Using maps to find our way remains great for vacations, but blindly following models in any other field can lead to errors in judgment or thinking. Using “the map is not the territory” as a mental model offers us a useful way to think outside your normal box.

“The map appears to us more real than the land.”

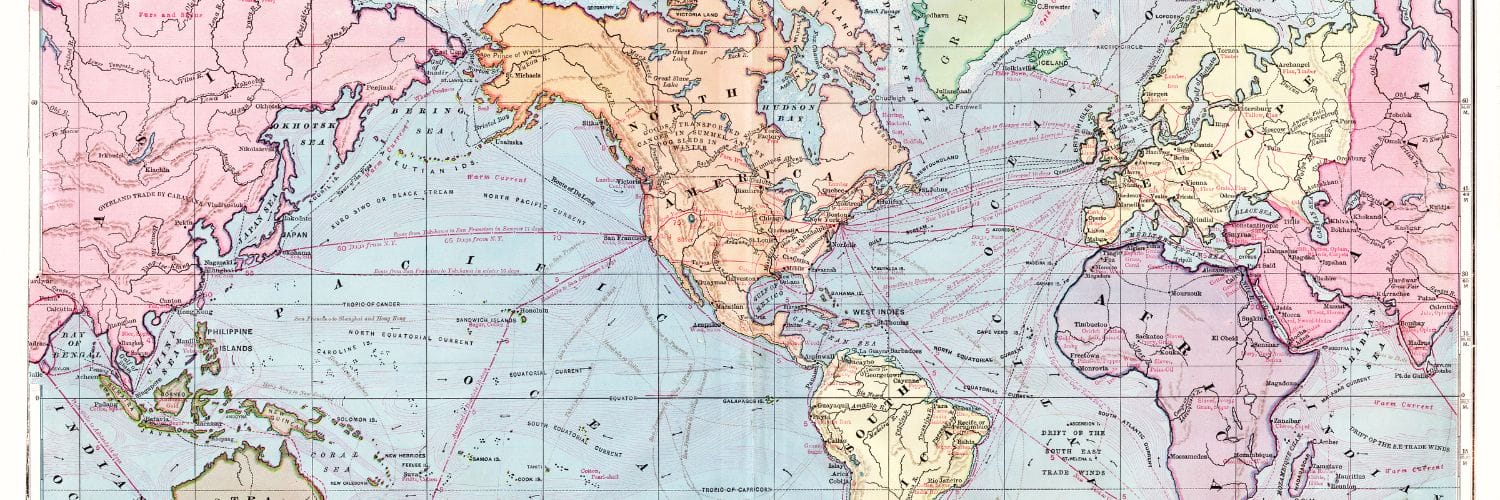

Think about a map; as a general rule, they are imperfect. If they offer a reduction of the area they represent if seen at full scale, then how we could use them? The reduction is what makes them useful to us. Maps also represent snapshots in time, offering visual clues of something that might not exist anymore. An example is looking at maps that Julius Caesar used during his march through ancient Gaul, modern France. Landmarks no longer exist; cities mentioned no longer exist. But the maps can provide context and details that help illustrate what the Roman legions endured.

Remember these thoughts, as they help us think and resolve problems.

In today’s post, we will discuss:

- The Origination of the idea “The Map is Not the Territory”

- An Example of How the Map is Not the Territory

- Nassim Taleb and VAR

- How to Put this Process to Work

The Origination of the Idea “The Map is Not the Territory”

In 1931, Alfred Korzybski presented a paper on mathematical semantics called “A Non-Aristotelian System and Its Necessity for Rigour in Mathematics and Physics.”

To us non-technical readers, this might appear as a bunch of gobbly goob, but the relationship between math and language remains important.

In Korzybski’s arguments throughout the paper, he introduced the idea the map is not the territory. This, in other words, means the description of the thing is not the thing itself; the model doesn’t offer us reality.

And while his paper might not have much practical use, it has enormous implications for our thinking and decision-making.

Some ideas from his paper:

- A map may have a structure similar to or dissimilar to the structure of the territory.

- Two similar structures have similar ‘logical’ characteristics. Thus, if in a correct map, Dresden is given as between Paris and Warsaw, a similar relation is found in the actual territory.

- A map is not the actual territory.

- An ideal map would contain the map of the map, the map of the map of the map, etc., endlessly…We may call this characteristic self-reflexiveness.

To navigate our way, maps are necessary, but they are flawed. Let’s take a moment to define what we mean by a map. In our definition, a map is an abstraction of reality, such as a model, theories, descriptions, etc.

We need abstractions to help guide us, but the problem arises when the map is flawed or we rely on the map totally to make our decisions.

The mind creates these abstractions to guide us through this complicated world. If our minds thought in a way each mile represented an actual mile, we would never get anywhere.

The problem we frequently encounter is we don’t understand the maps fully or the limits of each map. Often we rely on the abstractions to such a degree that we will stick with an incorrect map instead of having no map.

Even the best maps or models suffer from limitations or incorrect assumptions.

For example, as Korzybski mentions:

- The map could be incorrect without us evening realizing it.

- The map is, by necessity, a reduction of the actual thing, a process in which you lose certain important information.

- A map needs interpretation, a process that can lead to major issues.

An idea Charlie Munger has mentioned multiple times is that a good idea and our human mind act like the sperm and the egg. Once a good idea gets in, the door closes.

The map is not the territory that is a close cousin of the man with a hammer theory.

When we see a model working well, the problem we encounter is we tend to apply it in all situations. The model can cause errors in our thinking or judgment when used this way.

An Example of How the Map is Not the Territory

I discovered a great example of how the idea works while researching this post from Shane Parrish’s blog, Farnam Street, which I highly encourage you to check out.

“By most accounts, Ron Johnson was one the most successful and desirable retail executives by the summer of 2011. Not only was he handpicked by Steve Jobs to build the Apple Stores, a venture which had itself come under major scrutiny – one retort printed in Bloomberg magazine: “I give them two years before they’re turning out the lights on a very painful and expensive mistake” – but he had been credited with playing a major role in turning Target from a K-Mart look-alike into the trendy-but-cheap Tar-zhey by the late 1990s and early 2000s.

Johnson’s success at Apple was not immediate, but it was undeniable. By 2011, Apple stores were by far the most productive in the world on a per-square-foot basis, and had become the envy of the retail world. Their sales figures left Tiffany’s in the dust. The gleaming glass cube on Fifth Avenue became a more popular tourist attraction than the Statue of Liberty. It was a lollapalooza, something beyond ordinary success. And Johnson had led the charge.

With that success, in 2011, Johnson was hired by Bill Ackman, Steven Roth, and other luminaries of the financial world to turn around the dowdy old department store chain JC Penney. The situation of the department store was dour: Between 1992 and 2011, the retail market share held by department stores had declined from 57% to 31%.

Their core position was a no-brainer, though. JC Penney had immensely valuable real estate, anchoring malls across the country. Johnson argued that their physical mall position was valuable if for no other reason that people often parked next to them and walked through them to get to the center of the mall. Foot traffic was a given. Because of contracts signed in the ’50s, ’60s, and ’70s, the heyday of the mall building era, rent was also cheap, another major competitive advantage. And unlike some struggling retailers, JC Penney was making (some) money. There was cash in the register to help fund a transformation.

The idea was to take the best ideas from his experience at Apple, great customer service, consistent pricing with no markdowns and markups, immaculate displays, and world-class products, and apply them to the department store. Johnson planned to turn the stores into little malls-within-malls. He went as far as comparing the ever-rotating stores-within-a-store to Apple’s “apps.” Such a model would keep the store constantly fresh and avoid the creeping staleness of retail.

Johnson pitched his idea to shareholders in a series of trendy New York City meetings reminiscent of Steve Jobs’ annual “But wait, there’s more!” product launches at Apple. He was persuasive: JC Penney’s stock price went from $26 in the summer of 2011 to $42 in early 2012 on the strength of the pitch.

The idea failed almost immediately. His new pricing model (eliminating discounting) was a flop. The coupon-hunters rebelled. Much of his new product was deemed too trendy. His new store model was wildly expensive for a middling department store chain – including operating losses purposefully endured, he’d spent several billion dollars trying to effect the physical transformation of the stores. JC Penney customers had no idea what was going on, and by 2013, Johnson was sacked. The stock price sank into the single digits, where it remains two years later.

What went wrong in the quest to build America’s Favorite Store? It turned out that Johnson was using a map of Tulsa to navigate Tuscaloosa. Apple’s products, customers, and history had far too little in common with JC Penney’s. Apple had a rabid, young, affluent fan-base before they built stores; JC Penney’s was not associated with youth or affluence. Apple had shiny products, and needed a shiny store; JC Penney was known for its affordable sweaters. Apple had never relied on discounting in the first place; JC Penney was taking away discounts given prior, triggering massive deprival super-reaction.”

The above story perfectly illustrates the map is not the territory problem. The problem was not with Johnson’s thinking or ability, not even close. The problem lay in the model he used to form his thoughts; the model had changed from Apple to JC Penney, and he had not adapted to that idea.

This idea has been prevalent throughout history. One idea that springs to mind is the Roman defeat by the Parthians during the time of Julius Caesar.

One of the leading aristocrats of the time, Marcus Crassus, the richest man in the world, fancied himself a military genius on par with Caesar. In his vanity, he decided to build an army of his own and march on Parthia, a region in the middle east that was particularly troublesome to the Romans.

The problem with Crassus’s decision is that he marched in there with the idea that his legions would crush this nation without much effort, as the Romans looked down on these people. One of the first issues is that he stretched out his supply lines over many miles, which exposed the Romans to attack. It also slowed down the progress of the legions and allowed the Parthians to prepare for the upcoming battle.

Unbeknownst to Crassus, the Parthians fought in a style that was incompatible with the Roman style of close-order fighting, to which the Romans were superior. Rather, the Parthians fought on horseback and used a style of speed of attack and retreat that the Romans were ill-prepared.

What ensued when the Parthians did attack was a complete failure of the Roman system and complete destruction of the Roman forces, including the capture of Crassus, later killed by the Parthians. Along with the failure of Crassus’s army to adapt to the battle style, he also never bothered to scout ahead to understand the geography of the land to prepare for the upcoming battle.

Another example from history is the horrendous casualties suffered during World War One. At the time of the war, most generals still operated under the Napoleonic code of massing your troops together, marching them at a specific point, and overwhelming them with numbers.

But weapons had evolved much faster than the models used at the time to fight wars. With the development of machine guns, for example, the ability of fewer men to defend an area greatly increased while the death rate exploded.

At the beginning of the war, and to some extent throughout it, tactics dictated that you mass your troops along a small corridor and then have them charge right at the enemy at the smallest point. With the improvements in weaponry, these tactics spelled suicide for any foot soldier attempting this attack. In fact, World War One was a meat grinder, and many millions lost their lives because the generals refused to change their models.

The question we must ask is, “Were all of these leaders incompetent?” Not at all, but they failed to adapt their thinking to the current circumstances and instead relied upon old maps in their heads.

Nassim Taleb and VAR

One author particularly familiar with the idea of models and problems inherent in the blind following of said models is Nassim Taleb.

Taleb created the Incerto series – Antifragile, The Black Swan, Fooled by Randomness, The Bed of Procrustes, and Skin in the Game. All books in this series will help you improve your thinking process.

Taleb has remained quite vocal about the misuse of models for years; follow him on Twitter, and you will see that daily. But he first targeted the Value-at-Risk or VAR model as a model potentially misused.

The VAR model is a banking community model he created to help manage risk by providing the maximum allowance for losses depending on a confidence level. The higher the level, the less accurate the model.

He built elaborate statistical models to support the VAR theory, but I won’t go into all the financial wizardry used to create this model. The problem, as Taleb saw it, was:

“A model might show you some risks, but not the risks of using it. Moreover, models are built on a finite set of parameters, while reality affords us infinite sources of risks.”

Financial markets don’t have any degree of confidence in predicting the future. Relying on models with their standard of deviations can lead to the belief that random events will never occur and a failure to consider them.

One of Taleb’s most vocal points remains the day before the “worst-case” event would occur, you would not have the “worst-case” as your worst case.

For example, on September 10, 2001, no one in the world could have predicted the next day’s actions and the toll they would take on the lives of those directly involved. Additionally, no one on Wall Street could have predicted the fall of the markets the following day.

On September 10, what would the models have predicted as the worst day? I would hazard nothing like what occurred on 9/11.

Before the mortgage crisis of 2007, home values “always” went up, which laid the backward-looking, trend-following model to rest after the event.

So, how can we put this thinking to use?

How to Put This Process to Work

When thinking, we will do ourselves a favor by using simpler models. Albert Einstein likes to say that you should make things as simple as possible, but no simpler.

For complication’s sake, complicated models are not what we need to be after.

In today’s age of technology, we can rely on it too much. We confuse models for reality; in some cases, we believe the excel spreadsheet lives and can predict everything.

The discussions around models have increased in recent months with the reliance on them to predict the curve of the coronavirus. Many models have been wrong, in some cases, quite wrong. But we have doggedly stuck to those models to predict the future and based all actions on those models.

Reality often doesn’t work that way, and neither does life.

How do we do better and improve our models?

The first step is to realize that we cannot fully understand a map, model, or abstraction until we understand and respect its limitations.

We need to distance ourselves from the reliance on the map and realize what context the map is helpful and where the boundaries lie.

An example remains the use of discounted cash flow models to value companies. The DCF model requires assumptions about the company and prospects, which we can reasonably adjust. But one of the limitations is that if a company continues losing money, it remains hard to utilize; also, because of the nature of financials like banks, it is not as useful.

But if you blindly use a DCF to value every company you find, you can set yourself up for failure.

A better approach would be to use the DCF, which would benefit you the most, and find other models that would fit those other opportunities, whether distressed companies or financials.

Final Thoughts

In our continuing series on mental models, the map is not the territory that helps explain our use of models and abstractions to make decisions.

Using these models in and of themselves is not harmful; the problems lie in not truly understanding each model’s limitations. Approaching each problem like a nail, you have the hammer that can lead to errors in judgment.

It is better to build up many models to help you make decisions and continue to expand upon those models. Littered throughout history and finance are examples of how humans failed to adapt their models, and the results that became of them illustrate that pain.

Discovering other ideas from science, history, math, physics, and so on can help you broaden your maps and give you a sense of the boundaries and limitations of those maps. That is one of the keys to success.

One of the joys of life is discovering something new and finding out how it can improve your life, and it is an ongoing process that “all” of us will continue for as long as we live.

Thank you, as always, for taking the time to read this post. I hope you find something of value for your investing journey.

If I can be of any further assistance, please don’t hesitate to reach out.

Until next time.

Take care and be safe out there,

Dave

Related posts:

- Understanding the 12 Most Common Types of Business Models Updated 4/4/2024 In a speech in Switzerland, Warren Buffett discussed what he means by buying businesses he understands. “We don’t look for specific sectors; we...

- Second-Order Thinking: A Critical Component of Smart Investing Updated 3/6/2024 “Failing to consider second- and third-order consequences is the cause of a lot of painfully bad decisions, and it is especially deadly when...

- How to Learn the Mental Models of Charlie Munger: Be a Book with Legs Charlie Munger is one of the greatest investors of all-time. How did he get there? Munger has offered a few clues; a key one is...

- Warren Buffett’s Railroad Investment Updated 9/15/2023 2007, Warren Buffett revealed he had bought over 60 million shares in Berkshire’s first railroad. Buffett continues as our generation’s greatest investor. And...