As I continue to read through Rich Dad, Poor Dad, I must say that it’s becoming one of my favorite books and admittedly a book that I read much earlier in my investing and finance journey. In this chapter, Robert Kiyosaki focuses on explaining the differences between assets and liabilities and the true cash flow pattern of an asset vs. a liability.

“It’s not about how much money you make. It’s how much money you keep”

The chapter starts with this quote that I think really hits home for me. Making money is great. Saving money is better. Sometimes you’ll see these crazy news stories about couples that make $500,000 between them and that they’re broke…like how?

Well, it’s because they’re either financially illiterate, don’t care, or are morons.

I know, that might sound harsh, but if you spend $500,000+ in a year and save $0, then you are one of those three types of people, if not two or even all three of them.

“If you want to be rich, you’ve got to read and understand numbers.” If I heard that once, I heard it a thousand times from my rich dad. And I also heard, “The rich acquire assets, and the poor and middle class acquire liabilities.”

That’s a quote that Kiyosaki had in the chapter that also hits home – what category do you want to fall into? I don’t know about you, but I want to be rich…I guess I should start acquiring some more assets.

Kiyosaki has a very extensive list of his rules to make sure that you’re properly setup for financial success and man, is it extensive or what. Here we go!

Rule #1: You must know the difference between an asset and a liability, and buy assets

That’s the end of the rules…lol. I know, he got me, too. But that really shows how important that rule is. You have to understand the difference and make sure you only buy assets. But what does that actually mean?

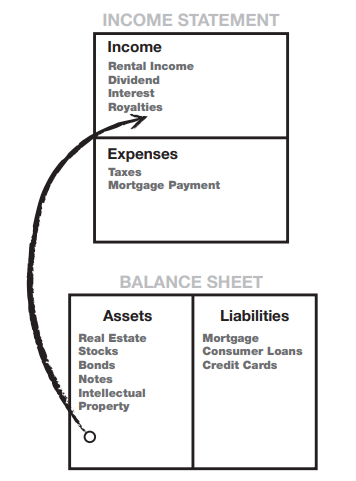

Well, an asset is simply something that you purchase that will hold its value, or even create future value for you. Examples might be real estate, stocks, bonds, or Intellectual property. An example of a liability is anything that you own that you still owe on or doesn’t have value such as a mortgage, loans or a credit card debt.

Seems simple, right?

Assets –> Income

Liabilities –> Expenses

Buy things that create income and avoid things that cause you to make payments. Honestly, that’s really the summary of the chapter. But, it’s much easier said than done.

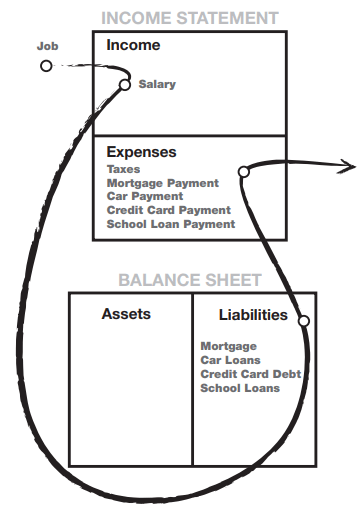

Think about it…if you’re poor and not able to save, then where is your money going?

Income –> Liabilities –> Expenses

As you can see from a screenshot of Rich Dad, Poor Dad, you’re not ever actually saving anything.

You’re earning money, paying your debt, and then blowing the rest of the money.

I used to be like this. I was awful. I spent so much money on stupid stuff that I would be scared to look at my bank account or credit card statement. When I graduated college, I had a great job, lived in a fairly cheap apartment, and still couldn’t save money.

Well, I shouldn’t say couldn’t – my financial illiteracy kept me from saving.

And I was also a moron.

So only two out of the three I outlined earlier…whoops.

This is not a lifestyle you want to be in. If you’re always working just to pay back what you already paid for, then you will never get out of that hole…ever. You have to make a change.

I did this by implementing a monthly budget process which you can use as well. The Doctor Budget has given me a sense of new life and freed me of some of my financial burdens to truly appreciate what I have and plan my future life of financial freedom.

Now, my life is more of a “rich” person, where my money follows a different trajectory:

Do I have some liabilities still? Yes, absolutely. I have a mortgage, car loan, student loans…but I understand what those are. My car is not an asset. It’s a liability. My house is not an asset. It’s a liability.

The house debate is one that never goes old and one that I’ve been on the other side of the fence on for most of my life, claiming that a house is an asset.

But what exactly is an asset, again? It’s an income generator. Does your house generate income? Nope.

“But Andy, my house is worth $500,000 right now. Eventually I will plan to sell it and move into a $200,000 home so isn’t it $300,000 in assets?”

No.

Have you sold your house? No? Then it’s not an asset. That is just an unrealized gain which is great to understand, but if the housing market crashes and your house is now worth $300,000, what now? Where’s that $300,000 in assets you had?

I’ll let you consider a house an asset…if it’s not your primary home. If you can sell a house and still maintain your same quality of life, then it’s an asset. What does this mean? It has to be a 2nd+ property used for rental income, etc.

Kiyosaki focuses a large portion of the chapter on houses, and I think he should, because it really is the age-old debate. Kiyosaki says that a house is a liability and I 100% agree with him.

Think about it – if you buy a house that is above your needs, but something you can still afford, is that a liability? ABSOLUTELY! But why?

When you’re tying your money up in the market, you’re experiencing an opportunity cost of investing that money in other ways, such as:

- Loss of time – while you’re paying an extra $300/month on a mortgage for a house you don’t need, you’re losing the opportunity to invest that $300 into the market

- Loss of capital – when you buy a house bigger than what you need, you’re going to have more expenses, therefore taking away even more cash. A 4000 square foot house is naturally going to have more expenses than a 2000 square foot house. There’s more square footage for things to go wrong, a more expensive AC unit that’s working to cool twice the square footage, a vacuum that’s being used twice as much…anything! Honestly, this is the point that really made me think, because it’s something I’d never thought of before, and there’s no better way to sidetrack a budget than the unplanned expense.

- Loss of education – if you’re not investing your money into the market and instead into a mortgage, you’re missing out on time for you to make mistakes, experience successes, and just an overall learning experience that you need, and I truly mean that it’s a need, to be successful in your investing journey.

Kiyosaki summarizes the chapter with three important takeaways:

- The rich buy assets.

- The poor only have expenses.

- The middle class buy liabilities they think are assets.

I don’t know about you, but I think that I should start buying more assets and stop treating my liabilities like they’re assets.

Related posts:

- Don’t Work for Money and You’ll Become Rich, says Rich Dad One of the most important lessons that Robert Kiyosaki teaches in his best-selling book, Rich Dad, Poor Dad, he tells us how important it is...

- The Surprising Disadvantages of a Savings Account (A Secret of the Rich) A lot of people will think that the best place for their money to be is in a savings account, but that’s just not accurate,...

- Make Life 2% Cheaper with Cash Back Credit Cards! Credit cards can get a bad wrap, but when using the right card and paying your account down to zero on a monthly basis, cash...

- Why the Financially Literate Can’t Build Wealth: 5 Major Reasons Updated 1/17/2024 Understanding finance basics doesn’t mean you’ll instantly begin building wealth. There are still several attributes that can lead you to fall short of...