks: We Need to Talk About Investor Behavior Today’s investor has a lot of options for investing money. Index funds vs. stocks vs. bonds vs. alternative currencies. The list goes on. With lots...

- VOO vs. SPY – Which One Will Make You More MONEY? One of the most common things that you will ever hear in the investing world is people using S&P 500 returns as a benchmark or...