The competition for which tool is the best stock screener is intense. Like brokers—there’s many to choose from. Because I’m a proud dividend value investor, I want to compare some of the most popular free value and dividend stock screeners to see if there’s an overwhelming favorite.

An easy way to do this is by running an example screen. Let’s consider a popular screen, a Peter Lynch “Fast Growers” screen that is run by value investors and DGI (dividend growth investors). I’ll provide the initial feedback and make observations as we run it through these stock screeners.

An obvious criteria before we start is that these tools must have an option to screen for dividends and value stocks.

The value component is expected—any stock screener with fundamental analysis data is almost guaranteed to include it. But if a value stock screener doesn’t have the option to sort for dividends, we won’t include it.

Last note before we get started: I have to admit that out of all the stock screeners on this list, I currently only use Finviz, so I might be a little biased.

However, since we’re going to just run some example screens and make our observations, I will try to be as fair in my conclusions as I can be as we search for the best dividend stock screener tool on the web.

Peter Lynch’s Fast Growers Screen

- Market capitalization

- 5 Year EPS growth

- Current ratio

- PEG ratio

- P/E ratio

- Debt to Equity ratio

For each dividend stocks screener that we examine, we will check to see if these options are available to run, and how detailed each screener allows you to go.

Dividend Stock Screener Criteria (yes/no)

- Dividend Yield

- Payout Ratio

To quality as an adequate dividend stock screener, we want to ensure that a screener also includes these 2 options as well.

Where dividend screens differ from value screens is that there aren’t any real popular ones—each DGI investor seems to be more unique on the type of screens they’ll run than even the value guys.

So we just want to make sure that these screeners at least have the option to sort for dividend, dividend yield, and payout ratio as a starting point.

Now, on to our search for the best dividend stock screener.

Dividend Stock Screener #1 – Finviz

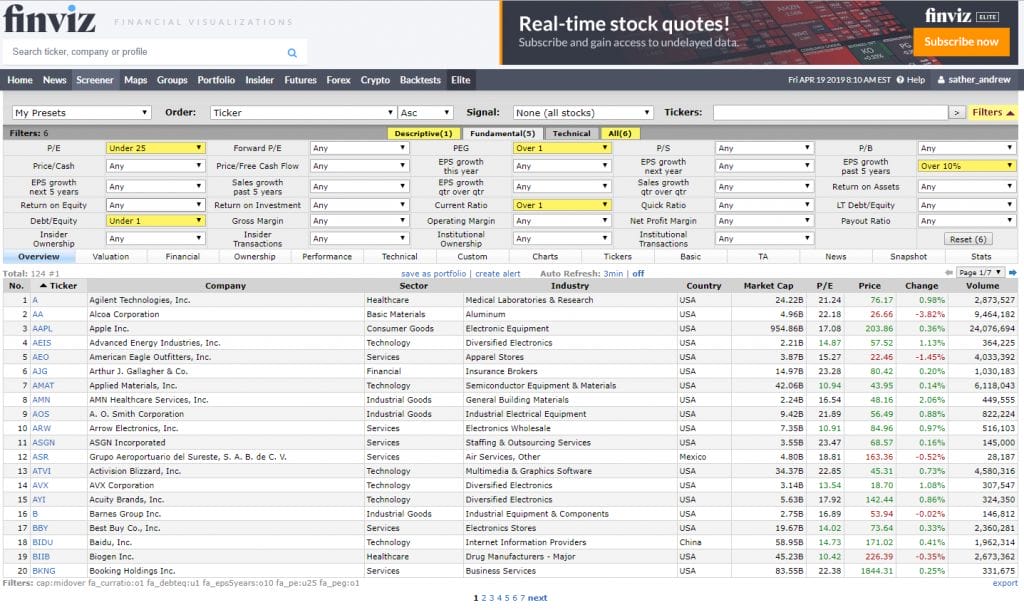

Pros: You can see from the screenshot (except for market capitalization, which is in the “Descriptive” tab) that each of the 6 filters that would be needed for a Peter Lynch “Fast Growers” screen are available to be used.

Not only that, but there’s a myriad of other filters for this stock screener, especially on the fundamental analysis side. I see some unique metrics such as the PEG ratio, along with the standard “return on” formulas such as ROA and ROE. There doesn’t appear to be an ROIC (return on invested capital) option though, at least with this free version.

Running the dividend check, we see that you also have options to include dividend stocks only—with dividend yield and payout ratio available for filtering.

Cons: The only thing I don’t like about Finviz as a value/ dividend stock screener is that your options for filtering are drop down selections rather than actual inputted numbers.

This can create some problems on certain filters, such as wanting to sort for negative P/E ratios or Debt to Equity ratios below 1.5 or 2.

Dividend Stock Screener #2 – Dividend.com

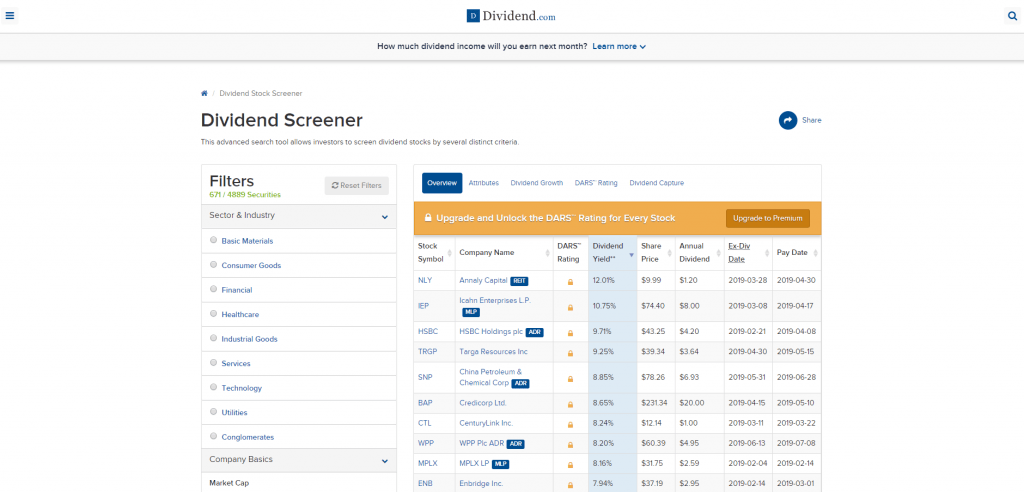

Cons: This screener from Dividend.com allows us to sort for Market Capitalization, but only in pre-defined ranges. You can only sort for the following ranges: Under $300m, $300m – $2B, $2B – $10B, and $10B+. That’s not a lot of options for value investors wanting to be more specific.

There also aren’t any valuation filters to sort for. You can’t run a Peter Lynch type screen at all, as you can’t filter for many fundamanetal analysis metrics such as PEG, P/E, or Debt to Equity ratio.

There is a way to sort for Earnings Growth, but unfortunately this is a paid feature.

Pros: I do like how you can sort for consecutive years of increasing dividend payments.

Just this feature alone would be worth it since you could export the list and then import it into a value stock screener like Finviz using their Tickers input box. However, this is also only a paid feature, so “you can look but you can’t touch”.

It does check all of our dividend criteria boxes, and allows you to sort each of those dividend metrics very specifically—all the way to the second decimal place.

Dividend Stock Screener #3 – Zacks

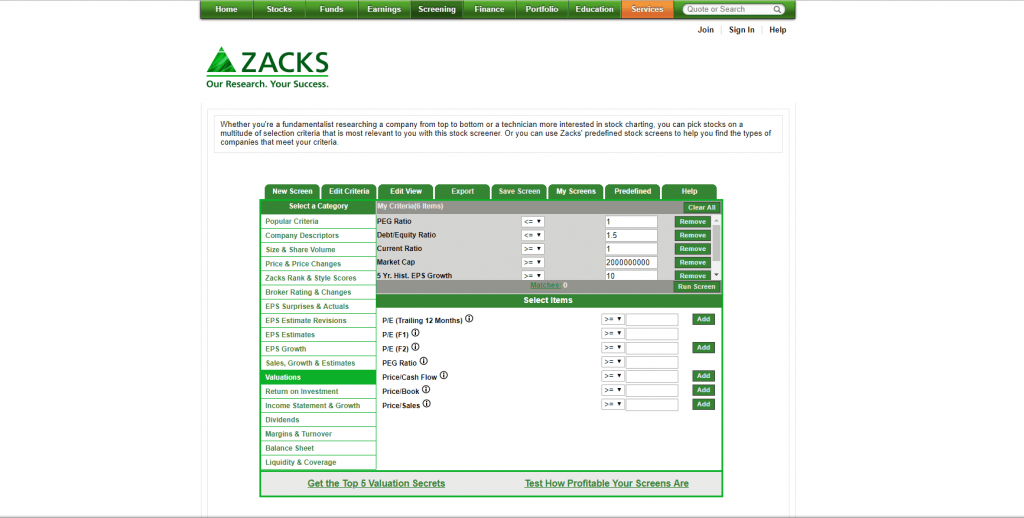

Pros: Just like the Finviz stock screener, we were also able to use the Zacks stock screener to run a Peter Lynch Fast Growers screen.

What’s great about this stock screener is that each value is fully customizable, you enter the data rather than having to choose from a drop down.

You can also sort for the standard dividend filters we’d want to see like Div. Yield % and Payout Ratio.

Cons: Comparing this to Finviz, one of the few downsides is that the screener doesn’t filter the list immediately. You have to make the criteria and then view the list separately.

Like any value stock screener, it takes a little bit of getting used to, such as with the Market Capitalization being in millions.

I also am not crazy about the presentation and visuals of the data. There’s not as much data available on your screen, with the ability to customize the data showing after the screen is run seeming limited.

(Big) Pro: But, a fantastic feature that can be very useful for this screen and other value screens like it is “Export to Excel”. You can do this with Finviz also, but you have to pay for a premium Finviz subscription.

And the Winner is…

After seeing some of these popular stock screeners in action, I’m actually going to crown Zacks as the best value and dividend stock screener here.

While I use Finviz and will continue to use it, it’s nice to know that there are other options that allow you to go deeper and with more precision (Zacks).

For a dividend value investor like myself, it probably makes more sense to combine a dividend stock screener and a value stock screener together, rather than trying to find one that’s all encompassing.

As I searched through the various free stock screeners online, I just couldn’t find one that combined the two needs just like that.

But alas, that’s the problem with being a contrarian investor. It’s not popular, so obviously the tools won’t be customized for me.

Hope this stock screener comparison helped.

Related posts:

- How to Find Investment Ideas with Free Stock Screeners and Websites Today I will show you some easy ways to find great investment ideas. These ideas will help you grow your wealth; best of all, they...

- Our Favorite (Free) Value Stock Screener: A Comprehensive Guide Chances are that if you have been investing for any period at all, you’ve likely used a value stock screener to try to find certain...

- 3 Simple Steps to Use Stock Market Analysis Tools to Find Great Companies The most common question that I get from new investors is “how do I find stocks to invest in?” Unfortunately, that’s not a simple question...

- 8 Top Dividend Blogs Dividends should be a central focus for any sound investing plan. Luckily for us, there has been a recent explosion of a vast number of...