Many investors turn to exchange-traded funds (ETFs) for their portfolios. ETFs can be a fantastic method of providing easy diversification and more predictable returns than individual stocks. Let’s review two of the most popular ETFs for this purpose: VOO vs VTI.

| VOO | VTI |

|---|---|

| Vanguard S&P 500 ETF | Vanguard Total Market ETF |

| Tracks S&P 500 | Tracks CRSP US Total Stock Market Index |

| 9.8% average annual return | 9.79% average annual return |

| $378/share | $204/share |

| .03% expense ratio | .03% expense ratio |

Click to jump to a section:

- What is an ETF?

- VOO vs VTI: Pros They Have in Common

- VOO vs VTI: Stock Composition

- VOO vs VTI: Investment Strategy

- VOO vs VTI: Share Price

- VOO vs VTI: Past Performance

- VOO vs VTI: Dividend Yield

- VOO vs VTI: Should You Buy Both?

- VOO vs VTI: Which is Best?

- VOO vs VTI: FAQ

What is an ETF?

An ETF is an asset that aggregates many individual stocks into a single stock tradeable on the stock market. ETFs are often to designed to track a specific index like the S&P 500 or to follow an investment strategy like high dividends. They operate very similarly to mutual funds, except for being tradeable on the stock market, which mutual funds are not.

ETFs are very popular with investors because they can provide immediate diversification. Using individual stocks, proper diversification can mean researching and trading dozens of individual stocks. Each must be valued, tracked, and adjusted over time.

This requires the investor to devote a significant amount of time to achieve their desired diversification. Plus, the performance is entirely dependent on the investor’s capabilities. If they fail to make the right decisions at the right time, the balance of their portfolio could shift and they could lose money.

On the other hand, ETFs provide a one-stop shop for diversification. A single ETF can contain hundreds or thousands of individual stocks. The party responsible for managing the ETF rebalances the portfolio as stocks fluctuate in value.

I have long loved ETFs for their ease of use. I am a huge fan of passive investing, and ETFs are an integral part of that strategy.

VOO vs VTI: Pros They Have in Common

Though VOO and VTI are different ETFs, they have similarities. A few of the best advantages both enjoy are:

- Low Expense Ratio: You must pay a fee to the management behind a fund. The ratio between this fee and the value of the stock is its expense ratio. Many ETFs have expense ratios of up to .5%, and mutual funds can easily reach 1%. However, VOO and VTI have expense ratios of .03%, practically zero.

- Diversification: Not every ETF contains solid diversification. If the criteria is too limited, an ETF may only hold a dozen companies. However, both VOO and VTI contain hundreds or thousands of companies, more than enough for proper diversification.

- Accessibility: Both VOO and VTI have a low starting investment of $1, so anyone can get started. Plus, since they are accessible on the standard stock exchange, any standard brokerage account will let you get started.

- Great for Beginners and Passive Investing: VOO and VTI are great ways for investors to gain exposure to the stock market easily. No complicated or risky stock picking is involved. Simply set up automatic investments, and you’re all set.

VOO vs VTI: Stock Composition

Every ETF has a unique stock composition. This is the mix of stocks that make up the fund.

Vanguard S&P 500 ETF (VOO) tracks the S&P 500. Thus, it contains approximately 500 stocks at any given time. These 500 stocks are the largest stocks on the stock market by market cap. For our purposes here, think of market cap as the overall value of a company on the stock market, though it is more nuanced than this.

The stocks on the S&P 500 are weighted by market cap. For example, a stock with a market cap of $1 billion would make up twice as much of VOO as a stock with a market cap of $500 million.

Vanguard Total Stock Market ETF (VTI), on the other hand, contains every stock on the stock market. It contains every stock, from penny stocks to $AAPL. However, it is still weighted by market cap.

In short, VOO solely contains large-cap companies weighted by market cap. In comparison, VTI contains every stock on the stock market, still weighted by market cap.

VOO vs VTI: Investment Strategy

Of course, every ETF aims to make money. However, the method to achieve this goal varies greatly.

Both VOO and VTI are managed by Vanguard and aim to track the overall U.S. stock market. Historically, the U.S. stock market has performed well over the long term, even through catastrophes. The NYSE is, by far, the largest stock exchange in the world.

VOO attempts to track the overall market by tracking the S&P 500. As mentioned, the S&P 500 only contains the 500 largest companies on the stock market by market cap. For comparison, there are around 4,000 total companies on the stock market.

The S&P 500 attempts to track the market by containing all of the largest companies. It ignores the lower-value companies, which are more prone to wild fluctuation that isn’t indicative of the overall market. VOO aims to take advantage of this by directly tracking or indexing (hence index fund) the S&P 500.

VTI attempts to track the overall market by tracking the CRSP US Total Stock Market Index. This index contains, as the name implies, the total stock market.

Of course, the thought is that the best way to track the overall market is to contain the overall market. This ranges from micro- to small- to mid- to large-cap stocks. However, these stocks are still weighted by market cap so that small, often fluctuating stocks don’t influence it too much.

In addition, containing so many companies inherently provided more robust diversification. A fluctuation in an individual stock is unlikely to make a huge difference with thousands of other companies balancing it out.

VOO vs VTI: Share Price

If your brokerage restricts you from trading partial shares, the share price can have a significant impact on a stock’s accessibility. I know that I don’t have a spare $500 sitting around to buy a single share of a single stock.

Not to mention that this makes it more difficult to properly balance your portfolio. If you have a $1,000 portfolio and one share of a stock costs $400, that’s 40% of your portfolio in one stock. Ideally, each stock should make up 5-10% of your portfolio.

As of right now (5/8/2023), one share of VTI costs $204, while VOO costs $378. So, you need nearly twice as much money in available cash to buy one share of VOO vs VTI.

Ideally, I would recommend utilizing a brokerage such as Robinhood or Fidelity that allows for partial shares. This way, you can trade with any amount you want, regardless of share price.

However, if your brokerage doesn’t allow for partial shares, TD Ameritrade being one notable example, VTI is a better option.

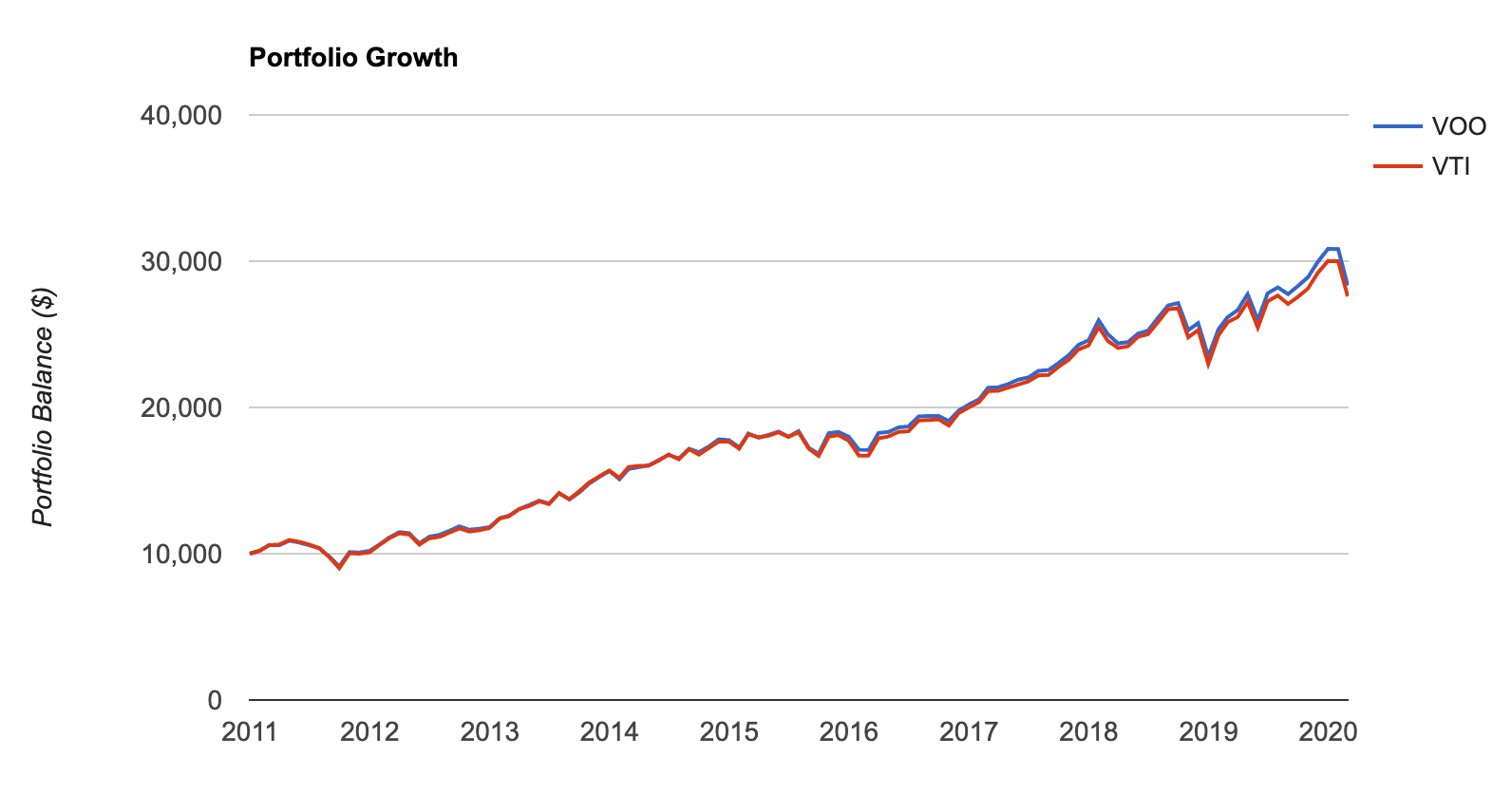

VOO vs VTI: Past Performance

Finally, the section you’ve all been waiting for. Keep in mind that past performance doesn’t guarantee future performance. However, it is by far the best indicator we have of how an investment will perform in the future.

Over the last 30 years, the returns of VOO and VTI have been:

TABLE: VOO 9.8% VTI 9.79%

I wouldn’t blame you for being disappointed in the lack of difference here. The truth is that both funds do a great job of tracking the overall market, so their performance is surprisingly similar.

Yes, technically, VOO has performed slightly better on average. However, for most people, a 0.01% difference in return on investment will result in barely enough money to buy a new pair of jeans.

VOO vs VTI: Dividend Yield

For many investors, dividends are a must-have. With ETFs, how dividends are dished out is often confusing.

With a single stock, a dividend is paid out by that company. For an ETF, you receive dividends from all of the stocks in that ETF that pay one. Each of these dividends is split up based on its percentage makeup of the ETF.

This is because by using an ETF, you are owning small portions of each stock in the fund.

For example, if you own one share of an ETF that gives you 0.5 shares of a company, you would receive half of its dividend.

This can be scaled up to ETFs with hundreds of companies. For example, Apple currently makes up 7.3% of the S&P 500 and thus VOO, which gives you about $29 of Apple when you buy one share of VOO, that $29 is about 16.7% of a share of Apple, giving you a whopping $0.15 annually from Apple dividends.

Once you add up all of these small dividends from the companies in VOO and VTI, you get a dividend yield of approximately 1.6% for VOO and 1.59% for VTI.

Neither of these dividends is great, but they are better than no dividend. A big reason for why they are so low is because large tech companies like Apple make up such a large percentage of each. But these tech companies tend not to pay a very high dividend. Apple, which makes up, by far, the most of each fund, only pays 0.53% in dividends.

VOO vs VTI: Should You Buy Both?

Since their performance is nearly identical, it may seem reasonable to purchase both VOO and VTI.

Though there is nothing technically wrong with this, it introduces unnecessary complexity to your portfolio. You now need to invest in both ETFs over time.

VOO and VTI are influenced by a nearly identical group of stocks since VOO contains the largest 500 companies and VTI contains the entire market. Investing in both will essentially provide you with asset allocation similar to VTI but with more focus on the top 500 companies.

There are two situations where it would be reasonable to be invested in both.

- You already have both in your portfolio. Sometime in the past, you decided to switch from one to the other and held onto the old one. Let’s say you moved from VOO to VTI. In this case, hold onto both. If you sell your VOO to buy VTI, you will be taxed on your sale of VOO. Then, down the road, when you go to withdraw, you will be taxed again. Simply leave your old shares in VOO and invest all new funds in VTI.

- Your retirement account restricts you. Many retirement accounts like 401(k)s restrict your investment options to a few funds. For example, say your preference is VOO, but they only offer VTI. You may choose to invest in VTI in your 401(k) and in VOO in a taxable brokerage account where you have free reign.

Outside of these situations, trying to diversify between the two stocks will be ineffective at best.

VOO vs VTI: Which is Best?

It depends. For investors looking for greater diversification, VTI is a better choice since it holds the entire market. For investors hoping to earn higher returns due to a higher concentration of high-cap stocks, VOO may be better.

In reality, whichever one you choose will have a marginal effect on your portfolio over the long run. Their performance and dividend yield is so similar that there will be no noticeable difference between the two.

VOO vs VTI: FAQ

What is their minimum initial investment?

Both of these ETFs have a minimum initial investment of $1.

This is assuming you have access to partial shares through your brokerage. If this isn’t the case, you need to purchase at least one whole share.

Remember that their share price is significantly different. VTI is currently at $204/share, while VOO is at $378/share. If you can’t buy partial shares and have a limited starting budget, VTI may be your only option.

Are they good for beginners?

Yes, absolutely.

Any ETF, especially those that track the market like VTI and VOO, are great for beginners. This is primarily due to their automatic diversification. Buy one stock, and you automatically hold hundreds.

They really come into their own when you take advantage of automatic investing. ETFs are great for buying and holding and aren’t intended for constant trading.

Are they taxed?

Yes, gains on ETFs are taxed just the same as any other stock. Keep in mind that just like any other stock, you are taxed far less when you hold it for longer than a year. This can easily save you up to 17% in taxes.

Follow a long-term buy-and-hold strategy to get the best results out of these ETFs.

Related posts:

- How to Choose the Right ETF Updated 10/27/2023 With more than 2,000 ETFs or exchange-traded funds available in the U.S. alone, choosing the right ETF might seem like picking out the...

- What the Value Trap Indicator Is and What It Is Not. “But I’m just a soul whose intentions are good, Oh Lord, please don’t let me be misunderstood” –Nina Simone If you’re reading this, you’ve either...

- 8 Major Stock Market Factor ETFs and Their Differences Updated – 11/3/23 A factor in the stock market is a set of characteristics, or style, of a group of stocks. Factor ETFs allow investors...

- VHDYX is “Closed to New Investors” – What Do You Do Now? As you know, Andrew, Dave and I are major dividend lovers! We all think that dividend paying companies are one of the best ways to...