Boom! I finally did it. I finished Kiyosaki’s book and now it’s time for my ‘Rich Dad, Poor Dad’ summary. Are you as pumped as I am?

If you’ve been following along with my review then you know that this has literally taken weeks, but I promise you the book isn’t that hard or long to read – I’ve just been trying to space out the Chapters to write different posts each week and to try to really reflect on some of the information that he bestowed onto me before writing my recaps!

So far, I have written six chapter summaries, and I will hit on a few of the very high-level lessons that I took away from each chapter!

Why a Scalable Income is Better Than an Hourly Wage for Wealth Building

Well, it was simple – “The Rich Don’t Work for Money”

This chapter was really as simply as it sounds – if you want to be rich, you’re not going to be working for money. But what exactly does that even mean? It’s simple if you really think about it but it’s hard to wrap your mind around at the same time…

If you have an annual salary of $50,000 or say that you make $15/hour – the amount of money that you can make is capped. It’s either capped on an annual basis at $50,000 or capped on an hourly basis at $15/hour. Sure, you can work more hours if you’re the hourly worker and increase your income, or you can add a second job or a side hustle, but the fact of the matter is that you’re really capping your earning potential.

If you can instead work in a way that allows you to have a scalable income, your earnings potential is endless! Think of it in an investing mindset:

Would you rather invest at a guaranteed 2% APR, say like in a CD, or put your money into the market and have the opportunity for no earnings generation, or even losing money, but also an opportunity for huge gains? Of course, you pick the stock market, right? The only time that I hear people say that they would pick the CD is if there’s some sort of caveat like being close to retirement, emergency fund, short-term savings, etc. – but that just further proves my point. Other than one offs, you pick the high earnings potential opportunity, and it’s no different with your income!

Instead of working for someone on a salary or hourly basis, work for yourself and find a way to scale your income. Kiyosaki was taught this lesson as a kid and applied it by turning old comic books into a comic book library and that’s what finally got the point across to him – what will it take to get the point across to you?

How to Identify a Cash Flow Pattern of an Asset (from Rich Dad, Poor Dad)

“It’s not about how much money you make. It’s how much money you keep”

This seems simple, right, but is it? How often do you hear a story about a couple that makes tons of money, but they blow it all? It’s disgusting. If a family makes $200K/year and spends $200K but your family makes $50K and spends 30K, then who is better off? I think that it’s obvious that the family that is better off is the one saving 40% of their income!!

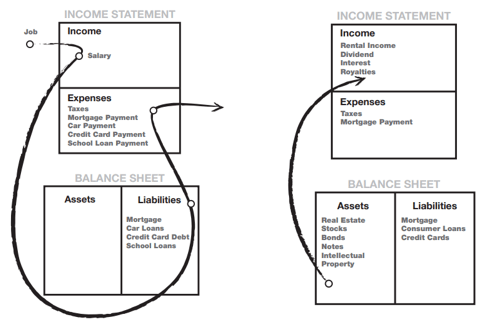

Just because you’re making a lot of money doesn’t mean crap. It’s about saving money and using that money that you make to gain assets instead of liabilities. So how do you do that? You must know the difference between an asset and a liability and buy assets!

Someone that just has a job where they funnel all of their money into things like an over-the-top house, expensive cars, unnecessary toys, and literally just anything that will cost money but not create any value. It comes in through a job and essentially goes right out the window!

The other alternative is to put your money into assets that then create income! Examples of this are stocks, real estate, bonds, high-yield savings accounts, and quite simply anything where you’re putting your money to work to create future money!

Take a look at the difference between these two scenarios, below:

In summary, there’s really three things to remember from this chapter –

- The rich buy assets.

- The poor only have expenses.

- The middle class buy liabilities they think are assets.

The Surprising Disadvantages of a Savings Account (A Secret of the Rich)

This chapter really hit home with me because I am already a “hater” of savings accounts in the sense that you are earning such a minimal interest rate and that it would surely be better off in the market, so I essentially limit it only to an emergency fund or things being bought in the short-term, but Kiyosaki brings another reason into play – taxes!

When you put money in a savings account, you’re earning the money, then paying taxes on it, and then ineffectively earning interest (although better than letting it sit in cash!). Kiyosaki urges us that the way to become wealthy is to instead earn money, spend it and then pay taxes. That’s really the difference between business owners and employees:

- Business Owners: Earn, Spend and then pay taxes.

- Employees: Earns, pays taxes and then spends.

But what does that really even mean? Well, Kiyosaki gives an example how an employee would have to justify a trip to Hawaii as a vacation, but a business owner could classify that trip as a business meeting. What’s the difference? The employee is using after-tax money while the business owner is using pre-tax money! That essentially means that the business owner’s money is ~25%+ more effective!

While I definitely do not recommend opening a business solely to use pre-tax money on your trip to Hawaii, you can implement a very similar strategy when it comes to investing in real estate! If you sell a piece of property but then use those funds to upgrade, you can defer what you would normally owe on taxes, therefore you can just keep continuously upgrading, tax free!

I know it seems confusing, but it makes a lot of sense when you really look at the math!

In summary, make sure you’re taking advantage of all tools that are at your disposal and not just blindly putting your money into a crappy savings account!

Don’t Work for Money and You’ll Become Rich, says Rich Dad

“You want to know a little bit about a lot.” These are great words to live by just in general. I don’t want to get off on a tangent, but I think that people get too narrowed and focused on one thing, and that makes them stay in the same line of work their entire life.

The more that you can get out and experience and learn different things, the more of a swiss army knife that you will become. The more things that you can experience to broaden your horizon is going to make you a more useful businessperson and will help you get out of the rat race!

Kiyosaki goes on later to say that the three most important skills for someone to be a successful manager are:

1 – Management of Cash Flow

2 – Management of Systems

3 – Management of People

All of these are things that can be taught through experiences and education. The key is to jump in, face the challenge head on and get going. None of these involve being the smartest person in the world, it’s quite simply just about making the move.

If you can jump in headfirst then you’re going to be setup to do things on your own and never be forced to work for money!

Why the Financially Literate Can’t Build Wealth: 5 Major Reasons

If you had to reread that title, then don’t feel bad – sometimes I did too just to make sure it was right! Financially literate…can’t build wealth…. what am I missing? Well, the 5 reasons, of course!

My top 2 reasons are fear and cynicism. Quite simply, people are fearful for anything that is new that might not seem normal. Unfortunately cutting your expenses and living below your means isn’t normal. But do you know what else isn’t normal?

Becoming Financially Autonomous. Retiring Early. Doing whatever you want because money isn’t holding you back.

“Normal” is keeping up with the Jones’, unfortunately. So many people get too focused on having what everyone else has that they find themselves too focused on building up liabilities like a super nice house and car instead of creating assets. Do you know what this does? It keeps the financially literate from becoming wealthy.

My other favorite top reason is cynicism. People are just so freaking negative these days and so eager to hate on things without any actual knowledge. As I was typing this sentence, I just kept thinking about the LeBron vs. MJ argument. Have you noticed that a large majority of the MJ homers are those that are 40+ and most of the Lebron homers are under 40?

They feel this way because this is the era that they lived through and they’re most familiar with, and not being familiar with something makes them cynical towards something else.

Investing and financial autonomy is the exact same. If you invest, I guarantee that you have been told that investing is too risky from someone that not only doesn’t invest, but never invested. They have no idea. They’re just cynical towards the idea and always assume the worst.

They will cite 2008 where the market dropped in half but not bring up that by 2019 the market was double the price BEFORE the stock market drop, meaning that it had quadrupled the low S&P 500 price. People will look for any reason that they can to justify their argument and it’s really just them being cynical.

They’ll say they’re not smart enough, or it’s too hard or complex, or that they don’t care about the stock market.

You can invest in an ETF high can get you great returns, especially compared to a savings account, and it takes next to 0 knowledge about the market – just a general base knowledge.

People look for excuses. Instead of looking for an excuse to say no, look for a reason to say yes!

10 Steps to Building Assets from a Bestselling Book about Money

And now we’re off to my favorite chapter of the book!

All of his reasons are great, but my two favorite reasons

- Find a reason greater than reality: the power of spirit

- Master a formula and then learn a new one: the power of learning quickly

The first is all about finding your ‘why’ and then sticking to it. Having that ‘why’ is what is going to get you through those hard times and keep making sure that you can persevere when the going gets tough. If you don’t have your ‘why’ clearly defined, the odds of you failing are much, much higher.

The second is simply having a formula mastered for your success! Have a process in place to allow you to keep building assets. It’s important to have a process to fall back on and constantly evaluate the process and make changes as changes are needed. If you don’t have a process and you’re just “winging it” then I also don’t really like your chances of success. Instead, clearly define steps that you intend to take, take those steps, and record thorough notes and observations throughout the process. At the end, reflect on it and change as you need, but only after the entire process is completed!

If I had to summarize ‘Rich Dad, Poor Dad‘, to this point, I think that I would do so with the three/four following words:

- Simplified

- Realistic & Relatable

- Actionable

These three things are why this book was so incredibly beneficial to me. I walked away with tangible steps that I could take immediately to make myself a better person, both financially and personally. I feel like Rich Dad, Poor Dad has truly helped mold my mindset into thinking about things in a more entrepreneurial mindset than what I have ever done before and is really, really making me focused and motivated on the future.

I have read multiple other books and written summaries on them including ‘What Works on Wall Street,’ ‘The Essays of Warren Buffett‘ and ‘Common Stocks and Uncommon Profits,’ but ‘Rich Dad, Poor Dad’ has had the biggest impact on me simply from a mindset perspective. All have been great books to read and I highly recommend you check them out, or at least the summaries, but ‘Rich Dad, Poor Dad’ is one that you 100% need to buy!

I have finished the book more motivated than ever to accomplish my own personal financial autonomy – now let’s get that countdown to FI started!

Related posts:

- A Complete Richest Man in Babylon Summary with Chapter Reviews I feel like I’ve blown through ‘The Richest Man in Babylon’ because the book was just so hard to put down! But don’t worry, if...

- A Complete What Works on Wall Street Book Summary Recently I have been reading and reviewing the ‘What Works on Wall Street’ book by James O’Shaughnessy and it really has been completely eye opening...

- Hidden Gems: A ‘Common Stocks and Uncommon Profits’ Book Summary Updated 8/25/2023 I’ve been putting together some chapter summaries with key highlights for the book Common Stocks and Uncommon Profits by Phil Fisher. It only...

- The Essays of Warren Buffett: A Complete Book Summary I feel like I’ve been reading the Essays of Warren Buffett for literally a lifetime, and although it hasn’t nearly need that long, it does...