To see all recent Disney 10q filings registered with the Securities and Exchange Commission, click this link or on the picture below.

Walt Disney Corporation reported its second-quarter earnings of 2020 on May 5. The full results of the Covid-19 Pandemic are just beginning to make itself known to the world, and Disney is not immune, no pun intended.

In this post, we will break down the financial results of Disney for the second-quarter 2020, which ended March 28, 2020, and present it in a summary form, such that you can look over the good, the bad, possibly ugly and get a sense of how the company performed during the quarter.

We will also cover how management is reacting to what is impacting its business and how they plan to react to how the virus has impacted them and what they expect in the coming months.

Most companies have pulled their guidance for the coming months, but we can get a broad overview of their expectations, as well as ideas of how they navigated the previous financial crisis of 2007.

Ok, let’s get to it.

Good Stuff

There were two bright spots for Disney in the second quarter. First revenue was up by year over year for Q2, an increase of 21%:

- March 2020 $18,009

- March 2019 $14,922

Also an increase of 29% over the last six months comparatively:

- March 2020 $38,867

- March 2019 $30,225

We are breaking down the segments to highlight some of the good stuff.

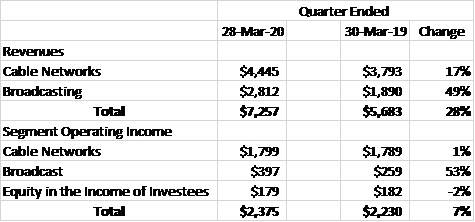

Media networks

Disney’s media networks increased revenues by 28% to 7.3 billion, and segment operating income increased 7% to $2.4 billion.

Cable Networks:

Cable networks increased by 17% to $4.4 billion, and broadcasting increased 49% to $2.8 billion in the second quarter. The increase was a result of a consolidation of the TFCT businesses, primarily a result of FX and National Geographic.

Broadcasting:

Broadcasting revenues improved by 49% to $2.8 billion, and operating income improved 53% to $397 million. The company attributes the increase to the further consolidation of TFCF, from program sales, and an increase in legacy operations.

At the beginning of 2020, the company adopted a new accounting guideline, which results in a lower amortization of capitalized episodic television costs during network airings for shows. The change will mean that amortization costs will be higher in the first part of the year and lower in the second half of the year.

Studio Entertainment

Studio entertainment revenues increased for the quarter 18% to $2.5 billion, and the segment operating income decreased by 8% to $466 million. The decrease was linked to lower costs from legacy programs. The decrease stems from decreases in theatrical distributions as all movie theaters across the country are closed as a result of Covid-19.

The closings impacted expected revenues from the film Onward, and the DVD sales of Frozen II and Star Wars: Rise of Skywalker.

Direct-to-Consumer & International

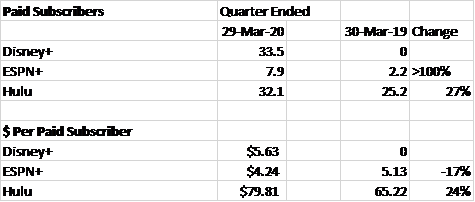

Direct to consumer & International revenues increased from $1.1 billion to $4.1 billion, and segment operating loss increased from $385 million to $812 million. The increase in loss is associated with costs related to the release of Disney+ and the consolidation of Hulu.

Disney+ in the first quarter of release saw 33 million people subscribe to the service, which resulted in $5.63 per subscriber for the quarter. Disney was hoping to see 6 million subscribers by the end of the year, so this was quite exciting.

Ok, those were some of the bright spots for Disney for the quarter. Now let’s discuss some of the items affecting last quarter.

Not So Good Stuff

Disney had a troubled quarter as the onset of implications of stay-at-home orders took effect around the world as a result of the Covid-19 pandemic.

Parks, Experiences, and Products

Parks, Experiences, and Products revenues dropped for the quarter 10% to $5.5 billion, and segment operating income saw a decrease of 58% to $639 million.

The decrease at the theme parks was a direct result of the stay-at-home orders around the world as all theme parks were closed in mid-March. The closures also affected the resorts, cruise lines, games and merchandising.

Disney estimates that approximately $1 billion on the park’s segment operating income was lost because of the closures. Before the parks, closing volumes and guest-spending were higher when compared to the prior-year quarter.

Additionally, costs were higher for the quarter, which was a result of new guest experiences, including Star Wars: Galaxy’s Edge. Also including in rising costs were payroll expenses that were absorbed even though there were no services offered.

Studio Entertainment

As mentioned above, the theater segment was negatively affected by all movie theaters closing as a result of Covid-19. The anticipated release of Onward, Mulan, and the DVD release of Star Wars: Rise of Skywalker greatly dampened revenue and operating income for the segment. Disney didn’t attach a financial figure, but you have to assume it was substantial.

Media Networks

The Covid-19 pandemic the hardest hit ESPN networks, there was a decrease in ad revenue, and the cancelations of major sports such as the March Madness college playoffs, Major League Baseball, NBA, and many more.

Additional Impacts from Covid-19

Several additional impacts from the pandemic were recorded during the second quarter.

Disney announced on May 11 that they were offering $11 billion in a bond offering to raise cash to sustain them until lockdowns are released, and the business can attempt to get operations running again.

Also, Disney announced they would be suspending their first-half dividend as another measure to retain capital and maintain their liquidity. The company said they would announce a revision of the dividend payment of the future as conditions improve around the world.

Risks

The primary risk that Disney faces currently is a result of all the lockdowns around the world in response to the pandemic. As a result of the forced closures of all business operations, apart from the digital, all operations have come to a standstill.

Disney was forced to furlough 100,000 of its employees during the quarter, and the worry is that once lockdowns are lifted, the return to parks might not increase enough to impact the business enough to bring all the furloughed employees back.

The future is unknown, and whether the return to business will be swift or slow is anybody’s guess. Early indications are that people will want the distraction, and the theme parks and theaters might bounce back relatively quickly.

Disney Shanghai has recently opened its doors, and reduced capacity and tickets were sold out in hours. Additional days were added to the openings, and everyone is tentatively optimistic about the results.

The biggest risk Disney faces is the possibility that the rebound is too slow, and the company needs to take on additional debt to continue operations. In the short run, this is doable, but in the long run, the additional debt might add headwinds to increasing growth.

Metrics

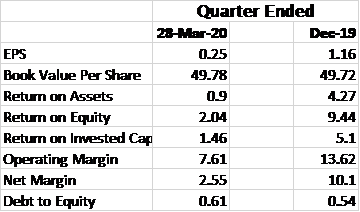

Disney finished the quarter with a market cap of $175,425 billion and a market price of $96.60

Valuation

Putting together a valuation based on current prices seems like a fool’s errand, but let us look back at the results of the last crisis and see if we can extrapolate a reasonable estimate.

During the financial crisis from 2007 to 2009, Disney saw a decrease in net earnings from 2009 to 2010 of 25%, a result of the financial crisis limiting demand to visit the parks, for example.

If we take that 25% decrease and apply that the current trailing twelve-month earnings, we can get reduced earnings to figure that might represent what Disney might experience over the next several quarters.

The inputs for our discounted cash flow are as follows:

- Estimated earnings – $4,036 billion

- Weighted Cost of Capital (WACC) – 6.26

- Free Cash Flow Growth – 5%

- Terminal Value – 2.6%

Net present value equals $37819.76 billion

Terminal Value will equal $62862.37, and discounting the terminal value and then adding in cash on hand, and subtracting all the debt we arrive at a price per share of $32.81, which is considerably less than the current price per share of $103.22.

The share price during the last crisis reached a level of $30 to $33 a share, with the net earnings approximately at the same level as we projected with a decrease of 25% of earnings. Of course, these are just projections based on the past, and the future is unknown.

I could use the current level of earnings and project a possible valuation. Still, I fully expect that the next quarter will show the full extent of the lockdowns and little to no revenue being shown, but that Disney will rebound going forward for the rest of the year.

Final Thoughts

I hope you enjoyed the summary of Disney’s second quarter 2020. The article is meant to help give you an overview of the performance of Disney during the quarter, and to give you an idea of what the company might be projecting for the future.

No opinions are offered, except for the valuation of Disney based on past and current projections. In this time of the pandemic, it is difficult to project, but in an attempt to give you a possible price target going forward, if the worst is to happen might be helpful.

To read Disney’s press release and the 2nd Q 2020 10-Q, please go here.

Thanks for reading, and stay safe out there.

Related posts:

- Tesla (TSLA) 10q: Links to All Filings (+In-depth Analysis on Recent 10-q) To see all recent Tesla (TSLA) 10q filings registered with the Securities and Exchange Commission, click this link or on the picture below. TSLA Analysis...

- Markel 10Q Summary First-Quarter 2020 Markel 10Q Summary Markel (MKL) reported first-quarter earnings on April 28, 2020, for the quarter ending March 30, 2020. The following report is a summary...

- Verizon (VZ) 10Q Summary First Quarter 2020 Verizon released its first-quarter earnings on April 24, 2020. In this post, we will discuss a summary of those results. Financial Metrics: Market Cap –...

- AT&T (T) 10Q Summary First Quarter 2020 AT&T 10Q Summary First Quarter 2020 AT&T Inc announced its first-quarter earnings on April 20, 2020. What follows is a summary you can read to...