The most common question that I get from new investors is “how do I find stocks to invest in?” Unfortunately, that’s not a simple question to answer, but with the help of these 3 simple steps, you can utilize some amazing stock market analysis tools to find great, undervalued companies.

I really think that Investing can be broken down into three separate focuses, per se – Passive Research, Valuation/Metric Review and the Deeper Dive. Each one of them are extremely important and all play a vital role in finding companies that are going to perform well for you.

So, why waste any time? Let me show you how to execute!

1 – Passive Research

Passive Research, to me, is anything that you might do for fun to simply learn about new companies. This can honestly be anything at all that might spark your mind to think about companies to potentially invest in.

For me, my #1 form of passive research is with podcasts. I love listening to all types of podcasts from Motley Fool to CNBC, but of course my #1 is the Investing for Beginners Podcast!

Podcasts are a great way to let my mind relax and just listen while I’m working out, driving, doing chores, cooking dinner – anything! I can just sit there and hear about people’s thoughts on a company, industry, etc. without any real effort.

I’m just trying to soak up what I hear and be unbiased and understand their opinions. This has really helped me start to diversify my thoughts and look into companies that didn’t directly fall into my circle of competence, and that’s how you can become a more diversified, better, investor!

Another way that I like to do passive research is with stock screeners. I know that stock screeners can be misleading at times, but I really like to look at different valuation ratios and just see what I end up with.

It’s never a final decision for me to invest, and honestly a stock screener might be the type of passive research that will then require the most research for me because I don’t know anything about the company except for a few metrics.

Stock screeners are always fun tools to look at, but with so many companies blowing through the normal valuation rules, they might be more prohibitive than normal – and maybe that’s a good thing!

I mean, Snowflake ($SNOW) just had their IPO this week and that was a cloud company that I was really looking at hard, but by the time the public could buy into the company, their shares were at a price so high that it was generating a P/S of 175!

Heck. No.

That is insane lol. I am a huge fan of cloud stocks as speculative investments but that level is just bonkers. I wonder if it drops back down drastically in the next few months…

Ben Graham likes a P/S of 1….so only 175X that. Not too bad…

Another great source of information is with…BLOGS! Of course, I think that the Investing for Beginners blog is the best, but there are some other blogs that I highly recommend as well.

Typically, I like to talk more high-level about companies as I’m growing my circle of competence and then look at an ETF as I have done with both gold and cloud stocks, but Dave will go ALL IN on different companies including Walmart with a thorough 10Q review.

I love to read different blogs just for more opinions and data and I love Dave’s because it’s such a thorough review but never so deep that I can’t follow it.

There’s a lot of other ways that you can continue to engage in this passive research such as by watching CNBC, reading different news publications like the Wall Street Journal or Bloomberg, or even looking at some different investing websites like Seeking Alpha or Zacks.

You’re really just wanting to do anything you can to brainstorm companies, so why not do just that – brainstorm! Think about things that you do in your everyday life that might seem inefficient and then try to see if there might already be a company that is solving this issue.

I am always on a path to find my “shark tank idea” and 99% of the time, the idea that I come up with has already been invented…lol. But I am ALWAYS brainstorming and just thinking about the next thing to come.

For instance, I have talked about how I love ROKU as a speculative investment, but I actually recently evaluated a company under the ticker of XPER because they’re basically taking the TiVo technology and using it to change this new world of online streaming.

I won’t’ say if I invested in them or not (I did) but I simply tried to not take things just at face value, but rather continue to grow on my knowledge and think 1, 2 or even 3 steps further, and that helped me find different companies that I might not have otherwise heard of!

Now that I have all these great companies in mind, what’s next? Time for Step 2!

2 – Valuation/Metric Review

I was about to say “this is the fun part” but I realized that I basically said that in the first step and also could say it in the third step. Honestly, I think investing in general is just fun!

Now that we have found some companies that spark our interest and maybe meet some of the qualitative requirements, or maybe you’ve found them through a stock screener, it’s time to dig in more!

I think that by far, the best way is to use the Value Trap Indicator (which is recently new and improved by the way).

I like the VTI because it forces me to actually open up the 10k and just look at some of the extremely important financial data. This might seem annoying but it actually makes me learn the company better.

Think about it with your personal budget – do you learn better by writing down your expenses or just by paying off your credit card? Obviously by tracking them and writing them down, and that’s why I made the Doctor Budget to allow people to easily do this, but that’s neither here nor there.

The VTI is the same way – you learn by doing. The hard work is all done by the intense calculations of the spreadsheet to give you some great indications if the company is actually a great value or a value trap, and that allows you to make a good decision on whether to buy or sell the company…as a starting point!

Andrew will never advise you to make a buy/sell decision solely off of the VTI, but if it’s going to do a lot of the heavy lifting, why say no?

Work smart, not hard, right?

If you’re interested, checkout the VTI here – you won’t be disappointed!

Another option that you have to look at some of the different valuations ratios is to checkout Yahoo Finance. Yahoo Finance is nothing more than a quick check but it does give me a sort of peek behind the curtain. You can look at some of the key financials such as sales, profits, and even some balance sheet data as well.

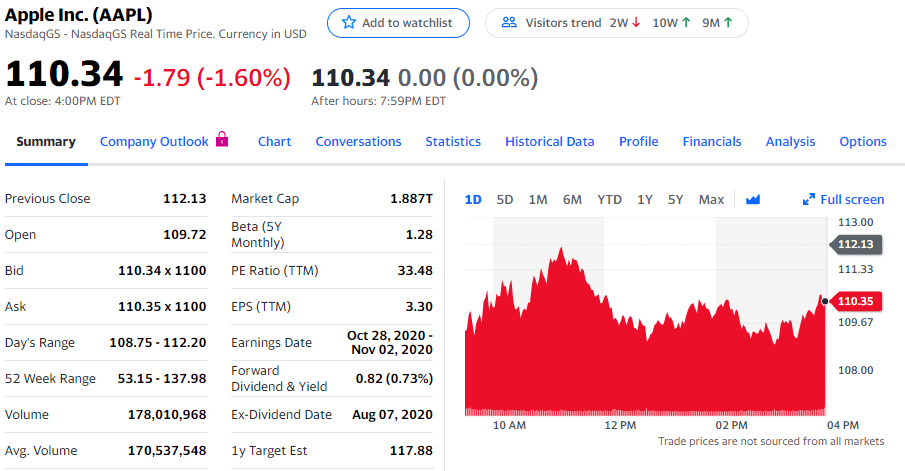

Below shows the initial screen when you click on Yahoo Finance just to get some high-level info like I mentioned:

I personally love using Yahoo Finance when I am checking my portfolio daily because I can link it to my Fidelity account and honestly, the platform is much sleeker and better designed for the user.

I always will find myself pulling up stocks randomly when I hear about companies on a podcast, CNBC, or anything else just to do a very simple scan. I will never make an investing decision to invest in a company based on this, but I may make a decision not to invest in the company if I see some insane valuation ratios that immediately deter me.

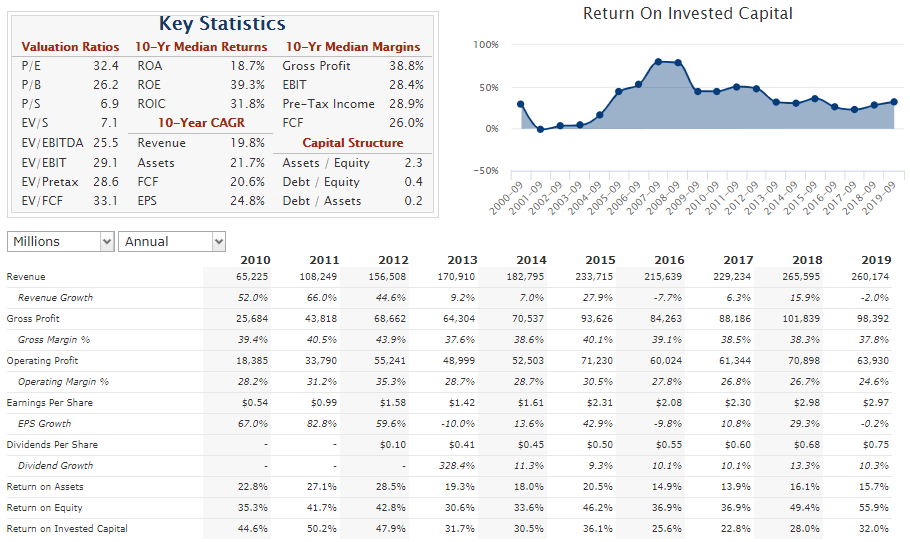

Another website that will give you a more in-depth look at some of the financials is QuickFS.Net. I like QuickFS.net because you can see a lot of the financial data in a very simple and easy-to-read way, as you can see below with Apple:

Of course, you’re going to want to go more in-depth before you invest, but this is a pretty nice initial look!

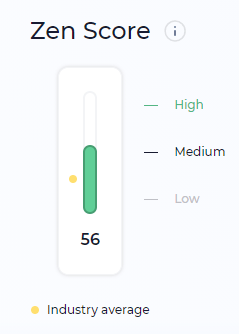

The last tool in step 2 is something that I just recently came across called Wall Street Zen. I really like Wall Street Zen because I think that they take a lot of this financial data and then go another step further.

One thing that they do is pretty cool is they analyze many different aspects of the company and then create a “Zen Score” which is essentially just their valuation of the company based off the various aspects that they’re evaluating.

While I do like this a lot, it’s imperative for you to do this on your own and create your own “Zen score”, and that’s why my favorite tool in Step 2 is easily the VTI. I think the VTI really gives you all the foundational knowledge that you need without the fluff so that you have a great knowledge when going to Step 3.

At the end of the day, that’s really the goal. Once you feel really good about some of the foundational aspects, then you can go headfirst into Step 3 without having to continuously try to understand the basics.

If you’ve made it this far, then good news – things are going to get even more in the weeds! But as an investor, that means you’re that much closer to finding a great company that’s going to meet your requirements to put your hard-earned money towards investing in them.

It’s time for the third step!

3 – Deeper Dive

It might seem boring. It might seem old school. You might not want to do it. But the best way to be fully prepared is to go to SEC.gov and read the 10k for the company.

I know that doesn’t sound like fun, and 10ks are massive documents, but when you’re going to trust a company with your money that you have busted your butt to not only make, but also to save, then you should take the time to read the 10k.

I’ve said before that I am ok if you want to invest a small amount in a company before reading a 10k, perhaps after Step 2, because I think then the information that you’ll read in a 10k will really start to stick.

I don’t have any data or analysis to back that up – just my own experience. I learn a lot better when it will directly impact money I currently have in the market, but that doesn’t mean I’m going in blind! I am still doing some analysis as I mentioned in Step 2.

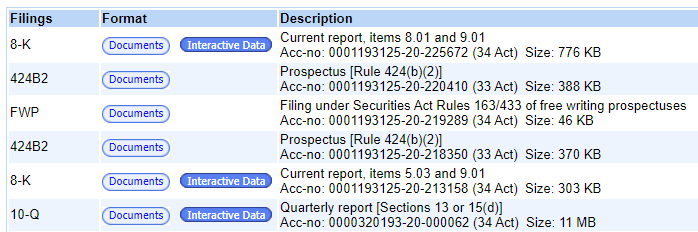

Once you go to SEC.gov, you can see all of the filings that the company has had in the recent history, as shown below with Apple:

The two that I will most commonly look at is the 8k and the 10k as I think that those are the most important. 10q’s are just a shortened version of the 10k that comes out quarterly instead of annually so if you want even more information on a quarterly basis, feel free to indulge!

They’re also much, much shorter than your normal 10k so it won’t take nearly as long as to read them.

I know that reading a 10k can be super overwhelming. It was to me. For instance, Apple is 60 pages and that’s actually even a shorter 10k than a lot that I have seen before.

Instead of trying to read the whole thing at once, maybe break it down and try to ready 10 pages/day over 6 days. You don’t need to rush through it – instead try to really digest and understand what you’re reading.

It’s not a race – you’re trying to better understand the company. And since you’ve already invested a little bit into the company, maybe that will take the “itch” off of feeling that FOMO, which is one of the worst behavioral finance tendencies that you can have.

Just take your time and ready it and keep learning more about the company!

I really feel like if you follow these three steps then you’re going to have some great conviction around the companies you choose to invest in. Sure, you’re still going to have some failures, but I bet your wins will outweigh your losses.

Just remember that you’re in this for the long-term! Short-term investors can get burned and the data proves that the long-term will outperform the short-term, so keep the end goal in mind!

Related posts:

- The 5 Best Personal Finance Podcasts for your FI Journey! I am such a huge podcast nerd. Like, I’m the type of person that will save the best personal finance podcasts for my workouts and...

- 4 Top Passive Income Books for Building Lasting Wealth Lately I’ve been on a sort of book review kick and have given some suggestion for best investing books but not I want to tackle...

- A Stock Market Basics PDF Written By a Self-Taught Investor [Free Download] Updated 4/21/2023 Starting anything new is scary, and investing is no different. We all have the same questions, where to start? It may seem overwhelming,...

- 10 Steps to Building Assets from a Bestselling Book about Money Kiyosaki is back at it again, this time with 10 steps for any of us to take when we’re building assets! Now, of course, building...