ARPU is a term that a lot of companies use nowadays to try to breakdown some of their financial reporting ratios on a per user basis, for the simplicity of comparisons.

ARPU stands for Average Revenue Per User, which companies can use to try and find the true Lifetime Value (LTV) of a customer. A lot of times, you’re going to see this with Software as a Service (SaaS) companies because they’re wanting to essentially compare the cost to acquire a customer vs. the revenue of that customer vs. the profit that this customer brings in.

Of course, it’s extremely important for companies to continue to drive up their number of customers and get as many people using their platform or product as possible, but the end goal is to monetize those customers, right?

Anytime that I am evaluating the LTV of a company that is primarily focused on driving revenue, I make sure that I am looking at their ARPU to try to get an idea of how they’re doing. Let me explain:

If all you do is sit there and look at some of the high-level metrics like revenue, earnings, debt, etc. – you might miss out on a lot of the “high risk, high reward” type of speculative investments. Maybe that’s your goal, and for a large majority of my investments, I do invest in those “boring” companies that are going to give me some very steady, consistent returns.

But, at the same time, I am young and willing to swing for the fences a little bit. Since I am young, I’m willing to take much more risks and aim for home runs. I see it two ways – I’ll explain with some baseball analogies ?

You can tell me that if you just consistently hit singles by focusing on companies with steady returns and increasing dividends, you’re definitely going to score some runs and likely win some games.

But all it takes is for a couple companies to hit a rut – maybe not get a hit for a few games in a row. Or, have a runner get thrown out stealing a base (company tries to change their business similar to Apple talking about getting into EV).

When your goal is to beat the S&P 500, there’s not massive upside for you. But depending on your situation, you might not want the massive upside.

Warren Buffett says the #1 goal of investing is to not lose money. I agree with him…depending on your age!

The other option is to try for homeruns! You’re going to strikeout wayyyy more often doing this but you might also get super lucky with some tenbaggers. I actually opened an account with Fidelity, separate from my normal accounts, and called it “Tenbagger Time”, where the ENTIRE goal is to make those investments go to a billion dollars or nothing.

I am literally looking for as much risk as possible and then investing that way. I did this in 2020 with four companies and my returns were almost identical to the S&P 500. But I had one company that was up over 100%, and truthfully, I think they have a lot of room to run.

I’m willing to swing and miss because of my age, and the way I started looking at these companies was by evaluating their ARPU.

If you’re looking at some of the high-level metrics, you might see revenue increase and think that’s a good thing, but the ARPU might actually decrease. Does that mean it’s a good quarter or a bad quarter?

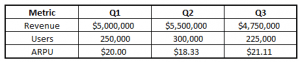

Take a look below – which quarter would you say is the best for an up-and-coming company based solely on revenue and users?

Hard question to answer, right? And it’s one that doesn’t necessarily have a definitive answer either way. I think it completely depends on the company and what their primary focus is.

If their main goal is to grow the user base, I want Q2 because that has the highest number of users but also the lowest ARPU.

If the company is focused on getting current users to spend more then Q3 is the best because the ARPU is significantly higher than the other quarters, meaning they’re becoming more effective at making their platform/product/service “sticky”.

If the company is going down both paths then Q1 seems to be a good blend, but personally, I want my companies to be more focused than just “growing users and revenue”. But that’s just personal preference.

Let’s get even further in the weeds with one of my favorite – ROKU.

ARPU is very important for ROKU because of the reasons that I mentioned. They’re trying to continue to drive their customer base to get “stuck” to their platform and then they can monetize off of that.

To find the ARPU for ROKU, I simply went to SEC.gov and typed ROKU into the company name, searched for the 10-K, and then searched for ARPU within the document.

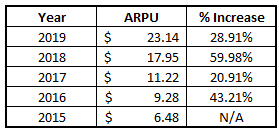

I was immediately hit in the face with how important that ARPU is to ROKU itself as it was mentioned very early on in their 10-K, and also mentioned a total of 12 times. I looked at a few different 10-K’s for ROKU throughout the year to find their ARPU and its annual growth rate:

The thing that I love is that every single year they are growing their ARPU by at least 20% over the last 4 years. Now, thinking back to my initial hypothetical example, my immediate thought was – are they growing users as well?

Turns out, they are. In 2019 users were at 36.9 million active accounts vs. 27.1 million the year prior.

So, not only are they adding more customers but they are generating more revenue off of those customers – win win! That is exactly what I want to see from an up-and-coming company like this that might not blow your socks off with their earnings.

“We generate revenue by monetizing our users’ engagement on our platform through a variety of services and capabilities, including video advertising in ad supported channels, sales of subscription services and other commerce transactions, brand sponsorship and promotions, and billing services. We measure monetization of our platform by calculating the ARPU, which we believe represents the inherent value of our business model, and growth in gross profit. In 2019, ARPU (which we measure on a trailing twelve-month basis) increased from $17.95 to $23.14 and gross profit for the full year grew from $332.1 million to $495.2 million.”

That comes directly from the 10-K under the “Our Business Model” section, and if that doesn’t speak to the importance that ROKU places on ARPU, then I don’t know what else will!

While ARPU is a very easy calculation to measure, I think it’s one that oftentimes is overlooked by investors, especially those that might not very familiar with these newer businesses.

You oftentimes will see ARPU being a primary point of focus in companies that are either subscription models or those that are trying to monetize a current user base.

For instance, some of the main companies that I think of are SaaS companies, Social Media, Streaming/Cable, video game services, etc.

All of those different types of companies basically do whatever they can to get users to their platform and then try to drive spending.

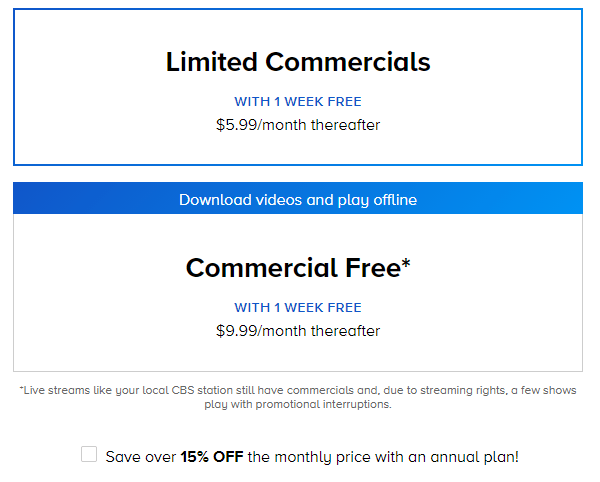

One that I instantly think of is for CBS All Access. They basically have a 3-step methodology to getting you in the door:

- Offer a free week so that you get hooked/forget to cancel

- Offer a cheap plan thereafter where you watch commercials (aka revenue from their advertisers)

- Offer a more expensive plan where you skip commercials (no ad revenue but more guaranteed income)

Oh yeah – you can also get a “discount” by paying in advance – take a look:

I mean, if you know you’re going to keep the service for a year then the discount isn’t bad considering it’s 50% over the annual total return for the S&P 500!

But for me personally, there is too much unknown to lock-in a year – mainly with my tastes and what I am going to want to watch, but that’s meaningless.

It might seem obvious that the Commercial Free option is more lucrative for CBS but if they’re capturing $4 or more in ad revenue per user then they’d be better off with the limited commercial option.

Truthfully, I really do try to stay away from investing in a lot of companies like this because I think that they’re competing for such a small piece of the pie.

If I had to pick my 5 favorite shows, I’d be looking at three different streaming services between Netflix, Hulu and CBS. Not to mention there’s also ESPN in there that is truthfully my most watched channel. Then, add on the fact that I live in the Midwest and we’re a Big Ten sports family, so we watch a lot of Fox and the Big Ten Network.

In other words – I have no loyalty to the actual channel/service but rather to the content and for that, CONTENT IS KING!

It’s a complete crapshoot for me to guess which provider is going to come out with the best content in the coming years but if I was forced to guess, I think it would be Netflix.

“So, Andy, why not buy Netflix?”

Well, two qualitative reasons, and I won’t even discuss the quantitative aspect:

1 – Netflix is my guess but they might not be the king.

They very well could get knocked off. Even when they have great shows, I will binge them and then likely cancel my subscription. The reason that I never canceled Netflix was because of The Office and Parks and Recreation – both of which are now on Peacock, NBC’s Streaming Platform.

Am I going to sign up for Peacock now? Nope. I learned my lesson. I am just going to buy a downloadable version of those shows so I don’t run into this issue again.

Content will keep me on the platform, but we’re getting so many options that I’m being forced to pick and choose and pause my subscriptions when not using certain platforms.

2 – I am not 100% confident that we stay with this individual streaming methodology.

Honestly, I can see a situation where people get sick of having so many different streaming platforms that we move back to cable. The issue with cable streaming currently is that it’s still very expensive and, in some cases, more expensive than actually getting a real cable box.

There’s no denying that physical cable is more reliable than streaming when it comes to viewing shows and getting things to work properly, but I think those are kinks that will be worked out in time.

I truthfully envision things moving back to a world that has cable subscriptions but now it will just be through a streaming platform, but I could be very wrong (and feel like I usually am ?)

For that reason, I like ROKU a lot. ROKU is built to be the platform for streaming regardless of if it’s individual services or a comprehensive cable package, so while those companies fight it out, ROKU is just getting more and more people on their platform and creatively finding ways to increase their ARPU.

Now, there are definitely things to be weary of when it comes to ROKU, and I’m not trying to sell you on the idea of ROKU, but really just wanting to give you a peak inside my brain when I am looking at speculative companies.

Similar to ARPU but different is a metric called AMPU, or as you guessed it, Average Margin Per User. This metric is a lot less common because let’s be honest – most of these companies don’t make money lol.

Truthfully, that can be a bit terrifying to invest in a company that is more focused on growing revenue than they are growing margin, but that’s the way a lot of the world is moving.

I love investing in these speculative companies but as I have mentioned, it’s a very small part of my portfolio. The other large portion is based on those “boring” companies that just consistently crush it, both in share appreciation and with their dividends.

Looking for a portfolio like that? I’d recommend checking out the eLetter and doing it quickly – Andrew has been on a FREAKING ROLL lately with some of his picks!

Related posts:

- How to Evaluate Lifetime Value (LTV) with SaaS Companies One of the most important metrics for a Software as a Service (SaaS) company is their lifetime value (LTV). This is such an important metric...

- “Knowing Your Numbers” Like the Sharks = Understanding Unit Economics Unit economics – what a boring topic amiright? No – I am not right. And chances are, you also agree that unit economics aren’t boring...

- Stocks with Negative Shareholders Equity: Are They Good Investments? In a recent episode of the Investing for Beginners Podcast Andrew and Dave take a deep dive into the financials for Starbucks and specifically key...

- Don’t Let Simple Valuation Ratios Muddy the Big Picture One pitfall that I think is very easy for us investors to fall into is getting blinders on and looking at some simple valuation ratios...