Chances are that if you have been investing for any period at all, you’ve likely used a value stock screener to try to find certain stocks that meet your investing requirements. If you haven’t done that, then I’m scared for you for one of two reasons:

- You’re going through each stock manually which is going to waste tons of time, or even worse…

- You’re not looking at the financials at all and you’re just winging it

Both of these options are no Bueno. A stock screener is a fantastic tool that will do a lot of the leg work for you and narrow down the list that you should investigate so you can spend more time to focus on this smaller, more focused list.

I’ve used a few different stock screeners throughout my investing journey and I honestly thought that they were pretty much a commodity and all the same until I watched this really thorough breakdown by Andrew on YouTube. This video just continued to make me say ‘wow’ out loud because I didn’t know how cool finviz actually was as a stock screener.

I’m not going to spoil all of Andrew’s awesome tips, but I will give a good overview of finviz and maybe provide a pretty cool tip at the end…

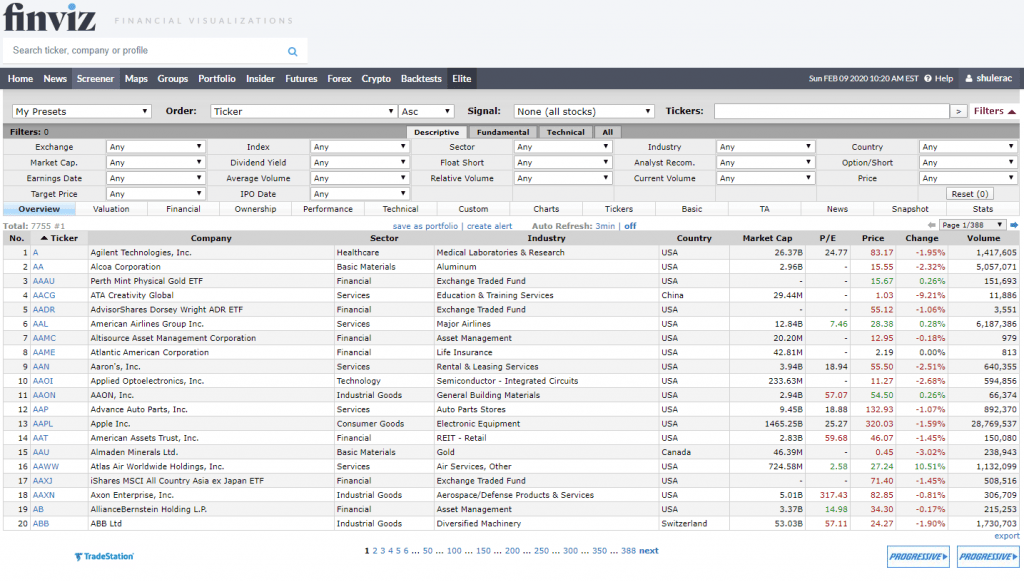

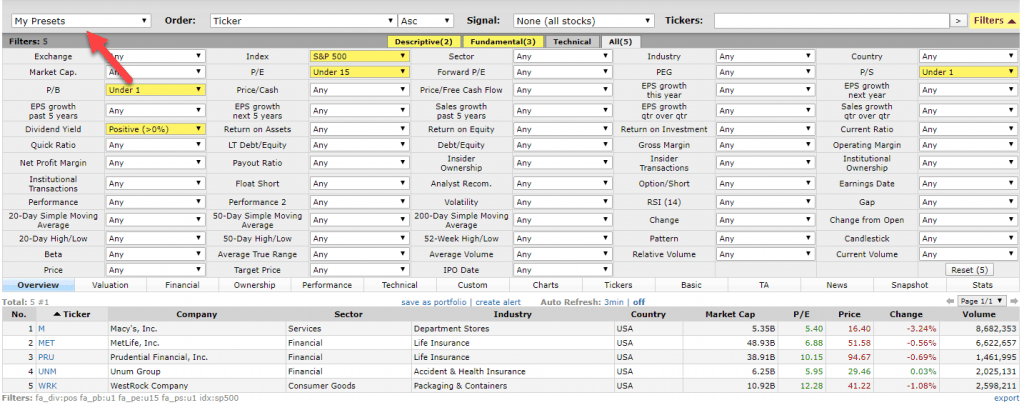

When you first got to finviz, you can click on ‘screener’ at the top and the screen will look like this:

As you can see, this screen shows 7755 stocks that are currently available to be screener for on finviz and you have the ability to make many different selections to narrow down your research. For instance, let’s say that we want to find stocks that meet the following criteria:

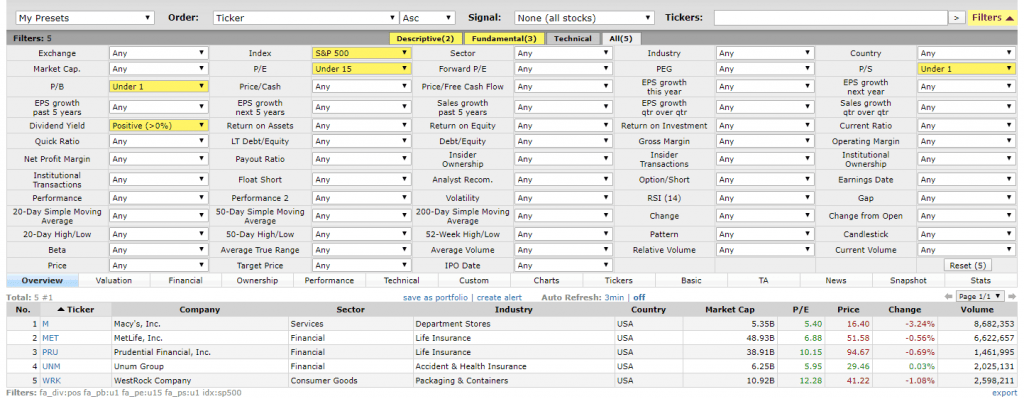

- In the S&P 500

- P/E < 15

- Currently paying a dividend

- P/B < 1

- P/S < 1

When I put those five requirements into the screener, as you can see in the screenshot below, I end up with five out of the initial 7755 stocks that meet these five requirements:

Now, as I mentioned, this is really the first step to starting my research. Now that I have it narrowed down to these five stocks, I can begin to investigate further on what I think about these stocks. To do so, I can simply click on the stock ticker and it will take me to that company’s page.

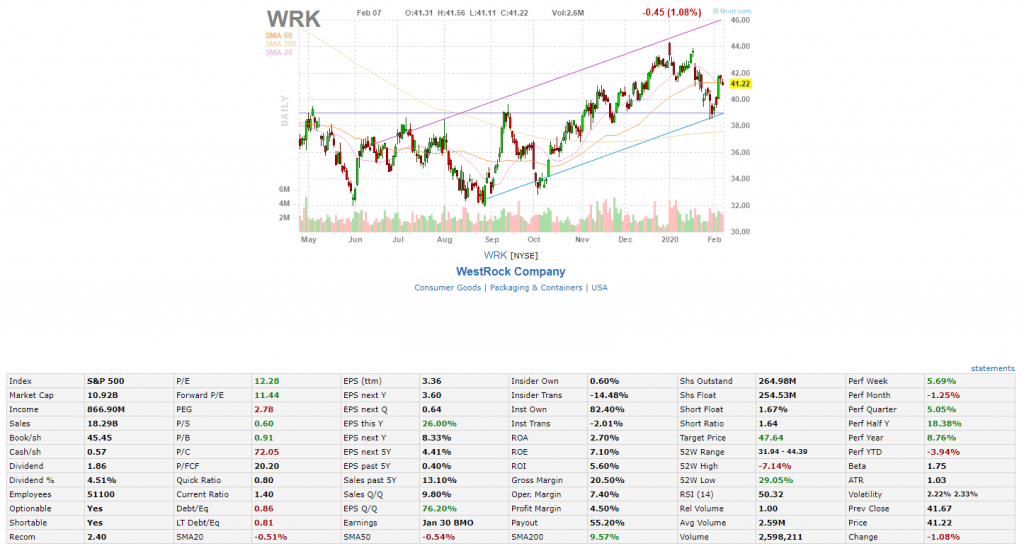

When I’m on that company’s page, the first thing to come up will show me a technical chart of how the stock has been performing and some of the major ratios that a prospective investor would be interested in knowing:

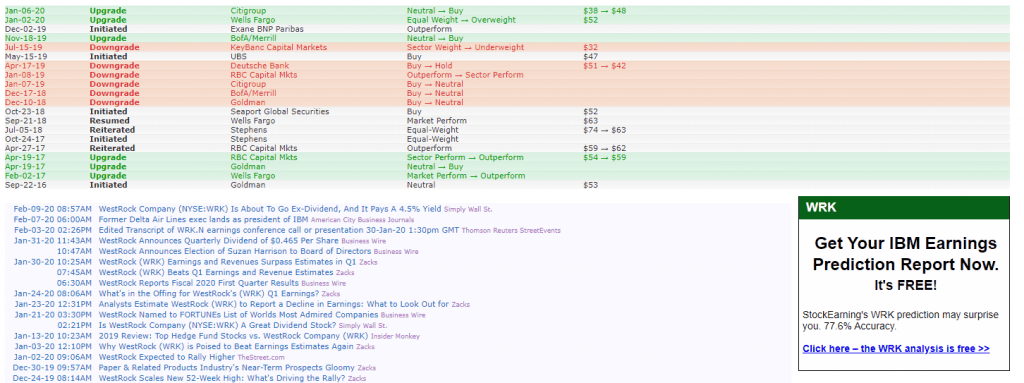

If you continue to scroll down, you can see the different recommendations that the investment companies are putting out on the company as well as any news that is relevant to this company that has recently came out.

As you can see below, WRK went through a tough time of quite a few downgrades all right in a row but now has received two recent upgrades in January from Citigroup and Wells Fargo:

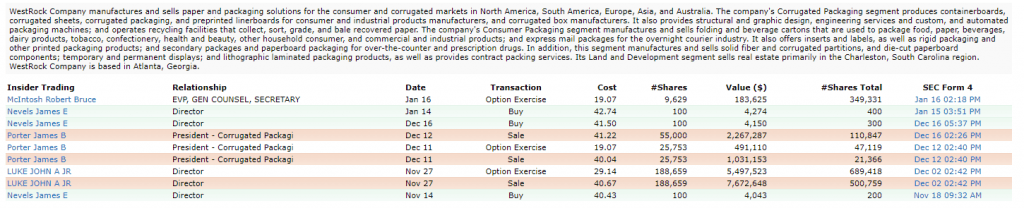

If you keep scrolling a little bit further, you can see an overview of the company and some of the insider trading activity that has been going on. Take it with a grain of salt, but I like to see what the insiders have been doing recently with their stock.

Personally, I don’t see any trading activity that might give me insight here, such as if management was buying or selling heavily. Most of the activity looks to be the management exercising their stock options which I don’t view as a good or bad thing.

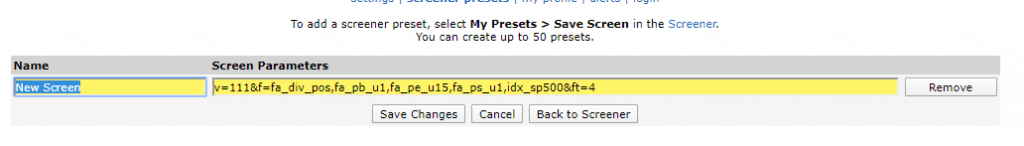

The thing that I really like about finviz is that if I want to run this screener repeatedly, instead of opening it up and selecting each of these five selections every month, I can simply just save the screen for the next time that I want to access it. All that I have to do is click on the dropdown in the top right of the screener that says, ‘my presets’ and then select ‘Save Screen’.

At that point, you will come on a screen like this where you can name the screen whatever you’d like and then go back and reference it in the future months:

It’s really just that simple!

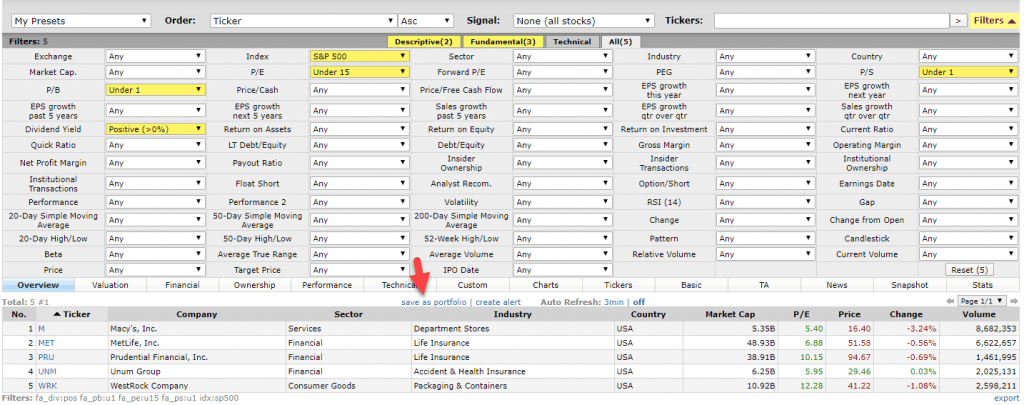

A really cool tip that I learned from Andrew’s YouTube video is that I could then go ahead and save this as a portfolio so that I can track it to see how it would’ve performed. All that I need to do is click on the ‘save as portfolio’ option that I am showing below:

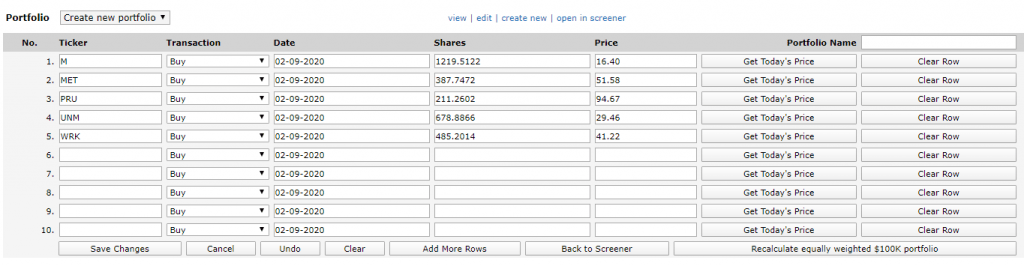

Once you do that, simply select ‘ok’ on the pop up that asks if you want to equally weight the portfolio. You do this so you can evenly compare the performance of each stock in the portfolio. Then your screen will look like this:

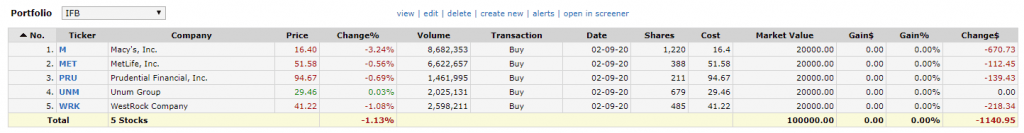

The last step is to enter a portfolio name and then save the changes so that you can reference it later. I saved this portfolio and now I can reference this exact screener portfolio to see how these stocks will perform months or years into the future:

This is a fantastic way to get your feet wet a little bit and try to learn better about the market without actually putting any money at risk. I never knew that finviz had the ability to do this until I watched Andrew’s YouTube video and I can assure you that I am going to do this quite frequently into the future.

As you can likely see, finviz is a freaking awesome tool but please note that this really shouldn’t be used as a true investment decision tool. This is step one of narrowing down the 7755 different companies to find some that match what you’re looking for in a company. Once your list is narrowed down, that is just the start – you now need to conduct your own research on the other qualitative and quantitative data that you’re looking for in a company so you can make sure that you’re making a sound decision.

You might notice that I haven’t talked much about dividends in this post, but guess what – by far, the coolest part of Andrew’s YouTube video was showing how he incorporates companies that are paying consistently increasing dividends into this screener. I’m not lying when I say that I literally stopped the video and got sidetracked for about 30 minutes just playing with this tip because I was so intrigued by it.

Seriously – check it out. You’ll be happy you did!

Related posts:

- The Best Free Value and Dividend Stock Screeners Compared: Example Screen The competition for which tool is the best stock screener is intense. Like brokers—there’s many to choose from. Because I’m a proud dividend value investor,...

- How to Find Investment Ideas with Free Stock Screeners and Websites Today I will show you some easy ways to find great investment ideas. These ideas will help you grow your wealth; best of all, they...

- 3 Essential Investing YouTube Channels For The Educated Investor Have you ever googled for some good Investing YouTube Channels? If not, you need to – but first, let me tell you which ones I...

- Defensive Investors: Rules from the Classic Book, The Intelligent Investor Updated 4/21/2023 In the 14th chapter of Intelligent Investor, Benjamin Graham outlines his seven criteria for defensive investors. The Intelligent Investor, considered by many as...