Updated 10/27/2023

Mastercard, along with Visa, is one of the card processing network giants that help enable money transfer between consumers and merchants. Whether it is in person, on your iPhone, or online, Mastercard is there to help make our payments easier.

Learning the history of a company like Mastercard and how it operates helps give you a better insight into any investment you make. History often shapes the future, and understanding the background helps us determine possible futures.

Understanding how companies make money is also a great idea; Mastercard is no different. Many investors avoid a potential investment with Mastercard because it seems too complicated, and we will work through Mastercard’s operations.

Visa and Mastercard are huge companies, with Mastercard owning a market cap of $382 billion and earning annual revenues of $15.3 billion in 2020. Visa carries a market cap of $449 billion and annual revenues of $24.1 billion in 2021. Needless to say, the card processing market is a hugely profitable one, and there is a lot of value in owning the different payment networks.

In today’s post, we will learn:

- Brief History of Credit Cards

- How Did Mastercard Start?

- Important Dates in Mastercard’s History

- How Does Mastercard Work?

Okay, let’s dive in and learn more about the history of Mastercard.

Brief History of Credit Cards

Before we dig into Mastercard and understand how they built their network, we should discuss the history of credit cards to understand why they are so valuable and rare today.

Over the past 70 years, tremendous competition and innovation have propelled the card industry forward. There has also been an enormous amount of consolidation taking place in the industry along the way.

And what remains is the “big four” of payment networks or card brands. Names like Visa, Mastercard, American Express, and Discover remain today despite tremendous competition among fintech providers such as PayPal and Square.

Visa and Mastercard are open-loop networks that route transactions between cardholders and merchants. In contrast, different banks, such as JP Morgan, are issuing the cards, handling credit needs, and acquiring merchants. Fun fact: Visa and Mastercard don’t issue any cards themselves.

Discover and American Express are closed-loop systems, which means they issue cards, extend credit, acquire merchants, and route transactions across their closed network.

How did the whole credit card industry start?

Diner’s Club is the one to blame; they are widely considered the first charge card in the U.S. Diner’s introduced their card in 1950 to a group of restaurants and business people in New York City. Because of their limited success, other cards started popping up, along with the first model of credit cards.

That brings us to the big Kahuna, BankAmericard, which began in 1958 with the famous “Fresno Airdrop,” which dropped thousands of BankAmericards into the laps of residents of Fresno, CA, in an attempt to jumpstart the credit card industry. That began the story of Visa, with BankAmericard dominating the credit card scene from 1960 to 1966, with only ten new credit cards issued during that time.

Part of the slow growth was that Bank of America hid its bankamericard’s success until 1966 when it became obvious that they had a hit on their hands. And from 1966 to 1968, credit offerings exploded, with 440 new cards introduced in the intervening two years.

Mastercard joined the fray in 1966 and went by the name Interbank initially, and although American Express had been around since 1850, it wasn’t until 1958 that they launched their first charge card to compete with Diners Club. Discover is the newest entry into the credit card wars, a spinoff from Sears’s foray into the financial world in the 1980s. Discover has been a standalone company since 1966, and funnily enough, it now owns Diners Club.

The use of credit has a long history, starting in 3500 B.C. in Sumer, where historians believe that credit began with consumer loans for agricultural uses. In 1800 B.C., Babylon was the first to formalize the laws around credit with the Code of Hammurabi. The Code helped establish the legal maximum length of interest rates. For example, the ceiling for grain loans was 33.3%, and silver was 20% per year.

From those humble beginnings began the economic idea of buying items on credit and paying that loan back over time while paying agreed-upon interest as the “cost” of borrowing. Fast forward to today, we have the powerhouses of Visa and Mastercard that help us manage credit and payments by enabling payments—and making it easier for consumers and merchants to exchange money for products and services.

Today, along with Visa, Mastercard is one of the largest global card schemes. The three largest banks in the US are ironically issuing their cards with Mastercard logos, such as JP Morgan, Citibank, and Bank of America.

How Did Mastercard Start?

Mastercard, originally known as Interbank before becoming Master Charge, began in 1966. The company began as an alliance of several regional bankcard associations reacting to the success of BankAmericard, which was issued by Bank of America, later known globally as Visa.

BankAmericard began in 1958 with the famous “Fresno Airdrop,” as Bank of America flooded the Fresno neighborhoods with the introductory BankAmericards. The first issuance of these cards ended in disaster as defaults soared as consumers weren’t sure how to use the cards and repay their loans, along with a surge in fraud.

But Bank of America believed in the new product and kept at it with changes along the way, and by 1961 began to show a profit. Bank of America kept all of this on the down-low and even allowed unfavorable rumors to circulate to keep any competition at bay. Bank of America was successful with the strategy until 1966, when the bank’s profitability became too hard to conceal.

After 1966, small and large banks began to band together in regional bank associations. The reason for these associations was that 15 states prohibited branch banking and required unit banking at the time. We can define a unit bank as one that can only operate at a single site, forcing them to remain small.

By joining these regional bankcard associations, the unit banks could quickly add credit cards to their financial product lineup, allowing them to quickly scale their economies of scale by outsourcing back-office operations like card servicing to the association.

The bank associations enabled the unit banks to consolidate their client bases and merchants to create networks to make credit cards more beneficial to both groups. The high failure rates of early cards resulted from small geographies of consumers and merchants around the issuing banks, leading to smaller economies.

Mastercard was born out of this move towards consolidating banking units and associations. In 1966, several regional banking associations connected to form the Interbank Card Association.

The original member banks were:

- United California Bank

- Wells Fargo

- Crocker National Bank

- Bank of California

The above banks formed Interbank, which, with the help of Marine Midland Bank of New York (later to become HSBC Bank), became known as Master Charge: The Interbank Card.

The distinctive two overlapping circles that grew to become the world-famous brand began with Robert Leavelle and his son, Martin, at the Farmer’s & Merchants Bank of Long Beach, CA.

Early bank authorizations for credit card transactions happened over the phone at first. But by 1973, Interbank revolutionized its authorization process and established a centralized computer network that connected merchants to the banks that issued credit cards.

Important Dates in Mastercard’s History

Below is a list of some important dates in Mastercard’s history. It helps highlight the growth of this small regional association to the mega-cap company it is today.

1966: The year of the founding of Interbank, the collection of regional banking associations. Unlike BankAmericard, which began with the backing of Bank of America, Interbank didn’t have the backing of any single bank.

Interbank controlled all aspects of the early credit card program, from establishing rules for authorization, clearing, and settlement of their cards. Interbank also controlled all the marketing, security, and legal facets of running their credit cards.

1968: In 1968, Interbank began branching outside US borders by allying with Banco Nacional in Mexico, which started Interbank’s global network. Later that year, Interbank formed relationships in Europe with Eurocard and Japan, solidifying their burgeoning global expansion.

By the late 70s, Interbank had grown its membership to Africa, Australia, and Japan.

1969: Master Charge enters the picture, as the branding of the card and name begins with joining First National Bank with the association and merging its proprietary Everything Card with Master Charge.

1973: The creation of the first computerized (INAS) authorization, clearing, and settlement process.

1974: introducing the first magnetic stripe on the back of the credit cards, making authorization far more efficient and helping reduce fraud.

1975: the system called INET enters the picture, which provides an electronic exchange among the Master Charge members. Automating the complete authorization process reduces the need for mailing credit card slips.

1979: The name’s evolution continues, with the renaming of Master Charge: The Interbank Card morphing into MasterCard.

1988: MasterCard purchased Cirrus, the largest ATM (automated teller machine) network globally, for a cool $34 million. With the purchase, MasterCard entered the world of ATM networks, creating the MasterCard/Cirrus ATM network, allowing MasterCard to deliver cash quickly and easily to its cardholders.

1991: In 1991, MasterCard continued its growth by partnering with Europay International to introduce Maestro, a global POS (point-of-sale) debit network, enabling customers to use their debit cards in the place of cash anywhere they saw a MasterCard logo.

2006: MasterCard goes public via an IPO by selling 95.5 million shares for $39 a share, with the NYSE ticker symbol of MA.

2016: MasterCard introduced a new branding with a name change to Mastercard and a new corporate logo containing the now familiar overlapping circles and the word Mastercard below the logo.

How Does Mastercard Work?

Like Visa, and contrary to popular belief, Mastercard is not in the credit card business. Mastercard is part of the duopoly, along with Visa, connecting consumers and merchants globally, enabling the moving of money easily. Mastercard helps provide the infrastructure that allows banks (financials) and merchants to communicate with each other.

As the second biggest player in the duopoly, Mastercard enables us to use our debit cards, credit cards, and prepaid cards in more than 150 currencies in over 210 countries globally. Mastercard processed over 90 billion transactions in 2020, with $6.3 trillion in gross volume.

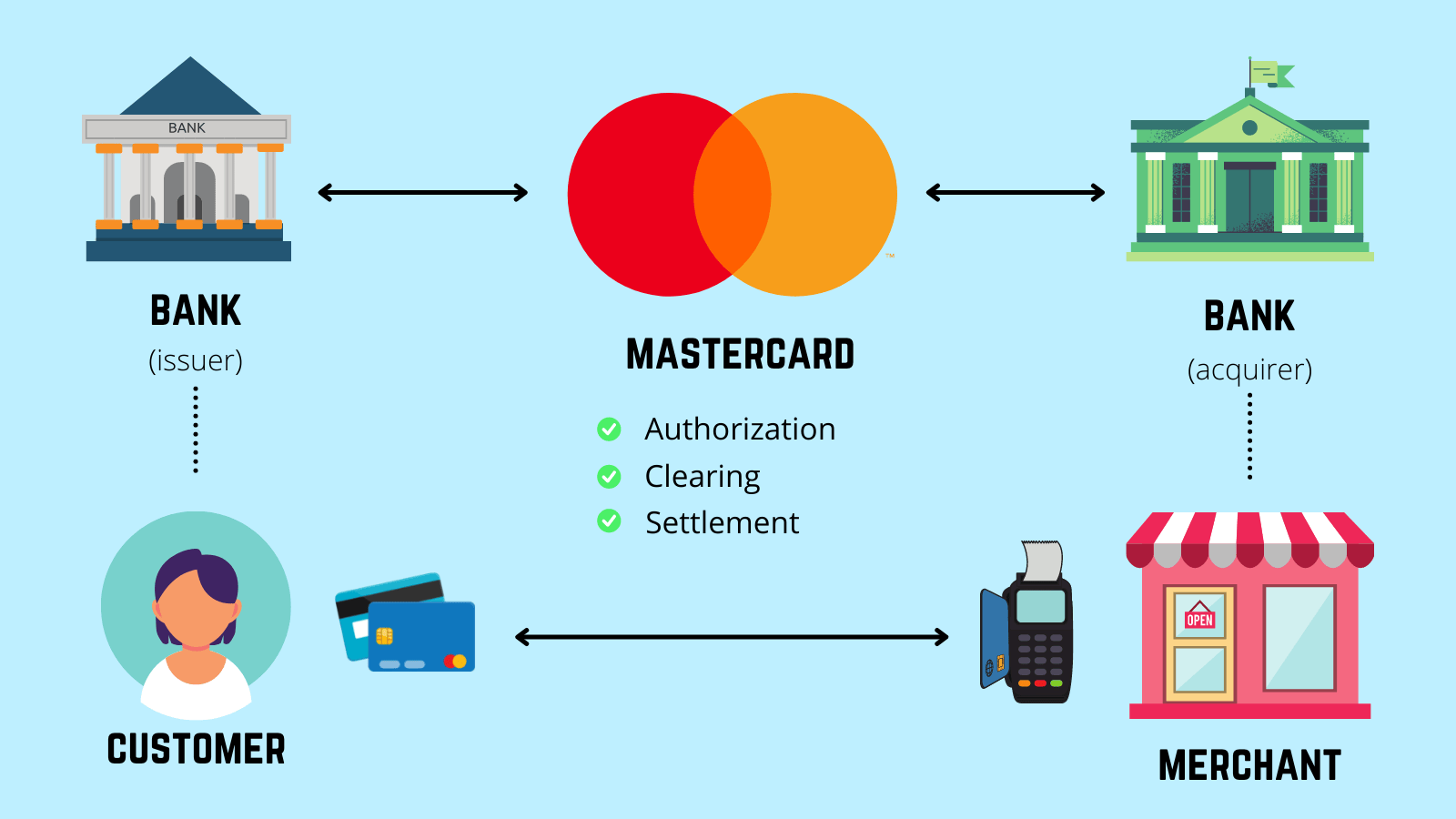

So, how does Mastercard make money? Let’s walk through the graphic below to help better explain the model.

In any of Mastercard’s transactions, there are four players:

- Cardholders

- Issuing bank (cardholder)

- Merchant

- Acquirer (merchants bank)

As we can see from above, Mastercard is in the middle of the process, acting like a toll operator, responsible for the authorization, clearing, and settling of the payments.

When Mastercard processes any payment over its rails, the banks will pay:

- A fee per transaction (transaction fee)

- % of the gross dollar volume (volume fee)

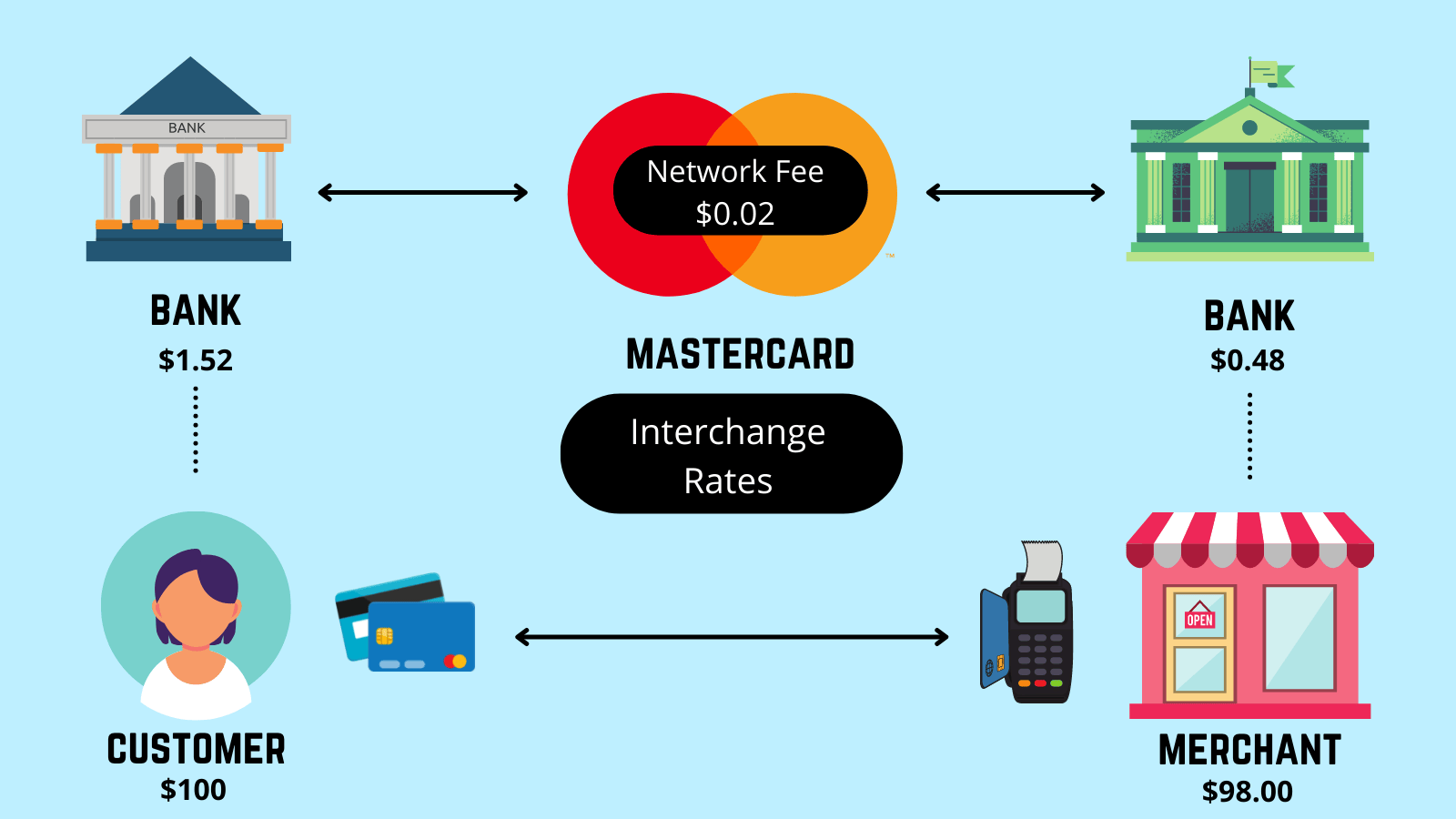

The customer starts the transaction by buying your new AirPods for $100; I know what a great deal! Once we swipe our credit card at the Apple store, a signal will route from Apple through Apple’s merchant bank for authorization. Our bank will check our credentials and whether we can fund this purchase. Once we approve, Apple’s bank will give the store the green light to finish the transaction. Apple’s POS (point-of-sale) will print a receipt, and we can go home with our new AirPods.

After we leave the store, the clearing process of the transaction continues. Apple’s merchant bank will send the purchase details to our bank to update our account and the merchant’s accounts and determine how much our bank will pay.

Finally, the settlement process continues with the acquiring bank (Apple’s), and the Apple store gets paid by our bank.

If you notice the graphic above, you might see that the Apple store only received $98 instead of the $100 charge we paid for the AirPods.

That difference of $2 is the merchant discount rate that Apple’s bank collects from the Apple store to enable payment. The acquiring bank must pass along part of the $2 to other players in the ecosystem, known as an interchange fee.

Our bank gets a bigger cut of the $2 because they take the credit risk they extend to us, and Mastercard collects a small portion to act as the toll operator between the two banks.

Here are some ideas to consider when considering the above process.

First, the process takes seconds to accomplish some things, which is an amazing feat. Second, Mastercard’s two cents may seem puny, but when you consider they process upwards of 90 billion transactions a year, it all adds up.

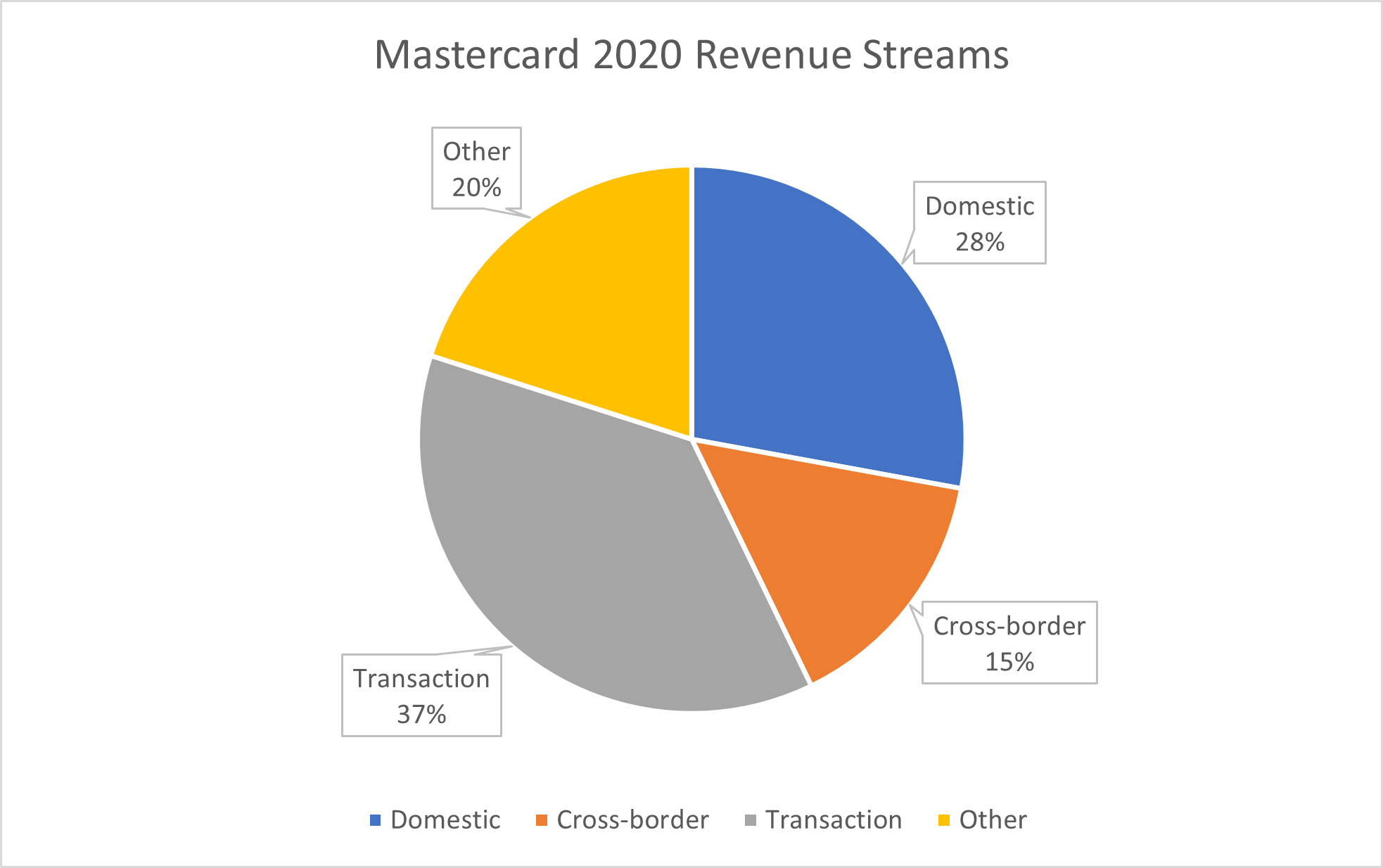

Mastercard classifies its revenues into four segments:

- Domestic assessment fees

- Cross-border assessment fees

- Transaction processing fees

- Other revenues

Below is a breakdown of Mastercard’s four revenue streams for 2020:

The company has a vast moat because of how Mastercard works and its network effects. The more consumers use Mastercard’s network, the more attractive the network becomes for merchants, which makes the network more convenient for consumers, and round and round we go.

At this point, Mastercard and Visa realize universal acceptance in most developed markets.

The highly scalable nature of Mastercard’s payment processing leads to huge cost advantages for large payment networks, which helps further entrench their competitive advantage.

Investor Takeaway

Mastercard, along with Visa, is one of the world’s most recognizable brands, and along with its strong network effects, it is in a dominant position in the payment processing space.

To invest in a company like Mastercard, it is helpful to understand its background and how the business model works.

When you think through the business model, it appears confusing, but it becomes much clearer once you dive into how money flows from merchants to the banks and back.

Consider this: if you had invested $10,000 in Mastercard at its IPO, that investment would now be worth $766,000. Not too shabby.

And with that, we will wrap up our discussion on the history of Mastercard.

As always, thank you for taking the time to read today’s post, and I hope you find something of value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- The Fascinating History of Visa and the Credit Card Industry Visa is arguably one of the world’s most recognizable logos and brands. Fun fact: they took the name because it is simple enough to sound...

- The History of American Express and their Business Model Updated 11/24/2023 American Express’s history helped shape the finance structure, along with its unique business model. Warren Buffett thinks so highly of American Express that...

- How Visa Makes Money: A Business Model Breakdown Updated 10/12/2023 Visa Inc (V) is one of the leading payment brands globally and its cousin Mastercard (MA). Visa provides payment services to over 200...

- The Future of Debit Card Processing, What It Is and How It Works Updated 10/27/2023 In 2020, the Federal Reserve Bank of Atlanta conducted a Survey of Consumer Choice, which reported that: Evidence also shows that increasing debit...