“Investing is the process of laying out money now to receive more money in the future.”

Most people think they need thousands or millions of dollars to start investing. The good news is you don’t. We will discuss how to start investing if you are new to the whole idea.

There are some simple steps to follow to get started as early as today. And the sooner you start, the sooner you arrive at your destination.

In today’s post, we will learn:

- Why Invest in the Market

- Things to Consider Before Starting

- 6 Perfect Investments for Beginners

Okay, let’s dive in and learn more about investing for beginners.

Why Invest in the Stock Market?

For most of us, retirement is a long way off, which we think we will do later. But today is the best time to start, and most people put it off, either because they fear what they don’t know or feel they don’t have enough money to start.

The stock market is one of the greatest places to create wealth. Of course, starting or owning your own business is a great way too, but that is not for everyone, where the stock market is open for all.

Starting to invest in the stock market seems scary and full of noise, confusion, and the potential to lose lots of money.

But investing is like anything else; once you learn the basics and understand the reasons behind the behavior, it all makes a lot more sense.

Starting with the why, the stock market is a place for people to buy and sell businesses, otherwise known as stocks. These stocks trade at values the market sets every day, and these values change a lot, sometimes by the minute. But the large swings are rare, up and down. Instead, changes are gradual over time.

This is why investing is a long-term game; it is not a get-rich-quick scheme, despite the noise you hear from the media or on social media. Those cases are rare and include a lot of luck, as well as skill.

The way to make money in the market is slow and steady, and by being consistent. But, as you will see, we don’t need to become stock-picking wizards like a Warren Buffett. Instead, you can find great investments that fit you and your life and help you grow your wealth.

So, why the stock market instead of using a savings account? The answer is simple, inflation. Inflation eats into our savings, and the simple fact is, our dollar today is not worth as much in the future because inflation eats away at that dollar.

For example, the price of milk rises, and that dollar you used to pay for a gallon is now $1.80 for the same gallon. And if your investments, savings accounts, or otherwise, are not earning more for you than the cost of inflation, you will end up with less buying power in the future.

Savings accounts today, especially in a brick and mortar bank like Wells Fargo, pay 0.01% on standard savings accounts, which means if you leave $100 in the account at the end of the year, you will earn one cent! Unfortunately, this means that we are losing money over the long term if we leave our future retirement savings in a savings account.

Savings accounts have a place in our financial picture, but they leave a lot on the table as a long-term investment.

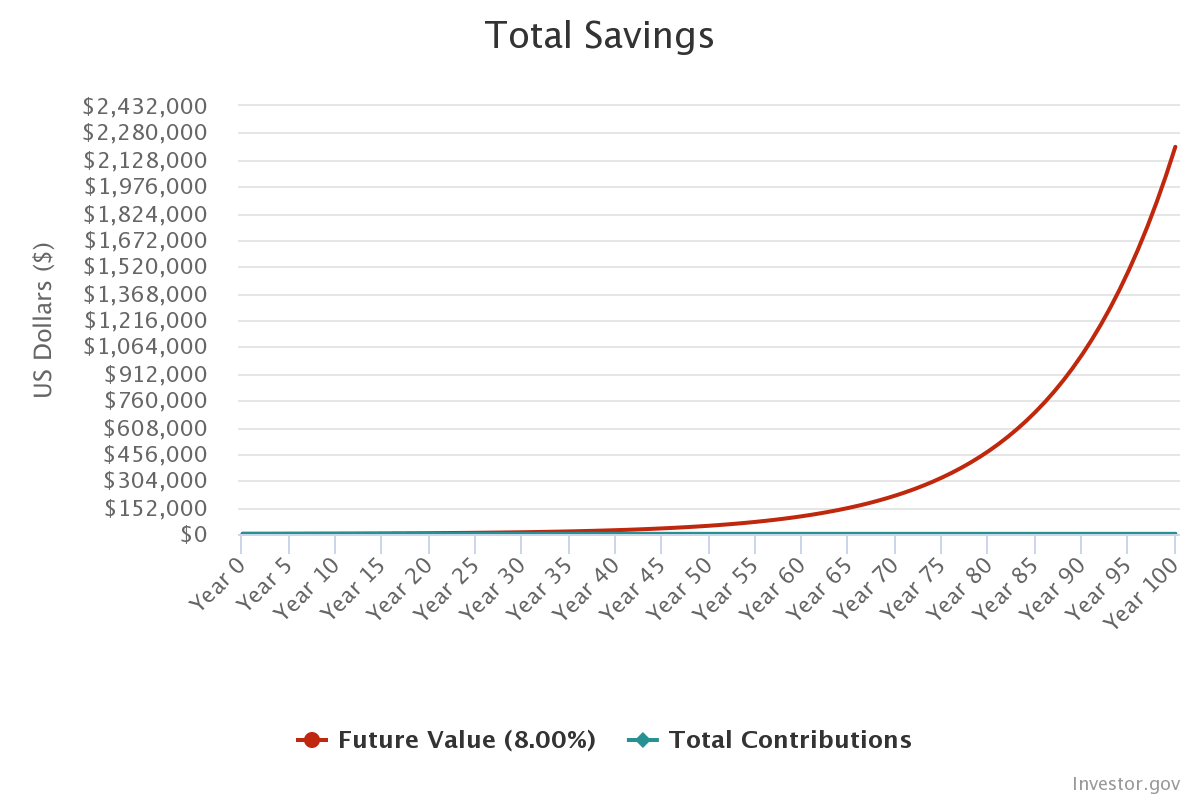

Over the last 100 years, the stock market has earned an average of 8 to 10%, which means if you invested $1,000 a hundred years ago at 8%, you would have over $2.1 million without investing a single additional dollar!

The above is a simple example of the power of compounding, which, as Albert Einstein is often credited with stating, is the eighth wonder of the world. Compounding allows our investments to grow over time and build upon themselves, and grow exponentially. Thus, the more consistently we add money and grow the pile, the larger the pile will grow. To get a sense of how powerful compound interest is, Download this compound calculator and play around with different numbers.

Investing in the stock market is one of the best ways to grow your wealth, and it can be done without a ton of effort and with a margin of safety or risk tolerance. And the earlier we begin investing, the earlier we put compound interest to work and the more we can gain from compound interest.

Things to Consider Before Starting

Before we dive in and learn more about what kinds of investments will be the best fit for us, we need to discuss some foundational ideas to set ourselves up for success. These ideas consider our goals, preferences, risk tolerance, and what kinds of accounts to open to best fit our needs.

Investing, like everything else connected to our financial path, is a personal choice. And what works for me might not for you, and that is okay. Choose what works best for you because the goal is to find what will help you achieve your goals.

Goals and Time Horizon

Consider what your goals are, buying your first home, investing for retirement, saving for your children’s education, or buying that dream car. All of those ideas need thinking through, and they will have a bearing on what kinds of investments work best for your goals.

Longer-term goals such as retirement, education, and your first home have different investments that work better for them. And, a shorter-term goal like a new car will have a different time horizon.

The longer the time horizon, the better fit is investing in the stock market. A shorter-term goal or horizon has better options outside of the market. The stock market is a long-term playing field and creating wealth over time.

My suggestion is to write your goals down or put them on a document on your computer that you can refer to from time to time. Studies have shown that putting your ideas down helps solidify them in our brains and makes them more tangible.

Risk Tolerance

Every investment we consider, stocks, bonds, ETFs, or mutual funds all carry some investment risk. A stock market is a volatile place, with prices fluctuating up and down over time. New investors or veterans need to understand your risk tolerance for the swings or volatility.

A note about volatility versus losses, a loss on a stock or any other investment is not real until you sell your position, where volatility refers to the ups and downs of the price in the market. Many famous names such as Apple, Google, Facebook, or Tesla have price movement daily. You will see your investments rise and fall over a long time horizon; that is normal, and don’t freak out and sell everything.

To assess your risk tolerance, consider whether your investments keep you up at night or if they allow you less stress and to enjoy your day. To give you an idea of the different types of investment risk, check out this blog post.

Diversification

When investing, it is best not to put all of your eggs in one basket. Even though you think that “this industry” will take off, putting all of your investments in one industry, for example, electric vehicles, can lead to some extreme volatility if the market turns against that industry.

A better idea is to diversify, which means to spread out your investments over a range of different assets or industries. For example, buying tech, financials, real estate, and retail is a small sample of the kinds of investments that are not closely related.

The simple reason for this, as markets move, some sectors move in and out of favor, and by spreading your investments across different sectors or assets (stocks, bonds, gold, etc.), you can reduce your risk.

And the good news is we can do this with various investment choices, such as individual stocks, ETFs, index funds, mutual funds, or your 401k. More on this in a moment.

Fees

In the investing world, there is no free lunch. But avoiding or lessening your fees is one way to earn better returns. With the creation of no-fee brokerages like Charles Schwab, Fidelity, and many others investing in stocks doesn’t cost anything to buy or sell, other than our time.

Avoiding fees in commissions is difficult, but not impossible, depending on how you choose to invest. If you manage your investments and use ETFs or Index funds, they offer low or zero-fee funds to help reduce those costs. Many mutual funds over different fees, so it is important to check on those before pursuing those investments.

What’s the big deal, you ask? Well, for example, if you invest $1,000 in a mutual fund that charges you 2.5% a year to manage that investment. Then you are automatically earning 2.5% less on your investment each year, which can eat up thousands throughout the investment. In dollar terms, your 2.5% fee means that your starting investment is $975 instead of $1,000. Meaning you are behind at the outset and will cut into your compounding power over time.

Retirement Accounts

If retirement is part of your financial plan, and it should be, then you need to decide what kind of investment account will work best for you. There are two basic choices for individual accounts, as well as your 401k with your employer. They are the Traditional IRA or the Roth IRA. The biggest driver of choice between these two is your investment horizon and how you want to handle taxes. Unfortunately, Uncle Sam will want his cut, but you have a choice on how and when they get their cut.

Traditional IRA – the easiest way to understand the Traditional is a tax-advantaged retirement account that allows you to invest your money pre-tax. That means you don’t pay upfront taxes on your investments, but you will have to pay them when you reach retirement or start withdrawing money.

Roth IRA – The Roth IRA is also a tax-advantaged account, but the difference is you pay the taxes up front and earn tax-free retirement monies that you owe zero taxes when you retire or start withdrawing money.

Both accounts have rules on withdrawals and amounts you can invest, but they are the best vehicles for us to put our hard-earned money.

To learn more about how they work and the best options for you, check out this blog post.

6 Perfect Investments for Beginners

Are you ready to start investing? Good, we have a few more housekeeping items to decide on, and then we can talk investment options.

The first decision, what kind of brokerage account is best for me?

Online Brokers

There are so many options for online brokers today it is dizzying. From traditional banks, online brokers, apps on your phone, it isn’t easy to know where to turn.

The first item to look for when choosing a broker, what kinds of fees do they charge and for what? Most online brokers or apps offer no-fee trading to encourage us to sign up, and those are the accounts I choose for my investments.

Depending on your investment needs, you have the choice between full-service or discount brokers. A full-service brokerage is your best bet if you need investment guidance, portfolio management, or other services. They offer all of those options, but they will charge you a commission fee, along with account minimums, for example, a minimum of $25,000 in account balances.

Discount brokers are the norm, and as I mentioned earlier, they typically charge zero fees for buying and selling. There might be fees associated with options or other more exotic types of investments, but generally, they are a low-cost option. The discount brokers handle executing the trades for you and offer lots of online tutorials and educational materials. But they are DIY outfits, meaning if you need help or investment advice, they can’t offer it to you. The discount brokers also typically have no account minimum requirements and offer many portfolio tracking options.

After you decide which type of brokerage works best for you, the accounts are quite easy to open, either with an app or online. To open your account, you need some general information, what kind of accounts you want to open (Traditional or Roth), how much you want to start with, and your bank information for linking and transfers.

It takes minutes to open and then a few days for everything to be approved, and then voila!

My favorite online accounts are:

What Kind of Investor Am I?

Before diving in and learning more about our investment options, you need to decide what kind of investor you are and how hands-on you want to pick your investments.

- DIY – are you the type that wants control over their investment choices and want to do the research? Then choosing individual investments is the way to go. The world is your oyster, and there are scads of different ways to go, stocks, bonds, ETFs, index funds, real estate, and much more. To learn more about pursuing your investments, start here.

- Need professional help – if you are the type that would feel more comfortable having a professional manage your investments and leave it to the pros. There are tons of options for you, from the personal touch to Robo-advisors. The personal touch ranges from investment brokers like Personal Capital, your bank, or outside firms like Charles Schwab. Some of these will require minimum balances, so keep that in mind.

- 401k – you can easily invest for your future using your employer’s 401k, which is professionally managed and allows you to invest it and forget it; plus, most employers offer matching, which is free money.

Depending on your choice from above will dictate which investment options are the best fit. Keep in mind that you can easily mix and match the above decisions. For example, you can and should contribute to your 401k, especially if they offer a match, plus you can manage outside investments on your own.

Now, we can discuss some of the top six investment choices available:

- Index funds – Index funds track a market index like the S&P 500 or Dow Jones, for example. They are professionally managed, with lower fees than a mutual fund. Most consider index funds as part of the passive investing basket, meaning there is not much buying and selling in the funds; rather, they are meant to mimic the market they track. The expense ratios for index funds are quite low, and they are available across the spectrum of investment vehicles. Some index funds require minimums, but Schwab and Fidelity offer zero or low minimum options. A great option for both professionally managed or DIY investors.

- ETFs – ETFs are similar to index funds in that they track an index like the S&P 500, and they offer extremely low fees. The main difference is that they trade on the market like a stock, which can fluctuate through the day. There are no minimums to invest in them; if you pay $220 for the VTI (Vanguard Total Index), then that is your price of admission. Also a great option for the DIY investor and professionally managed.

- 401k or Employer Retirement Plan – If you have the option of a 401k or employer retirement plan at work, chances are this is your first go-to for your investment goals. If your company offers the plan, plus a match, that is free money, along with professional management of those funds. The contributions limits are much higher than individual accounts, and you can have the money taken directly from your paycheck, which offers both convenience and consistency. You do have choices for your investments, but it will be a more limited menu. 401k’s are strictly a professionally managed investor type, with limited options to choose from, not the best option for a DIY investor.

- Robo-advisor – Robo-advisors are the perfect vehicle for those who want to “set it and forget it,” investing style. These advisors offer a preset list of menu options that are managed by AI and have low fees. Suppose money is tight and your employer doesn’t offer retirement benefits. In that case, Robo-advisors are a good choice because they offer investment options with very little money, and they do all the heavy lifting. You can also have the money directly withdrawn from your paycheck, like a 401k. One option is the company, Betterment, the founder of Robo-advising.

- Individual Stocks – If you are a DIY type investor, choosing your stocks is the best way to go and offers the most upside. There are risks involved with investing in individual stocks, and there is more work involved in portfolio maintenance and diversification. And with the advent of stock slices or pieces of a company, you can literally buy $10 of Amazon if you want, for no fee. It allows you to own pieces of companies that might take months to save for and participate in the growth of some of the best companies in the market. There is also the excitement of learning about new companies, business, and how the economy works.

- Investment Apps – Several apps target beginning investors, Acorns and Stash, among the most prominent. Acorns round up your purchases on your debit card, deposit the money in a brokerage account, and invest them in Robo-advisor ETFs. There is no minimum to start, and it makes its first investment at $5. Stash is similar because it offers ETFs and individual stocks and helps beginners learn to build a portfolio. Both apps come with fees and are limited in the investment choices they offer. These are great for those wanting to start, but the budget is tight and offers a great way to get started.

Investor Takeaway

The bottom line is there has never been a better time to start investing for your goals than today. There are numerous options out there, no matter the income level. Investing is available to everyone, and there are tons of options to fit whatever your goals or interests.

From stock slices to zero-fee brokers, there are many options for us to get started, and the sooner you start, the sooner you will reach your destination. With a little due diligence on what types of accounts, account minimums, and how much you have to start, you can start investing today.

We’d love to hear from you. What’s your why for investing? What led you to want to start this learning journey? Let us know!

FAQ

Can I start with $100 or less?

Yes, if you have $100, there are many things you could start with:

- Start an emergency fund

- Open a brokerage account and buy five stocks for $20 using stock slices, offered with Charles Schwab and Fidelity, for example.

- Open a Robo-advisor and invest the money

- Have your employer add it to your 401k

What is the S&P 500?

The S&P 500 is a term that refers to the 500 largest companies in the United States and is a stock index that tracks their performance. Most investors refer to the S&P 500 as a benchmark for stock performance. All of the top companies you often hear about are in the S&P 500, such as Apple, Amazon, Facebook, Microsoft, and many more. It is also known as the Standard & Poor’s 500.

What is Value Investing?

Value investing is the term associated with buying companies at a discount or on sale. And then waiting for those companies’ value to appreciate. It is championed by the great Warren Buffett, Charlie Munger, and many others. To learn more about value investing and how to start valuing companies, click here.

What is Growth Investing?

Growth investing is the method of investing that follows the revenue growth of the company. Typically, growth companies are new to the stock market and are young tech companies changing the rules of business or offering groundbreaking technologies. To learn more about this type of investing, click here.

Related posts:

- Investment Terms Everyone Should Know Updated 9/3/2023 If you are new to investing, all the terms and jargon might seem overwhelming. But today’s post will help you learn some of...

- ETF & Index Weighting Schemes With ETFs and passive investing continuing to grow in popularity, it is important for investors to understand the various index weighting schemes that our trusted...

- The Practical Solution to Begin Investing With No Money Updated – 11/3/23 Although it’s not easy to start investing with no money, it certainly isn’t impossible. Keep reading for tips to start your investment...

- Debunking 9 of the Top Investing Myths That Beginners Believe Updated – 11/3/23 Did you know that the #1 reason that people don’t invest is because they’re terrified that Handy Andy’s returns will make their...