I’ve made it well-known in the past that I had borrowed from my 401k to help payoff some higher debt in the past and I have said that this was a big mistake of mine…but, was it? Let’s crunch the numbers with this 401k loan calculator and get down to the bottom of things!

A 401k loan is exactly what it sounds like – you’re borrowing money from your own personal 401k that you can then go on and use for other things. You can take out 50% of your 401k balance up to a maximum of $50K and then pay it back over a period, typically maxed at 5 years. There are quite a few different pros and cons that should be evaluated when making this decision:

Pros

- Speed and Access to the Money

I think that this is by far #1. You can get the money extremely easily by simply logging into your brokerage account and requesting a loan from them. For instance, let’s go step-by-step with the process that I literally just did with Fidelity in 2 minutes.

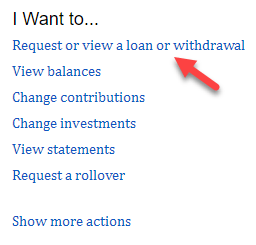

Once I logged into Fidelity, I clicked on the “Request or view a loan or withdrawal:

Then, I can immediately see exactly how much I can both take out as a loan and then also withdrawal:

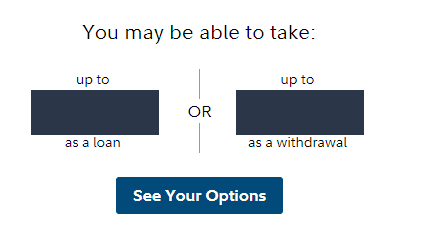

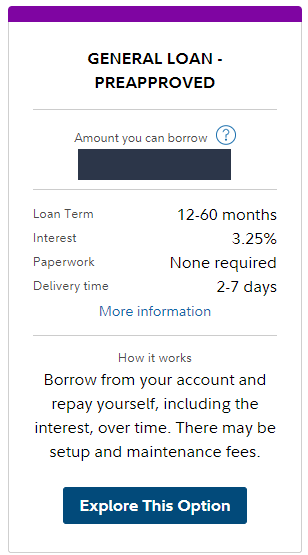

When I click on that “See Your Options” button, I get the following screen which shows me the term, interest and delivery time:

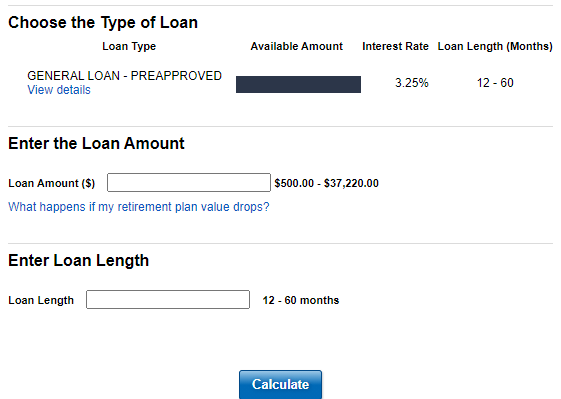

Then I can click on the “Explore This Option” button and I can enter in the amount that I want to borrow and my desired loan length:

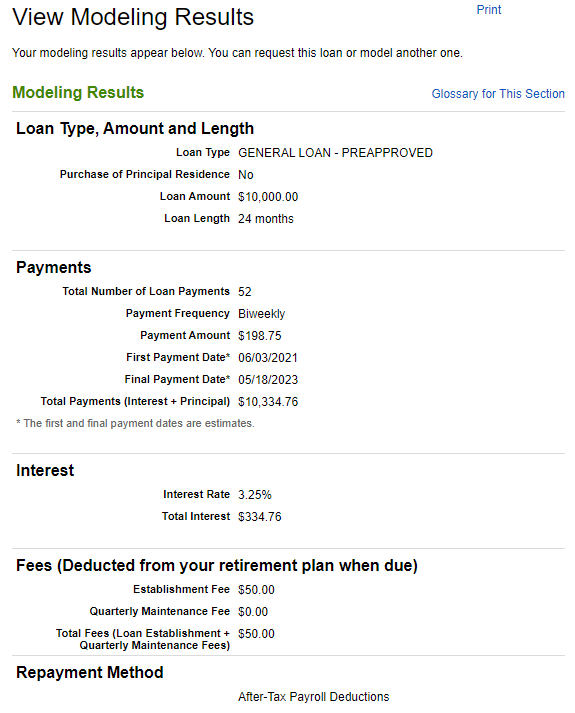

For example, I put in $10K and 24 months just to see how that would look:

As you can see, over this 2-week period I am going to be making biweekly payments that come directly from my paycheck on an after-tax basis to pay back this loan. The total interest that I am going to pay is about $335 + $50 fee for a grand total of $385.

All in all, this process took no more than 5 minutes and the money can be in my account in a week – that is a major pro if you need the money quickly!

- Interest Rates are Generally Lower

Another pro that you can see from above is that the interest rates are typically lower than a normal personal loan. I am in the market for a new home right now and mortgage rates are barely lower than that 3.25% from Fidelity, let alone a personal loan of something where you might just be paying off some high-interest debt on a credit card and there’s no collateral for the lender to hold onto, such as with a car loan.

- The Loan Won’t Hit Your Credit Report

Because you’re borrowing from your own money, this loan will not hit your credit report. I think this is a great thing if you’re in a situation where you’re going to be having your credit pulled soon and you don’t want it to look like you’re moving things around and maneuvering yourself into a position.

Now, this is definitely a slippery slope, because you shouldn’t be taking the money out of your 401k to buy something that you cannot afford and by it not hitting your credit report, this does somewhat open this door, so you really, really need to make sure you’re understanding what you’re doing prior to removing your funds from your account.

- You’re Paying Interest to Yourself

This is such an awesome Pro in my eyes. With a normal loan, you pay interest to the lender and this one is no different – you are the lender so you’re simply just paying interest to yourself!

I love this so much because by paying interest to myself, I am giving myself back even more money than I withdrew from the account in the first place. Now, this isn’t 100% a pure benefit but that’s something that we can talk about later in the cons section!

- No Early Payoff Penalty

Some loans, and I really don’t know why, will charge you a penalty if you pay off the loan early. Maybe it’s because they were expecting more interest than what you’re going to pay them by paying it back early?

But with the 401k loan, once you set the amount that you want to borrow and the term you want to borrow the money for, the amount that you owe back is now fixed. Paying the loan off early doesn’t save you any interest but it does get your money back into your account earlier.

So, in the example that we gave above where you’re paying the $335 in interest for $10K over 24 months. If you made those 52 biweekly payments out of your paycheck, you’re going to pay $335 in interest.

If you paid back literally the entire balance 2 weeks after borrowing it – yep, you still must pay that $335 in interest. They’re essentially calculating the entire interest based on the amount and term that you provided and then just tacking that entire amount onto the balance.

- No Income Tax on the Loan

You didn’t pay taxes on the money going into your 401k and you’ll avoid taxes on the money coming out – a huge benefit! Basically, you’re getting to borrow less to fund the reason for borrowing because it’s not taxed compared to if you were having to use after-tax dollars.

For instance, if you wanted to pay off a $5K credit card loan, you could simply withdraw $5K in pretax dollars from your 401k. If you were going to pay that off with after-tax dollars and you were taxed at a 25% tax rate, you would need to save $6,667 to be able to accomplish that goal as 75% of $6,667 is $5K.

All these pros probably make things seem rosy but trust me, there are also some major cons that you need to be aware of prior to taking out a 401k loan.

Cons

- Your Money is No Longer Compounding

This is by far the biggest one to me. The second that the money comes out of your 401k, it’s done compounding. It’s literally just sitting there doing something else and not reaping the rewards of the stock market. Historically, the annual return of the S&P 500 is over 10%, so you’re likely going to be missing out on those returns for the time that your money isn’t in the market. Not ideal.

If you were to just let that same $10K that we borrowed sit in your 401k for 30 years and assume you get 8% returns each year, you’d have $109K in 30 years.

But, if you instead pulled that money out for two years, put it all back in after that 2-year period, and then let it compound for 28 years, your balance would only be $93K.

So, those two years cost you $16K in your retirement account. Did you make up for that somewhere else? Hopefully!

- If Your Employment Ends, the Loan Repayment May Be Expedited

If you separate from your employer, either voluntarily or involuntarily, you may owe the entirety of the loan back immediately or at least by tax time the following year. It’s highly dependent on your employer and the brokerage so prior to taking a loan out, you need to find out the answer to this question.

I cannot stress this to you enough – you need to know the answer to this question because if you would get laid off, you’re obviously less likely to have the income to pay off the loan and now are going to owe a huge amount back at once.

Quite simply, you’re not going to be able to do it. You’re going to default.

Now, it’s not a default like with a normal loan where your credit gets crushed, but instead your retirement accounts will just be getting crushed because you’re just going to lose out on those funds. They will be converted to a withdrawal rather than a loan and then you’ll owe taxes and penalties on them.

It’s really a bad situation. This is a “must ask” prior to borrowing and you need to have that backup plan if something tragic were to happen with your employer.

- You Use After-Tax Dollars to Repay the Loan

This is not ideal as you’re putting after-tax dollars into the 401k and then will be taxed at retirement time as well. Essentially, you took the benefit of the tax-advantage with a 401k and used it when you borrowed the money. Now you’re having to pay the piper when you put your funds back into the account.

I know a lot of people have major issues with this, and I think it’s completely fair to think about because you’re effectively losing out on some years of a tax-advantage – it’s just something that you really need to consider!

So, we’ve gotten through all the pros and cons – but what should we do?

Well, you guys know me – I am one that is so loyal to the numbers so let’s look at what they say!

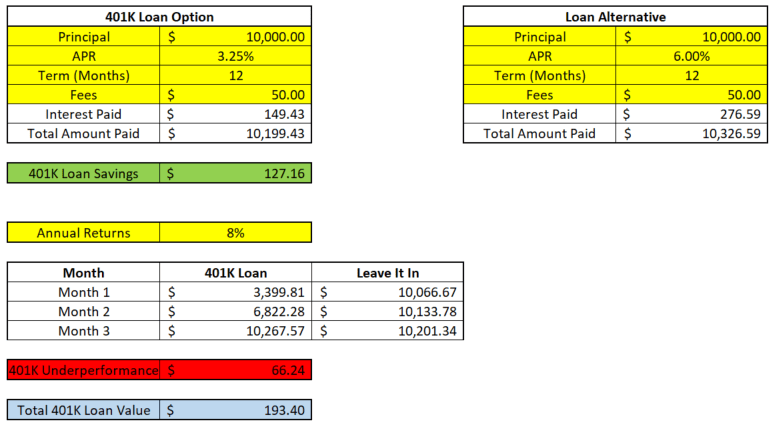

All that you need to do is fill in the yellow highlighted cells as shown below:

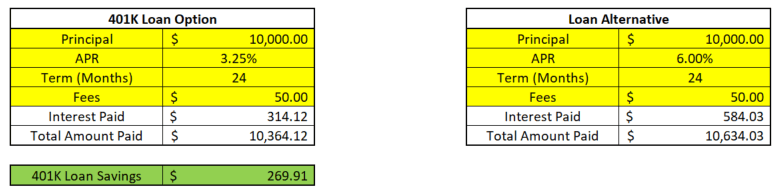

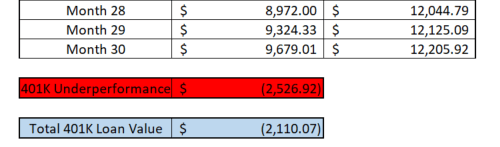

These cells should all be able to be filled based on what you find out from your brokerage and then the rest will calculate automatically. You can see that the left is a 401K loan option vs. the right chart that is your “alternative”.

I think about the alternative as what you would have to do if you had to get the money from some other source. I have seen a lot of personal loan rates in the 6% range, and truthfully that number might be a little low, but it’s what I decided to go with.

As you can see, in this situation the 401k loan will beat the loan alternative by $269.91.

But that’s only part of the equation! The other part is examining what the loan have done if it was instead left in the portfolio.

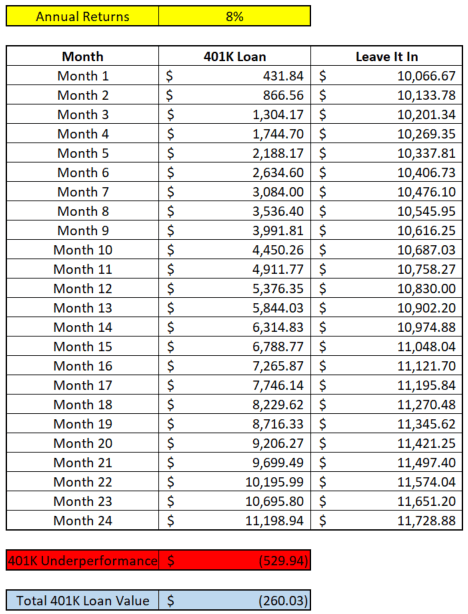

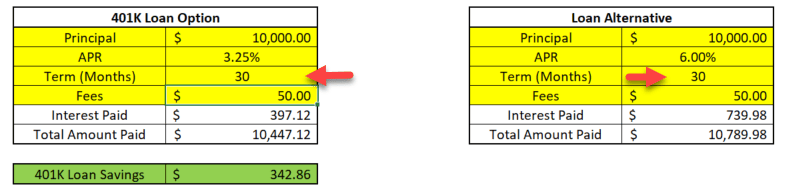

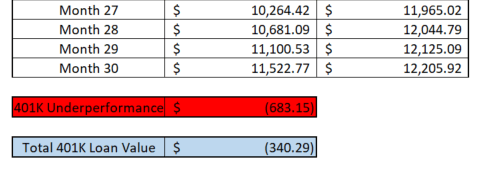

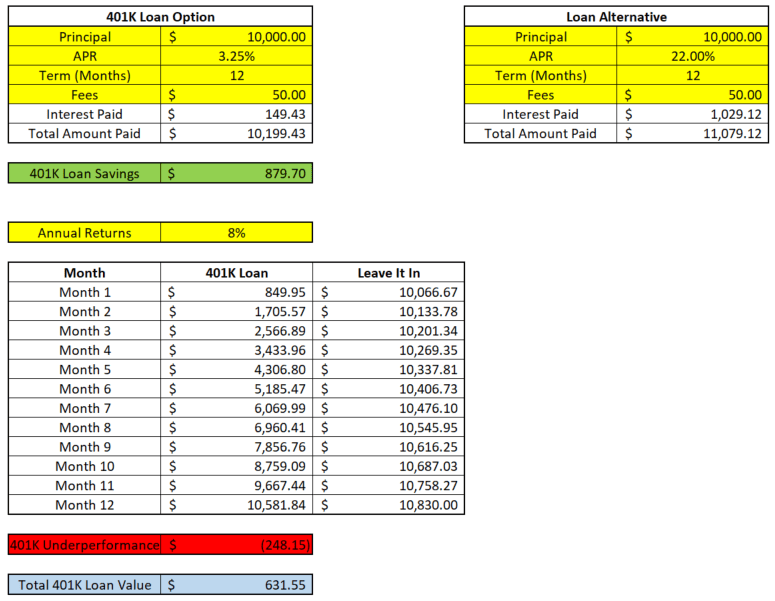

All that you need to do here is to fill out the assumed annual returns which I have highlighted in yellow:

The “Leave it In” option will compound at .67% each month as that’s 1/12 of the 8% annual returns while the 401K loan is also compounding at that rate, but only for the amount that you’re contributing back into the 401k, which is $431.84/month.

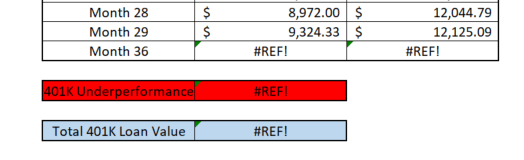

All in all, you’re actually worse off by $260 in this situation by taking out the 401k loan. I’ve included 5 different tabs, each one representing 1 year for a payoff period, so that should hopefully cover the term that you’ll be evaluating. If you need to do something off like 30 months, just go to the 36-month tab and highlight months 30-35 and delete the cells.

You’ll get an error message, but you can then just highlight the cells and drag them down and everything will work perfectly. See below:

Delete months 30-35 (6 months’ worth):

Drag month 29 down by highlighting all cells and clicking in the bottom right:

Once you drag it down 1 row, it works:

But notice that the 401k loan value looks off – you need to go update the months in the top to say 30:

Now it looks good!

I wanted to show you how you can personalize this tool to make it work for you. So many tools out there are like, “here it is – don’t mess with it and accept it for what it is!”

But that’s why I love Microsoft Excel – you can always make it work for you if you know what you’re doing!

So, is a 401k loan worth it? Well, it all depends on your use, in my opinion.

If you’re looking at taking out a 12-month loan to pay off a 22% credit card, then yes, it’s worth it!

The situation that I am in is that my wife and I are looking for a new home, but we can’t put 20% down on our new home until we sell the old one. We’re very close, but not quite 100% there yet.

Houses are selling in record time which means we will likely sell fast but it might take some time to buy. Since we don’t want to be homeless or must do a short-term rental (hard for our son and our pets to do that), we’re choosing to buy first knowing we can likely sell easily.

So, a 401k loan is one of many options we’ve considered among things like a bridge loan/recast, putting down less than 20%, and others.

If we were to do it, our intent would be to pay off the loan as soon as the second house sold. So maybe we’d be paying it off in three months instead of 12 even though the loan was for 12. We’d still have to pay that 12 months of interest (to ourselves) but the money would be back in the market just 3 months later.

When we do that, the 401k looks good over a different option like a second mortgage or personal loan:

But again, that’s just one option we must consider.

You see – personal finance is personal and there’s never a “right” or “wrong” answer. Things always “depends on the situation”. My advice is to simply become as well-informed as you can.

I have a friend that’s a financial advisor and I’ve called him multiple times throughout this process to brainstorm ideas including taking out Roth contributions for a very short-term. You just need to take the time to really understand your situation, become educated, and make the best decision that you can at that point in time.

I know that it can be overwhelming, but that’s why we’re here trying to make the Language of Money something that we all can become fluent in!

Related posts:

- This 401k Match Calculator Shows How Powerful Compound Interest Can Be There’s various compound interest calculators out there, but not many specific 401k match calculators that are easily manipulable to show how different contributions and employers...

- Optimize Your Retirement With This Roth vs. Traditional 401k Calculator! To many people, the terms “Roth” and “Traditional” only apply to their IRA, but I am here to tell you that this is not the...

- Take Control of Your Own Destiny with This 401K Employer Match Calculator! Every now and then I will have someone tell me that they’re choosing to forego their 401K employer match because of something else like paying...

- Avoid a 20% Down Payment AND PMI with a Piggyback Loan! Trying to scrape up the money needed to put money down on a house can be so incredibly hard, especially if you haven’t been planning...